A Real Estate Investing Trust (or REIT) is a very popular investment vehicle where you can buy shares of a company and gain partial ownership over a diverse group of real estate assets.

If you’re not familiar with REITs and how they work, check our article explaining the ins and outs of a Real Estate Investment Trust.

Most REITs are traded on the stock market (though not all), so, with the simple purchase of stock, you are gaining ownership in the real estate sector. For those who want real estate in their portfolio but who don’t want any of the hassle associated with the ownership, REITs make a ton of sense.

There are a lot of great aspects to a REIT but there are also a number of drawbacks. So, let’s dive into the pros and cons to see if a REIT is a bad investment or not.

How a REIT Works

REITs tend to have a very simple and understandable business model. They purchase property with the intent to lease it out. The property gets rented, maintained, and upgraded as needed. Then, 90% or more of taxable profits are passed on to the shareholders. The corporation avoids those taxes and instead, shareholders pay tax on that income.

Mortgage REITs are slightly different as they finance real estate and earn income from interest on those investments. It’s fundamentally the same though.

How REITs Earn and Distribute Money

REITs invest in just about everything related to real estate and their investments are categorized into 13 property sectors.

It’s also pretty amazing that REITs collectively own more than $4.5 trillion in assets across the US.

REITs invest in all kinds of real estate. Everything from offices, apartment buildings, warehouses, retail centers, medical facilities, data centers, cell towers, infrastructure, hotels, and more. Most REITs invest in only one type of real estate but some do hold properties of various types in their portfolio.

How Do You Make Money on a REIT?

Owning money from a publicly traded REIT is no different than earning money from stocks.

You will see it fluctuate daily based on the market demand and supply for shares of the REIT. If it’s a good REIT it should generally trend upwards, but there are periods of time when real estate won’t perform well and REITs will similarly perform poorly.

Then, each REIT provides dividend distributions usually on a quarterly basis. You can either reinvest those dividends or take the cash and buy something else entirely. Some people even fund their retirement with dividends.

Which REITs Pay The Highest Dividends?

Don’t evaluate a REIT based only on dividends because yo could fall victim to a “yield trap.” This is where the dividends are too high to maintain so the company pays out of excess capital. The payment then reduces the book value of the company which causes shares to drop.

So, over time, yields may not keep pace with dropping prices. This is a yield trap.

Highest Dividend REIT: Annaly Capital Management (NLY)

Annaly Capital Management, Inc., a diversified capital manager, invests in and finances residential and commercial assets. The company invests in various types of agency mortgage-backed securities, non-agency residential mortgage assets, and residential mortgage loans; and originates and invests in commercial mortgage loans, securities, and other commercial real estate investments. Annaly Capital Management, Inc. also provides financing to private equity-backed middle market businesses; and operates as a broker-dealer. The company has elected to be taxed as a real estate investment trust (REIT). As a REIT, it is not subject to federal income tax to the extent that it distributes its taxable income to its shareholders. Annaly Capital Management, Inc. was founded in 1996 and is based in New York, New York.

https://finance.yahoo.com/quote/NLY?p=NLY

While this company provides an impressive 10.4% dividend yield as of the time of writing, it appears to be a yield trap.

As you can see, prices have steadily declined for years. Additionally, the dividend has been cut multiple times over the past few years.

High Yield REIT: PennyMac Mortgage Investment Trust (PMT)

PennyMac Mortgage Investment Trust, a specialty finance company, invests primarily in mortgage-related assets in the United States. The company operates through Credit Sensitive Strategies, Interest Rate Sensitive Strategies, and Correspondent Production segments. Its Credit Sensitive Strategies segment invests in credit risk transfer (CRT) agreements, CRT securities, distressed loans, real estate, and non-agency subordinated bonds. The company’s Interest Rate Sensitive Strategies segment engages in investing in mortgage servicing rights, excess servicing spreads, and agency and senior non-agency mortgage-backed securities (MBS); and related interest rate hedging activities. Its Correspondent Production segment engages in purchasing, pooling, and reselling newly originated prime credit residential loans directly or in the form of MBS. PNMAC Capital Management, LLC acts as the manager of PennyMac Mortgage Investment Trust. The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its shareholders. PennyMac Mortgage Investment Trust was founded in 2009 and is headquartered in Westlake Village, California.

https://finance.yahoo.com/quote/PMT?p=PMT&.tsrc=fin-srch

PennyMac is a well-known mortgage company, and many of you likely have your mortgages serviced by PennyMac.

Their yield is an impressive 9.3% with stable stock prices going back at least 10 years.

Additionally, they have a very stable dividend yield that dipped only during the first 6 or 9 months after the pandemic and have resumed standard dividend payments since then.

High Dividend REIT: Two Harbors Investment Corp. (TWO)

Two Harbors Investment Corp. operates as a real estate investment trust (REIT) that focuses on investing in, financing, and managing residential mortgage-backed securities (RMBS), non-agency securities, mortgage servicing rights, and other financial assets in the United States. Its target assets include agency RMBS collateralized by fixed rate mortgage loans, adjustable rate mortgage loans, and hybrid adjustable-rate mortgage (ARMs); and other assets, such as financial and mortgage-related assets, including non-agency securities and non-hedging transactions. The company qualifies as a REIT for federal income tax purposes. As a REIT, the company must distribute at least 90% of annual taxable income to its stockholders. Two Harbors Investment Corp. was incorporated in 2009 and is headquartered in Minnetonka, Minnesota.

https://finance.yahoo.com/quote/TWO?p=TWO&.tsrc=fin-srch

Two Harbors Investment Corp sports an impressive 10.48% yield currently. It’s important to note their evaluation took a major hit during the pandemic and it hasn’t recovered yet.

Additionally, their dividend has been cut by more than 60% over the last few years. So, that doesn’t bode well for the future of this REIT.

Your Investment Portfolio With vs Without Real Estate

Traditionally, adding real estate to an investment portfolio reduces the overall risk profile of the portfolio. Simultaneously, it increasing returns. So, how do REITs place into this?

Historical Returns of Real Estate Investment Trusts

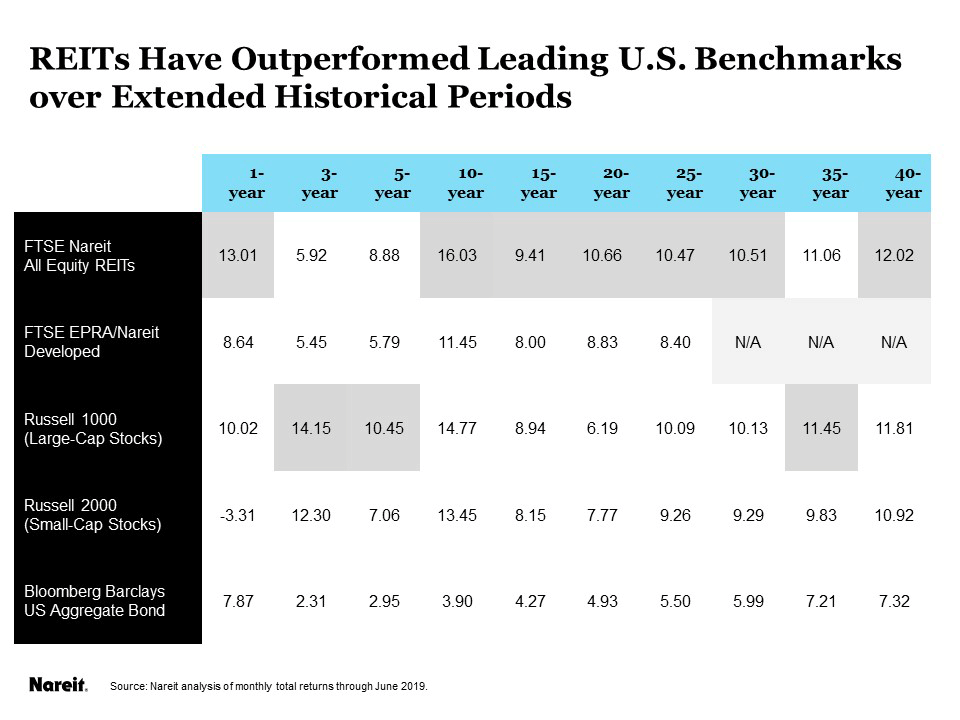

REITs have actually outperformed the broader stock market during most periods of time. They provide reliable and increasing dividends over a long period of time which is combined with long-term capital appreciation through stock price increases.

Are REITs a Good Investment?

The evidence is pretty straightforward that real estate beats the stock market in terms of performance, and also has less volatility. So, having real estate in your portfolio is definitely a net-positive effect.

But, REITs are not the same thing as real estate. So, the question is: “Are REITs a Good Investment to Add to My Portfolio?”

While REITs do have a lot of the benefits of real estate, they do have some unique risks. Let’s dig into those before answering the question if REITs are a good investment.

Drawbacks to Investing in a REIT – Why to NOT Invest in REITs

REITs are not for everyone. If you’re wondering why REITs are a bad investment for you, then this is your section.

The biggest pitfall with REITs is they don’t offer much capital appreciation. That’s because REITs must pay 90% of their taxable income back to investors which significantly reduces their ability to invest back into properties to raise their value or to purchase new holdings.

Another drawback is because of their structure, REITs tend to have very high management and transaction fees.

Additionally, REITs have become more and more correlated with the broader stock market over time. So, one of the prior benefits has lost its appeal as your portfolio will become more subject to market swings.

Risks of Non-Traded REITs

Non-traded REITs or non-exchange traded REITs do not trade on a stock exchange, which opens up investors to special risks.

Share Value

Non-traded REITs are not publicly traded, which means there are far fewer disclosure requirements and the asset is illiquid. As a result, it’s difficult to determine the value of the underlying assets, but also what the market value is at any given point in time.

Lack of Liquidity

Non-traded REITs are also illiquid because they are not trading on a public market.

One of the big benefits of a REIT is the ability to sell your shares, so if the REIT is not publicly traded then you are giving up one of the biggest advantages of having a REIT in the first place.

In many cases, non-traded REITs can’t be sold after a minimum of three, five, or even seven years with no fee. Sometimes one can redeem early but with a penalty.

Distributions

Non-traded REITs function by pooling money to buy real estate then manage those assets.

Sometimes dividends get paid out of the pooled money rather than from income generated by the assets. This process limits cash flow for the REIT and diminishes the value of shares.

Fees

A very big drawback to many non-traded REITs is the upfront fees.

Many charge 7-10% and some as much as 15% of all cash invested. Imagine buying an investment and starting off 10%+ in the hole before a single property has even been bought.

Additionally, management fees are the silent killer of REIT returns. Pay attention to how much the managers are being compensated and if they are taking a portion of gross rents, purchase/sale price, etc.

**PAY ATTENTION**

Look for REITs with low upfront fees along with low management fees, early redemption, and a transparent reporting process. If the fees are too high the management is not incentivized to find great deals or manage them well. Instead, they’re focused on finding deals that maximize their compensation.

Risks of Publicly Traded REITs

Publicly traded REITs offer investors a way to add real estate to an investment portfolio and earn an attractive dividend. Publicly traded REITs are a safer play than their non-exchange counterparts, but there are still risks.

Interest Rate Risk

The biggest risk to REITs is when interest rates are increasing. This reduces demand for REITs because it makes real estate more expensive and makes investors more risk-averse.

Alternatively, rising interest rates indicate a strong economy which means lower vacancy, rent growth, and increasing property value. But historically, REITs don’t perform well when interest rates rise.

Which REIT Should I Choose?

A major risk with investing is choosing the wrong sector to invest in or investing too heavily in one type of stock, leading to an unbalanced portfolio.

This is true in real estate as well.

For example, suburban malls have been in decline for a very long time, so if you invested in a suburban mall REIT, you probably won’t be too happy with it.

On the other hand, mixed-use urban living has been doing exceptionally well as millennials prefer the live/work/play living environment over suburban housing (though this may be changing).

Trends change, so it’s important to research the properties or holdings within the REIT to be sure that they’re still relevant and can generate good returns for your portfolio.

Tax Treatment

This isn’t specifically a risk, but rental income is considered ordinary income for tax purposes. Therefore, REIT dividends will have a significant portion that is taxed as ordinary income.

Stock Market Correlation

While rental income and property values are not correlated with the stock market, publicly-traded REIT prices are highly correlated with the stock market.

In fact, since the crash of 2008, REITs have actually proven more volatile than the broader market. It turns out that REITs are highly susceptible to external shocks because 90% of all profits have to be paid out to investors. This leaves very little cash available for inevitable market corrections.

Without cash to ride out downturns, they may be forced to liquidate assets at bargain prices. Additionally, recessions can cause a reduction in rental income that exacerbates this issue.

How to Invest in a REIT

It’s really straightforward, depending on what kind of REIT you’re looking for. If you want a publicly-traded REIT simply go to a finance website, search all the available REITs, pick one, and buy just like you buy any stock.

My preferred brokerage is Interactive Brokers. They have some of the best options for purchasing stocks, options, futures, and even international stocks. Go here to sign up with them. Oh, did I mention they’re going to give you up to $1,000 in free stock?

If you are looking for something a bit more exclusive with higher potential returns, we recommend Fundrise (check out our review of Fundrise).

Go here to set up a free account, browse their offerings, and choose your investing strategy, and invest. It’s pretty straightforward.

How Often do REITs Pay Dividends?

Any stock can pay dividends on any schedule they choose. They can even skip dividend payments entirely.

In general, REITs pay dividends quarterly but many do pay monthly.

REIT Alternatives

There are many REIT alternatives. You could invest in rental property yourself, invest through a syndication, or even an ETF.

If you’re not going to buy your own real estate, then our preferred investment is through Fundrise. Check out their exclusive offer here:

Conclusion – Are REITs a Bad Investment, or a Good One?

There are arguments on both sides of the debate. REITs are a good investment for some investors while they may be a terrible investment for others.

If you do want to invest in a REIT, we do recommend Fundrise which has extremely low fees as compared to the rest of the industry.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply