Real estate may be the only industry that uses the term “cash on cash return.” It’s an odd way of calculating returns but it is quick and easy to use. If you’ve read any real estate book, blog post, or seen any video, that it is almost a certainty that you’ve heard the term “Cash on Cash Return” used.

But, what is CoC Return and how do you calculate it? More importantly, we’ll discuss how you make decisions using it.

What Is Cash On Cash Return in Real Restate?

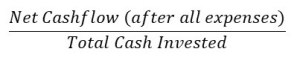

Cash on Cash return is calculated as the total cash you get from a deal every year as a percentage of the total cash you invested. It is a fundamental concept for real estate investors and the basis for most real estate investment decisions.

How to Calculate Your Return

If you invested $20,000 in a rental property and it paid you $4,000 cash this year, then your Cash-on-Cash return is 20%. You calculate this by taking $20,000 and dividing it by $4,000.

Try to remember that this is calculated entirely with your cash return and compared to the cash invested. Do not confuse cash on cash return for return on investment (ROI) or return on equity (ROE). Cash on cash returns are far easier to calculate, but they explain a different story to the investor than other return calculations.

Cash on cash return does not include any appreciation, depreciation, equity pay down, or other things that have real effects on your net worth.

Cash on Cash Return Formula

Example #1

An investor buys a property for $100,000, puts $20,000 in work, and pays another $10,000 in carrying costs and closing costs.

The investor has put a total of $130,000 into the project.

If the investor turns around and sells it for $150,000 there is a total profit of $20,000.

This is a total return of 15.4%

Pretty straightforward, right?

Cash on Cash Return Example #2

Let’s say the investor above does the exact same deal, but this time borrows $100,000 from a lender and pays an additional $5,000 in interest. The total cost of the project is now $135,000 and there is a profit of only $15,000.

But, the investor has only put $35,000 cash into the project.

$15,000 / $35,000 = 42.9% cash on cash return.

Even though there is less profit, the rate of return is much higher.

Cash on Cash for Rental Property

Let’s use the exact same property as the first example. The investor purchases the property and spends $130,000. Then, he or she get’s a conventional loan for 75% of the value, meaning the loan is for $97,500 and the amount of cash the investor spends is $32,500.

The investor rents the house out to a tenant. For simplicity let’s just say PITI is 900, the expenses are $600, and the rent is $2,000. The total expenses are $1,500 and rent is $500 for a total cash flow of $500 per month or $6,000 per year.

$6,000 / $32,500 = 18.5% cash on cash return.

Cash on Cash Return vs Return on Investment (ROI)

This example will illustrate the difference between cash on cash return and ROI.

In the example above, you’ll notice cash flow is rent minus PITI and expenses.

But part of that PITI actually goes toward principal pay down and will be recovered when the property sells.

Cash on cash return doesn’t care about that. It just wants to know how much cash we put in the pocket compared to how much we invested.

You’ll also notice that the property is actually worth $150,000, meaning $20,000 was earned right up front for a total equity of $55,000. Again, cash on cash return doesn’t care about that equity.

Though the PITI for the year is $10,800, roughly $1,566 would be counted toward profits (Principal payments were just estimated because we didn’t use an exact interest rate).

So, if after 1 year the house was sold, the income and expenses would look like this

- Rent: $24,000

- PITI + Expenses – $18,000

- Net Rent – $6,000

- Proceeds from Sale $20,000

- Principal Pay Down $1,566

- Total Profit – $27,566

ROI – 78.8%

If the house was sold in year two, it would look something like this

- Net Rent – $12,000

- Proceeds from Sale $24,500 (assume 3% appreciation)

- Principal Pay Down $3,200

- Total Profit – $39,700

Yearly ROI – 56.7%

You can see that the longer you hold it, the less your ROI becomes. It’s because you take the fixed profit (value-add equity) and divide it over more years.

As you can tell, ROI and Cash on Cash return yield different results.

Calculating Returns On Rental Properties is Important

Cash on cash return tells you how much cash you are going to put into your bank account this year compared to how much money you took out of the bank at the beginning.

It tells you nothing more and nothing less.

Cash on cash is a simple and beautiful calculation.

ROI is extremely difficult because it needs to take into consideration cash flow, tax benefits, as well as equity or appreciation which you don’t receive until after you refinance or sell.

The great thing about cash-on-cash return is its cash in your hand.

If you can have a great cash on cash return, then any added appreciation or equity pay down is just a bonus.

What Is A Good Cash On Cash Return?

This is a hard question to answer because it depends on you.

Some people have a high-risk tolerance and want a very high return. Others want safe but lower returns.

Many investors consider the return to be related to risk. A high return means a high risk. If a person is near retirement, they may want very little risk and thus prefer very low cash on cash returns.

Though risk may not be directly related to this measure, many people still treat it as such.

Some people may accept a low cash return in order to accept a high ROI based upon a value-add deal. Others may care less about earning equity and just want a high paying investment right now.

The point is, it’s impossible to really tell you what a Good Cash on Cash Return is because – it depends.

What is more important:

IT’S IMPORTANT TO SET GOALS

Whatever your reasoning, set a goal and then achieve it.

If you want 10%, go for it. If you want 5%, go for that. Nobody can really tell you what is right or wrong because your own risk tolerance and investing goals are what is important to you.

If you want 10% cash on cash returns, great… just know that before running the calculator. If you don’t have a plan, you may decide “alright, that’s good enough.” after punching the numbers in and getting a result.

Set your return goals high

I believe it’s important to set really high goals for your returns. With leverage, it’s possible to exceed 20% or 30% ROI and easily have double digit cash on cash return.

Set high goals and if you fall short, you are still better than if you set low goals.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply