Regardless of how much you might hate math, real estate investing requires you to understand the fundamentals of financial analysis.

Fortunately, there are programs and software out there to help us overcome our deficiencies and become proficient real estate investors, even if we don’t have a math degree.

Here are the best real estate investing calculators that we have been able to find on the internet (as of 2018) in descending order.

- Why Not Calculate by Hand?

- Best Real Estate Investment Calculators

- Real Estate Investing Calculations

Why Not Calculate by Hand?

You can do this, of course, but it is the least desirable method as it opens you up to the most risk of making a mistake. Even if you are an expert mathematician, mistakes happen so it’s best to use a calculator.

Additionally, if you are new to real estate, it is easy to forget something, leave something out, or just not know that it should be included in the calculation.

That being said, everyone needs a fundamental understanding of the calculations behind real estate investing calculators. So, at the bottom of this article, we’ve included the most important real estate investing calculations that you need to know.

Best Real Estate Investment Calculators

It’s tough to decide what the best investment property calculator. There are several to choose from and they generally fall into one of four categories:

- Free javascript or browser-based calculator (basic cash on cash calculator or house flip calculators for example)

- Extremely expensive but really high-quality real estate calculator (commercial real estate calculator for example)

- Online software with monthly recurring fee (focused on rental property usually)

- Excel-based calculators (for both rental property calculator and house flip calculators)

In this review, we’ll focus mostly on Excel-based calculators, not because they are the best, but because nothing else really fits right.

First, new investors don’t want to spend $500-$1,000 or even more on a calculator and advanced real estate investors should be knowledgeable enough to buy or build their own without this review. So, the expensive rental property calculators are out.

The free javascript based calculators are fun to click on, but are generally not worth using more than as a learning tool. They are good at teaching a concept such as cash on cash return, but not good at actually analyzing deals. So, these are out.

Some browser-based calculators are OK, but their primary purpose is to generate traffic (and sales, ads, or other revenue) for the website. Their purpose isn’t to deliver an excellent product, but to create clicks, so their interests don’t really align with the interests of the customer, so these are out too.

Online recurring revenue calculators are fine and work well, but you will be a real estate investor for the rest of your life, so it makes more sense to own your calculator than to rent it. That being said, there is ONE that made the list because it’s high quality and a low enough price to make it a good entry-level product.

That leaves excel based calculators. They are generally the best combination of quality and price that you’d want in a product. So, let’s dive in (in reverse order)!

Disclaimer: We strive to be as unbiased as possible in all of our reviews, so in the interest of transparency we just want you to know that if you click on any of the links below and sign up or purchase their product, we may be compensated a small fee at absolutely no additional cost to you.

The #1 The Deal Analysis Calculator

This is the top-ranked calculator because of the value. It’s not the calculator with the most features, nor is it the cheapest.

It has the best analysis for the price.

This calculator is a workhorse and has all of the fundamentals you need for deal analysis meeting or exceed the other calculators but for about 1/3-1/4 the price. The difference is, this calculator does not have the preformatted reports.

So, if you’re looking for something that prints out pretty reports, you’ll have to copy the data into a powerpoint or word document. But, if you want all the same (or better) analysis at a fraction the cost, this is the one for you.

It lets you quickly calculator gross/net rent, vacancy, and get’s into the minutia of operating expenses (which is awesome!).

It’s really cool that you can input a discount rate (the interest rate you could be getting somewhere else) which helps you determine when you should sell/refinance. This calculator, of course, has all the fundamentals such as debt service coverage ratio, total return, cash on cash return, return on equity.

This calculator lets you visualize your expenses as a ratio of income and also breaks down each expense category as a percentage.

Plus, it’s all formatted so you can print it.

Income and Expense Forecasting

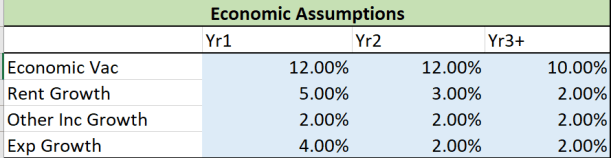

Any good calculator should help you project out 5, 10, or 30 years. This one has that, plus the ability to model in short-term market fluctuations.

It’s important to be able to have short-term adjustments to the long-term trend because you can model in major changes. For example, if you think the economy will slow down next year but pick back up the following year, you can model higher expenses and lower rent growth next year, then flip it the following year.

Also, using the economic vacancy factor, you can model in a really high vacancy year 1 if you plan to kick everyone out, renovate, and rent them out at a much higher rate.

This lets you model vacancy for renovations when you purchase, a hot economy slowing down, or a ramp-up of expenses if current ownership is neglecting their property.

Accurate Expense Assumptions

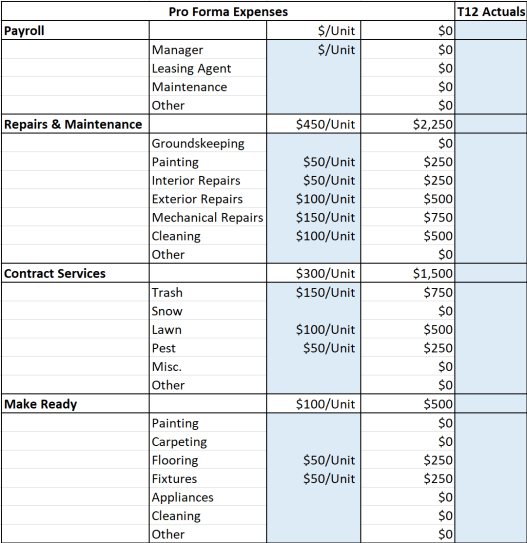

One of the biggest problems is that people forget to account for a lot of expenses.

This calculator breaks your expenses down into 11 “buckets” with each bucket having sub-categories within it. You definitely won’t be forgetting any expenses with a sheet like this.

Also, we’ve included a special “reserve” account which will help you account for future capital expenditures such as a roof, heating system, HVAC, etc…

You can also visualize it on a per unit basis so you know if this particular building operates for more, less, or about the same as other properties you are analyzing.

Modeling Rents

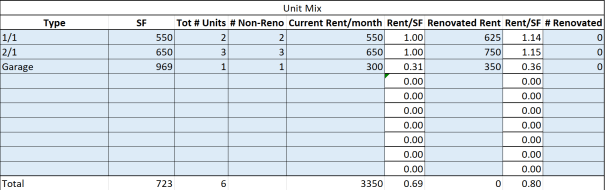

Knowing the current rents and comparing it to the pro-forma rents is fairly easy, but it’s difficult to model the transition between the two.

If you are looking at a 12 unit building and plan to upgrade the units and increase rents, we allow you to model that over a period of months. So, if you plan to complete all the renovations in 12 months, this calculator will assume you turn over 1 unit every month and model your income appropriately

Also, you can input if some apartments are currently renovated and don’t need to be upgraded.

Lending and Financial Modeling

You can easily include rehab costs into your loan if your lender allows it. Also, flexible amortization options and the ability to model in an interest-only payment period makes this calculator very powerful.

If you have partners, you can include a general partner / limited partner split along with including a working capital account, acquisition fee, and other expenses that are normal when partners are included or in a syndication style arrangement.

You can also use a cap rate or ARV for selling price.

2. House Flipping Calculator

This is probably the best house flipping calculator on our list, so it’s going to get the #2 position for that reason.

This product gives you a great calculator, but the value is in the reports. As you know, most house flippers are not using their own money to do the deal, they are borrowing private or hard money.

So, amazing and high-quality reports give a great first impression and increase your odds of funding the deal.

3. Cash Flow Analyzer (Canada) – Rental Software For Canada

I added this to the list because it is the only software designed specifically for Canadian real estate investments.

It’s the same software as #4, but with adjustments to make it specific to Canadian real estate and taxes.

4. Cash Flow Analyzer

This is a good product and it produces some very good reports/presentations to give to investors, partners, etc. Also, I like it because it’s not “salesy” like rehab/rental valuator is. It shows a product, price, and features, and what you see is what you get.

It’s also a good product for the price (between $100 and $130 depending on which calculator you get). At that price you get very professional looking reports, all the financial ratios and metrics you need, and more.

5. DealCheck

This is a pretty solid product and has all the functions you’d need/want in a real estate calculator. It has both rent and flip calculators and includes long-term economic assumptions (such as rent/expense growth), nice looking reports, and an offer calculator.

The only drawback is that it is a monthly subscription. But… it’s only $7/month so you don’t have to think very hard before signing up.

6. RehabValuator – Calculator for House Flippers, Wholesalers, and Agents

This is very similar to RentalValuator… because it’s put out by the same person.

And the model is exactly the same. You can get the free version of the software that is pretty good, but if you want more features, you need to pay for it.

7. RentalValuator – Rental Investment Calculator

Rental Valuator is a solid calculator with a Freemium pricing model. Basically, you can access a basic version of the calculator for free, but that gets you on their marketing list where they try to sell you not only the upgraded version but courses and training as well.

This is probably the best *Free* software out there, so if you’re looking for something free, this is the calculator for you.

Real Estate Investing Calculations

Capitalization Rates (cap rates)

The capitalization rate, also known as “cap rate”, is a method used to calculate value and estimate rate of return in commercial real estate.

Cap Rate Definition:

The capitalization rate, or just cap rate, is the ratio of Net Operating Income (NOI) to asset value. If a property sold for $100,000 and generates $8,000 of income after expenses (but before finance costs), then the cap rate would be $8,000 / $100,000 which is 8%.

The capitalization rate is used to determine the value of income producing property. There are several methods to estimate value including the gross rent multiplier, and comparative market analysis.

Though using cap rates to value property or your return on investment can be very accurate most of the time, it is still not applicable in some circumstances.

How To Calculate Cap Rates

Let’s say you are purchasing an apartment building that is selling for $1,000,000 and has an NOI of $50,000, then it would be said to have a cap rate of 5% (or 5 cap).

Rent to Cost Ratio

Rent to cost ratio is the total rent as a percentage of the total cost.

So, a property with a monthly rent of $1,000 and a selling price of $100,000 would have a rent to cost ratio of 1%.

A lot of people use some “rules of thumb” to help them buy good deals. Two of these rules related to the rent to cost ratio are the 1% or the 2% rules.

Basically, it states that if your rent is is roughly equal to or greater than 2% of the total property price, then you will be able to generate positive cash-flow on the property and a decent profit. If it’s equal to 1% you should be able to break even.

- A $100,000 property should generate $2,000 per month in rent to meet the 2% rule

- To meet the 1% rule, the same house should generate $1,000.

Obviously, there is a huge difference between the two rules – You probably don’t want to find deals at the 1% rule and you probably can’t find deals at the 2% rule. In reality, you’ll land somewhere in between.

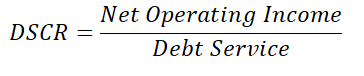

Debt Service Coverage Ratio (DSCR)

The debt coverage ratio (also known as the debt service coverage ratio, DCR, or DSCR) is a simple ratio that tells a lender how much of your cash flow is eaten up by the mortgage payment.

Debt service coverage ratio calculation

In general, it’s calculated as:

where:

Net Operating Income = Gross Income – Total Operating Costs

Debt Service = Principal + Interest

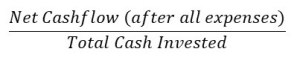

Cash on Cash Return

Simply stated, cash on cash return is the yearly return on the cash you invested. If you invested $20,000 in a rental property and it’s returning you $4,000 this year, then your Cash on Cash return is 20%.

Do not confuse cash on cash return for return on investment (ROI) or return on equity (ROE). Cash on cash returns are far easier to calculate and explain a different story to the investor.

ROI is the combination of cash earned, appreciation, equity pay down, tax incentives, as compared to your total investment. Return on equity is like ROI, except it is calculated against your total equity vs your total investment.

Cash on cash return does NOT include any appreciation (or depreciation), equity pay down, or other factors that may affect your overall return on investment.

How to Calculate Your Return

The formula is very simple actually:

50% Rule

In order to analyze the property, you will need to make assumptions about your expenses. That’s where the 50% rule comes in:

The 50% rule is just a simple assumption that 50% of your rental income will go toward operating expenses. Principal and interest payments are excluded from operating expenses as well as capital expenditures but it includes most other expenses you will incur. – Eric Bowlin

The 50% rule includes all operating expenses which include (but are not limited to):

- Taxes

- Insurance

- Utilities

- Property Management Fees

- Maintenance Expenses

- Marketing/Rental Fees

- Turnover Costs

- General Administration

- Payroll Expenses

- Capital Expenses (or savings for CapEx)

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply