Before you start investing in commercial real estate, regardless if it’s via online crowdfunding or through a syndication, you want to know what sort of investment you are getting into.

In general, crowdfunding and syndications both invest in commercial real estate. Single-family properties are too cheap for developers to raise

And usually those are commercial real estate projects.

Since commercial real estate is new to most investors, we’re going to cover the different property types within commercial real estate, as well as the different classes of property and neighborhoods.

Asset Class vs Property Type vs Property Class

An asset class is a group of investments that have similar characteristics and behave similarly in the marketplace.

Equities (stocks), fixed income (bonds), and cash equivalents (money market) are the 3 traditional

There are a whole host of alternative asset classes which professionals may agree or disagree on them, such as valuable art, numismatics, or other collectibles. Increasingly many are looking at crytpo currencies as an alternative asset class.

Each asset class can further be broken down. For example, there are 11 sectors for stocks (healthcare, industrials, technology, etc).

A lot of people will ask about asset classes in real estate. What they actually mean to ask is about property types within the asset class of real estate. There are no asset classes within real estate because real estate is an asset class.

Property types are what the real estate asset class is broken down into. Just like stocks have 11 sectors, real estate has a variety of property types from office to multifamily.

Real estate does have a “class” rating system as well, which may be part of the reason why people confuse the terminology.

Property classes in real estate are referring to a rating system we use in the real estate industry to help us categorize neighborhoods and property types. This is generally on an A to D rating scale where A is the nicest properties and D is the oldest and most run down.

Real Estate Property Types

The asset class is an overarching and very broad type of investment. Within real estate, there are 4 primary types of property which include:

- Residential

- Commercial Real Estate (CRE)

- Industrial

- Land

Each one of these can be further broken down. For example, farming and resource extraction (mining and oil) are

We’re going to focus on commercial real estate because that is what most investors are buying when they want to buy income producing

Types of Commercial Real Estate

There is almost an unlimited number of types of commercial real estate, but here are the most common ones you’ll see.

Multifamily

Multifamily is a type of commercial real estate because the owners buy it to produce income, not to live in.

Multifamily is anything that is 5 units and above (in the United States).

There’s really no reason for it except that the primary mortgage lenders Fannie Mae and Freddie Mac will back personal/residential mortgages on any owner occupied property 1-4 units, but not 5 and above.

So, a homeowner can get a traditional mortgage on a 4 family, not on a 5 family.

4 family properties are technically multifamily. But, they are excluded because they are bought by typical homeowners. Commercial multifamily property is exclusively 5 units and above.

Garden style, mid-rise, and high-rise buildings are 3 sub-categories of multifamily to be aware of.

Retail

Retail is the subcategory of commercial real estate that includes all shopping. This includes everything from a building with a single retail tenant in it (such as a fast food restaurant), all the way up through shopping plazas or even shopping malls.

It is a really complicated space because there are a variety of lease terms that can directly impact the value of the asset. For example, a single tenanted building with a lease that is about to expire is worth far less than the same building with a new 10-year lease.

Additionally, there are different types of malls, shopping centers, outlets, and more that complicate the space.

Regardless of how they are broken down, they are all considered retail.

Office

Similar to retail, these can be multi-tenanted or single-tenanted. But, unlike retail, these can range from giant skyscrapers to small office condo developments.

Self Storage

Self-Storage is relatively new to the list and is not included in most other breakdowns of commercial real estate. But, it should be.

Self-storage is one of the fastest growing and most stable CRE investments available. Supply simply cannot keep up with demand in many markets, and available spaces are being leased up at unbelievable rates.

Hotel

These are properties that are owned and operated for the purpose of very short term rentals. Can also include motels.

Mobile Home Parks

Mobile Home Parks are a huge sub-category. It’s often overlooked or counted as a sub-category to multifamily, but that’s not accurate.

Mobile home parks were very popular in the 70’s and earlier, but few new MHPs have been built in several decades. As such, occupancy is high and stable.

On the other hand, infrastructure is aging and investments in underground water/sewer, roads, and electrical can be very costly.

Special Purpose

This just captures all the other unique types of commercial real estate out there such as amusement parks, bowling alleys, and more.

Classes of Property

In residential and multifamily, the property/neighborhood class is a rating from A to D. It describes the overall age and quality of both the neighborhood and the individual property. For example, you might hear that this is a C class property in a B class neighborhood.

Office space also uses a rating system, but it’s generally from A to C.

Class A Property

These are the most prestigious properties that demand above average rents. They often include many luxury amenities, have high quality finishes, top of the line technology, and great accessibility to local transportation, shopping, etc.

These are generally 10-15 years old and are in the most desirable locations. Increasingly, older buildings in downtown areas are being converted to class A properties. It is often more desirable to convert than to tear it down and

Class B Property

These are generally 20-40 years old and appeal to a wide range of people. They get average or slightly above average rents and have a good combination of amenities. Their finishes are good though possibly slightly older.

They still appeal to higher end tenants but cannot compete with the luxury and finishes of Class A properties.

Class C Property

These are functional spaces and are offered at a discount to newer properties. These are generally 40+ years old and may not have been upgraded in decades.

C class properties will appeal to general blue-collar working class people who prefer functionality over amenities.

Class D Property

These are properties that have issues. The issues could be age, from bad tenants, crime, mismanagement, or changing demographics.

The tenants who live here will generally have low wage service jobs or just government assistance. They may have significant deferred maintenance, require additional security, and have problems attracting better tenants.

People don’t generally buy D class properties without a plan to

Which Class is Best to Invest in?

There is no right answer. Some investors prefer lower class properties while other investors prefer higher class properties.

There is a trade-off between property class and difficulties you’ll deal with.

Higher class properties will have wealthier tenants who tend to take care of their apartments better. They are also far less likely to default and be evicted because they care about their credit score and eviction history.

Lower class properties will attract

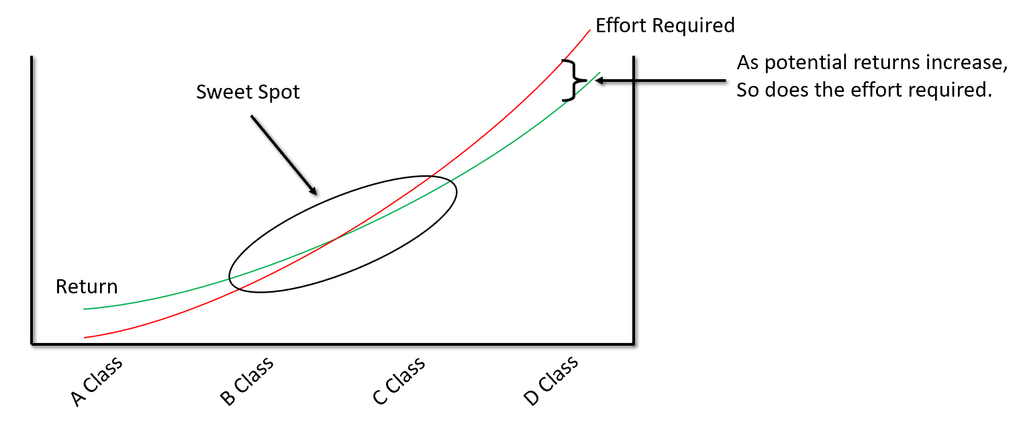

This graph explains it well.

Your potential returns go up as you go to lower class properties (green line). But, the work and effort goes up as well (red line).

You’ll see that the work begins to out the additional returns at some point. I call this the sweet spot and it’s somewhere around the B- to C class properties.

Class A properties are great if you have no time or don’t want to pay a lot for management. D Class are great if you have a ton of time to deal with tenant problems.

But, a good balance is somewhere in between.

Pros and Cons to Different Property Types

Each type of property, as well as each class of property, has its own positives and negatives. It’s impossible to go over every nuance, but let’s cover a few.

Pros and Cons of Multifamily

Multifamily is probably the most common property type for investment purposes. It’s for a good reason too.

Large multifamily has an unbelievably low default rate. For example, Fannie Mae backed multifamily loans have a delinquency rate under 1%, even at the height of the last recession.

So, multifamily is a very safe investment.

Additionally, multifamily had one of the highest rates of return of any property type in 2018.

So, it’s one of the safest investments and also has one of the highest returns.

The cons are that multifamily is more regulated than in other sectors. States and cities can enforce rent controls or other policies that can make life more difficult for landlords.

Pros and Cons of Self Storage

Self storage is probably the next safest and 2nd highest return type of real estate.

There is a high demand for self storage right now and construction cannot keep up with demand. So, occupancy is high, rents are increasing, and there is room for expansion.

Additionally, you are dealing with belongings and not people. So, it’s easier to evict and sell their things.

Pros and Cons of Retail or Office

Retail and office are different, but their pros and cons are similar.

Generally, you’ll have longer tenancy and lower expenses because the tenant will do most upgrades, repairs, and maintenance. This is especially true if you have a triple net (NNN) lease.

The big drawback is when a tenant leaves, it can take a lot of time to fill it. So, you may have 10 years off occupancy followed by a year or longer of vacancy.

Mobile Home Parks Pros and Cons

MHPs have a ton of pros – tenancy is very stable and costs are low.

On the other hand, infrastructure may be old and require work. It can also be difficult to evict because the tenant actually owns their trailer and just rents the land.

Crowdfunding Readers Guide

This article can be read alone or you can read the entire crowdfunding guide. You can read the other sections by clicking below:

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply