Yes, a recession is coming. That’s obvious

Well, I obviously say it tongue in cheek but I also say it very seriously.

Yes, there is a 100% probability of a recession. What no one knows is exactly when and exactly how bad it will be.

I’ll lay out exactly what is happening, what is coming, and what you can do to financially prepare to survive the recession and thrive on the back end.

What is a Recession?

While it seems in vogue to change the definition of words to fit whatever the current narrative is, the classic definition of a recession is “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” – NBER

Classically, this is measured by 2 quarters of negative GDP growth. When the measure of all economic activity in an economy declines for two quarters in a row, that absolutely meets the definition as laid out by NBER.

Only the National Bureau of Economic Research has the authority to declare a formal recession, and they often declare the recession only when it’s formally over. That gives us a lot of issues when trying to plan for recessions and makes it difficult to adjust behavior during the recession… which is their goal.

You see, if everyone knew there was a recession, then people would dramatically reduce spending and increase savings which would exacerbate the recession. So, they keep a tight lid on things until near the end of it.

When Will a Recession Happen?

In my opinion, the recession already started – earlier this year we did have two consecutive quarters of negative GDP growth which is the classic indicator of a recession. But, it was not accompanied by the typical reduction in jobs and wages that are associated with a “real” recession.

Since then, GDP ticked up for a quarter meaning it’s possible we are in the midst of a “double dip” recession, which is where we see a brief recovery only to be followed by another recession.

It’s been amazing to me that we have the highest inflation in 4 or 5 decades, out of control spending, and a political party in power pushing destructive policies for business, families, and individuals, and still people have good jobs at good wages.

Many speculate that all the stimulus handouts are still working their way out of people’s savings accounts. Incredibly, many states are still sending stimmy checks – look at California’s recent inflation payout to their residents which obviously will only exacerbate the inflation problem.

I digress.

Layoffs – a Sign of a Recession to Come

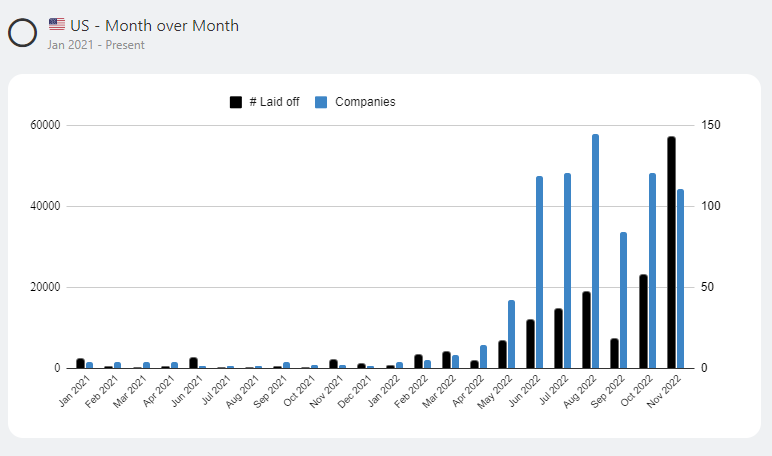

We are starting to see large layoffs happen in industries that are very inflation and interest rate sensitive, such as big tech. It seems about 71,500 tech employees have been laid off this year and many tens of thousands more non-tech workers as well.

The graph below shows just tech layoffs going back to January 2021 and you can see substantial increases starting in the spring of 2022.

This is graph isn’t something you’ll hear about in the main stream media and you definitely won’t hear about it by the Biden Administration. But the data paints a clear picture.

Right now layoffs are in the most sensitive industries to interest rates. But as larger numbers of those employees are let go and cut their spending, that will ripple into other sectors such as service work who’s wages are tied to total spending on going out.

Eventually it will hit durable goods sales as people defer large purchases in exchange for basic items such as groceries and gas.

Real Estate Prices Are Coming Down

We’ve seen a roughly 10-15% price decrease in real estate in many major metros. Similarly, we have also seen substantial price drops in commercial real estate.

I won’t break it down in this article, but the price drops follow a pattern of where the money originated from. Money starts on the west coast and north east then flows inward. As tech jobs have been lost, the money that flows from the west coast has dried up. This is dragging down important markets they purchase in – such as Boise, Idaho and Las Vegas, Nevada.

We also have housing inventory ticking up slowly and price drops increasing.

The core of this story is that increasing interest rates are putting a serious damper on real estate speculative activity. Furthermore, it’s squeezing average homebuyers who’s potential mortgage bills are skyrocketing – pricing them out of the market entirely.

The only saving grace is there hasn’t been any fundamental change that’s forcing current homeowners or rental property owners to sell. So, inventory is staying low which is keeping prices relatively flat after the initial price drops earlier this year.

Walmart vs Target – Which is Inflation Hedged?

This is evidenced in the recent earnings reports of Walmart and Target. Target derives about 20% of its revenue from grocery sales. They focus on having a person buy a few basic items while they’re there at target buying other things.

Walmart on the other hand derives about 50% of its revenue from groceries and is a destination for grocery shoppers.

Walmart has maintained its overall profit goals while target has struggled. The reason is because consumers have reduced typical consumer goods purchases and spend a growing percentage of food and gas.

So, just about every sign points toward a coming recession much larger than the on we had in 2022. It’s fairly obvious that anyone saying otherwise is trying to sell some hopium.

How to Prepare for the Recession

The way to prepare for a recession is fairly simple. You need to cut spending, cut investing, work to make more money, and stack cash.

As for me, I hardly eat out, I diversified my investments, and I’m head down working hard. My goal is to earn as much as I can now.

The reason is 3-fold:

- Financially survive any calamity that happens.

- Take advantage of the crisis and buy as many investments as possible

- Be poised for massive growth on the back end.

During the Great Recession I did exactly that and made millions in the decade that followed. Now we are entering a new recession and the next crop of multi-millionaires will be born in the next 24 months.

Recession Mistakes to Avoid

There are two major mistakes to avoid over the next 12-24 months.

- Thinking the recession is over because the MSM and Democrats say so.

- Thinking the recession is still happening because Republicans say so.

Investing during a recession is like catching a falling knife. If done perfectly, you’ll make a ton of money. Alternatively, if you let it hit the ground you’ll break the blade and miss your chance.

First of all, don’t be lulled into a sense of hope and coziness. There is close to a zero percent chance we don’t see a continued economic decline in 2023.

Instead, get back to the fundamentals. Focus on finding value. Don’t be afraid to take action even when everyone you hear is telling you the opposite.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Great points here, and I agree we are already in a recession, but because it was an election year, the goal was to; not let the cat out of the bag, so that ‘low information voters’ don’t get wind of it. Your recession advice is great, I’m stashing cash to have dry powder to avail myself to some great deals in the future. Happy Holidays!!