You’ve heard that real estate is a good way to generate some passive income and you’re thinking about renting out your house or buying an investment property to rent for income. So, you’re wondering – how much rent can I get for my house? In other words, you need to determine the fair market rent.

Estimating the wrong rental rate for your property could be the difference between profit and loss, so it’s extremely important to determine the fair rental value of your house or apartment before making any major financial decisions.

Being just 10% wrong on your rent analysis eats all your profits. Now, imagine being just 5% wrong on rents, 5% wrong on operating costs, and a few percent wrong here and there, and suddenly your profitable deal is now losing money.

So, grab some popcorn and pay attention to this article.

Market Rents – Defined

The market rent is the rent you could potentially receive when renting a unit in a standard ‘arms length’ transaction under normal economic conditions. This should be adjusted for any fees that are included such as utilities, amenities, etc.

What is Not the Market Rent

Let’s say your apartment listed for the fair market rental price of $1,500 per month. You are receiving showings and interest, so it’s just a matter of time until it’s leased to a qualified tenant.

Then, suddenly a financial expense pops up and you need to get some cash ASAP. So, you call all the people who viewed the apartment and offered a $150 discount if they signed and paid the deposit today.

Someone bites and you lease it at $1,350. Is this the market rent?

No.

It’s not the fair market rent because you made a financial decision due to being a distressed property owner who needed cash fast. The need for cash trumped the need to maximize profits. So, this rental value shouldn’t be considered as fair market rent.

In fact, a professional investor would list the $1,500 as the market rent then write down a cost of $150/month as “loss to lease.” We won’t get into the details of that here but if you click that link you can read all about how the pros calculate this.

How to Estimate Fair Market Rent For Your House

We’ve covered what fair market rent means and why it’s important for you to be precise while estimating it. Now, it’s time to learn how to estimate the fair market rent of your rental property.

For this step, you’ll need a spreadsheet or some blank paper. Also, you’ll want to pull up your favorite source of rental listings in your area. It could be Zillow or Apartments.com or it could even be craigslist or some other classified section.

Step 1) Collect the Pertinent Information in a Spreadsheet

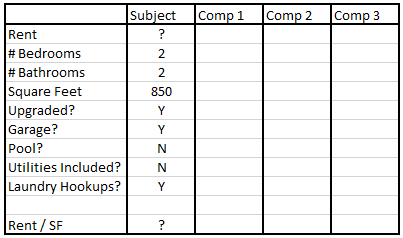

Your apartment is called the “subject property” and we need to collect information about this first. Generally you can just list it in a column and label each column. It could look something like this:

As you can see It’s a very simple layout with just the most pertinent information. You’ll notice rent and rent per square foot are empty because those are the pieces of information we are looking for..

Step 2) Search Apartment Listings in Your Area

Now it’s time to scour the area and try to find comparable units that are for rent or recently rented. You’ll want to narrow your search for units that are extremely similar to yours. If you can’t find many, there are ways to make adjustments to the values but I cover that in the article on doing a comparative market analysis, so go read that if you are in a complex situation.

You’ll also want to exclude units that are in dramatically different condition or areas than yours. So, don’t include the run down property renting for half the rate as others. Similarly, don’t include the luxurious newly built condos nearby, as they’ll have dramatically higher rents that you won’t achieve.

Step 3) Record the Rents and Take Notes

The reason we have the list of amenities and information below the listing. That way we can accurately compare and know we have a good match.

Hopefully you have plenty of rentals to compare to in your market area. If you’re in a small town it can get a little difficult. For simplicity we’re going to assume your units are fairly average and there’s a lot of comparable units that are rented in your area. If that isn’t the case, check out the extremely detailed article on comparative market analysis which will break down exactly how to make significant adjustments to your analysis.

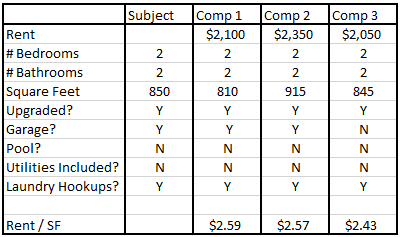

Now that you’ve recorded the details of each unit, we’ll put it in the spreadsheet.

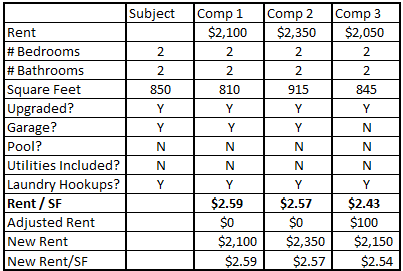

Step 4) Adjust the Results

Inevitably, there will be some differences between the properties. The next step is to make some simple adjustments to your analysis to compensate for that. So, we’ll need to add a line to our spreadsheet to allow us to do that.

The purpose of making adjustments is to make the rent equivalent for different properties. In this example you can see one apartment does not have a garage and it also earns significantly less rent than the other units.

Based on your research in this area, you believe that tenants will pay roughly $100 extra per month for properties that have a garage as compared to those that don’t.

So, we want to think about comp 3 as if it had a garage, then what would it’s rent be? You add $100 to the current rent because it would earn more if it had a garage added.

Similarly, if it had an amenities that the subject property does not, we would subtract the value to make the comp match the subject.

Step 5) Average the Rents

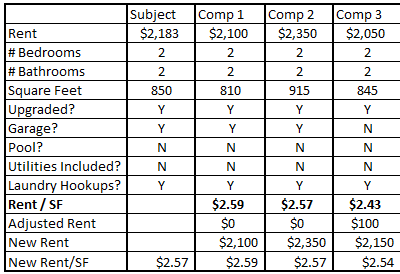

Now that we’ve recorded all the data and made the adjustments, the hard part is over. The rest is just crunching the numbers.

Now, we’re going to want to find the average rent per square foot for these units. In this case, the average rent is $2.57 per square foot. We can extrapolate that to be a total rent of $2,183 because this unit is 850 square feet.

Step 6) Check to See if Your Work is Realistic

Once you are complete with those steps, it’s time to check to see if it’s realistic. The way we do this is to see if the nominal rent is anywhere near the rents of the other units.

What I mean by nominal rent is the total monthly rent, not the rent per foot. In this example we came up with $2,183 per month. Is it in the same range as the other 3 units?

The other rents are $2,050, $2,100, and $2,350. The rent for our unit is not the lowest or the highest. It’s actually quite comfortably in the middle. So, this rent does appear realistic.

You’ll run into issues if there are dramatic differences in the units. For example, perhaps all the comps are 600 square foot apartments and yours is 1,200 square feet.

Even if a unit is twice as large, tenants generally don’t pay twice as much for the same number of bedrooms. There is a limit to what tenants will pay, that’s why you need to compare the rents multiple ways before settling on a final price.

Market Rent Analysis – Example

It’s important to note that you cannot compare rents from apartment buildings to rents from single family or duplex/triplex style homes.

A 1,000 square foot home is going to have a totally different rent than a 1,000 square foot apartment in a large complex. The listings will generally be on all the same websites so all the steps we are going to do will be the same. Regardless, it’s really important to remember that you need to pay attention to the type of property you’re buying and compare it to similar properties, not just similar units.

For simplicity, I’m going to compare units in apartment complexes, but remember that the steps are exactly the same for a single-family home.

Listing the Pertinent Information

Let’s say that we are looking to buy a small apartment building in a Garland, TX which is a popular rental market. It might have a variety of unit types, but for this, we are looking at a 2 bedroom, 2 bathroom, unit that is roughly 850 square feet. The owner is currently renting them for approximately $850 per month.

It’s an average apartment building in the area with a pool, options for covered parking, and washer/dryer hookups. It has all the standard amenities found in the area, but nothing above and beyond.

Broad Overview of the Market

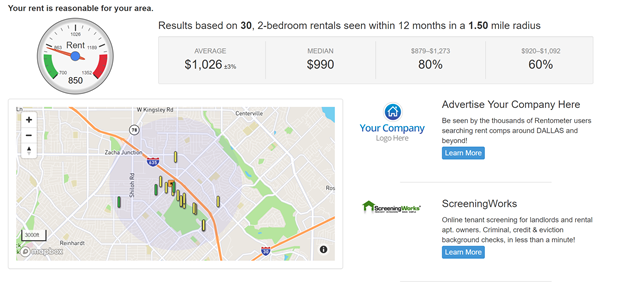

The first thing I like to do is a get a really broad overview of the rents in the market. I like to use a tool called rentometer.com. Simply go to the website and type in the address, rent, and number of bedrooms. Then it pops out a cool analysis that looks like this.

This tool doesn’t make any adjustments for amenities, unit size, number of bathrooms, etc. So, you cannot make any final decisions based on it! Do not forget that. This is to get a broad overview and nothing more.

But, it does show you the range of rents in the market. For example, we know that 80% of all 2 bedroom units within a 1.5 mile radius rent for between $879 and $1,273. Only 20% either above or below that number. So, we can assume 10% are above and 10% are below.

Since this building is getting $850 for a 2 bedroom apartment, it falls in the bottom 10% of all listings. Another way to say it is that 90% of units in the whole market are renting for more than the one we’re going to buy.

There are many reasons why the rent in this apartment could be so low. Perhaps it’s much smaller or maybe it is missing some amenities that others have. We don’t know yet but this is a major consideration because at first glance it appears we have a lot of room to increase rents. That will require some more research though.

This is a great piece of information to start our analysis with and now that we have a high level overview, we can go a bit deeper and find some comparable properties.

Making a List of Comparable Rentals

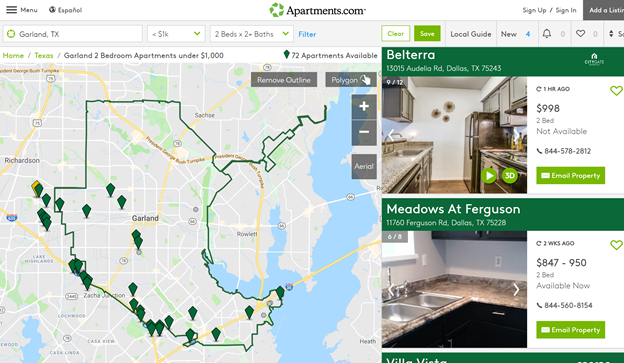

Now you’re going to want to find a listing site that you like to use. It could be Zillow, Apartments.com, Trulia, Realtor.com etc. Even google maps can help you find apartments for rent. I use a variety and don’t have a strong preference, but for this exercise I’m going to use apartments.com.

Put in the city and filter by number of beds/baths. Additionally, I put a filter to look for apartments under $1,000/month in rent because my high level analysis showed around 50% of rentals in the area have higher rents than $1,000. Upon further research it was very evident the higher priced units were in a more expensive part of town and were newer buildings.

Since the property type and area is so different, they aren’t good comps to use in our analysis. Here’s what it looks like:

On the left is a map of the area and on the right you can scroll through different listings. You can see pictures of two average apartments with decent finishes but nothing above average. These are going to be our comps.

Now it’s time to pull out a spreadsheet or paper and input the information you find.

| Building | Rent | Square Feet | Condition | $/ft |

| Subject | $850 | 850 | avg | $1.00 |

| 1 | $847 | 850 | avg | $0.996 |

| 2 | $998 | 905 | avg | $1.103 |

| 3 | $927 | 825 | avg | $1.123 |

| 4 | $725 | 650 | good | $1.115 |

| 5 | $989 | 1025 | avg | $0.965 |

| 6 | $950 | 900 | avg | $1.056 |

| Mean | $906 | 859 | $1.055 | |

| Median | $938 | 875 | $1.079 |

If you run into any rentals that are way outside of range, you may want to consider discarding it. In the statistics world, we consider extreme data to be outliers and it can skew all the results. For example, if you found something with a price per foot of $0.75 or $1.40 you might toss it because it’s so far out of the ordinary that something unique is going on there.

Now imagine you have 6 comparable rentals and 5 of them average $1.00 per square foot and one rents at $1.50 per square foot.

The average rent per square foot of the first 5 units is $1.00. But, if we include the 6th apartment the average changes to $1.08. One unit changes the result by 8%!

So, if we look at the first 5 comps, the fair market rent for our 850 square foot apartment should be $1.00 per foot or $850 per month. If you add in the 6th, then the fair market value would be

$1.08 * 850 = $918

If we listed the unit at $918 per month we may find it sits vacant for a long time!

In this set of data I have already excluded extreme outliers. But, you will almost definitely run into it, so keep this in mind.

Interpreting the Results

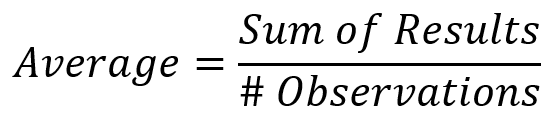

In general you just average the results after making adjustments and that is your fair market rent estimate. I like to take a deeper look and consider both the median and the mean.

Just as a quick refresher, the mean is simply the average of the numbers. You calculate this by adding the results and dividing by the total number of observations.

The median is the number where half of the results are above and half are below. Let’s manually calculate each with this information. Here is our list of rents in nearby units:

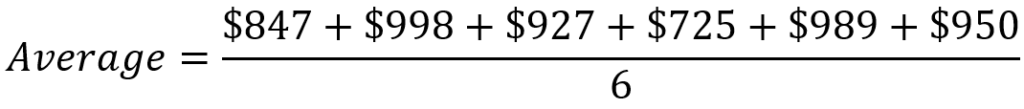

We have a total of 6 units we’re comparing to and their rents are:

Average Rent = $906

Average Rent/sf = $1.055

When the mean and median are very different, it means that something is weighting the results down or up. That’s why it’s important to look at the median.

To calculate the median, the first thing we do is organize the data from smallest to largest:

$725, $847, $927, $950, $989, $998

If you have an odd number of observations, you take the middle one. If you have an even number of observations like we do, you take the middle two and average them. So you average $927 and $950 to get $938.50.

Looking first at the average and median rents, you can see the average is $906 and the median is $938. This discrepancy makes sense because we can see that most of the rents fall in a relatively narrow range but one rent is only $725.

This brings down the average but doesn’t affect the median. The mean and median square feet are close together because while you do have one apartment that is very small, another one is very large and they come close to balancing out.

You will often find there is a dramatic difference between mean and median. Generally this is caused by a few extreme results that are dramatically different than the rest. This will cause the average to shift but the median won’t be impacted so much.

In this situation you need to dig in, figure out why, and resolve it before moving forward. The results need to “make sense” intuitively.

Digging Deeper and Interpreting The Comps

The rent per foot is a bit more interesting in this example because there are 3 ways to look at it. The first is to simply take the mean and multiply it by your square feet and get a market rent.

But, since we know one or two numbers are dragging the average down, you might want to consider the median.

So far we think we can list the apartment for somewhere between $897 and $917. These numbers are very close and probably won’t have much impact on if we can get it rented out quickly or not.

It’s always important to do a reality check on the data, so let’s parse the results further. In this situation, let’s look at the raw data.

Instead of looking at the rent per month, I want to look at the rent per square foot. We can see that two of the rents are pretty low. They are under $1/sf which is below our subject property which we hope to buy. Just quickly eyeballing the data, we can see 3 apartments are clustered around $1.10 – $1.12 range. One is around $1.05 and 2 come in dramatically lower under $1

The one that is at $1.05 is similar to our mean result. But, 3 results are over $1.1 per square foot leads me to believe these prices are more indicative of what the market can support for rents. So, I want to know how that translates to potential rent.

It is always best to be more conservative when analyzing your data. But, we may consider all 3 results and create a range of potential outcomes.

First, I’d see what my lowest potential income would be using the smallest number of $897. The goal is to make sure the deal works under a worst case scenario.

Then, I’d set $935 as my targeted goal. We don’t expect to get there but it is a reasonable and achievable goal based on the data. This is for internal use only and not something you need to share with lenders or other investors.

Lastly, I’d use $917 as my most likely outcome and base my underwriting around this.

Additionally, knowing this information does give me some wiggle room when negotiating price on the property. If they want a higher price I can see how high the rent needs to go in order to make the deal still work. If that number is within my range, then I may be able to wiggle my offer price up.

Fair Market Rental Rates

The fair market rent is whatever you can get for rent on your unit. All of these steps and processes are ways to estimate that price so we can make informed decisions with our money.

The only way to know the actual rent is to own the property (or something very similar) and rent it out. Once you do that, you’ll know the actual fair market rent for that unit.

Now, with these straight forward steps you’ll have a good framework to estimating the potential income from your rental property. The next step is to figure out the ongoing operational costs to manage and maintain your rental property.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply