It is a lot of money, but it’s also not a lot at the same time. You might have $100k after selling a house, rolling over a 401k or IRA, receive it as an inheritance, etc. It feels like it takes forever to get it, until you have it.

So, let’s dive into the best way to invest 100k.

NOTE

For starters – you should never invest any money that you absolutely need! So, this exercise is for disposable money only.

Additionally, this is not investing advice. This is just for reference only and you should speak to your own advisors before making any investments

- Should I Diversify my $100k Investment?

- Allocating My Money

- Why I Would Invest My 100k Heavily in Real Estate

- Real Estate Cash-Flows 6-10% On Average

- Real Estate Has Tax Benefits

- You Can Leverage Real Estate (Cheaply)

- 1. Crowdfunding

- Investing With Fundrise

- Investing with RealtyMogul

- 2. Direct Real Estate Ownership

- Finding Good Real Estate Deals

- Running the Numbers

- 3. Side Business in Real Estate

- Starting a Lead Generation Company

- 4. Investing in Stocks

- What is an Index?

- What is an Index Fund?

- Why Invest in Index Funds?

- The Best Way to Investing $100,000

Should I Diversify my $100k Investment?

The first thing to think about is diversification. Should I diversify?

This will depend on my current financial situation. If I have a bunch of other investments elsewhere, then I would consider dropping my $100k into just one investment.

If this was all of my disposable money that I want to invest, then I’d diversify it.

I will assume that this 100k is all the money available, so in this theoretical example, I’ll diversify it. But, if you ever wanted to dump it all in one place, you could just pick one of these categories and put it all in there.

Allocating My Money

Since I’m going to invest my $100,000 in a diversified fashion, I’m going to plan how to allocate the money first. In order to do that, I need to lay out some options to invest in first. Here are a few.

- Stocks

- Bonds

- Real Estate

- Business Ownership

- Commodities

- Venture Capital

- Crowdfunding (venture capital, real estate, etc)

There are definitely more options but these are probably the most mainstream. I don’t want to dive deep into something that requires a lot of very specific knowledge or experience to get into.

Looking at this list, I’m going to cross a few items off right away.

Crossing Off My List

First, I’m going to toss bonds. They earn too little and values are inversely related to interest rates. Since interest rates are going up, bond values are going down. Plus, who wants a few percentage points of return when everything else returns so much more?

The next thing I’d toss of is venture capital. The minimum investments are going to be too high and the cashflow is not there. Generally, VC companies have big pay days if they sell or go public, but won’t return any capital in between. I like good cash flowing assets.

The third item I’m going to toss is commodities. It’s an area where you can make a lot of money, but it requires a lot of specialized knowledge that most of us don’t have. Or, it requires a lot of speculation and that isn’t a solid investment strategy.

That leaves stocks, real estate, business ownership, and crowdfunding. I personally would allocate my money into those 4 categories as follows:

- 40% – Direct Real Estate Ownership

- 20% – Crowdfunded Real Estate

- 20% – Stocks

- 20% – Side Business Venture

Yes, yes, I know it’s 60% real estate…

Why I Would Invest My 100k Heavily in Real Estate

You can make a ton of money in a lot of ways, but I love real estate. That’s why I’ve chosen to allocate 60% of my money into real estate in this exercise.

Besides the fact that real estate is the only tangible asset on the list, it is also one of the best performing overall.

I won’t dive into it in depth here, because I go really far into it in my stocks vs real estate article, but here is are a few quick highlights:

Real Estate Cash-Flows 6-10% On Average

On average, real estate provides a cashflow (income after all expenses, mortgage, etc) of 10%. It can be much lower if you’re buying in a very high cost area, and it can be way higher if you’re in tertiary markets.

Well, it can also lose money, but every investment runs that risk. Like all investments, you need to do a lot of research and diligence before buying.

So, the average return is already equal to or higher than the average returns of the US stock market.

Real Estate Has Tax Benefits

The biggest benefit to real estate is you can offset most of the income with depreciation. This is a paper write-off that the IRS lets us have, because generally real estate is actually appreciating.

So, most gains are entirely offset by paper losses. This is a HUGE benefit that people don’t realize.

You Can Leverage Real Estate (Cheaply)

Real estate has one of the most well established credit markets and the only credit that I’m aware of that offers very long-term and low-cost loans.

This can be used to leverage your investment in a safe and inexpensive way to bump up your returns.

I’m starting with crowdfunding because it’s easy to get started. I’ll be putting $20,000 of my $100k investment into this.

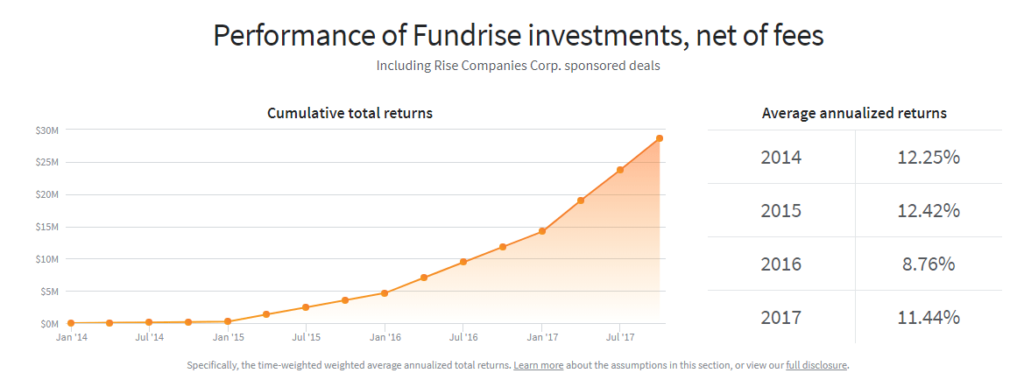

I’d jump right onto my favorite platform, Fundrise, and drop a portion of my investments right in there. The great part is you can invest with your retirement fund.

Investing With Fundrise

It’s a super simple process so this won’t take long.

I like Fundrise because it’s done well with the money I invested in it back in 2016. My return has average around 10% per year, and there has been some appreciation as well.

So, here’s how to invest with them:

First, go to the Fundrise website and pop your email address in there.

Next, select your plan.

Third, connect your account and fund the investment.

Simple, right?

Investing with RealtyMogul

I’d also save a little bit and pick maybe two projects with RealtyMogul and put $5,000 in each one.

The big difference between RealtyMogul and Fundrise is that Fundrise invests your money into projects for you; with RealtyMogul you have to pick the individual properties. I like having a bit of both in my portfolio.

Investing with them is super simple as well.

First, go to the RealtyMogul Website. Click on “start investing” and fill out the information.

Look at their available properties. Choose the ones you like, and fund them.

With $20k invested in total, I’d expect to earn an average yearly return of at least 12%. So, $20k will create $2,400 per year in income for me.

I’d put 40% of my $100,000 investment money into my own real estate. At the $40k mark that allows me to buy a property that is roughly $200k in value. I can get a good triplex or fourplex at that price.

I think real estate is one of the best ways to invest money, regardless if you have $10,000, $50,000, $100,000 or even more to invest.

I’d expect at least a 15% cash on cash return and another 2-3% per year in appreciation. So, this $40k should earn around $7,000 per year for me.

Getting started in real estate is a little bit more challenging than just dropping money into crowdfunding. You can get started making offers in the next 30 days by checking this course out.

There are 4 things you need to learn in order to succeed at investing in real estate:

- 1Find a Deal

- 2Run the Numbers

- 3Finance the Property

- 4Fill it With Good Tenants

Finding Good Real Estate Deals

There are really 3 ways to find good deals – MLS, Direct Mail, or Online Lead Generation.

Of course, some deals are found by worth of mouth, knocking on doors, etc. But the 3 methods I mentioned are the only 3 that are truly scalable.

Finding Deals on the MLS

I’m not going to go into this too much, but, here are the basics.

First, find a good real estate agent. I like to use Agents Invest for a few reasons. First, the owner of the company is a real estate investor and she finds and trains agents around the country how to work with investors.

Second, it’s totally free to the investor.

Third, her agents often find deals that are not on the MLS, so it saves a lot of work for me.

Direct Mail Marketing

If you want to cut out the agent and go direct to the seller, a good way is with direct mail marketing.

In a nutshell, you buy a list of addresses, put together letters, and mail to them. Then, you wait for calls to come in.

Every time I’ve done this, I get about a 3% call back rate. So, if I mail 1,000 addresses, about 30 call me. Of that 30, maybe 3 are good deals and of those 3 I might get one.

In some markets, it’s more competitive so the numbers may be lower.

I go into a lot more detail on this method in my course on creating deal flow.

Online Lead Generation

Most questions start with a google search. Everything from “how do I avoid foreclosure” to “how do I sell my house fast” are all questions that people go to the internet to solve.

So, by creating that resource online, you might be the one they contact!

I use Investor Carrot for my online lead generation sites. Getting started with them is super simple too!

Simply go to the Investor Carrot site and pop in your email address.

Go through the prompts and set up your free trial.

Then start building content!

It does take about 3-6 months to generate any movement on Google, so be patient when first getting started.

Running the Numbers

This is the hardest part and there is no way we can get into it all here. But, we’ll cover the 4 basics you need to know, which are:

- 1Determine After Repaired Value

- 2Estimate the Rehab Costs

- 3Know The Rents

- 4Budget for Ongoing Operational Costs

Determining After Repaired Value

After repair value, or ARV is what the property will be worth after any necessary repairs are completed. Hopefully, the ARV is higher than whatever you are purchasing it for.

The goal is to buy it for a certain price, do some work, then have the ARV be significantly more than what you put into it.

The best way to estimate the ARV is to do a comparative market analysis (watch this video and subscribe)

Estimate Rehab Costs

There are a lot of rules of thumb and none of them apply everywhere. It also depends a lot on the size of the property in question.

The best way to estimate costs is to bring a contractor with you to give a rough idea.

You could use the $25/foot method which assumes a full interior upgrade costs about $25/foot, but that is fairly substantial.

There is also the $3,500 – $7,000 rule for interior upgrades on smaller apartments.

or…

You get the point. It’s hard to estimate!

Know Your Rents

Similar to doing a comparative market analysis, you’ll want to look at comparable rents in the area. Here are the keys to estimating rents:

First, find 3 or 4 apartments for rent in the area that have similar characteristics such as age, amenities, size, number of bedrooms, etc.

List their rent prices from cheapest to most expensive. If one is way out of alignment with the others, you want to know why. If it’s an outlier, I’d discard it.

Look at the remaining comparable apartments to see if they have rents that are similar then simply average them if it’s true. If they have a wide variety, then look to see which one is most like yours. Then, go find more apartments for rent that are more closely aligned with yours.

Operational Costs

This is one of the biggest mistakes that most new investors make – they forget to budget properly for operational costs.

The easiest thing to do is to simply use the 50% rule. Basically, this says that 50% of your income will go your your expenses (everything except the principal and interest payments).

This rule isn’t always accurate, so it’s good to get in the weeds and determine every expense you’ll have

Putting the Numbers Together

Next, you want to put it all together into a good calculator.

Remember though, the results are only as good as the information you put in, that’s why we put together this course in analyzing your real estate deals. So, check that out too!

I’d take $20,000 and invest it in a side project.

While this is not an entirely passive investment, it can become passive if it grows. Additionally, if it’s set up in a smart way, I can dedicate just a little bit of time to hopefully get outsized returns for the time commitment.

Honestly, not investment starts as completely passive, not even rental property. The key is to set it up well and have good systems in place.

There are two ways to go about this. I could start something completely unrelated to my other investments such as an eBay or Amazon FBA site. The other option is to start something that has synergy with one of my other investments.

Me personally, I’d rather have a business that ties in with other things I’m doing. So, I’d start a business related to real estate, but that isn’t actually investing in real estate.

Starting a Lead Generation Company

Instead, I’d start a lead generation company. I don’t have time to run around dealing with random homeowners, so wholesaling wouldn’t work for me.

To start, I’m going to build a real estate wholesaling website with Investor Carrot, then I’m going to sell those leads.

This has synergy, because at any point I could keep the leads and chase down the owners myself, allowing me to potentially buy the real estate myself which ties into #2. I can make money in this business and also earn even more through direct ownership.

I know that starting a site costs only a hundred or two, so what about the other $19,500?

Well, I’m starting a business, so I’m not going to do all the work myself. While it’s super easy to bootstrap the business and do the work myself, since I’m allocating funds to it, this is how I would spend it

- $4,000 for writers

- $2,000 for VA and link building

- $5,000 for direct mail

- $1,000 for technology (hosting for a year, email list, etc)

- $7,000 in reserve

Like I said, you do not need any money at all to start this business. But, since I have the budget and want to build it fast, I’m allocating some funds to help it get started and grow.

Content Creation

For $4,000, you can buy a lot of content. This will be perfect, because you need some good content to rank well in Google.

Using a service like textbrokers, you can get decent articles written for not a lot. A decent 1,000 word article is going to cost you around $45.

Not all of your articles will be that long, so let’s just say you can get 100 articles written for $40 or so on average. Writing that myself here on Ideal REI, it took me close to 12 months to get that many articles, and most of them were not 1,000 words long.

So, it’s a great amount of content to drop on a site to help it rank well.

Link Building

I’d hire a VA to do outreach to other sites to try to build some links. Generally, you can find a VA on a site such as upwork.com for very little, even just a few bucks an hour.

You will need to give them very specific instructions in order to get them to work well, but it isn’t too hard to show them how to find relevant websites and give them a script to send for emails.

Link building is important because it will help those new articles rank well on Google.

Direct Mail

Direct mail is really expensive and time consuming, but there are a lot of services out there that you can use to print and mail your letters for you.

I’ve never used any online, so I can’t recommend one, but a lot of people I know have used them and have had success.

This is a good way to kick start your referral business.

Technology

It costs about $40 per month for Investor Carrot, then you’ll want an email list service, and maybe a few other pieces of technology to help you manage your leads, any offers, etc.

So, $1,000 is a fair amount for an entire year for this startup business.

Reserves

I want to keep a lot in reserves so I can double down on whatever works. If I see success online, I’ll write more articles and build more links. If direct mail is working, I’ll up my budget there.

By having some reserves, it will let me grow in the direction that works.

This is the most boring of all the options and the most well understood, so I’ve put it last.

I would invest the remaining money into a low cost index fund that tracks one or more of the major indices such as the DOW, Nasdaq, or S&P 500.

What is an Index?

An index is a group of stocks that track the performance of the stock market, or a specific subset of it. The index is weighted based on the stock price, so larger companies have more weight.

There are a number of indexes including the S&P 500, NASDAQ, or Dow Jones Industrial Average.

Each index tracks something slightly different. The S&P 500 tracks how large US companies do as a whole (and is made up of 500 of the largest companies in the US). The Dow Jones tracks only the 30 most influential and largest public companies.

The NASDAQ is a little different because it is an index and also a trading exchange.

So, the S&P 500 and Dow companies can be bought or sold on the New York Stock Exchange, but the NASDAQ Composite companies are bought and sold on the NASDAQ exchange. These companies are heavily made of tech companies such as Apple and Google, but can be smaller tech companies or even others such as Starbucks.

What is an Index Fund?

A fund that buys stocks to mirror the movement of the whole index is called an Index Fund. If it’s traded openly on the market, this is called an Exchange Traded Fund (or ETF).

The fund will pick an index to follow, and they they allocate their holdings based on the underlying index it’s tracking.

So, an S&P 500 index fund will go up and down in tandem with the actual S&P 500.

Why Invest in Index Funds?

It’s generally accepted that most people cannot pick stocks that outperform the market as a whole. If they do, generally they cannot continue to outperform year after year.

So, if one cannot pick stocks that outperform the market, then why not invest in the entire market? Or… at least some large portion of it.

Additionally, the fees in Index Funds are generally very low. So, even if a fund manager can outperform the market, the additional fees will generally make up for a large portion of the extra gains.

This takes the difficulty out of stock picking and makes investing easier to understand to the average investor.

I generally buy into funds that track the S&P 500, because I believe it’s the best representation of the overall economy. But, there are a number of indexes for you to buy into depending on your personal goals.

Additionally, there are other low cost funds that track the indices around the world, so you can get creative here and get some exposure to foreign assets as well.

The Best Way to Investing $100,000

I’ve covered a lot of different ways to invest $100k. Like I said before, it really depends on your personal situation and risk tolerance.

It also depends on any other investments you might currently have as well.

For me, I’d diversify it into these 4 areas. I’ve invested 80% of the money into good, solid, investments. The last 20% I put in something riskier – a startup company.

Of that 80%, I put 3/4 into real estate and 1/4 into stocks. This follows along with my research that real estate generally outperforms the stock market.

If you aren’t interested in diversifying, just pick just 1 and focus in on that one – such as buying a bigger apartment building or diversifying it all in crowdfunded real estate.

How would you invest $100k? Would you invest it in real estate? If not, where would you invest it and why?

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply