Real Estate Investment Calculator

Results:

Total Cashflow:

Cash on Cash Return:

Real estate investment can be a complex field, requiring careful analysis and informed decision-making. One key tool in the investor’s arsenal is having a Cash on Cash Return calculator (CoCR).

To aid in this, we’ve developed a user-friendly cash on cash return calculator designed to simplify these calculations, making it easier for investors to make informed decisions, whether in rental properties, house flips, or other forms of real estate investment.

How to Use the Calculator

Our calculator requires input of five key variables: Gross Potential Rent, Vacancy Rate, Operating Costs (as a percentage of total income), Mortgage Costs, and Total Investment. Here’s a step-by-step guide to using it:

- Enter the Gross Potential Rent: This is the total rent you expect to receive in an ideal scenario with 100% occupancy.

- Input the Vacancy Rate: This is the percentage of time your property might be unoccupied. It’s crucial to be realistic in your estimations.

- Include Operating Costs: Enter this as a percentage of your total income. This figure should encompass all recurring expenses such as maintenance, management fees, and utilities.

- Mortgage Costs: If you have a mortgage on the property, input your regular payments here.

- Total Investment: This is the total amount of money you’ve invested in the property, including down payments and any renovation costs.

After entering these figures, click the “Calculate” button to receive your Total Cashflow and Cash on Cash Return.

In the world of real estate investing, “Cash on Cash Return” is a term that often surfaces. It’s a metric used by real estate investors to evaluate the profitability and efficiency of their investments. Understanding this concept is crucial for anyone involved in real estate investing, whether you’re a seasoned investor or just starting out.

What is Cash on Cash Return?

Cash on Cash Return is a rate of return ratio that calculates the total cash income earned on the cash invested in a property. In simpler terms, it measures the annual return the investor made on the property in relation to the amount of mortgage paid during the same year.

How is it Calculated?

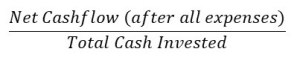

The formula for Cash on Cash Return is relatively straightforward:

Where:

- Net Cash Flow is the net income generated by the property (rental income minus all expenses, including mortgage payments, property management fees, maintenance, etc.).

- Total Cash Invested includes the down payment, closing costs, renovation costs, and any other initial expenses.

Why is Cash on Cash Return Important?

- Investment Performance Indicator: It helps investors assess the performance of their real estate investments. A higher cash on cash return indicates a more profitable investment.

- Comparative Analysis: It allows investors to compare the profitability of different investment opportunities. This is particularly useful in markets with varying property prices and rental incomes.

- Strategy Formulation: Understanding cash on cash return can aid investors in formulating strategies for future investments, such as deciding whether to pay cash or finance a property.

- Risk Assessment: It can also be a tool for risk assessment. Properties with lower cash on cash returns might be riskier investments.

Limitations of Cash on Cash Return

While useful, cash on cash return has its limitations:

- Does Not Account for Appreciation: It only considers the cash flow and does not take into account the potential appreciation of the property’s value.

- Ignores Financing Costs: If the property is financed, the cost of the loan (interest rates, loan terms) is not considered in this calculation.

- Short-Term Focus: It primarily focuses on the immediate annual return, not the long-term profitability or total return on investment.

- Variable Expenses: The return can be significantly impacted by unexpected expenses or vacancies.

Why Cash on Cash Return Matters

Cash on Cash Return is a crucial metric for real estate investors. It offers a clear picture of an investment’s profitability and efficiency by comparing the yearly return to the total cash invested. Understanding CoCR is vital in making informed decisions and ensuring the sustainability of investments.

Rental Property Investment

In rental property investment, CoCR is a critical measure of the property’s performance. It helps investors understand if their rental income is sufficient to cover expenses and yield a reasonable return. A healthy CoCR in rental properties indicates efficient use of investment capital and a stable income stream. For instance, in a high-demand area, a property with a lower CoCR might still be a wise investment due to potential appreciation and stable rental income.

House Flipping and Other Investments

For house flippers, CoCR is an indicator of the potential profitability of a flip. A high CoCR suggests that the flip could yield significant returns relative to the cash invested. It’s crucial for flippers to consider CoCR alongside factors like market trends and renovation costs. The success of a flip often hinges on buying the right property at the right price and efficiently managing renovation costs to maximize resale value.

Examples of Calculating Cash on Cash Return

Calculating Cash on Cash Return in various scenarios helps illuminate how different factors influence the profitability of real estate investments. By examining diverse examples, investors can gain insights into effective strategies for different types of properties.

Example 1: High-Performing Rental Property

- Gross Rent: $30,000/year

- Vacancy Rate: 5%

- Operating Costs: 20% of income

- Mortgage Costs: $10,000/year

- Total Investment: $200,000

Scenario: This property is in a sought-after urban area with high rental demand, justifying the higher rents. The effective rental income is $28,500, and the operating costs are manageable, leading to a solid CoCR of 6.4%.

Example 2: Successful House Flip

- Sale Price: $250,000

- Purchase and Renovation Costs: $150,000

- Total Investment: $150,000

Scenario: The property was purchased at a below-market rate in an up-and-coming neighborhood. Strategic renovations significantly increased its value, leading to a high resale price and a CoCR of 66.7%.

Example 3: Transforming a Negative Cash Flow into a Profitable Investment

Initial Scenario:

- Gross Rent: $15,000/year

- Vacancy Rate: 10%

- Operating Costs: 30% of income

- Mortgage Costs: $12,000/year

- Total Investment: $100,000

Initial Calculation:

- Effective Rental Income: $15,000 – 10% (Vacancy) = $13,500/year

- Operating Costs: 30% of $13,500 = $4,050/year

- Total Cashflow: $13,500 – $4,050 (Operating Costs) – $12,000 (Mortgage) = -$2,550/year

- Initial Cash on Cash Return: -2.55% (-$2,550 / $100,000 * 100)

This property starts as a negative investment due to its high vacancy rate and low rents. To turn this around, an investment is made to renovate the units and improve tenant appeal.

Improvement Plan:

- Renovate units: $20,000 (added to the total investment)

- New Total Investment: $100,000 (initial) + $20,000 (renovation) = $120,000

- New Rents: Post-renovation, the rents are increased to a total of $20,000/year.

- New Vacancy Rate: With better units, the vacancy rate drops to 5%.

Post-Renovation Calculation:

- New Effective Rental Income: $20,000 – 5% (Vacancy) = $19,000/year

- Operating Costs: 30% of $19,000 = $5,700/year

- New Total Cashflow: $19,000 – $5,700 (Operating Costs) – $12,000 (Mortgage) = $1,300/year

- New Cash on Cash Return: 1.08% ($1,300 / $120,000 * 100)

Analysis: After the renovation and tenant restructuring, the property has transitioned from a negative cash flow to a positive one. The new Cash on Cash Return is 1.08%, reflecting a successful turnaround. By investing in property improvements and repositioning it in the market, the investment has shifted from a loss-making venture to a profitable one, showcasing the importance of strategic upgrades and effective property management.

What Constitutes a Good Cash on Cash Return?

A good CoCR depends on the investor’s risk tolerance and return goals. Investors should assess their comfort with risk and how it aligns with their financial goals. High-risk properties often promise higher returns but require more extensive market knowledge and active management.

Determining Personal Investment Goals

Investors should define what they seek from their investments. For some, a stable income with low risk is the priority, while others might aim for high growth, acknowledging the associated risks. This personal benchmark is crucial in evaluating what a ‘good’ CoCR is for an individual investor.

Balancing Risk and Reward

A good Cash on Cash Return should reflect the best possible return adjusted for risk. For instance, a property offering a 10% CoCR in a stable market might be more appealing than a property in a volatile market offering 15%. It’s about finding that balance where the return compensates adequately for the risk taken.

Investors can also consider diversifying their portfolio to spread risk. A mix of properties with varying levels of CoCR and risk can create a balanced investment portfolio that aligns with long-term goals.

Market Comparisons

Finally, comparing the CoCR of potential investments with market averages and similar properties is essential. This comparative analysis helps in understanding what constitutes a good return in the current market context.

Conclusion

Understanding and utilizing Cash on Cash Return is essential in making informed real estate investment decisions. Our calculator simplifies this process, giving you a quick and clear view of potential investments. Remember, a good investment is not just about high returns; it’s about balancing those returns with an acceptable level of risk. By carefully considering CoCR in the context of your personal investment goals and market dynamics, you can make more strategic and profitable investment decisions in the complex world of real estate.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply