I’ve saved a ton of money, so I’ll invest it in some real estate.

Famous last words.

Cash in the bank is important for a down payment, but qualifying for a loan is based almost entirely on your debt to income ratio. Many prospective landlords or investors have not fully considered this before deciding to achieve financial independence by becoming a real estate investor.

Debt to income ratio (DTI) is one of these often-overlooked factors that can end up making or breaking the chances of any investor.

The Need for Capital

In order to invest in real estate, investors need massive amounts of capital.

It’s just a fact that real estate is really expensive.

Many real estate investment opportunities hundreds of thousands of dollars for even small investments.

In order to come up with those payments, the vast majority of people need to be able to secure a loan. This loan will allow them to purchase the property and then either rent it out or sell it later for a profit.

While you may be looking at the deal and it’s potential returns, the bank is more interested in looking at you and your ability to pay them back.

A bank has to look at many factors before they consider giving over a large sum of money. The first thing they look at is your credit score. If your credit score is too low, they won’t give you a loan, regardless of what interest rate you offer to pay.

The credit score is based on the history that a person has had of paying off their debts. It helps banks decide who gets loans and what kinds of interest rates people receive that are associated with those loans.

There are a lot of ways to improve your credit score if yours is low. Here are several ways to improve your credit score.

Loans and credit scores

This is the main thing that people think about when they consider how a bank views their creditworthiness. The credit score has become a ubiquitous part of nearly every conversation about gaining credit and qualifying for loans.

However, a credit score is mainly focused on the past. A person with a track record of paying off their debts is a better bet than an individual who does not have that track record.

But banks are also interested in a person’s present financial status. Years of successfully paying off loans do not matter if an individual cannot pay off the loan that a bank is considering giving them.

In order to capture this present ability to pay the loan, banks have begun to implement a particular tool known as the debt to income ratio.

The Debt to Income Ratio Defined

The debt to income ratio is the amount of debt that an individual owes relative to their income. Banks have two different measures of it.

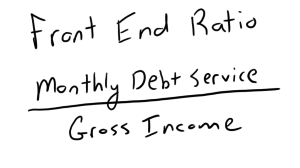

It is calculated by taking the total monthly payments and dividing it by the total gross income. This is also called the front-end ratio.

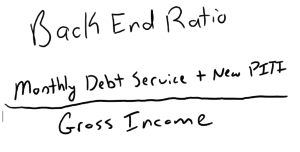

The back-end ratio is the total monthly payments + your new PITI payment divided by the total gross income.

It is important for the bank understanding your ability to pay back the loan at this present time. The bank knows how individual finances work and the mix of income and obligations that individuals have.

A person with a higher amount of debt going into a loan compared to their income may have less of an incentive to use their relatively small income to service their new mortgage.

They may be more interested in covering older debts with higher amounts that would do more damage to their creditworthiness if those debts were defaulted on.

A poor DTI ratio could make gaining a loan of the amount required for real estate difficult if not impossible.

Ways to Improve Your Debt to Income Ratio

There are really only two ways to improve your debt to income ratio – increase your income or lower your debts!

The first thing you need to do is create a good budget (and stuck to it).

After creating your budget, you should know if you have a budget surplus or deficit.

If you have a deficit, you will need to increase your income to a level that can cover all your bills (and then pay down debt). Or, you need to adjust your lifestyle to fit into your budget.

Once you are at a stage where you can begin to think about reducing debt, here are the two best methods.

Debt Consolidation

The first, and easiest way is through debt consolidation. It’s faster than paying off debts, however, it is also an incomplete solution.

The process does not make the debt go away or provide an easy way out of debt. What it does is allow you to take the same debt and spread it out over a longer repayment period with lower interest rates.

This can help lower your overall monthly payment, which can be a huge help in lowering your DTI ratio

The consolidation process happens when a company or government group helps an individual bring all of their debts together into one. The single debt package is then given a flat interest rate and a reasonable timetable. There are no large fees or harmful terms.

In most instances, debt consolidation can be a helpful way of making sense of one’s debts and bringing a vast number of debts together into one easily managed package.

Debt Pay Down

Paying off debts is another approach to solving a DTI problem. This approach is more difficult than debt consolidation but also more permanent.

The first step is to gather all of your debts from every source and write them down. Write down the total payment along with the total debt.

Next, rank the debts by the highest interest rate to lowest.

Finally, start paying off the debt with the highest interest rate.

If your highest interest rate debt is massive, then you might want to consider paying off your smallest debt first. You do this because of the psychological impact of being able to pay off a debt.

Once you pay off the smallest debt, you can then take that extra savings and apply it to the next smallest debt, and continue to do this.

It’s smartest to pay off the highest interest rate debt first, but what is most important is that you are paying it down.

Conclusion

Potential investors should not be troubled by a poor credit score or a high DTI ratio. You should instead focus on improving those factors.

These are active steps that everyone can take to improve their income and better pay off their debts. The biggest thing holding you back is yourself. So, take some action and start lowering your debt to income ratio!

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply