It’s common to hear in the real estate world to use the 1031 exchange as a powerful strategy. It allows you to defer taxes on capital gains of your real estate investments or business property.

Big and small investors all over the country use it.

It has become an even bigger topic over the last couple years as real estate prices have soared around the country, people are looking to take some profits off the table and reallocate them with as little tax burden as possible.

But, what is a 1031 exchange? How does it work? What are the rules around it? What are some strategies to use with it?

We’re going to dive into that. We’re also covering some rules, types of exchanges, and benefits (or pitfalls) of using the 1031 exchange.

- What is a 1031 Exchange?

- The Basics of the 1031 Exchange Rules

- 4 Types of Real Estate Exchanges

- Benefits of 1031 Exchange

- Drawbacks of 1031 Exchange

- Tips to Help the Process Go Smoothly

- The Possibility of Refinancing After a 1031 Exchange

- 1031 Exchange Strategies

- Frequently Asked Questions

- Snowballing a Portfolio With a 1031 Exchange – Conclusion

What is a 1031 Exchange?

The 1031 Exchange (also known as a like-kind exchange) is found in section 1031 of the IRS code, hence where the name comes from. According to the IRS a like-kind exchange is:

When you exchange real property used for business or held as an investment solely for other business or investment property that is the same type or “like-kind” — have long been permitted under the Internal Revenue Code. Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss under Internal Revenue Code Section 1031. If, as part of the exchange, you also receive other (not like-kind) property or money, you must recognize a gain to the extent of the other property and money received. You can’t recognize a loss.

https://www.irs.gov/businesses/small-businesses-self-employed/like-kind-exchanges-real-estate-tax-tips

Furthermore, Like-Kind property is defined as:

Properties are of like-kind if they’re of the same nature or character, even if they differ in grade or quality.

Real properties generally are of like-kind, regardless of whether they’re improved or unimproved. For example, an apartment building would generally be like-kind to another apartment building. However, real property in the United States is not like-kind to real property outside the United States.

https://www.irs.gov/businesses/small-businesses-self-employed/like-kind-exchanges-real-estate-tax-tips

To put it in layman terms: The strategy allows you to defer the payment of capital gains taxes on your investment property. The only requirement is you purchase another like-kind property with that profit.

When Should I Use a 1031 Exchange?

You earn income on your property and are taxed on it accordingly each year. In addition to that, your property is likely appreciating each year. The profit is realized when you sell it. So, upon sale, you are taxed.

Additionally, the IRS allows you to depreciate the value of the property each year. You then catch up on those deferred taxes upon sale. This can lead to an even larger and unexpected tax burden if you’ve owned the property for a number of years. This is especially true if you’ve been taking advantage of cost segregation which allows you to speed up your depreciation thus allowing additional depreciation in early years of ownership.

So, a 1031 exchange allows you to defer these taxes. You’ll need to speak with an accountant about your specific tax situation to determine if this is the right decision for you. But, in general, our clients love to defer taxes as long as possible.

Everyone will eventually take their cash off the table and pay taxes on it, but deferred taxes allow you to save the tax-money and invest that in the meantime. Other investors will hold the property until they eventually pass it on to an heir, which has a whole different set of tax rules which is beyond the scope of this article.

How to Do a 1031 Exchange? ![]()

Traditionally, a like-kind exchange required a simultaneous swap of similar properties. Realistically, this is extremely rare and difficult to pull off, so there is generally why the majority of exchanges are delayed or include a middle-man who holds the cash between the sale of your current property and purchase of your next investment property.

To use the strategy effectively, you must sell one property, take the capital gains from that, and purchase another property with those capital gains. It’s important to note that the IRS like-kind exchange rules require the new mortgage and new purchase price to be equal or higher on the replacement property.

For example, if you sell a $500,000 property and it had a $400,000 loan on it, your new property must have both a purchase price of greater than $500 thousand and a mortgage balance of greater than $400 thousand. We’ll get more into these rules later.

There are 4 kinds of like-kind exchanges that you can do, and you should hire a 1031 specialist to help you determine the best way to accomplish this. Your commercial real estate consultant will be able to provide recommendations for who to work with. We’ll get into the 4 types of exchanges in a moment, but first, let’s dive into the rules that govern exchanges.

The Basics of the 1031 Exchange Rules

We all know that nothing is ever simple when the government or taxes are involved. So, there are 7 primary rules for the 1031 exchange. They are:

- Must be a like-kind property

- It is for investment or business purposes only

- Must be greater or equal value

- Must not receive a “boot”

- Both are the same taxpayer

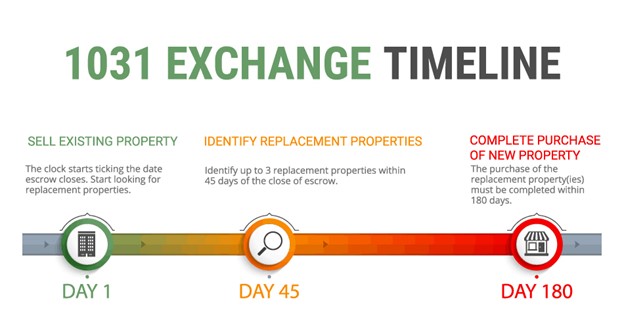

- 45-day identification window

- 180-day purchase window

Now we will dive into each rule.

1) 1031 Exchange Includes Like-Kind Property

To qualify as a 1031 exchange, the old property and the new property must be “like-kind” which we covered in the beginning.

But, just to reiterate in different words, one can’t sell a car and buy a house, sell a house to buy stocks, etc. It’s because they are not the same type of property. For real estate, you can exchange basically any kind of real estate for any other kind, as long as it’s for business or investment purposes.

For example, you could:

- exchange a house for an apartment complex, or vice versa.

- An office building for a multifamily.

- A vacation rental for a strip mall.

NOTE: 1031 Exchanges can include more than two properties. For example, you can sell two houses and combine the equity to purchase a 10-unit building. In essence, you can play ‘Monopoly’ with your property. Using a 1031 allows you to exchange 4 green houses for a red hotel.

It can get complex, so make sure you hire a good intermediary.

2) The 1031 Exchange Is for Investment or Business Purposes Only

As has already been mentioned, you can only use a 1031 for investment or business property. It cannot be used for personal property, even if it’s real property. You cannot sell your home and buy another home.

3) The New Property Has Greater or Equal Value

The IRS requires the market value and the equity of the property purchased to be the same as or greater than the property sold. If it’s not, you will not be able to defer 100% of your tax burden. Though you can defer some of it.

Let’s say you have a $1 million property with a loan of $500 thousand. To get the full tax deferment, the new property has to be worth $1 million and the new loan has to be $500 thousand or more. It’s important to note that you can purchase one property or multiple properties. The key is to make sure the sum is greater than those figures.

4) Must Not Receive a “Boot”

A “Boot” is the difference between the gain from the property your selling and the amount of cash needed for the property your buying. Let’s say you are selling a $1 million property. You plan to buy a $750,000 property. Your boot could be $250,000 and you’ll have to be taxed on this. I’m assuming no loans or other variables.

It’s important to know that you can exchange into less valuable properties, but you will be taxed on the gains you don’t use in the exchange to purchase another property.

5) Must be the Same Taxpayer

The name on the property being sold must be the same as the name on the new property, and the tax returns also must match those names. This is true with one exception which is a single-member LLC which is considered a pass-through entity, so it doesn’t apply.

For example, If John Smith owns Main St LLC and sells a property. Then he purchases a new property with an entity named Park Ave LLC. If John Smith is the only owner of both those LLCs, this still qualifies as being the same taxpayer.

6) 45-Day Identification Window

You have 45 days after the sale of your property to identify up to three potential like-kind properties you want to purchase.

This is actually quite difficult as you ultimately need to close on one of the properties you identified. This is true especially in today’s market because many properties in many areas are over-priced and finding good value is a challenge.

An exception to this is known as the 200% rule. In this situation, you can identify four or more properties as long as the value of those four combined does not exceed 200% of the value of the property sold.

7) 180 Day Purchase Window

You have to close on the property within 180 days after the sale of your property OR the due date of the income tax return for the tax year which you sold the property. Whichever is earlier.

4 Types of Real Estate Exchanges

There are primarily 4 types of 1031 exchanges to choose from which include delayed, reverse, simultaneous, and construction/improvement exchanges.

Each is used for a different purpose, so we’ll break down each and how it’s best used.

The Most Common 1031 Exchange – The Delayed Exchange

This is by far the most common type of exchange used by investors today.

This happens when you sell the first property before acquiring the new property.

In other words, the property you currently own (also called the “relinquished” property) is sold first. The property you want to get (the “replacement” property) is purchased second.

You, (The Exchangor) are responsible for the entire transaction before the exchange can be initiated. You have to market the property, get a buyer, and get a purchase and sale agreement, before initiating the exchange.

Once this has occurred, you then hire a third-party Exchange Intermediary. They then initiate the sale of the property and will hold the proceeds from the sale in a trust. You then work on securing a like-kind property.

Don’t forget about the timing requirements we discussed earlier.

Simultaneous 1031 Exchange

We touched upon this previously in a previous section, but let’s dig into it a little more.

A simultaneous exchange is when the property you sell and the property you are purchasing are closing on the same day. The two closings happen simultaneously.

This is a really important caveat. Even a short delay can result in the disqualification of the exchange. You may be forced to pay full taxes on it in this situation.

Digging a little deeper – There are three ways that a simultaneous exchange can happen.

- Two parties swap deeds

- Three-party exchange. This is where an ‘accommodating party’ facilitates the transfer and does it simultaneously for you.

- A simultaneous exchange with a qualified intermediary. In this situation, they structure the exchange and walk you through the entire process.

Reverse 1031 Exchange

Perhaps the most fascinating form of the 1031 exchange is the reverse exchange. A reverse 1031 exchange is also known as a forward exchange.

It occurs when you purchase the replacement property first before selling your current property.

Theoretically, this is an amazingly simple process where you make a purchase then make a sale. But it can be tricky because you are required to make the purchase in all cash. Unfortunately, Most banks won’t offer a loan for a reverse exchange.

Here’s one curve-ball to make things a little more challenging. If you cannot sell your property within 180 days given by the law, then you will forfeit the exchange entirely.

The reverse exchange follows most of the same rules as the delayed exchange with a few exceptions:

You have 45 days to identify what property is going to be sold as “the relinquished property.”

After the initial 45 days, taxpayers have 135 days to complete the sale of the identified property. You will then close out the reverse 1031 exchange with the purchase of the replacement property

Construction or Improvement Exchange

This is a pretty interesting one as well. The construction or improvement exchange allows you to make improvements to the replacement property. The difference is you will be using the equity from the exchange property.

In other words. You can use tax-deferred money to improve the new property. You do this while it’s in the hands of the intermediary during the 180-day period.

There are 3 additional rules you must follow if you want to defer the entire capital gains.

- The equity must be used on improvements or as a down payment by day # 180.

- The new property must be “substantially” the same as the one you identified. So, a tear-down and rebuild would probably be disqualified.

- The value of the property must be equal or greater once you receive the deed back. It’s important to note that the improvements must be in place before you can the property from the intermediary.

Benefits of 1031 Exchange

Using a 1031 exchange offers several benefits, including:

It’s a Tax-Deferred Exchange

The primary reason people use the 1031 exchange is that it allows them to defer tax payments. You’re able to sell an investment property and reinvest that money in another property, deferring what you would have owed had you not re-invested in another property. You don’t need to deal with capital gains tax, which can be significant.

Leveraging and Increasing Cash Flow

Another benefit of using the 1031 exchange is that it allows you to leverage and increase cash flow for re-investing.

Since you aren’t paying the government on the sale of the property, you’re able to use that money toward your next investment. It gives you increased purchasing power and more leverage to invest.

You might be able to invest in a property with greater benefits than you would have if you’d been forced to pay taxes on the sale.

Relief from Investment Property Costs

If you sold a property that was a significant burden, you can sell it without worry about the taxes you would normally owe on it. This gives you relief from the cost of real property maintenance and management and helps you afford a property that, hopefully, comes with fewer issues.

Or, you can trade up for a property with an onsite manager to deal with issues.

Accumulation of Wealth and Assets

According to financial experts, 1031 exchanges are an excellent wealth-building tool and investment opportunity. Performing numerous 1031 exchanges over time and following exchange rules makes it possible to benefit from ongoing cash flow and net worth increases.

The benefits are greater than had you invested in real estate then sold that real estate and paid the taxes on it, especially if you do this over and over. If you can defer the tax owed each time you sell a property, it adds up to significant savings.

Theoretically, it might be possible to re-invest over a lifetime and leave the final properties to heirs, and, depending on how the estate is structured, the tax burden might be eliminated. The loan is abolished upon your death so the estate never has to repay it.

Never Pay Taxes – Stepped Up Basis

Your beneficiary gets a stepped-up basis on the inherited property meaning their basis is the fair market value of the inherited property at the time of the taxpayer’s death. Should they choose to sell the property, the transaction is taxable only to the extent of the difference between the stepped-up basis and the net sale price.

It’s important to keep in mind that you won’t be pocketing the proceeds when you sell a property in a 1031 exchange. What you save in tax deferral compounds into the new investment. In the long run, though, the savings pay off and your net worth grows.

Drawbacks of 1031 Exchange

Despite the benefits of a 1031 exchange, there are a few drawbacks. These include:

Having to Follow Numerous Procedures, Rules, and Regulations

When you’re dealing with the IRS and benefitting in some way, don’t assume it will be easy. There are plenty of regulations related to a 1031 exchange. You’re being rewarded for investing back into the property and as such, you need to follow the rules. If you don’t, you could face significant tax penalties.

It’s common to encounter roadblocks when trying to use a 1031 exchange. One of the most common problems is finding a replacement property within 45 days of the sale of the preceding property. Extensions are rarely granted. It’s important to meet with real estate professionals to structure 1031 exchanges so you aren’t penalized.

Dealing with Reduced Basis on the Acquired Property

When you use the 1031 exchange, the replacement property has a reduced tax basis. This is the purchase price less the gain deferred on the sale of the preceding property as a result of the exchange. If you ever sell the replacement property, the deferred gain will be taxed.

For many, this is the primary disadvantage of 1031 exchanges. The depreciation in the replacement property is reduced because the tax on the replacement property is calculated based on the purchase price of the replacement property minus the gain.

Inability to Recognize Loss

Since taxes are deferred, so are losses. If it’s a windfall profit year, deferring losses that can offset large profits is a painstaking decision. Weigh the benefits of the deferral against the downside.

Boost in Future Tax Rate

If you sell the investment property in the future, you’ll be hit with higher capital gain rates and other tax increases. The capital gain tax recently rose 15 to 20 percent and there is now a healthcare tax of nearly 4 percent on certain gains.

Tax-Deferred Does Not Equal Tax-Free

Keep in mind, tax-deferred and tax-free are not the same thing. If and when you sell, your tax liability is still there, in full force. It’s something you have to keep in the back of your mind when setting your long-term investment goals.

Tips to Help the Process Go Smoothly

Most investors understand that, in a like-kind exchange, they are unable to touch the money and need to locate and begin the purchase process for the replacement property within 45 days of the closing date of the property being sold.

These two things are true but there are other things you need to get in place ahead of time to guarantee a smooth 1031 exchange. For instance:

Complete the Exchange Documents Prior to Closing

Make sure the exchange documents are signed prior to or on the date of the closing of the sale of the property being relinquished.

Consider Who Will Purchase the Replacement Property

This is important if you are operating an LLC. Remember, the person selling the property must be the same one buying the property to enjoy the tax benefits.

Make Sure You’re Able to Defer All of the Gain

Two things are required in a 1031 exchange to defer all of the tax:

- The replacement property must be worth the same amount or more than the relinquished property. For example, if you sell something for $1 million, you have to buy a property worth at least $1 million or the deal could be taxed, at least in part.

- You must invest the total net equity from the sale into the purchase of the new property. For example, if you sell something for $1 million and there’s a $300,000 loan on it, the $700,000 netted from the sale must be rolled into the new property.

Consider the Expenses

Some expenses can be paid with the exchange proceeds without triggering a tax. These include commissions, fees held in escrow, exchange fees, and taxes related to the transfer.

If you sell a property you intend to use in a 1031 exchange, though, you won’t be able to give the buyer a credit because this equates to exchanging proceeds for non-exchange expenses. This can result in your exchange being partially taxable so it’s best to come in with your own funds if you want to offer these incentives.

Consider Safety

A third-party intermediary holds funds until it’s time to reinvest in the replacement properties when you do a 1031 exchange. Make sure you understand how those funds are held and that you are working with a financially strong and reputable intermediary.

The execution of a 1031 exchange is best done under the guidance of an experienced professional. It’s too easy for an investor to get tripped up on the complex rules and regulations the Internal Revenue Service has in place.

Finding a knowledgeable professional is critical for accurately assessing is better for your investment goals. They can also help you find a suitable replacement property within the limited time frame to appropriately reinvest the proceeds from the sale.

We have experience working with clients on 1031 exchanges and can help you with your 1031 exchange documents. We’re here to answer all of your questions and do what we can to make sure the transaction goes smoothly so you can enjoy the benefits that come with a 1031 exchange. To learn more or to begin your 1031 exchange, sign up for our newsletter.

The Possibility of Refinancing After a 1031 Exchange

Refinancing a property acquired through a 1031 exchange is a strategy that investors might consider for various reasons, such as securing a lower interest rate, changing the loan’s term, or accessing equity. However, this move is laden with IRS scrutiny, primarily concerning the intent and timing of the refinancing.

Timing and Intent: The Crucial Factors

- Timing: The IRS has not set a specific safe harbor period post-exchange for refinancing. However, tax professionals often recommend a substantial period (typically at least six months to one year) between the exchange’s completion and the refinancing to avoid the appearance of a prearranged plan, which could invalidate the exchange.

- Intent: The IRS examines the investor’s intent. If the refinance seems like a strategy to access cash, contradicting the investment purpose of the 1031 exchange, it could lead to tax consequences. The property should primarily serve as an investment, not as a means to extract equity.

Structuring the Refinance

The loan must be properly structured, ensuring it’s secured by the property and not giving an impression of personal gain. This structuring is vital to maintain the integrity of the 1031 exchange:

- Loan Type and Terms: Choose a loan type that aligns with your 1031 investment strategy. Fixed-rate mortgages offer stability in payments, while adjustable-rate mortgages might provide lower initial rates. Consider the loan’s term, interest rate, and any potential prepayment penalties, as these will impact your investment’s long-term profitability.

- Equity Access: One of the primary reasons for refinancing is to access the property’s equity. However, it’s crucial to balance how much equity to extract. Too much equity withdrawal can increase the loan-to-value ratio, potentially raising the risk profile of the investment and impacting loan terms.

- Debt Structuring: The new loan should ideally not exceed the amount of the original debt on the exchanged property. This is to avoid the perception that the refinance is being used to access cash for personal use, which could be problematic from a 1031 exchange perspective.

- Interest Deductibility: Interest on the refinanced loan is typically tax-deductible when the loan is used for investment purposes. Ensure that the structure of the refinance maintains this deductibility, as it can significantly impact the overall cost of the loan.

- Closing Costs and Fees: Factor in the closing costs and fees associated with refinancing. These costs should be weighed against the potential benefits of the refinance to ensure it is financially worthwhile.

- Lender Restrictions: Some lenders may have specific restrictions or requirements for refinancing properties involved in a 1031 exchange. It’s important to discuss your situation with potential lenders to understand any limitations or additional requirements they may have.

- Legal and Tax Compliance: The structure of the refinance must comply with IRS rules regarding 1031 exchanges. This includes ensuring that the refinance is not seen as part of the original exchange and that the funds are used in a manner consistent with the investment intent of the 1031 exchange.

- Risk Management: Consider how the refinance impacts your overall risk exposure. This includes assessing the new debt level, the property’s cash flow post-refinance, and your ability to manage the investment under different economic scenarios.

- Future Sale Considerations: Think about how the refinance might impact a future sale of the property. A well-structured refinance can enhance the property’s value and attractiveness to future buyers, while a poorly structured one can have the opposite effect.

Professional Guidance: A Necessity

Given the complexities, consulting with tax professionals and real estate attorneys specializing in 1031 exchanges is indispensable. They can offer tailored advice and ensure adherence to IRS regulations.

Examples Illustrating Refinancing After a 1031 Exchange

Example 1: The Conservative Approach

John, an investor, completes a 1031 exchange by acquiring an apartment complex. He waits for one year, during which he demonstrates the property’s use as a rental. After this period, he refinances to secure a lower interest rate. This cautious approach aligns with IRS expectations, as it shows a clear investment

intent and a reasonable time gap between the exchange and refinancing.

Example 2: The Growth-Oriented Strategy

Sarah, another real estate investor, uses a 1031 exchange to acquire a commercial property. After operating it successfully for 18 months, she decides to refinance. The refinance allows her to withdraw some equity, which she then reinvests into upgrading the property, enhancing its value and rental income potential. This scenario demonstrates a growth-oriented strategy where the refinancing serves a clear investment purpose, aligning with the spirit of the 1031 exchange.

Key Considerations for a Successful Refinance Post-1031 Exchange

- Documenting Intent: Maintain clear records demonstrating the investment nature of the property. This documentation can be crucial if the IRS reviews the transaction.

- Evaluating Financial Implications: Understand the financial implications of refinancing, including interest rates, loan terms, and potential impacts on cash flow and property value.

- Monitoring Market Trends: Keep an eye on real estate and lending market trends to time the refinancing optimally.

- Compliance with IRS Rules: Ensure that the refinancing does not contravene IRS rules related to 1031 exchanges. This compliance is where professional advice becomes invaluable.

- Long-Term Investment Strategy: Align refinancing with your long-term investment goals. Refinancing should fit into a broader strategy for property management and investment growth.

1031 Exchange Strategies

There are a lot of strategies for using a 1031 to your benefit. But at their core, they are all about deferring taxes as long as possible. We’ll cover some here.

Simple Appreciation Method

This is fairly straight forward and one of the most common strategies. It involves buying a cash-flow positive property that is at or near full value. You purchase it with the intent of having some cash flow. But, you are primarily investing because you believe in the long-term potential of a particular area.

You may hold onto it for 5-10 years while accumulating appreciation and also paying down the debt.

At the end of the hold period, you will have a lot of equity that will be taxed upon sale. You will now want to level up and buy something bigger or better.

So, you use a 1031 exchange to defer the taxes on the sale and upgrade to something larger.

Simple 1031 Exchange Example

Let us say you purchase a $1m property and over your hold period it appreciates to $1.5 million.

Additionally, you have depreciated the asset by $250,000 on your taxes over the years, leaving you a total taxable gain of $750,000. Note: it will be a bit more complicated than this, we are just using simple numbers to illustrate the point.

So, the goal is to purchase a property that needs a minimum investment of $750,000 which would give you a purchase price of roughly $3 million if you get a loan at 75% loan to value ($750,000 down payment as 25% down).

In this example, you hold an asset for a number of years and receive cash flow from it. Then you turned around and bought a property that is worth double to continue the same process.

Add Value Snowball Strategy

This strategy is essentially the same as the simple appreciation method but on steroids. It’s also going to be a lot like the BRRR method but with some modifications.

Instead of purchasing a property that is at full value, you will focus on finding a property that needs to be improved. This should allow you to create additional equity through a rehab, reposition, or through increased rents and decreased operating costs.

Once you have forced the asset to appreciate, you can then sell it and find another property to do this. While this strategy does require more work and effort, you can supersize your portfolio very rapidly. This is because you are held back only by the speed you turn over the assets and the amount of effort you want to put into it.

Do it With a Delayed or Improvement 1031 Exchange

You can do this with a delayed 1031 exchange and use your own cash for rehab or improvements. But we’ll use an improvement 1031 exchange as an example:

Let us use the previous numbers and you have $750,000 in equity to spend. You could use an improvement 1031 exchange to purchase a property that needs a lot of work.

Let’s say you can find a property that is worth $2 million. It will require a $500,000 down payment, and you can use $250,000 to rehab or improve the property. After the repairs are complete, let’s say it’s worth $3 million.

In this example, you have the $750,000 cash in equity that you put in. You have an additional $750,000 in appreciation that you’ve created through your efforts.

Instead of waiting 5 or 10 years to use the 1031 exchange again, you could turn around and sell it much sooner. Then do the same strategy into an even larger property.

Monopoly Method

A 1031 exchange doesn’t have to be used to move from one property into a larger property. You can use the 1031 exchange to sell multiple smaller properties and level up into something much bigger.

Many investors start with single-family homes or duplex or triplex style homes. In this example, you may have accumulated 4, 5, or even 10 plus smaller homes.

It would be a bit overwhelming to sell 10 properties and try to buy 10 larger properties. So, you could sell them in groups and use the 1031 exchange to level up. Just like in monopoly when you trade in 4 houses for a red hotel.

It’s important to note that all the timelines begin the moment you sell the first property. So, your 45 day and 180-day windows apply from the moment of the first sale. If you have 10 houses for sale, it may be difficult to close all 10 within the window. So it may be prudent to sell them in smaller groups that are easier to manage. Regardless, it’s important to take note of what you can legitimately sell during your time frame.

Using this method, if you sell 3-4 at a time you could turn your 10-house portfolio into 3 small multifamily properties. If you are able to sell all 10 at once you could jump into one medium size multifamily investment property.

Covid 1031 Play

According to CP Executive, many investors are seeking to leave the multifamily market. They aren’t leaving real estate but are moving into stand-alone triple net retail locations. It’s worth considering that you can use a 1031 to completely reallocate your portfolio from one type of real estate to another type entirely.

For example:

Imagine you have middle to low-income housing that is heavily impacted by rent controls or eviction moratoriums. You can sell those and move to a stand-alone Walgreens, KFC, Dollar General, or other recession-resistant retail location.

High Equity to High Cash Flow Play

Many investors on the west or east coasts purchased property a decade or more ago and have seen massive price appreciation. But they’ve also seen their rents as a ratio of price decrease significantly as price growth outstrips rent growth.

Many investors are choosing to sell their coastal portfolios and reallocate to suburban portfolios. This is where appreciation will be less substantial, but the return on equity will be substantially higher.

Frequently Asked Questions

In order to qualify as a 1031 exchange, the assets must be like-kind and also must be for investment or business purposes. You do not have to buy the same type of property or same quality though.

look at the process, The Motley Fool has published an excellent guide for the 1031 process.

This depends on the type of exchange used, but in your typical delayed 1031 exchange you have 45 days to identify the replacement property and 180 days to finalize the purchase.

In most cases there is no stipulated minimum, but generally it’s accepted that 12 months is the minimum hold period to avoid issues with the IRS. If you hold it for less, the IRS could say you had no intention of holding it as an investment. You are required to hold for a minimum of 24 months if you are related parties.

Yes, but it is subject to capital gain taxes and there is a certain process. Cash can be taken during the sale and funds will be paid directly to you before the 1031 exchange begins.

On the other hand, if the replacement property is of a lower price than the sold property, the difference will be given to you upon purchase and you’ll be subject to your taxes.

If you take out cash during the exchange process, it can invalidate the entire thing.

You are not required to use the entire value of the property you sell. The difference can be kept by you and it is also known as a boot or cash boot. It’s important to note that this money is not deferred and there are rules as to when and how you can take the cash.

The 1031 exchange is a system to defer your federal tax liability. You may still be subject to state or municipal taxes. In many instances you can also defer or avoid these as well, but you will need to speak to a professional that can help you navigate your local tax rules.

While the property is technically transferred twice – first to a qualified intermediary, then to you, it is considered a direct transfer. As such you should not be subject to multiple transfer taxes and there is no penalty for having an intermediary

The simple answer is that pooled investments cannot invest using a 1031 exchange because the owners are required to be the same for both the purchase and the sale. So, if you are part of a syndication, you generally cannot make another purchase using a 1031 unless every member and their contributions hasn’t changed.

But, there are a couple ways to invest using a 1031 exchange and also have a pooled investment structure.

Alternately, you can invest using what’s called a TIC, or tenants in common. With this structure, you can invest alongside other investors and use a 1031.

Alternately a Delaware statutory trust, or DST, is also an acceptable structure for investing using a 1031 exchange.

Snowballing a Portfolio With a 1031 Exchange – Conclusion

As you’re already aware, real estate is one of the most proven methods to accumulate wealth and achieve passive income. This is great, until it comes time to pay Uncle Sam.

The best way to defer taxes indefinitely is through investing in real estate using a 1031 exchange, or like-kind exchange. Using the variety of techniques that we laid out in this article, you can take your assets and level up to larger and more profitable portfolios. Throughout your life.

It is true though that the 1031 exchange is extremely complicated, even for full-time career investors. Small mistakes can put your tax deferment at risk of being taxed. This is why you need to contact a professional to help you through the process.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply