When you are planning to invest over 50, you have to realize that your goals shift as near retirement.

Instead of high-risk investments with a high potential for appreciation, you’re instead focused on asset preservation and making sure the cash is there for you when you actually do retire.

Additionally, you may want to shift into higher cash flow investments rather than investments with a lot of appreciation but little payout in dividends or quarterly payouts.

Here are a few great ways to invest that might meet your goal of both cash flow and asset preservation.

Real Estate

There’s no doubt that real estate is one of the most tried and true ways to invest.

It has far less volatility than the stock market and is a high cash flow asset with slow and steady appreciation.

The first thing to remember is that a home is not usually a good ‘investment’. When we say real estate as an investment, we are really talking about rental property or other properties that are income-producing.

Though owning a home may make sense for you because you need a place to live. Also, home ownership might make sense if you value having the stability that doesn’t come with renting, then it’s perfect.

If you do decide to buy rental property though, there are 4 key steps you must take.

Procure the Right Property

Procuring really breaks down into a few sub-steps and is the single most important step of the whole process. After all, they say you make or lose money when you buy not when you sell.

The first part is to find a great deal. You might find great property from direct mail marketing, online lead generation, or through openly listed properties (like the MLS).

One of the ways I’ve been generating leads lately is with a website for motivated sellers. People search online to sell their house fast, find my site and submit their info.

To host that, I like to use OnCarrot.com which specializes in that. They are fairly inexpensive and do all the hard stuff for me so I can focus on real estate.

The second part of this is to analyze your deals.

This is the bread and butter or meat and potatoes of real estate investing in general, and we can’t get too in-depth here (because entire books are written on this topic!). But, let’s cover the basics.

When analyzing your deals you want to know what your cash on cash return is going to be as well as the overall return potential.

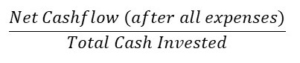

Cash on cash return is the total cash you put in vs the total cash you get out. It’s calculated as:

This is a little different than the overall return on investment because it’s based on cash flow. Some income is not realized immediately in the form of cash flow, such as principal paydown or equity appreciation.

Add Value

The next step is to add value to your property.

You can do this with renovations, increasing rents, changing management, or any number of other creative ways.

The reason you want to add value is that you want to get the most cash flow for your investment. The higher the value of the property, the more income it will produce. Additionally, you can refinance in the future and cash out some (or all) of your investment.

Stabilize Occupancy

Occupancy is a bit more complicated than just the total occupied units. We like to consider the total rental income vs the total potential rental income to calculate occupancy.

So, a unit could be occupied every day for the entire year, but still have a high vacancy if that unit is way below market rent.

For example, if the market rent on this unit is $1,000 per month and you have it rented to a long-term tenant for $800/month. You’re still at 20% vacancy.

You will want to rent out any vacant units and also rent them at or near market rents.

Grow Other Sources of Income

Once you’ve done the first 3 steps, this is almost an afterthought. But, you’ll want to find other ways to earn money on every property you buy.

It could be for charging for the best parking spot, renting out storage units, getting a coin-op laundry, etc.

Think about it this way.

Let’s say you have a property that is netting you $1,000 per month after all expenses. A lot of people might overlook some of the small things I mentioned, but perhaps we can rent out a small storage area on the property and install some coin-op laundry.

…and each one earns a modest amount, only adding up to $100 per month.

That’s a 10% increase in your income! Would you say no to a 10% pay raise at work?

Of course not, so why would you say no here?

The Stock Market

Picking stocks is a really difficult thing to do. In fact, many experts say it’s virtually impossible to pick stocks in a way that guarantees better results than the “market” as an average.

While over a long period of time, stocks always go up, they are very volatile. The volatility could leave your investment less than where you want it when it comes to withdraw some of your nest egg.

So, in general, older people don’t want to try to pick a bunch of random stocks, and also don’t want to invest in a volatile investment.

Instead, focus on buying low-cost ETFs or mutual funds that are focused on dividends rather than appreciation.

These investments can yield 4-5% returns in dividends and are far more stable than the overall market becuase they are more mature companies.

The 4% dividend could help you offset when you need to sell any of your investment as well.

5. Crowdfunding Investments

One of the best ways to invest over 50 is through real estate crowdfunding.

Basically, developers need investors, and you can provide the capital they need to complete projects.

By doing that, you get a piece of their earnings. In fact, the investors get most of the returns and the developer gets around 1/5 or 1/4 of the total returns.

So, if you want the benefits of being an equity owner in one of these deals without the effort required to actually find and oversee them, then crowdfunding is perfect for you.

My two favorites are Fundrise and RealtyShares. I recommend going and signing up for both because it’s free, then looking at their investments and how they work. Then, pick what works best for you.

Sign up for Fundrise here

Fundrise has a number of funds you can invest in which allocate and spread your investment across dozens of different properties based on the prospectus. It totally removes the difficulty in investing in real estate because you just deposit money and they take care of the rest.

You can even reinvest the dividends! They make it super simple. You can read my Fundrise review here.

Equity Multiple, on the other hand, allows you to pick and choose the properties you want to invest in. The minimum investment is relatively low so you can spread your investment out across multiple deals. You can read my EquityMultiple Review here.

Conclusion

The key is to focus on steady cash flow rather than volatile appreciation. Then, diversify, do your research, and feel comfortable with what you’re investing in.

If you are heavily invested in real estate, you might want some stocks or crowdfunded investments.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply