I’ve long said that real estate is an amazing way to become financially independent; it’s also true that you can make money in any of the real estate niches, just not in every niche.

Every investor or real estate agent that I know who has tried to jump into a drastically different niche because they found a “good deal” has lost a lot of money (or wasted a lot of time).

The more you specialize in a niche, the more money you can make from it, but also the more you can suffer if that niche falls out of favor or when the economy shifts.

So, In this article, I will share over 100 different niches in real estate for you to get started in if you’re a beginner, or to expand to if you are more experienced.

Real Estate Niches Defined (Loosely)

The problem with real estate is that almost everything can fit into multiple categories or niches. For example, you can fix and flip condos, buy and hold them, be a real estate agent or Realtor specializing in condos, or be a condo inspector, appraiser, etc.

Condos can be in a duplex or triplex, mid-rise, or high-rise. They can be luxury condos or geared toward the general workforce.

So, you will undoubtedly see some overlap and see some items that could be categorized differently.

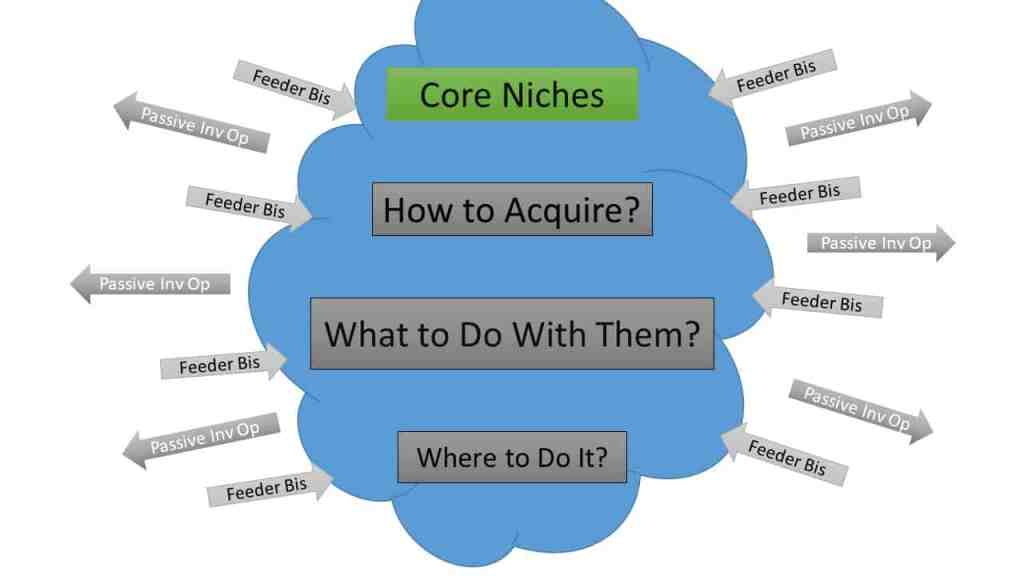

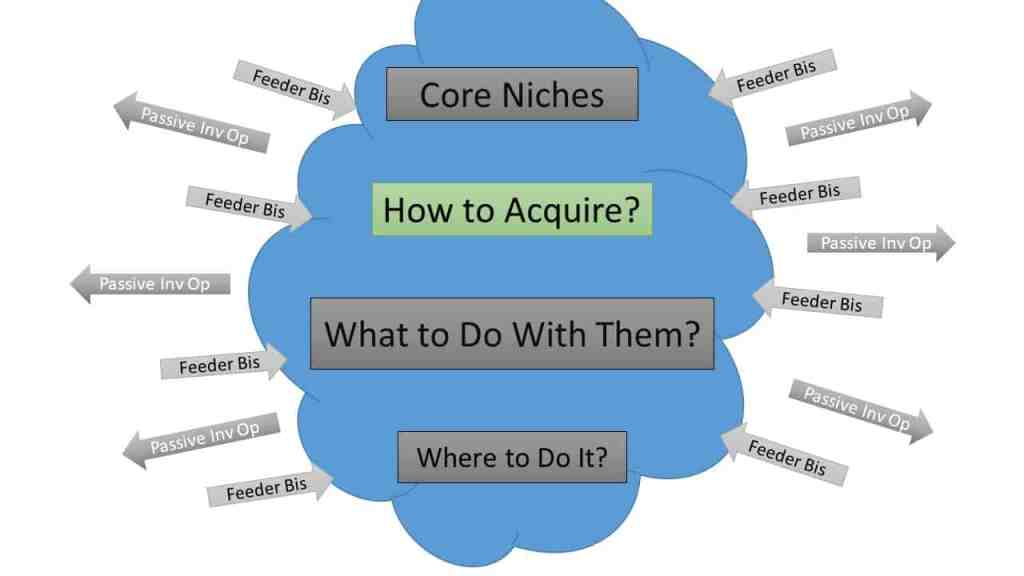

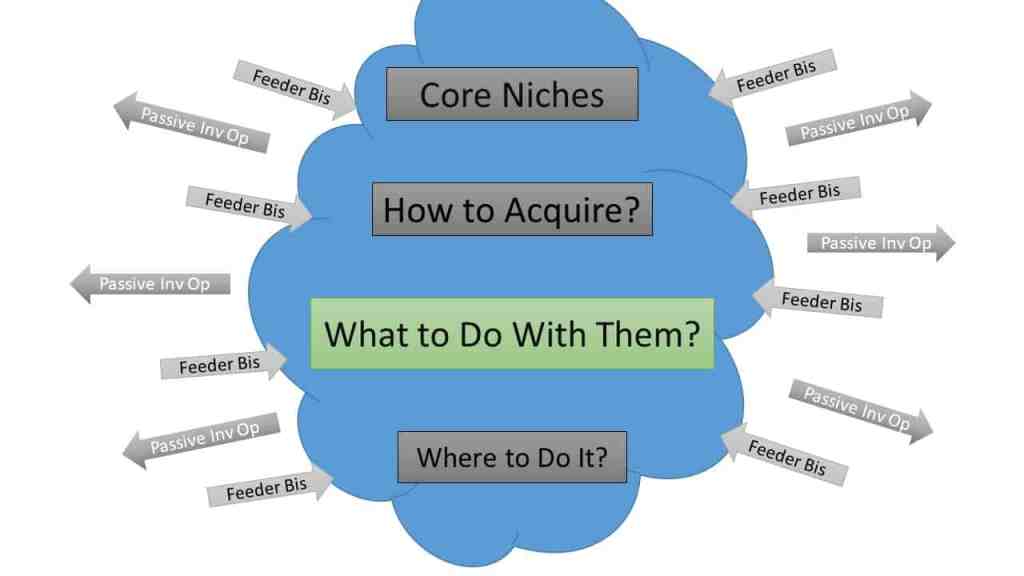

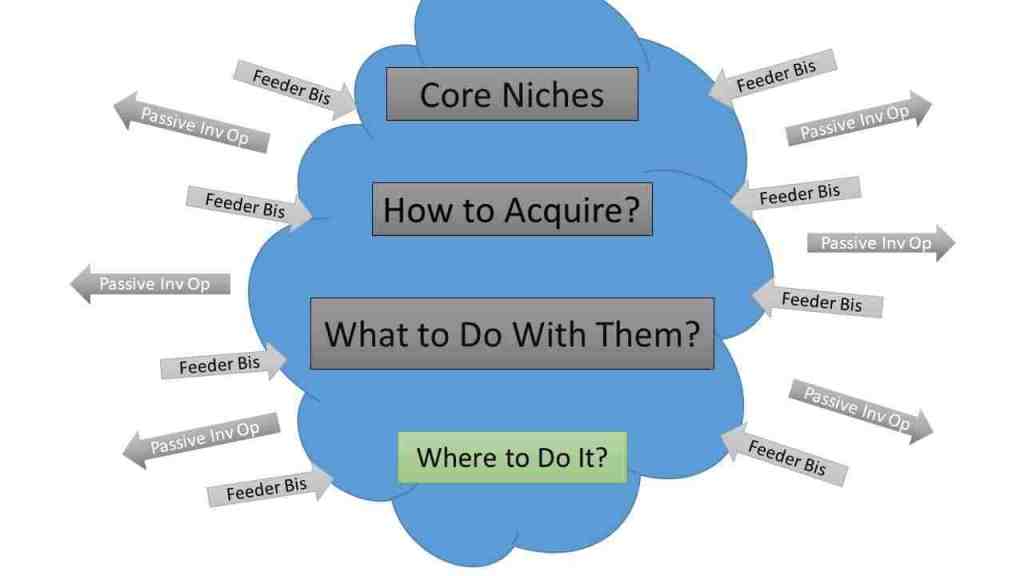

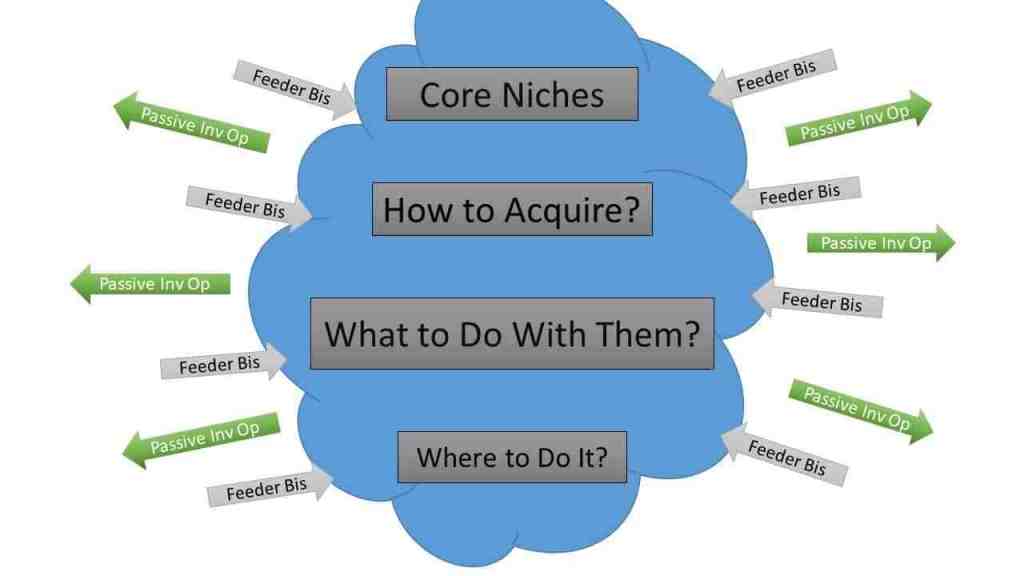

That being said, I have tried to loosely categorize the niches as follows:

- Core Real Estate Niche– Where you most likely will be actively involved when investing, or if you’re a real estate agent, you’ll be able to help buy/sell these.

- Acquisition Niches

- Core Strategies

- Sub-Niches

- Niching Down by Location

- Geographic Micro-Niches

- Passive Investing – Where you will most likely be more passive. Don’t forget, you can be passive in almost every type of investment if you are a limited partner, so this is difficult to categorize.

- Related Fields That Feed Into Real Estate – Not everyone has the money or network to be a real estate investor. These are good feeder niches that will put you around the right people and give valuable skills and get you into your first deal.

You can also click on the following links to be brought to the section of the article related to that topic.

Many professional marketers will say that to be successful in just about any area of business, you need to niche down at least 4 levels.

For example, buying multifamily in Dallas is just two levels (type – multifamily, location – Dallas). It’s too broad.

Do you buy and hold or fix and flip? What about a ground-up development or in-fill redevelopment? You’ll never be successful with this broad of a category.

Now you niche down and want to buy and hold multifamily in Dallas. That’s better, but still rather broad.

In something as competitive as real estate, you really need to niche down further.

So, you could be a (1)buy/hold (2)multifamily investor in (3)Dallas that primarily purchases old buildings (4) with code violations

See how it’s very specific and focused? That’s how you become an expert.

- Real Estate Niches Defined (Loosely)

- Real Estate Niches for Investors and Realtors

- Core Real Estate Niches

- 1. Single Family Detached

- 2. Single Family Attached (townhouse)

- 3. Duplexes/Triplexes

- 4. Residential Multifamily (2-4 Units)

- 5. Apartment Buildings

- 6. Apartment Complexes (or Apartment Communities)

- 7. Condos

- 8. Mobile Homes

- 9. Mobile Home Parks

- 10. Retail

- 11. Shopping Centers

- 12. Office

- 13. Industrial

- 14. Medical

- 15. Sports and Entertainment

- 16. Self Storage

- 17. Land

- 18. Mineral Rights

- 19. Farms/Ranches

- 20. Parking Lots/Garages

- 21. Motels

- 22. Hotels

- Ways to Acquire Real Estate Regardless of Niche

- Core Real Estate Niche Strategies

- Real Estate Sub Niches

- 1. Short-Term Rentals

- 2. Vacation Rentals

- 3. Ski-Home Rentals

- 4. Student Rentals

- 5. Rent-to-Own

- 6. Assisted-Living

- 7. Supported-Living

- 8. Single Family Portfolio Sales (breaking from large to small portfolio)

- 9. Properties With Structural Issues

- 10. Single Family Development

- 11. Subdivisions

- 12. Multifamily Development

- 13. Mid-Rise and High-Rise Condos

- 14. Luxury Condos

- 15. Luxury Houses

- 16. B-Class Housing

- 17. Workforce Housing

- 18. Section-8

- 19. Green Properties

- 20. Small Housing (Micro Housing)

- 21. Victorian Conversion (to Multifamily)

- 22. Use Conversion (Industrial to Multifamily)

- 23. Single Family to Assisted Living

- 24. Multifamily to Supported Living

- 25. Receivership

- 26. Single Family Portfolio Sales (breaking from large to small portfolio)

- 27. The Value Add Play

- 28. The Management Turnover Play

- 29. Teardown/Rebuild

- 30. Additions/Second Floor

- 31. Handicap Housing Conversions

- 32. Military Housing

- 33. International Students

- 34. Pet-Friendly Rentals

- 35. Single Use NNN Development

- 36. Commercial to NNN Conversion

- 37. Shared-Space Rentals

- 38. Airbnb Your Extra Rooms

- 39. Airbnb your vacancies.

- 40. Live-In-Flip

- Core Real Estate Niches

- Real Estate Niches by Location or Geography

- Geographic Real Estate Micro-Niches

- 1. Lake-Front Property

- 2. Golf-Course Homes

- 3. Ocean-Front

- 4. Gated Communities

- 5. Retirement Communities

- 6. Mixed-Use Properties

- 7. Overseas Retirement

- 8. Gentrifying Neighborhoods

- 9. International Investment

- 10. Walkable Communities

- 11. Homes That Face East (or South)

- 12. Urban in-fill development

- 13. Subdivisions

- Geographic Real Estate Micro-Niches

- Passive Investing Niches in Real Estate

- Feeder Professions to Real Estate Investing

- Real Estate Niches – There’s Something for Everyone.

Real Estate Niches for Investors and Realtors

This is tough to break down, but I’ve loosely categorized everything into 3 categories. First, there are core real estate niches which are broad “top-level” categories.

Next, there are ways people acquire those deals. A lot of investors focus on a style of acquisition more than the actual type of real estate they are acquiring.

The last category is what you DO with that real estate. People acquire real estate with different end-goals in mind.

Core Real Estate Niches

1. Single Family Detached

This is the most common and well-known niche of real estate investing. You could probably break this real estate niche up into another 15 or 20 sub-niches based on age, house design, geographic location, etc.

Single-family residences (SFRs) are generally built with one house per lot (but not always, especially on the east coast). Most people have lived in one at some point or another so almost everyone is familiar with them.

Additionally, there are a lot of popular TV shows now that have popularized single-family homes as investment properties. Prices are based on comparable sales.

Single-family homes as flips can work in any market in any state, as it’s just of a function of the purchase price, costs, and the after repair value.

Generally, a SFR as a rental works in poor or very low-cost areas in the midwest or southeast. Also, they can do well in working-class neighborhoods because the prices are lower but rents are higher (as a percent of total cost).

Chad Carson, a real estate investing expert who teaches others how to invest in real estate recommends searching first for markets with great economic prospects, high population growth, and a good rent to price ratio.

2. Single Family Attached (townhouse)

This is a separate real estate niche because they are very similar to SFRs but there is the added component of an HOA.

The vast majority of attached single family homes have a common wall (or two) and share a foundation and roof space, but, the land is separately deeded. The HOA generally collects fees to cover the maintenance of these but also the HOA imposes a number of restrictions and an additional layer of red-tape to go through.

Here’s a great story from my friend Michael over at FinanciallyAlert who’s first investment property and forgot to read all the HOA restrictions. His property wasn’t an attached single-family but his rental property couldn’t actually be rented out because of the HOA!

3. Duplexes/Triplexes

Duplexes and Triplexes are similar to attached single family homes except the land is usually not separately deeded so one owner has ownership of both or all units on the land.

4. Residential Multifamily (2-4 Units)

Each of these has built upon the last. All duplexes, triplexes, and fourplexes will count was residential multifamily, but I have separated this because multifamily is not limited to just side-by-side triplex and fourplex layouts.

Residential multifamily can stack on top of each other, be multiple duplexes on one lot, or be laid out in any way you can think of.

This is the area that I specialized in as I got started in real estate. They have the added benefit of qualifying for FHA, VA, and other traditional sources of financing.

5. Apartment Buildings

Apartment buildings (and all commercial real estate) are different from residential properties because they are evaluated based on the Net Operating Income and the Capitalization Rates.

They generally have 5 or more units all within one building. In fact, some can have hundreds in one giant building, but more often you see 10-20 units in a building.

6. Apartment Complexes (or Apartment Communities)

These are pieces of land with a number of buildings on them. Often, each building has 8-12 units but they can range anywhere from just a few units per building all the way up to hundreds per building.

Complexes have the added benefit that the grounds often have a lot of amenities such as pools, dark parks, gyms, and even parking garages.

Often these are purchase in syndications where a lot of people pool their funds together to buy an asset this large. This is my newer area of real estate and closed on a 192-unit complex just recently.

7. Condos

Condos are really no different than an apartment building or apartment complex, but where the owners are the tenants. Each tenant owns their own piece of the building and everyone pays fees to cover the exterior and common area maintenance.

Condos are a very interesting niche because their values tend to swing wildly with the market but they also have very few unexpected maintenance items because the HOA covers it all.

8. Mobile Homes

I’ve broken this down into two sections. This real estate niche is about the mobile homes themselves (and not the land). People buy, fix, sell, and rent mobile homes for profit. It is super niche but they really aren’t making new mobile home parks so it’s a great place to be.

9. Mobile Home Parks

This is the land that the mobile home operators lease. They lease the land from the park, then keep their mobile home on the land. The park has to provide basic services such as water, sewer, and electricity, but often these are submetered.

A couple of people killing it with mobile homes are Rachel Hernandez and John Fedro.

10. Retail

This niche entails a huge variety of real estate and includes locations for banks, restaurants, grocery/convenience, etc. When I think of retail (vs the next category) I’m thinking mostly stand-alone buildings with one or a few tenants.

11. Shopping Centers

This includes obvious things such as malls but also includes plazas, strip malls, etc. A great strip mall or shopping plaza on a busy street can be very valuable.

12. Office

Office space is for businesses to lease to conduct business. It’s different than retail because generally the business is not selling merchandise at their location and are probably more service-oriented. Office buildings, office plazas, shared space, etc all fall into this category.

Fundrise offers a lot of office space to invest in for as little as $1,000 or $5,000.

13. Industrial

Can include distribution, production, R&D, warehouses and more. This is a very interesting niche for real estate agents especially.

A lot of times real estate investors are involved in industrial space as a conversion opportunity, such as from a warehouse to apartments or warehouse to self-storage.

14. Medical

This is becoming more common than it was in the past. Doctors, specialists, and others related to the medical profession are starting to consolidate into medical cities or plazas. I’ve even heard of old malls being converted into medical office space.

15. Sports and Entertainment

This is a super cool niche and can include gyms, movie theatres, pools, spas, golf, amusement parks etc. Our current president is famous for his golf courses.

16. Self Storage

No Toilets, No Tenants, No Trash…or so they say. Everyone needs to store their junk but no one has anywhere to put it. Self-storage has become amazingly popular and a very lucrative niche to invest in. LTVs are higher and returns are better than most other niches.

17. Land

Land is an amazing niche, but one I was always cautious of. It can be sold as-is, developed, leased, or turned into a mobile home park, RV park, hunting grounds, or anything else you can possibly think of.

The best investor I know in this niche is Seth over at RETipster. He is full of knowledge and even has a guest post on this website about investing in land.

18. Mineral Rights

In many parts of the country, people buy the land and a home on top of it but don’t own what’s underneath it. These mineral rights can be very valuable or completely worthless, depending on what’s underneath the land!

19. Farms/Ranches

This is obviously related to land, but needs to be divided out because the value of the land is derived more from its ability to produce or livestock than on its ability to produce housing. Unless your farm is near a large city, then the farm might be a prime candidate for a sub-development!

20. Parking Lots/Garages

Similar to mobile home parks, parking lots are just leasing land to people for a short period of time. The value of the lot is based upon the amount parking costs and the number of people who park there!

21. Motels

Hospitality can really be broken down into more niches, but I stuck with two. Motels are usually lower end short-term rentals. Motels usually have few, if any, amenities and the room doors go directly to a parking lot or other exterior area.

22. Hotels

Hotels are slightly different than motels. They can be dilapidated holes or amazing luxury getaways. The difference is that hotels often have interior hallways and some amenities such as restaurants, gift shops etc.

Ways to Acquire Real Estate Regardless of Niche

For each of the core real estate niches, there are a number of ways to find deals. Though not every item on this list works for every core real estate niche, there undoubtedly are a lot of ways I have not listed that will generate leads and deals.

There are 12 ways to acquire real estate in this list, combined with the 22 core real estate niches, that creates 264 ways to specialize in real estate.

1. Short Sales

Short sales occur when a property is being sold for less than the mortgage amount, but the seller has always paid their mortgage. This often happens when people use high leverage loans on properties and then fail to maintain them. Also, it’s common when people purchase at the top of a housing cycle and then sell near the bottom.

This is a great niche for those who are patient enough to play the game. Short sales can often take months extra to close because banks are notoriously slow at approving the offers.

2. Foreclosures

When a seller stops paying the mortgage, the bank will take the property and sell it to recover some of the value of the loan. Foreclosures work differently everywhere, but generally, they are done with a foreclosure auction.

Regardless of how it’s accomplished, it’s generally the same. You are buying a distressed property at a discount, so the bank can quickly recoup some of its losses.

Be careful though, foreclosures come with no warranties and no recourse if you buy something with major unknown problems.

3. Preforeclosure

Buying preforeclosure is usually done by looking at upcoming auctions or delinquent notices and trying to contact the seller and buy the property prior to the actual foreclosure. Often, as a buyer, you can position yourself as the “good guy” against the bank and get a ridiculously low price before it ever hits the auction block.

4. REO

If the bank isn’t able to sell the foreclosure at auction, they will take possession of it and list it on the open market. In some states with less competitive auctions, banks will prefer to take possession and sell it. In other places, the auctions are so competitive that it just makes more sense to sell the properties there.

This can basically be considered a “foreclosure” with a different way of transferring title.

5. Bankruptcy

You can use public data to find people who are going through bankruptcy. They may be looking to reduce their debt burden by selling their property.

6. Estate Sale/Probate

Grandma was too stubborn to sell her home before she passed away, so now the kids have the property and want nothing to do with it. They can’t agree on anything except to sell it fast and get the cash, so it forces a quick sale on the market.

Some people will collect information on probates or build relationships with attorneys who specialize in this area and then work the estate to help take the burdensome property off their hands.

Listing agents do the same thing by working to list the property.

7. Fire Damage

This is an amazing little real estate niche. Fires happen and sometimes people walk away rather than repair. This happens for a lot of reasons, but how it concerns you is you might be able to get it at a huge discount!

8. Mold/Water Damage

Water is a horribly destructive force and even just a little water will quickly destroy an entire home. Mold, similarly can bloom out of control and make a house uninhabitable very quickly.

The costs to fix water damage or remediate mold can be prohibitively expensive. But, if you know what you’re doing you and can negotiate right, you can make a lot of money.

9. Code Issues

Many places keep lists of properties with a lot of delinquencies or code violations. If you can take these problem properties and offer a solution (buy from them or find a buyer) they may be looking to just hand over the keys and walk away.

10. Divorce

Divorce often kills the price of a property. If one person is forced to sell because of the spouse, they may not care at all about the price they get, just to spite the other person. Or, forcing a very quick sale will mean a very low price. Regardless, there is a lot of opportunities here.

11. Tax Liens

When you don’t pay your taxes, the local government will put a lien on your property. Depending on the state and municipality, the government will either foreclose and take the property or just sell the lien to an investor. Either way, this is a good opportunity for some returns.

12. Condemned

Condemned properties don’t always need to be torn down. If you are savvy, you can find a way to bring it back to life for a fraction of the rebuild cost.

Core Real Estate Niche Strategies

There may be some other niche out there, but as far as I can tell you either

- Build something and sell it (or keep for rent)

- Fix something and sell it or

- Buy something and rent it out.

Within those broad categories of real estate, there are probably hundreds of different sub-niches to play with. I’ll go over some of those sub-niches in a minute, but a moment let’s do some quick math.

So far, there are 22 core real estate niches and 12 ways to find deals in those niches leading to 264 areas of specialty. There are an additional 3 things to do with each of those leading to…

792 real estate niches.

1. Fix-and-Flip

Though this has a strong component of project management, speculation, and is probably more of a JOB than an investment, it’s still important to include flipping as a niche of real estate.

Though it is by far most popular in the single-family market, flipping can be done in some fashion in any real estate niche. People do flip apartment complexes and storage facilities, but the timeline is a bit longer and the process is slower than with single-family due to the deal size.

The basics of flipping a residential property are

- Finding a deal well below market value, usually 75% – 80% of market value less any repairs and holding costs

- Purchase it

- Get the work done

- List it for fair market value

Of course, each step is difficult and complicated, but the overall process is fairly simple.

With commercial property, it’s a little different since fair market value is determined by the NOI. So, you would find a property below market value, find ways to increase the NOI, then sell it based on its new net income.

Some really well-known house-flippers are Danny over at Flipping Junkie and Mark at InvestFourMore.

2. Buy-and-Hold Rentals

Again, an amazingly broad category. Rather than flipping, some people to buy then hold the property long term. Not only are there a lot of tax benefits to holding a property, but you can generate long-term passive income vs just a quick shot of cash from flipping.

Investors look at two metrics overall, the cash on cash return, and the overall return on investment.

- The cash on cash return helps us decide if it will produce the cash we want NOW but excludes any appreciation, tax benefits, equity pay down etc.

- ROI includes all of these other factors to help calculate the overall return once it’s sold in 5 or 10 years.

3. Development

Literally, any asset can be developed from the ground up. This category also includes purchasing existing property, tearing it down, and building something new.

The basic idea is that a piece of land or building is not at it’s “highest and best” use. An old single family home near a bunch of multifamily properties might be worth far more if it were torn down and rebuilt.

The same premise holds true in reverse. An old 4 family building may be torn down to build a luxury home.

And of course, it applies to commercial, industrial and any other niche in real estate.

Real Estate Sub Niches

Like I said before, you should niche down a minimum of four levels.

Going back to my example before:

So, you could be a (1)buy/hold (2)multifamily investor in (3)Dallas that primarily purchases old buildings (4) with code violations

In something as competitive as real estate, you can really niche down 5 or even 6 levels, though you need to be careful as you don’t want to niche down so far as to have no deal flow.

So, you could be a (1)buy/hold (2)multifamily investor in (3)Dallas that primarily purchases old buildings with (4) code violations near universities and converts them to (5)student housing.

That’s 5 or 6 levels deep (you could say “near universities” is another level deeper, or count it toward “Dallas” as a geographic area)

Here are some examples of sub-niches under each of the core categories of buy/hold, fix/flip, and developing.

I’m not counting these to the overall total but will cover several just to help give you an idea of how broad this is! I encourage you to think hard about your area and broad niches that you want to work with and get creative with your sub-niche!

1. Short-Term Rentals

This category has exploded in recent years. Previously, short-term rentals were primarily for vacation homes such as winter ski houses, summer beach houses, etc.

Now, people are renting out apartments on a short-term basis for vacationers, business travelers, or people just passing through. It’s really amazing how the market has changed!

This can be a risky venture, as housing laws are very strict while laws governing hotels and other lodging are completely different. Trying to use a home as a hotel will not favor you well if there is a dispute.

2. Vacation Rentals

Vacation rentals are a really interesting real estate niche. Generally, the rental where it earns all of its income, then for the other 2/3 of the year it sits unused.

The investing style is going to be completely different because you’ll have to budget for an entire year but earn income during a short period. Also, cleaning expenses may be really large because most vacation rentals have a high tenant turnover rate.

3. Ski-Home Rentals

This is a great example of a vacation rental. People may not want to stay at the ski resort, so they’ll rent a home nearby for a few days or a week. Also, cabins in the woods can be used for winter sports such as fishing, hunting, etc.

4. Student Rentals

As the name suggests, this niche in real estate is all about renting to college students. It can be a tough niche to be in (trust me, I used to have student rentals) but the rents are generally higher than the market.

Be careful though, lenders don’t have as good of terms, insurance companies charge more, and cities/towns really don’t like it when you stuff a lot of unrelated people into one apartment.

5. Rent-to-Own

Some investors love the rent-to-own properties. Essentially, you are combining a flip with a rental by fixing a property up then you rent to a tenant, but also make payments toward a deposit. You get all the rent, get to sell it soon, but also get the tenant to take care of any and all maintenance items in the house. You eliminate all costs, increase your income, and sell for a nice profit. This is a solid strategy.

6. Assisted-Living

These rentals focus on people who need long-term and continuous care, usually for the elderly. It’s a tough niche to get into as there may be licenses and employees required, but it’s also possible to just renovate houses to the specifications of an assisted living operator, then just lease the space to them.

7. Supported-Living

This should not be confused with assisted living facilities. Supported living is when the property is renovated to fit the needs of people who need long-term accommodations, but they are generally not elderly. These people often have mental or physical handicaps and may have visiting specialists from time-to-time, but in general, can survive on their own. Jennifer over at REI Millionaire specializes in support living rentals.

8. Single Family Portfolio Sales (breaking from large to small portfolio)

There are some huge single family owners out there. People who own thousands of homes…and they simply don’t have the time or energy to sell those houses one by one. Often, they sell a huge chunk of their portfolio at a discount, just to sell it quickly and reduce the transfer costs.

If you have the resources or relationships, you can buy these portfolios and break them down into smaller portfolios or even sell them individually.

9. Properties With Structural Issues

I absolutely love this niche! I love it so much that I wrote a great article about it over at Coach Carsons, how to buy properties others avoid.

The basic idea is that just about everyone is told to avoid properties with structural problems. If everyone avoids them, then few people are bidding on them, right? So, why don’t you become the person who knows everything about structural issues and also be the one to get the crazy discounts?

10. Single Family Development

This is pretty straightforward. You buy a piece of land and build a house on it. But, don’t think it’s simple! Just because it’s straightforward doesn’t make it easy. There is a LOT that goes into developing a piece of land.

11. Subdivisions

In that same vein, subdivisions are when you buy a large piece of land and build a road, bring utilities, and build a number of houses.

12. Multifamily Development

Multifamily is hot right now, especially as Millenials shy away from buying homes, and homeownership rates have stayed at generational lows. The supply of new multifamily can’t keep up with growing demand which is causing rents to spike across the nation. So, why not develop some multifamily?

13. Mid-Rise and High-Rise Condos

This niche fits well into flipping or rentals. It’s often very easy to find condos at a significant discount if they are damaged or mismanaged.

It’s important to watch out for the HOA rules and fees because they can be amazingly expensive and restrictive in what you can do. Also, with a condo, it’s really hard to control your neighbors and what they are doing.

14. Luxury Condos

Luxury condos are one area where you can gain a lot of appreciation, but they are also one of the first real estate niches to get hit when a downturn is coming.

15. Luxury Houses

These can be great flips because most people buying in the luxury space simply don’t have the will or patience to deal with rehab. They prefer other people to take care of that stuff and are willing to pay for it.

16. B-Class Housing

Below luxury housing and high-end housing, is the B Class housing. It’s often a little bit older apartments (1980s and 90s in most markets except the northeast). These offer some affordable alternatives to the A-class apartments but are still a big step above workforce housing. You’ll see more skilled trades and younger professionals in B class properties.

17. Workforce Housing

This niche is focused on older housing (60s and 70s) and focused mostly on blue-collar and service workers. They are still generally safe and even offer some amenities, but they are smaller, cheaper, and have lower end finishes than A and B class apartments.

18. Section-8

This is the worst of the worst. First off, Section 8 often pays a lot, so income can be huge, but you’re going to be taking in all the tenants no one else will rent to. Most C class and above apartments won’t accept any section 8 or will just accept a very small percentage. This niche is focused on providing acceptable accommodations to almost entirely to people with section 8 vouchers.

19. Green Properties

This real estate niche is becoming more and more popular as people become more conscientious and aware of the environment.

Green Homes will use the landscape, orientation to the sun, and a number of other factors to make them more energy efficient. For example, hills can provide great insulation and orientation toward the sun can provide great passive solar heat and the potential for perfectly oriented solar panels.

A lot of insulations and other chemicals and materials are very harsh to produce and far from natural. An emerging category within “green building” is the use of renewable resources, repurposed wood, and other building materials that are more “green.”

20. Small Housing (Micro Housing)

Kind of within the vein of green properties, micro-housing is the idea of living in extremely small homes so more people can own homes and do it at a much cheaper price.

Unfortunately, many building and housing codes actually set minimum square foot requirements per occupant so these are actually not buildable in many jurisdictions.

21. Victorian Conversion (to Multifamily)

This is a super niche category of real estate. Victorians were built predominantly on the east coast in the 1800s. These homes were often very large and beautifully designed.

As amazing as it is to bring these back to life as single-family homes, many places they were built are no longer well suited for single-family. So, people will come in and cut them up into 4, 5 and I’ve even seen 7 apartments in one.

22. Use Conversion (Industrial to Multifamily)

In older parts of the country, it is very common to see old mill buildings or factories repurposed into nice multifamily apartments.

Often, these are only feasible with tax-credits and other subsidies and incentives from the local governments that are trying to revitalize old areas of the city. So, take on a project like this with caution.

23. Single Family to Assisted Living

As people age, they may need to be moved into assisted living housing. Basically, these are very niche homes that will renovate and repurpose a home to meet the needs of an assisted living company.

24. Multifamily to Supported Living

Small multifamily properties can be a great option for supported living. You generally lease these buildings to agencies that specialize in supported living. These companies pay for the renovations and upgrades to bring your property to the standards they require for their individual occupants.

25. Receivership

When properties fall into disrepair, the state or city can step in and demand repairs. If the owners fail to fix or repair their property, the municipal government can appoint a “receiver” who will do the repairs. in exchange for their work, the receiver gets a super-lien position and can even foreclose against the owner and bank if necessary.

26. Single Family Portfolio Sales (breaking from large to small portfolio)

I met a guy before that did this as a niche. Basically, he purchased large portfolios from big investors (100+ single-family homes for example), then broke them up into 15-20 unit deals.

When the big investors had such large quantities, the time, selling costs, and commissions were large enough that they’d prefer to just sell them at a discount to a large buyer.

These buyers could then just chop up the deal and earn a spread.

This strategy could really be applied to so many things! Perhaps a single-family rehab with a large lot. Chop up the land and sell it to a developer while you fix and flip the deal.

Buy a lot with 2 or 3 homes on it (this was more common several decades ago) then find a way to subdivide and sell for more.

The options are endless!

27. The Value Add Play

Buy a property below market value, then add value. Simple enough, right?

Obviously not. If it were so simple, everyone would just do it. Instead, you need to be creative and know how to create value that others overlook or fail to see.

28. The Management Turnover Play

This is in the same vein as the value-add play except that the value to add is by firing the management and putting in a new management team.

…and this is way more common than you think! Most problems with any property is derived from the management.

29. Teardown/Rebuild

This is more common in areas where land is in short supply, such as in cities or along major thoroughfares. The idea is that the current building is not the best value, so you tear it down and put something more valuable.

For example, the old farmhouse next to the new highway might make a better service station or shopping plaza.

30. Additions/Second Floor

If most homes in an area are 2,500 square feet and selling at $200/sf, and you find a 2,000 sf home and can build an addition for less than $200/sf, then it might make sense to add-on!

Why not, right? If you can add 500sf for $100/sf, you can earn the difference of $100/sf ($50k in this example), just by doing the addition.

I wouldn’t go much larger than whats common in that neighborhood, as there might be diminishing returns as you get larger and larger.

31. Handicap Housing Conversions

This is a super cool niche! There are a lot of handicap people who need homes to buy or rent, but almost none are built with them in mind!

If the layout supports the wider hallways and special ramps and equipment necessary, you might be able to charge a premium (either for rent or for sale) for your property.

32. Military Housing

If you are lucky enough to be near a military base, there are some great opportunities for you!

Military housing is a double-edged sword and it really depends on the particular installation you are buying near.

The bad part is entire units can be mobilized and you could lose a significant amount of your tenant base almost instantly. It can also take a whole year to have the occupancy recover if it’s a large enough mobilization!

The great part is, military members usually pay their bills! If you are smart enough to collect their Commander and First Sergeant’s information upon move-in, you can contact them in the case of non-payment.

Owing money is a big deal in the military and people can lose security clearances and receive discipline for non-payment.

Elizabeth over at The Reluctant Landlord has an interesting twist on this where she keeps buying property as her husband is stationed at different posts around the US.

33. International Students

Students moving from overseas will pay a lot more for nice and safe accommodations that are fully furnished for them to walk right into when they arrive. Imagine if you were going overseas and had nowhere to stay. You’d pay a premium to feel like everything is taken care of.

34. Pet-Friendly Rentals

As more and more rentals have stricter and stricter pet policies, the places that have a loose policy will have a big advantage for occupancy.

I have a beautiful and friendly Pit-Bull and couldn’t find any quality apartments in Dallas. Finally, I found a solid upper-end apartment complex that would accept my breed and I was willing to pay just about anything to get it.

On a side-note, I was there almost 3 years and never once heard of a dog-bite incident.

35. Single Use NNN Development

If you have a prime piece of land, places like McDonald’s, CVS, and others will sign a 10+ year true triple-net lease if you build to their specifications.

You can earn the spread between construction costs and sale as a commoditized investment product.

36. Commercial to NNN Conversion

A lot of plazas and strip-malls will have normal leases for the occupants, especially if it’s family-owned. You can buy it and convert the leases over to triple-net and possibly increase the value of the lot by reducing costs.

37. Shared-Space Rentals

A cool new trend where a large space is rented out by one tenant, then they sub-divide the space and create an environment where small business owners can come and collaborate.

It’s great because small space is hard to find for small businesses so this space often rents very fast and the larger tenant gets to earn the spread.

38. Airbnb Your Extra Rooms

If you own a home with a lot of bedrooms, you could lease out some of your bedrooms for some extra cash.

39. Airbnb your vacancies.

If you have vacancies and stage them with basic living arrangements such as a bed, couch, and some basic kitchen equipment, you might be able to Airbnb them and earn a little money during your vacancy period.

40. Live-In-Flip

This is a lot of popular names on the web, but I like to call it the live-in flip.

First, you buy a house that needs some work then move into it. Over a period of a couple of years, you fix it up in your spare time. The key is to sell it for a tax-free profit (consult a CPA, but most personal residences don’t have taxes on capital gains) and leverage up into another home and do it all over again.

The owner of my favorite personal finance blog 1500Days has earned a huge portion of his net worth by doing exactly this.

Real Estate Niches by Location or Geography

Geography will exponentially increase the number of real estate niches there are. According to the last US Census, there are 486 Urbanized areas where you can choose to specialize in. For simplicity, I’ll say there are an additional 486 suburban or rural areas (I’m sure the real number is in the tens of thousands).

So, you can choose a few of 972 general geographic areas in the United States to specialize in.

Back to the math. Since there are 792 different real estate niches and now 972 places to specialize in, there are now 769,824 total niches.

I know my title said there are only 792 niches, but would you have believed me if I just came out and told you the number right up front? You probably wouldn’t have even clicked the article!

And these are just broad categories, I haven’t even gotten into some of the micro-geographic niches which I’ll go over in a minute. Also, every urban, suburban, or rural area can definitely be broken down further, and as an investor, I’d suggest you specialize in just a few areas.

Think about it, you could be:

- A buy and hold investor who likes mobile home parks and finds deals in near urbanized areas in Tennessee, Virginia, and Kentucky that are REO or going through Foreclosure.

- You could do tear-down rebuilds for single-family homes near Boston that you find primarily from probate or estate sales.

- Perhaps you focus on rehabbing and selling various water damaged or moldy multifamily in suburban Florida you find through by mining through state code violations

I could go on all day because, after all, there are 770,000 real estate niches!

Geographic Real Estate Micro-Niches

Tired of all the niches yet? Don’t worry, only about 40 to go.

We’ve already gone over the key urban/suburban categories, but you can really dive deep into geographic targeting.

Just because you know everything about one type of real estate doesn’t mean you know anything about super micro-niche geographic locations.

Here are some examples:

1. Lake-Front Property

There are a LOT more rules near bodies of water than elsewhere. Also, the value of the property will vary depending on it’s access to the water, location on the lake, what the town allows for activities on that lake, and a lot more.

2. Golf-Course Homes

A lot of very desirable homes exist near nice golf courses. You could specialize in knowing every property near every golf course in your county.

3. Ocean-Front

An amazing albeit risky niche. People LOVE the ocean when the weather is good, but things like hurricanes make them expensive and risky.

4. Gated Communities

Every gated community is different. You could be the go-to person to buy HOA liens, or get in there and rehab any of their foreclosures.

5. Retirement Communities

Many areas allow communities to designate themselves 55+ or retirement communities. As you can imagine, these properties probably end up at an estate sale at some point.

6. Mixed-Use Properties

Any property with 2 or more use groups can be difficult but also lucrative. Most common you’ll see retail on the first floor and multifamily above, but different combinations do exist.

The difficulties are that insurance is a lot higher and building codes are stricter.

7. Overseas Retirement

A lot of Americans are retiring overseas. You could buy rental property in those communities then advertise it here for retiring Americans.

8. Gentrifying Neighborhoods

This a bit speculative, but many cities have bad areas that are “getting better.” Investors will come buy property in these areas and inject some capital improvements to help speed along the process.

If after 5 or 10 years those neighborhoods truly turn a corner, prices can spike dramatically.

9. International Investment

This is the exact opposite of overseas investment. The idea is that you specialize in finding foreign buyers who are willing to pay a premium for property that appeals to their tastes and preferences. Foreign investors may want to buy in very specific neighborhoods based on their race or origin.

10. Walkable Communities

The younger generations value communities that are walkable – where you can walk to do basic shopping, eating, and to other amenities. Buying real estate in these sorts of areas can be very lucrative, especially as these preferences show no signs of changing.

11. Homes That Face East (or South)

I’ll be honest, I had no idea this was a thing until I started researching for this article, but apparently, this is actually a thing.

There are some cultures that believe homes should face east for various cultural or religious reasons, but also many others are looking for it because the rising sun helps warm the house.

Hilly areas may find that houses that face south or are on the south side of hills will sell for significantly more than the ones on the north side of the hill.

12. Urban in-fill development

Buying land or buildings in major urban areas, then developing or redeveloping the property to fit the growing city. These neighborhoods are generally very small geographically but there is a lot of potential for profit if you can snag a good buy.

13. Subdivisions

Some people specialize in buying in certain subdivisions. The fact is that some subdivisions are more valuable than others, so why not specialize in the ones that fit your investing goals?

Passive Investing Niches in Real Estate

These are great ways to diversify your portfolio and will require a lot less work. Also, passive investing is a great way to “get your feet wet” so to speak.

But, I’m not going to include these in the above count because the number would just get crazy! You could, in theory, specialize in REITs that buy urban mobile home parks in Tennessee, but there are just too many variations and combinations that I’ll just set these aside and let the numbers above rest in peace.

But, there are a ton of ways to invest passively in real estate, so here are a few!

`1. REITs

Real Estate Investment Trusts are a structure that pools capital and invests in a variety of real estate within the scope of their business plan.

REITs are quite a complex structure and I cover it more in this review of Fundrise, which specializes in eREITs.

2. Real Estate Funds

Real Estate Funds are very similar to REITs except they are less regulated and there are some differences in the tax structure.

3. Syndications

Real Estate Syndications are entities that generally purchase one single asset and pool investor funds to purchase it.

They are different than real estate funds and REITs because the asset is identified before forming the syndication whereas funds and REITs are formed first and raise capital then identify and purchase properties later.

4. Partnering

Similar to a syndication, except you’d be in a small partnership as a passive (or mostly passive) investor.

Partnering is great, but make sure you know the partner very well.

5. Mortgage Notes

This is a pretty unique niche, but you can actually buy mortgage notes. Some people specialize in buying non-performing notes, then work with the owner to restructure the note and get it performing again.

6. Private Lender

Private lenders just loan money on projects for a very high-interest rate. These are not 100% passive, but the majority of the actual work is done by the person who is borrowing.

Typically a borrower will come to you and apply for financing. You, as the lender, will underwrite the loan and make sure you’re protected in case they default.

Then, you’ll charge a very high percent (10-18%) and sometimes even charge points on the loan. The purpose is these are very short-term loans for deals with significant value to add.

7. “Connector”

This is a little hard to define, but I’ve seen it enough that I need to include it.

A “connector” is a person who just knows a lot of other people. By connecting these people together, deals get done. Usually, the connector is compensated some kind of finders fee or is giving a small portion of the deal for making it happen.

8. Crowdfunding Loans

There are a lot of crowdfunding websites out there that focus on loans. They are safer than equity because of the lien position, but the returns are going to be lower.

Here’s more information on crowdfunding platforms.

9. Crowdfunding Equity

Equity is a bit riskier than investing in loans, but the returns are usually higher. Equity crowdfunding is just like syndication, except it’s done online and without a personal relationship with the syndicator.

Here is more information on if crowdfunding is a good investment or not.

10. Turnkey Rentals

This is where you buy a rental from a turnkey company where it’s already rehabbed and has a tenant/management already in place.

It’s “turnkey” because there is literally nothing left for you to do but buy it and collect the rent.

My friend Brian over at Rental Mindset is focused entirely on single-family turnkey properties.

Feeder Professions to Real Estate Investing

Since there are over 770,000 real estate niches, I’m sure you can find one that fits every budget. But, if you somehow cannot find one, here are some professions that help feed into real estate investing.

The idea is that you get a JOB in one of these professions then learn a lot of skills and gain experience and contacts related to investing to help you better prepare for a future as an investor.

None of these are really niches per se, but you should probably know what niche you want to be in before you try to find a profession related to it. So, in a way they fit, which is why I’m including them here.

1. Residential Sales Agent

Whenever someone thinks about getting started in real estate, they almost always think they should go get their real estate sales license.

Real estate sales is not for everyone and a lot of people get disheartened by the difficulty of the profession and then stop trying to be a real estate investor.

But, for others, access to the MLS, training, and connections helps build a deal pipeline and gets them started.

2. Commercial Sales Agent

This is exactly the same as the first one, except these agents focus on commercial real estate. This is a way harder niche to get started in, but ultimately it is far more lucrative.

3. Home Inspector

A home inspector can easily build relationships with all kinds of landlords and investors. Also, you will learn just about everything you need to know to look for when you start buying your own properties!

4. Real Estate Appraiser

You won’t build up a ton of connections, but you’ll be really good at determining market value and the after repair value of any property you walk into!

5. Contractor

If you have worked in the construction industry before, you may want to try to be a contractor for a bit.

First of all, you’ll learn just about everything there is to know about project management and hiring subcontractors, but you’ll also learn how to properly estimate the construction costs of the projects you’re looking to do!

6. Bird-Dog

If you already have a profession and don’t want to change, you could become someone’s “bird-dog.” Essentially, you just look for great real estate deals and help someone else pursue or get them.

You’ll learn how to find deals and even earn a bit of side-money in the process.

7. Mortgage Broker

Learning how the finance side of things works is a huge bonus. You’ll be able to underwrite deals the way lenders and bankers will, so you’ll always be confident when you apply for financing.

8. Hard Money Lender

A hard money lender uses other people’s money to loan to borrowers and they just earn a fee or points to get the deal done. It’s like being a private lender, except using other people’s money.

9. Property Manager

Being a landlord is tough work. If you work as a property manager before buying your own rental property, you’ll be particularly well suited to manage them efficiently and inexpensively.

Who knows, you might be able to make an offer on one of your client’s rentals before it hits the market.

10. Interior Designer

Not to be confused with an interior decorator. An interior designer specializes in redesigning houses which includes making structural changes or completely redesigning kitchens etc.

You’ll be on top of all the latest trends and you’ll be able to envision the final product as soon as you walk into a new property.

11. Wholesaling

This has become almost cliche – every new investor thinks they will start as a wholesaler to build up some cash before buying rentals or flips.

This doesn’t always work this way, but sometimes it does. It’s a hard field and you have to be really good at it to make any money. But, if you have the drive and determination, then you can make a lot of money.

I knew a team in Dallas that was making $50,000 per month wholesaling single families. There were two people on the team so that’s $25k each. Not bad for never taking possession of a single property!

Real Estate Niches – There’s Something for Everyone.

I’m sure you skipped to the bottom if you’re reading this. I wish I could have done that when writing it!

Anyhow, I hope this article gets the point across that there is clearly some kind of real estate for everyone. it doesn’t matter what your income, location, or current profession is, there is a way for you to get started.

What’s holding you back?

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply