I started using RealeFlow at the beginning of 2021 and decided to make a fair RealeFlow review to share my experiences and help you decide if it’s worth it or not.

First, we’ll cover some basic information about the company and software, then we’ll dig into features, pros, cons, and final verdict.

Disclaimer: I personally have tried this software and this review is based upon that experience. If you find this review helpful and click any links in the article RealEstateInvesting.org may receive a small referral fee which helps us grow and offer more free information and reviews.

A Little About RealeFlow Investing Software

RealeFlow was founded in 2007 and currently has around 35 employees as of 2021. They provide a variety of services and software for real estate investors under the RealeFlow brand including marketing websites, direct mail lists, direct mail printing and sending, email marketing, property listings, Customer Relationship Management (CRM), deal analysis, and other automations.

They are best known for their property search database and integrated direct mail marketing, but they have a fully inclusive ecosystem for a real estate investor to find and close off-market properties.

So The RealeFlow software can be used equally as well for real estate agent or for real estate investors.

Why Try Real Estate Investing Software?

Here at RealEstateInvesting.org, we don’t believe anyone *needs* any subscription software to be successful. The founder of this company himself started using absolutely nothing other than a spreadsheet which nowadays you can get for free.

But, and that’s a big but, real estate investing software such as RealeFlow and others are designed to make your life easier and business more efficient. Additionally, if used correctly, software should make your business more profitable.

If you are targeting the right areas and properties, your marketing costs should go down. If you are following up consistently, your conversion rates should go up. It’s really that simple.

RealeFlow definitely does that. But the question is – are the features worth the price? Let’s dive in to the features.

Review of RealeFlow Features

The first thing you need to do is set up an account. So head over to RealeFlow.com and get set up (for free). Once you navigate to the page you’ll be greeting with a screen that looks like this.

Punch in your info and click start. You will have to enter your credit card information. So, make sure you put a note in your calendar to cancel in 13 days if you don’t like it so you don’t get charged.

RealeFlow Dashboard

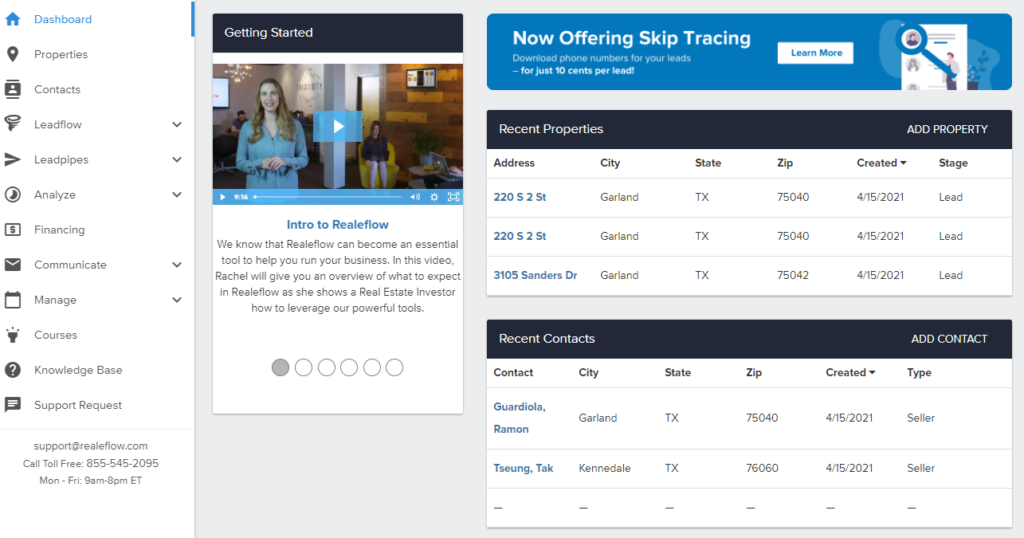

Next, you’ll see your dashboard. I added a few random properties in a random city just to fill it out so I can share it with you:

You’ll see on the left-hand side everything the software can do, and we’ll get through most of those features in this review.

Review of RealeFlow LeadPipes

The first thing we want to familiarize ourselves with is Leadpipes, which is where we find our leads. in RealeFlow it is broken down into property leads, people leads, and probate leads. Each portion of it is designed to help you find qualified leads in a different aspect of your real estate investing business.

Property Leads Review

The property leads portion of this review of RealeFlow will come first as it’s probably the entry point for most investors.

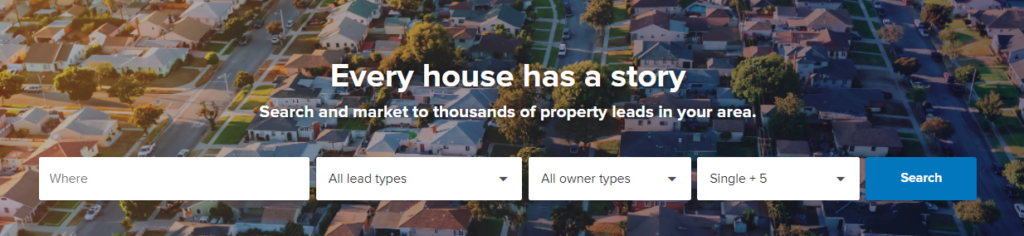

It’s really simple, you punch in some search criteria and start building your list of potential properties to market to.

Start by punching in the city/state, zipcode, metro, etc that you’re looking in.

Next, you’ll want to choose a lead type. RealeFlow includes these potential lead types:

- Absentee owners

- Cash Buyers

- Free & Clear

- High Equity

- Low Equity

- Upside Down

- Active Listing

- Bored Investor*

- Foreclosures*

- Long-Term Owner*

- Potentially Inherited*

- Pre-Foreclosures*

- Vacancy*

- Zombie Property*

You can also sort your RealeFlow Leadpipes by owner type:

- Individual

- Business

- Financial

- Government

- Trust

Or property type:

- Single-family

- Condo

- Townhouse

- Multifamily

- Apartment

- Land

- Mobile

Anything with an asterisk is a premium lead type requiring a higher level subscription.

Leadpipes Property Leads Review – Example Search

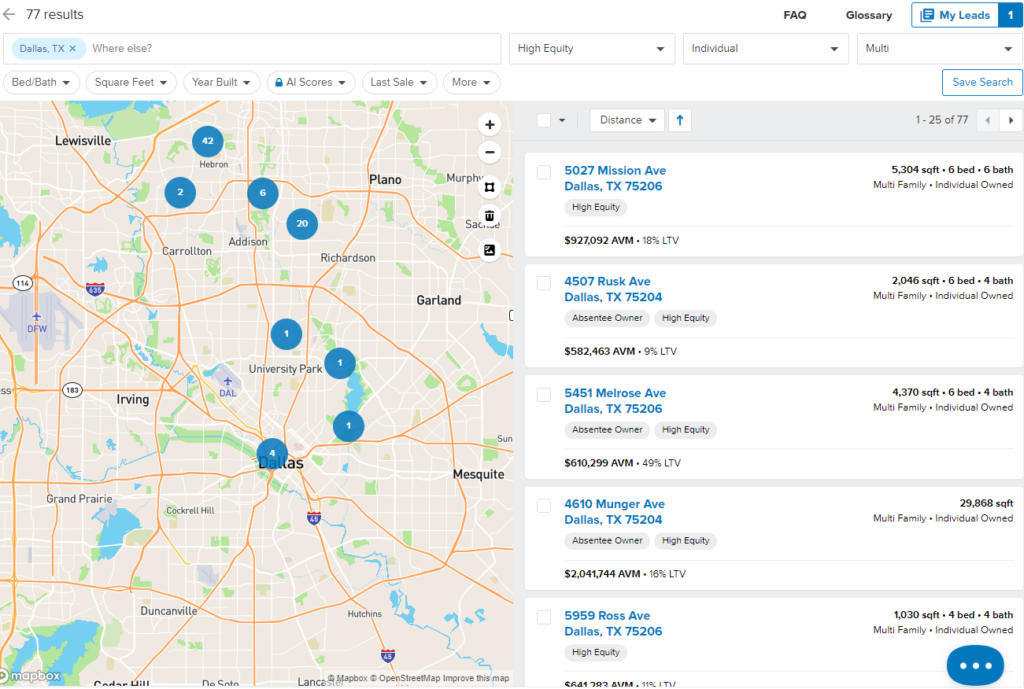

I did a quick search for high equity owners that own the property in their own name (not an LLC), all in the city of Dallas and came up with 77 results.

I did a few searches and came up with 53 properties that were owned free and clear, 92 that are absentee owners, and 33 that were cash buyers. In total there are 254 individually owned multifamily in the city at the exact moment I did the search.

As you can see, I can stitch this list together with nearby cities to create a very small group of potential properties to market to. This is far better than pulling huge lists from address aggregators and sending thousands or tens of thousands of mailers out hoping to get a call.

This is a very cost effective way of creating a list.

RealeFlow Leadpipes People Leads

While Peopleleads is not much different from property leads, I feel I need to briefly cover it in this review of RealeFlow.com

As you can see, the setup is very similar, but it’s focused on individuals. Generally they put these lists together by creating an algorithm that finds individuals or entities that lend on owners who own a property for a short period of time.

Anyhow, you can search for:

- Private Lenders

- Renters*

- Bankruptices*

Once again, an asterisk requires a premium level to the service. I ran the search and found almost 8,200 potential lenders in the city of Dallas. I’m not going to post that screenshot because it contains names and addresses on it.

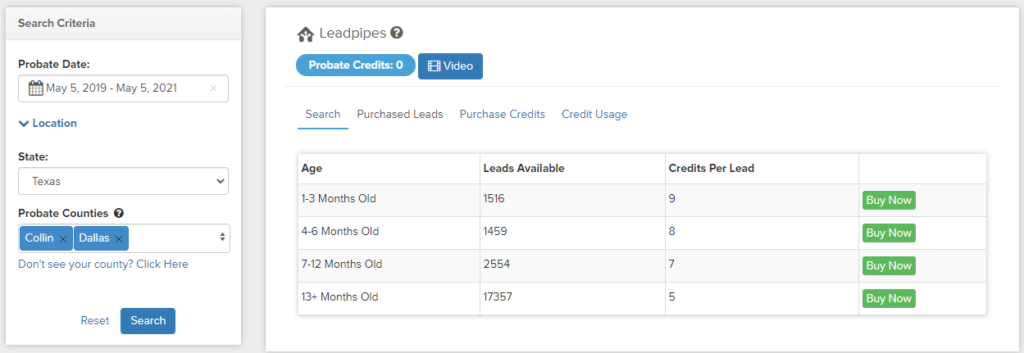

RealeFlow Leadpipes Probate Leads

Probate leads are offered as a subscription or for one time purchase. The search is pretty straight forward – just choose your state, counties, and probate dates and click search.

Here is a quick search I did as an example with over 20,000 results in just two counties:

With the cost per credit being around $0.32 each, and the cost for a fresh probate lead being 9 credits, the total is around $2.88 each. Older leads Cost $1.60.

RealeFlow Deal Analysis Review

There are three parts to the RealeFlow deal analysis section – Deal analyzer, repair estimator, and rehab planner. All 3 pieces are very important to know before making a purchase.

Generally, when making offers you won’t have everything planned out. You’ll want a basic budget and costs lined up to make your offer but before closing you should have your numbers refined and timeline planned out.

You do this because every adjustment you make to budget or timeline affects your final profitability. So plan it ahead of time!

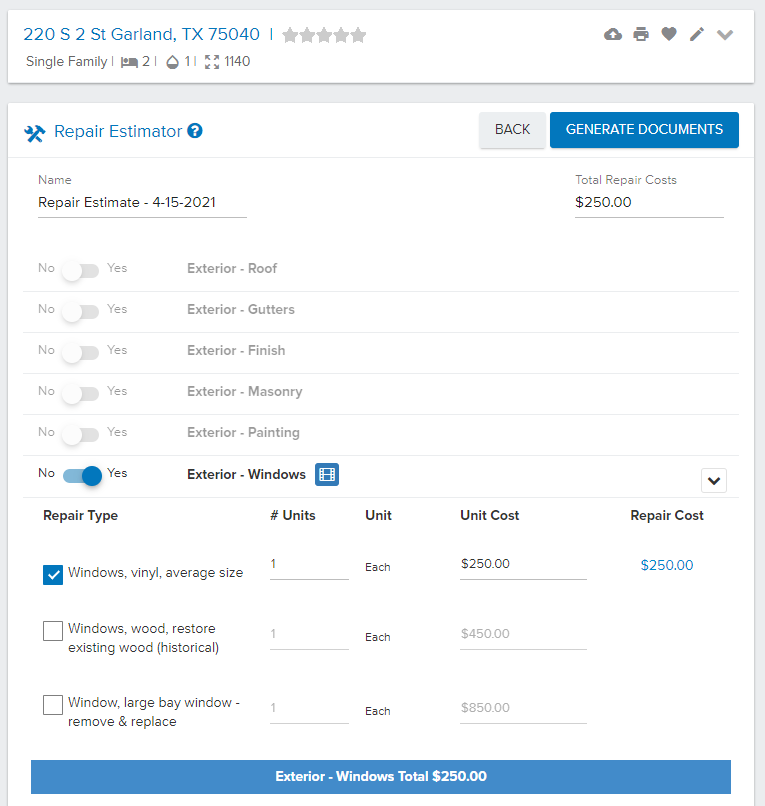

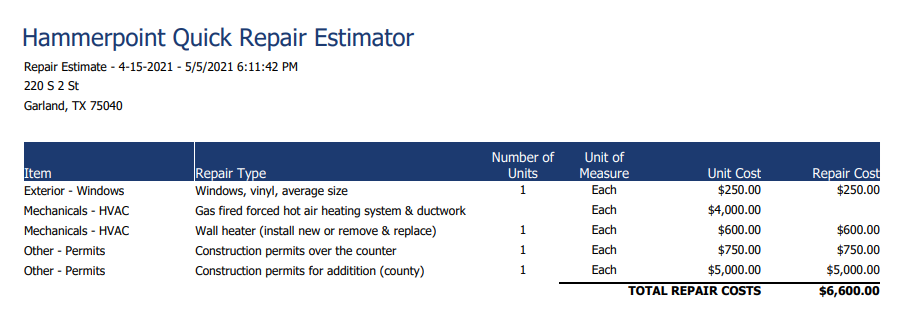

RealeFlow Repair Estimator

I’m going to start with the repair estimator because in theory you need a rehab budget before you can run a full analysis. So, it makes sense to review realeflow repair estimator first.

The repair estimator is quite easy to use but leaves a lot of room for error for anyone who doesn’t know prices of everything off-hand.

The calculator auto-fills some basic numbers in which is helpful for getting a rough estimate, but these numbers are very far from perfect and will likely leave you far off of your final budget. It’s bad to over budget as you’ll miss good opportunities and it’s really bad to under-budget because you’ll lose money.

But, the repair estimator is very simple to use. Also, it creates a very simple budget that can be easily printed or saved and emailed to your lender which will require this budget. Here’s one I randomly threw together for this review.

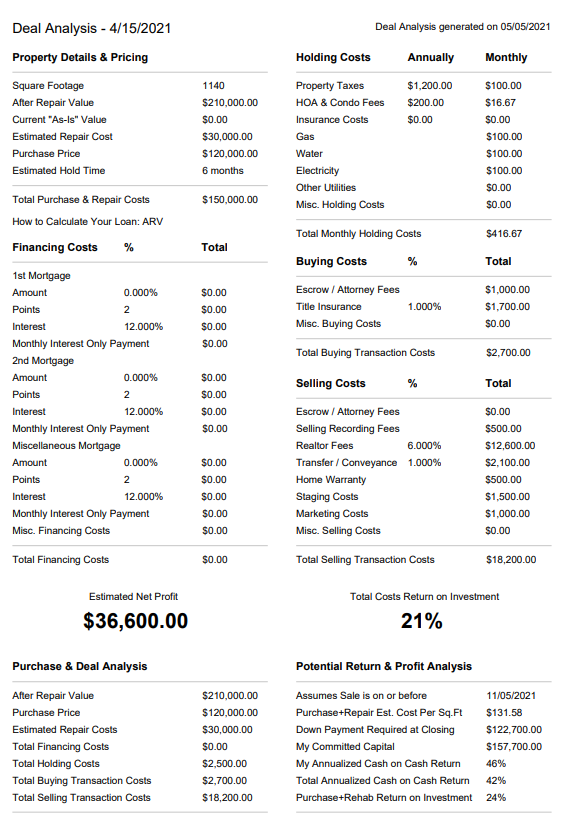

RealeFlow Deal Analyzer Review

The analyzer is pretty robust and covers everything you could want related to fix-and-flip properties. There actually isn’t that much to talk about here. You punch in the information and it pops out the answers.

I will say that this analyzer does not estimate returns for rental properties over any period of time. If you are looking for rental property analyzers you should go check out some of the best real estate investing calculators on the web at this link.

But, for flip calculators this is very easy to use, robust, and exports a nice report you can send to your lender or other investors.

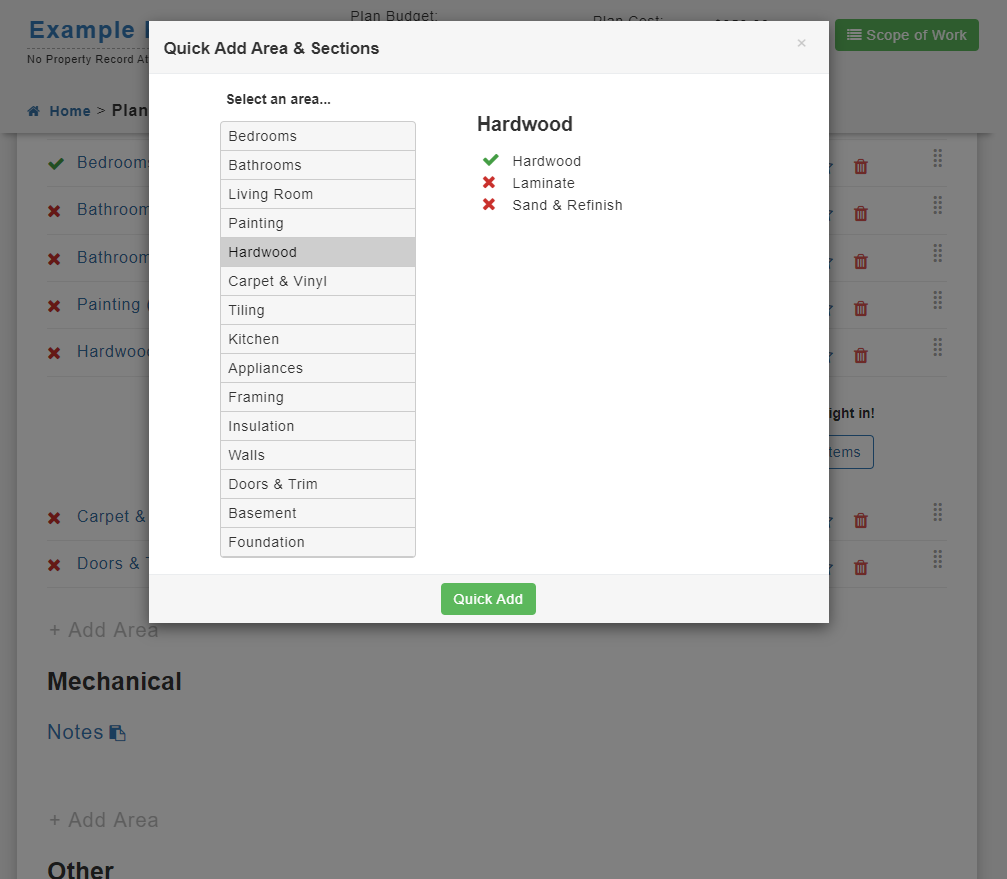

RealeFlow Rehab Planner

The rehab planner is quite robust when creating your scope of work, and it is definitely more advanced than the excel spreadsheets most investors are using to generate these reports.

You start with the checklist given and choose what rehab items you need or don’t need.

Then, you just need to take the time to go in and fill in each line.

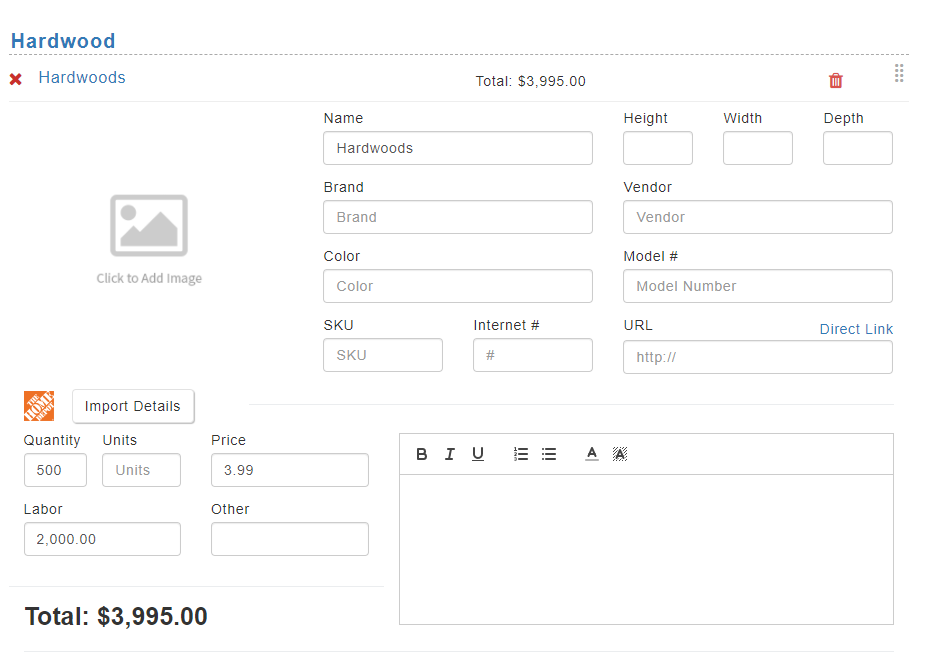

Here, I’ve chosen some quick-add options to speed the process up.

In the next step you add some details about the item. The cool part is you can auto-import the details from Home-Depot if you look up the SKU.

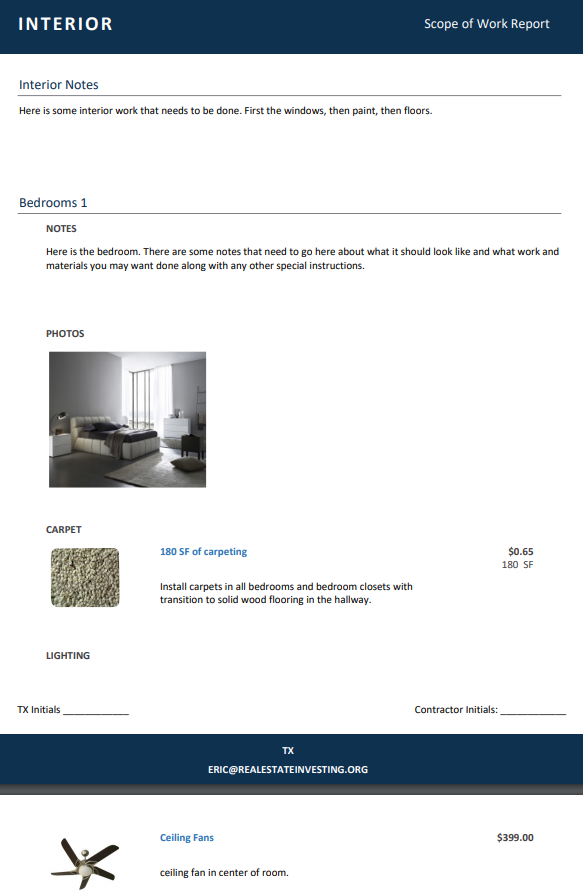

Now, once you’re done adding all your details you’ll be able to print out a report to give to the contractor.

There’s one really interesting thing to notice here, they do not include the labor estimates into the scope of work. This is great because you can give it to the contractor for them to use when making a bid. That way nothing is missed or forgotten about.

RealeFlow Leadflow Review

Realeflow’s service called “LeadFlow” is a comprehensive real estate investing software designed to assist in generating more leads and closing deals quickly. It encompasses a range of powerful tools including a Real Estate CRM, a repair estimator, and real estate websites. Here’s a summary of what LeadFlow offers:

1. Generate Leads

Access to a Wealth of Leads: LeadFlow’s lead generation capability is a game-changer for real estate investors. The software provides instant access to a vast database of discounted property leads in local areas. This feature is particularly beneficial for investors looking to gain a competitive edge in the market. By offering detailed information such as names, addresses, and contact details of motivated sellers, LeadFlow ensures that investors are always a step ahead in identifying potential deals.

Targeted Lead Selection: The platform’s sophisticated filtering system allows investors to pinpoint leads that match their specific criteria. Whether looking for properties in distress, owners who are motivated to sell quickly, or properties in a particular neighborhood, LeadFlow’s lead generation tool simplifies the process. This targeted approach not only saves time but also increases the efficiency of the investment process, ensuring that investors focus their efforts on leads with the highest potential for profitability.

2. Analyze The Deal

Quick and Accurate Property Analysis: LeadFlow’s deal analysis tool is designed to provide investors with a quick and comprehensive understanding of a property’s potential. By simply entering the address of a property, the software automatically calculates projected profits, the maximum allowable offer (MAO), and suggests the most suitable exit strategy. This feature is invaluable for making informed decisions, allowing investors to assess the viability of a deal within minutes.

Informed Investment Decisions: The ability to analyze a deal efficiently reduces the risk of making poor investment choices. Investors can avoid overpaying for properties and can identify deals that align with their investment goals. This analytical capability is crucial, especially in fast-paced real estate markets where quick decision-making is key to securing profitable investments.

3. Make The Offer

Confidence in Making Offers: Making an offer on a property can be daunting, especially for new investors. LeadFlow eases this process by providing detailed property data that investors can use to make informed offers. The software includes pre-written scripts that help establish rapport with sellers, eliminate fear, and facilitate quick agreements. This feature is particularly useful in negotiating deals and ensuring that offers are both competitive and realistic.

Streamlining the Offer Process: The structured approach to making offers provided by LeadFlow helps in maintaining a professional demeanor throughout the negotiation process. By using a standardized method, investors can avoid common pitfalls in deal-making and increase their chances of having their offers accepted. This streamlined process not only saves time but also increases the efficiency and success rate of real estate transactions.

4. Fund The Deal

Finding the Right Lenders: One of the most challenging aspects of real estate investing is securing funding for deals. LeadFlow simplifies this by offering a feature to connect with private lenders. Investors can select from a dropdown menu to find potential lenders interested in funding their real estate deals. This access to a network of lenders is a significant advantage, especially for investors who may not have extensive contacts in the financial sector.

Effective Funding Strategies: The software assists in setting up meetings with potential lenders and provides tools like a prewritten direct mail campaign and a “credibility kit”. These tools are designed to enhance the investor’s credibility and persuade lenders to fund their deals

. The credibility kit, in particular, is a powerful tool that allows investors to professionally present their business plan, past successes, and projected returns. This level of preparation and professionalism can significantly increase the likelihood of securing the necessary funding.

5. Rehab The Property (Optional)

Efficient Renovation Planning: For many real estate investors, the rehabilitation of a property is where significant value can be added. LeadFlow’s software includes a feature that allows investors to walk through a property, estimate repair costs item-by-item, and generate a custom rehab plan in under five minutes. This tool is incredibly useful, especially for those who may not have extensive experience in construction or renovation. It ensures that all potential costs are considered and helps in creating a realistic budget for the rehab process.

Streamlining the Rehab Process: The ability to quickly and accurately estimate repair costs and generate a rehab plan from a mobile device like an iPad or cell phone is a game-changer. It allows investors to make on-the-spot decisions and start the rehabilitation process without delay. This efficiency is crucial in the real estate market, where time is often a critical factor in the success of a

project. Moreover, the software’s user-friendly interface means that even those without deep construction knowledge can navigate the rehab process effectively, ensuring that projects stay on track and within budget.

6. Sell Or Rent The Property

Maximizing Property Exposure: Once a property is ready for sale or rent, LeadFlow offers a feature to list it on an active buyer network. This exposure is crucial in attracting the right cash buyers or renters. The platform’s reach ensures that properties are seen by a large audience, increasing the chances of a quick and profitable sale or rental agreement. This tool is particularly beneficial for investors looking to minimize the time their property spends on the market.

Streamlined Closing Process: LeadFlow also provides fill-in-the-blank legal documents to facilitate the closing process. This feature not only saves time and reduces the need for external legal consultation but also ensures that transactions are conducted smoothly and professionally. The availability of standardized legal documents is a significant advantage, particularly for investors who handle multiple properties and need to streamline their operations.

Leadflow Review – Website Options

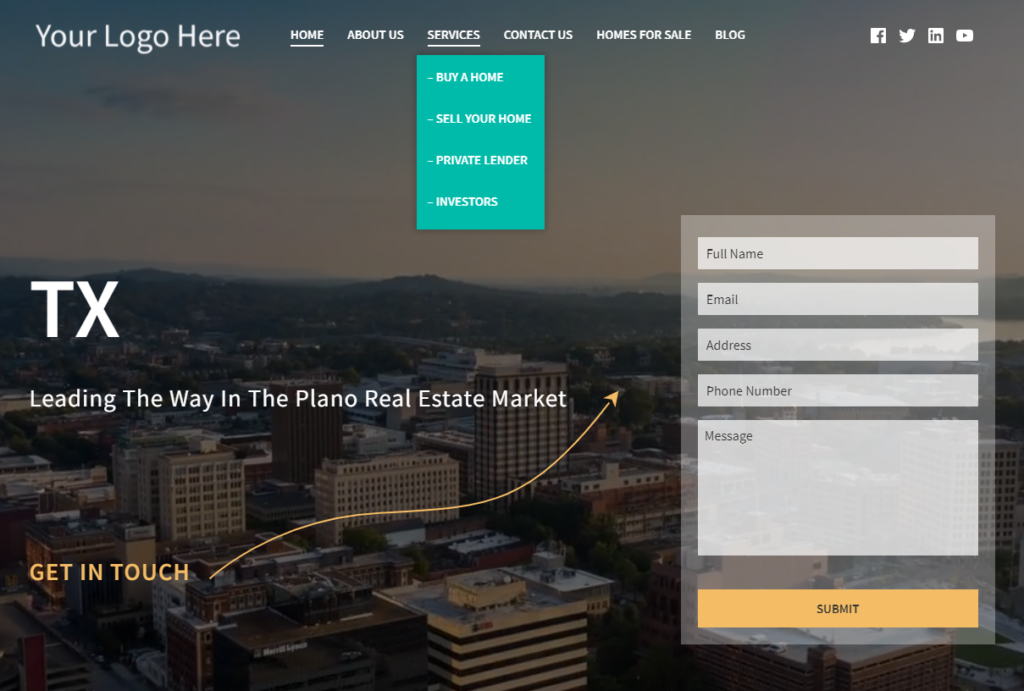

Setting up a new website is very simple and takes only a few minutes. Additionally, you can connect your own domain to it so you can self-brand.

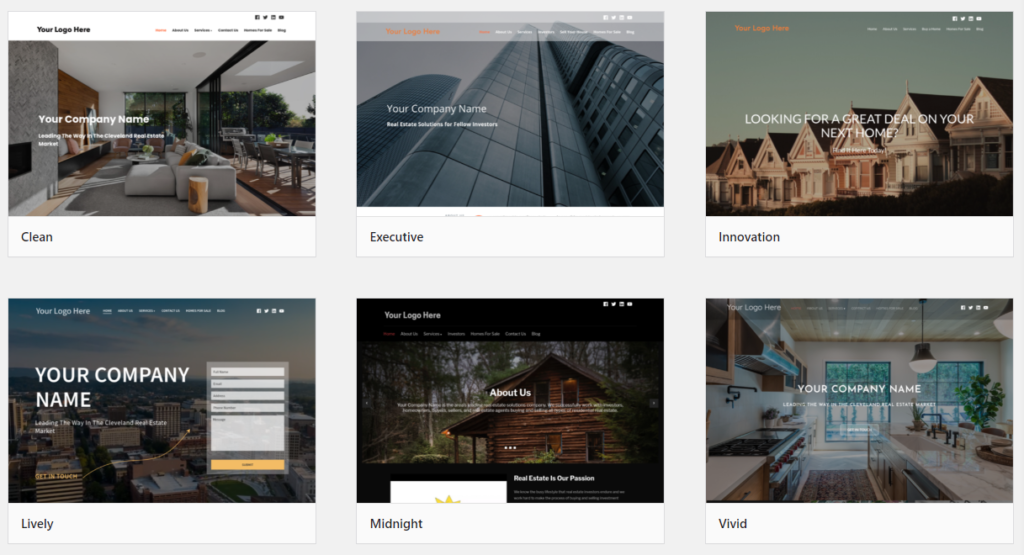

As of writing, there are 6 core themes that are all modern looking.

Once you pick a theme you’ll choose a content pack. The content packs slightly adjust your theme and content based on what you’re trying to accomplish or who you’re trying to target. These are built on WordPress so we already know the functionality is strong and it’s easy to use.

As of writing, there are 11 content packs to chose from:

- Investors

- Buyers

- Buyer/Seller Combo

- Distressed Seller

- Stop Foreclosure

- Absentee Owner

- Sell Fast

- Dream Home

- Renters

- Private Lender

- Cash Buyer

Some of these are single page sites while others are multi-page sites, so pay attention to what you’re choosing based on what you are trying to do.

I put together a buyer/seller combo site as a test for this review. Here’s what it’s like:

This particular website is geared to active investors who are buying or selling properties at any given moment. There’s even a place for private lenders to contact them. I’ve highlighted one of the dropboxes in the menu in the image above.

One interesting point is the blog comes pre-populated with 3 pieces of content. As a website owner myself, I know how important content is to showing up in search results, so it’s nice to see this.

Once people come to your website either through search or through ads, they are given multiple ways to get onto your email and mailing list so you can contact them.

RealeFlow’s Leadflow Direct Mail Campaign Review

One of my biggest reasons I chose RealeFlow to review is the cost of direct mail was so low!

Not only are the lists free to generate and can be updated at any time, but they integrate direct mail for you and it is really cheap to send!

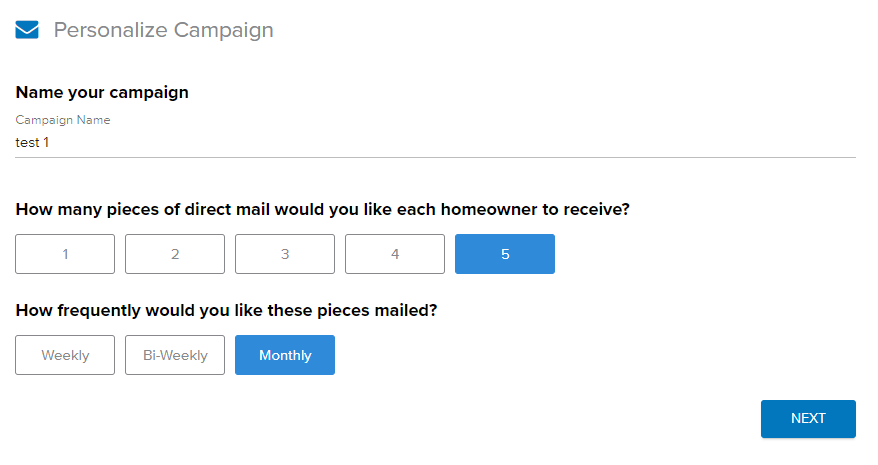

First, you need to put together the campaign you’d like:

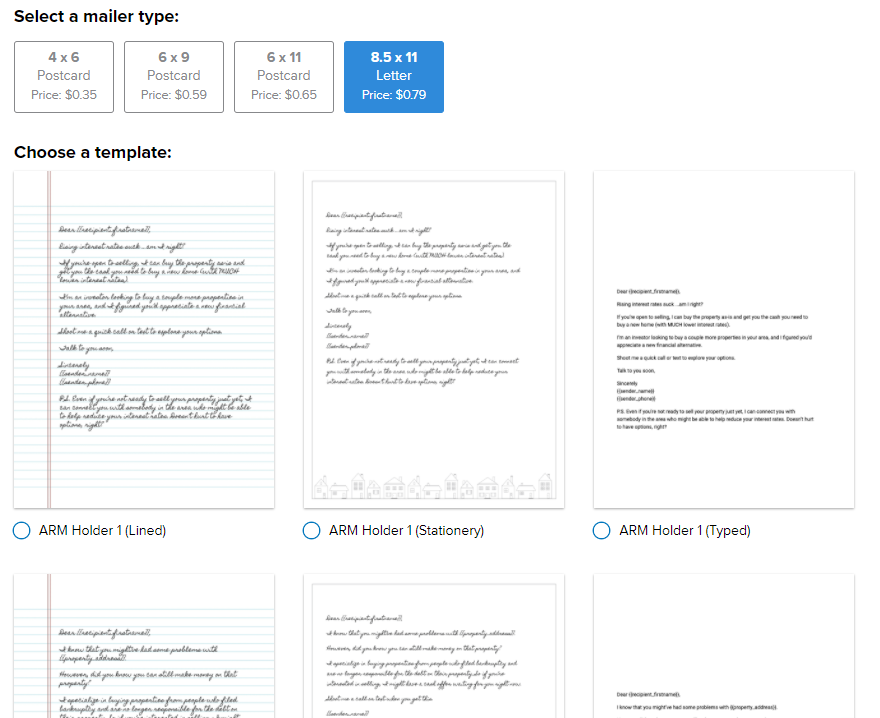

Then, for each mailer you need to customize the mailer. You can vary between postcards and letters to keep the cost down.

When you pick an option, you then get to choose a premade template or to create your own. Here’s an example of the ones you can choose from for letters.

I went through the process and created a simple 5 part letter series to go out to a couple addresses I randomly selected.

The total cost per piece of mail is $0.79. Since the cost of postage is at $0.55 currently, there is only 24 cents in printing the letters and envelopes. Obviously they’re saving some money by putting these together in bulk, but it’s still incredibly cost effective to use this integrated service.

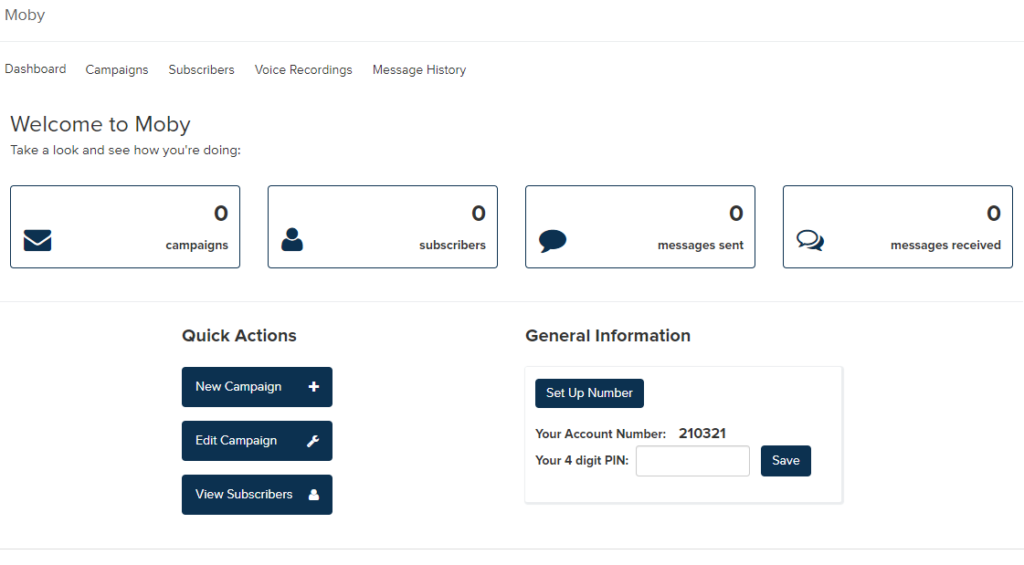

Review of RealeFlow Moby

Moby is an integrated mobile marketing management. The goal is to track how many subscribers you have as well as how many people contact you.

The goal of this is to take people from eyeballs on your website to phone calls and then move them over to your CRM.

Customer Relationship Management

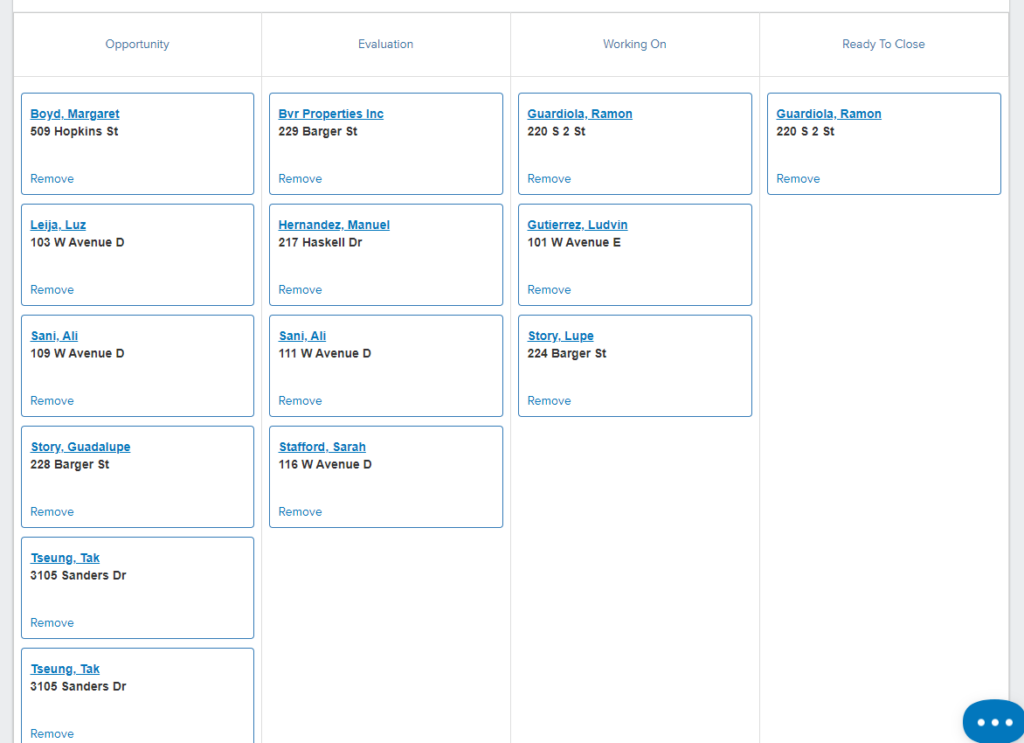

Customer Relationship Management in RealeFlow is handled in the “scrum board”. This is where you can track the properties in each stage of your deal flow. The best part about this is the flow is completely customizable to fit whatever business flow you have.

You’ll start by doing a property search. You can then add those properties to a direct mail campaign.

Once an owner contacts you, you find their address in the system and move them over to your scrum board.

Once on your scrum board, you can move them along your deal flow or remove them entirely.

I’ve put together a totally random list of properties and added them to my scrum board to illustrate how it looks.

It’s really simple to use, just drag any property to any column. If you click on the property it brings you to the property page where it lists information, notes you have, and you can even adjust the analysis.

Additionally, from the property page you can publish any properties for sale directly to your site for visitors to search.

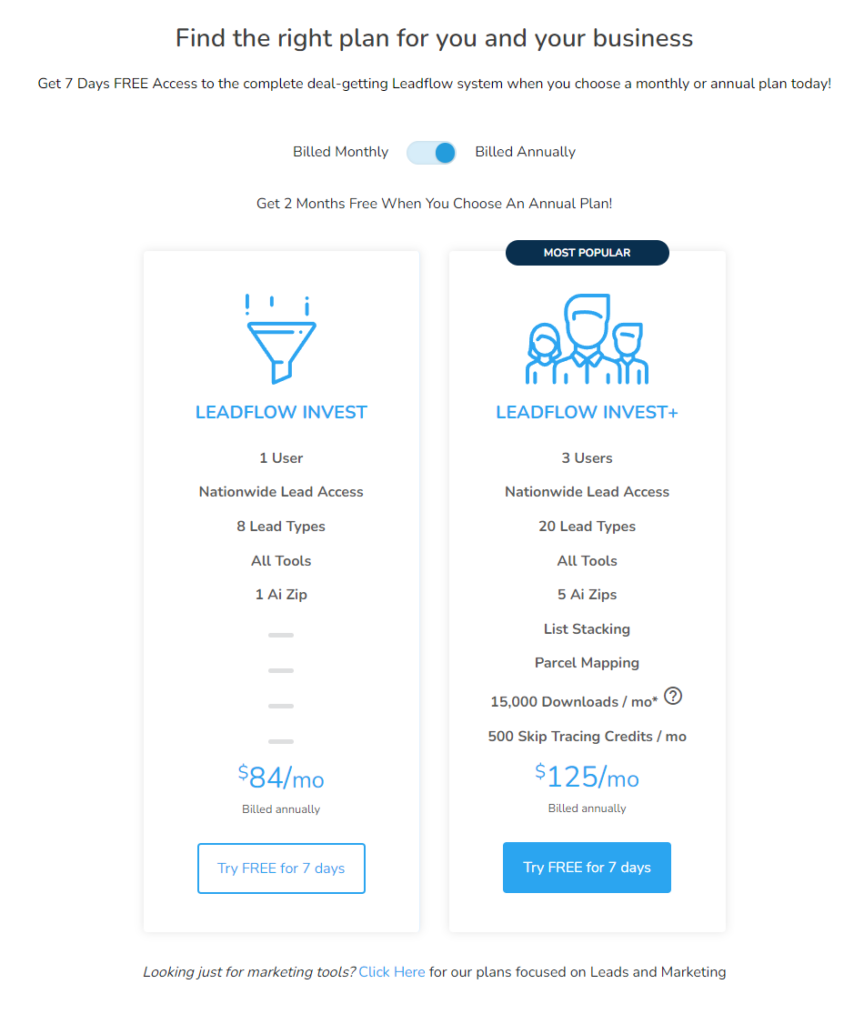

RealeFlow Pricing

Currently, RealeFlow is priced in 3 tiers based on what you want to do.

Most people just getting started out can get away with the cheaper option to start, but serious investors should start at the pro option. This is the one I tried.

There are dozens and dozens of different feature differences between these two plans so it’s impossible to break down the differences between them. but you can navigate over to their pricing page and compare the options.

Is RealeFlow Worth It?

There are a few ways to determine if something is worth the price. The first and most obvious is if it’s saving you time that you could otherwise do something productive.

The answer to that question is clearly yes.

Another way to determine if something is worth buying is if it saves you more than it costs.

The cost savings just on direct mail is enough to justify it. The cost of a 1,000 address mailing list is around $400, and $0.85+ for direct mail. Add in the CRM ($25/month elsewhere), and websites ($25-$100/month) it’s a no-brainer

RealeFlow Pros

– Direct mail options are Amazing

– Websites are robust and easy to use

– I love the scrum board

RealeFlow Cons

– There are a few too many upgrade options for various features. It would be nice to have more included in the subscription.

How Does RealeFlow Compare to Other Companies?

Here we’ll provide a straightforward comparison between RealeFlow and other leading real estate investment software platforms. Our focus will be on highlighting the key features, advantages, and drawbacks of RealeFlow in relation to its competitors. This comparison aims to offer clear insights to help you decide which software best suits your real estate investment needs.

REIPro Vs RealeFlow

ReiPro and Realeflow are both prominent software platforms in the real estate investment sector, each offering a suite of tools designed to streamline various aspects of the investment process. ReiPro differentiates itself with a strong focus on lead generation and comprehensive property data, offering detailed information on properties across the United States. Its platform is particularly noted for its extensive database, which includes information on millions of properties, making it a powerful tool for investors seeking in-depth research and data analysis capabilities. Additionally, ReiPro provides a CRM system, deal analyzers, and marketing tools, but it stands out most for its data-centric approach, offering investors a deep dive into market trends, property histories, and potential investment opportunities.

Realeflow, on the other hand, positions itself as a more all-encompassing solution, covering a wider range of the real estate investment lifecycle. Its LeadFlow feature is particularly notable for not only generating leads but also for guiding users through the entire process of deal-making – from analyzing potential deals to facilitating the rehabilitation of properties and assisting in the final sale or rental. Realeflow’s strength lies in its ability to offer a comprehensive, step-by-step system that supports investors throughout the entire investment journey. This includes features like direct mail campaigns, repair estimators, and legal document templates, making it a versatile choice for investors who want a more guided and structured approach to real estate investing.

RealeFlow vs Propstream

Realeflow and PropStream are both highly regarded in the realm of real estate investment software, but they cater to slightly different aspects of the real estate investment process. Realeflow is known for its comprehensive approach, offering a suite of tools that guide users through the entire investment journey. Its standout feature, LeadFlow, not only assists in lead generation but also supports investors in deal analysis, property rehabilitation, and the final stages of selling or renting. Realeflow’s strength lies in its all-in-one functionality, which includes direct mail campaigns, repair estimators, legal document templates, and a CRM system. This makes it particularly appealing to investors who desire a holistic, step-by-step system that can manage multiple facets of real estate investing from a single platform.

PropStream, on the other hand, is renowned for its robust data aggregation and analytics capabilities. It offers extensive data on properties nationwide, including details on market trends, property history, and potential investment opportunities. PropStream’s forte is in its ability to provide deep insights and analytics, making it a powerful tool for investors focused on detailed market research and analysis. Additionally, it offers features like targeted marketing lists, rehab estimators, and a CRM, but its primary appeal lies in its data-driven approach to real estate investing. This platform is particularly suited for investors who prioritize thorough research and data analysis in their investment decision-making process.

In essence, while both Realeflow and PropStream offer valuable tools for real estate investors, their core strengths serve different investor needs. Realeflow is ideal for those seeking a comprehensive, guided experience through the entire investment process, whereas PropStream is more suited for investors who place a high emphasis on data analysis and market research to drive their investment strategies.

Overall Recommendation

Strong Buy

How Does RealeFlow Compare to Other Companies?

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply