I’m sure you’ve done it before – you looked on Zillow to figure out what you’re house is worth. Don’t be ashamed, most people do that. What you don’t realize is Zillow is just using a computer algorithm to do a comparative market analysis.

With a little effort, you can do it yourself and quite possibly be far more accurate than Zillow.

While your property is definitely unique and different from your neighbors, people are presented with many options when house shopping. Just as the consumer will weigh all their available options, you too must weigh all of the available competition. That’s what a comparative market analysis is.

What is a Comparative Market Analysis?

The comparative market analysis is used to create an estimate of fair market value for a specific 1-4 unit house. This is done by finding similar properties nearby that have sold within the prior 6 months, then making a series of adjustments to capture any differences between the properties. Once this is complete, an estimate of the property value can be made.

The CMA is used to help evaluate how your home will fare against the competition. It takes a look at both homes that are currently listed and those recently sold. The purpose is to find the highest price that will still make the home competitive on the open market. – Realtor.com

Doing a Comparative Market Analysis (CMA), and finding comparable sales should be just one piece of your overall property analysis. You should also consider rental income and expenses (such as maintenance, taxes, and mortgages) to analyze your return.

It should also be noted that there are multiple ways to analyze the value of the property. Other methods include using the capitalization rate or gross rent multiplier.

In general, you won’t use other methods for residential property. Capitalization rates are for commercial properties or residential properties with 5 or more units. The gross rent multiplier is not an accurate way to determine property value at all. So, avoid this as well.

What is a Comparable Sale?

A comparable sale, or comps, are just other properties in the area. It should have similar features such as the number of bedrooms and bathrooms. Perhaps even, similar square footage, garage characteristics, lot size, etc. Fortunately, there are ways to adjust for differences. You should find the most similar properties first, and only deviate if you absolutely must.

Also, they should have been sold within the last few months, but generally no longer than 6 months ago.

By looking at these properties and doing a little bit of math, we can get an idea of what our property might sell for (also called the subject property).

Finding recent sales is really easy because it’s all public record. If you have access to MLS then great, use that. If not, you can easily use a resource such as Zillow.com.

With services like Zillow, it’s easy enough to sort properties by what has recently sold, then write down the information about each property.

How to Use Comparable Sales to Determine Market Value

Let’s just remember that you are looking at one property, trying to find similar properties nearby, then using those similar houses to try to estimate the selling price of the subject property.

So, if you have a 3 bed, 2 bath, 1200 square foot home in a certain neighborhood and a couple of weeks ago a similar aged 3 bed, 2 bath, 1200 square foot home in a similar condition sold for $200,000, then this house will likely sell right around $200,000 as well.

A real estate agent or broker will create a report to help you estimate what a property is worth. No license and very little training is required to create a CMA (whereas a license is required for appraisers to make an appraisal), so if you don’t have an experienced agent or broker, you could be getting bad information.

As such, you should know how to do your own analysis. The example above is very similar and straightforward, but often the conditions in the market are not so simple and many agents are not that great.

You might want to buy a duplex where one side has 2 bedrooms and the other side has 3 bedrooms, but all of the other sales have either 2 and 2, or 3 and 3. So, how do you know what it will be worth?

Often, you might have 3 beds and 1.5 baths but all the comparable properties are 3/1 or 3/2. These nuances can make or break a deal, so we’ll dive into the nitty gritty details so you know how to make your own CMAs or can at least see if your agent’s CMA is realistic or not.

Simple Comparative Market Analysis Example

If you can find nearly identical properties, then you should have no problem simply comparing. For example:

Target property – 1500 sf, 3 bed 2 bathrooms listed for $160,000

- #1 Comp – 1550 sf, 3/2 – sold for $152,000

- #2 Comp – 1475 sf, 3/2 – sold for $150,000

- #3 Comp – 1520 sf, 3/2 – sold for $155,000

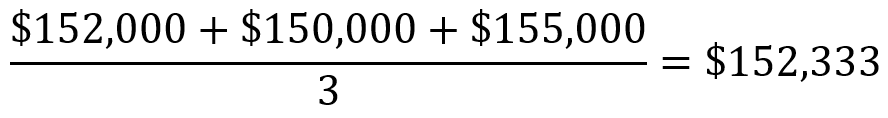

In this example, you might just average the selling prices to get an average.

So, the target property is probably worth somewhere around $152,000 and you should negotiate accordingly. There is always some variance due to things such as condition, curb appeal, and location within the neighborhood, but the comps are very similar and there isn’t much to do with the CMA.

Making Adjustments to a CMA

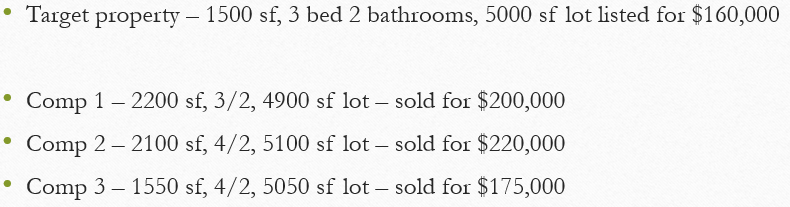

It gets a little more difficult when there are no (or very few) similar properties in the area. Let’s take this property as an example:

Well now, isn’t this a tricky one?

Comp 1, the only 3/2 on the list, is 700 square feet larger and also on a huge lot. There is no way the smaller property we are looking at is worth anywhere near that much. On the other hand, Comp 3 is similar sized but has an extra bedroom in it. Again, not great for comparison purposes because people are always willing to pay more for an extra bedroom.

Finding the Value of a Bedroom

The only way to try to get an estimate of the market value of our target property is to try to find the value of the differences and adjust the comps based on those differences. The goal is to make the comps more like the target and figure out how much it would sell for if they were adjusted. Let’s start by listing them out.

It can be tricky because there are a lot of variables. Let’s start by comparing Comp 1 to Comp 3.

I notice the lot size is similar, square feet are similar, and bedrooms are the same. The dramatic difference between the two is the number of bedrooms. We also notice that Comp 2 sold for $20,000 more than Comp 1 sold for. Since everything else is pretty similar and the big difference is the number of bedrooms, we can reasonably assume that the difference in price is due to the different number of bedrooms. So, going from bedroom #3 to bedroom #4 increases the value by $20,000.

Adjusting the Value For 1 Bedroom

Now, our goal is to make the comparable sales look more like our target property by adjusting them. Comp 2 has 4 bedrooms so we want to know how much the value would change if we chopped off a bedroom. Based on the analysis above, if you took away 1 of those bedrooms, the value would drop by $20,000. So, we’ll put a -$20,000 under the bedrooms for Comp 2. You can do the same for Comp 3 as well since it has 4 bedrooms.

I just went ahead and inputted $0 for all the bathrooms because they are the same.

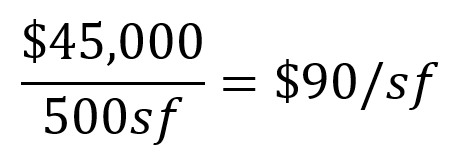

Now, let’s take a look at square feet. As a quick note on this, we are generally looking for large differences in square footage, as small differences have virtually no discernable effect on selling price. So, you’re generally looking for a difference in excess of 100sf. Now, you can see that Comp 2 and Comp 3 are basically the same except there is a big difference in the square footage of the two. Comp 2 is 500 square feet larger than Comp 3 and also sold for $45,000 more.

So, let’s adjust each of the 3 comps down to 1,500sf by simply multiplying the number of square feet by the total price per foot. Our CMA now looks like:

What’s My House Worth?

You’ll notice the CMA is coming up with a bit lower of a price than the asking price on the target property.

This is OK and fairly common.

Most people will try to list their property slightly above the market value hoping to generate a higher offer. It’s also good to notice that the adjusted prices on the 3 comps are remarkably similar. This means there is a good chance we are accurate.

You may find that if there are too many differences between your target properties, you’ll have to pull in more comps to isolate those variables. It’s because your goal is to have everything else be similar except the one variable you are trying to adjust. In this example, we adjusted the bedrooms and square footage, so we needed a minimum of 3 comparable sales. If we added in lot size, we’d most likely need to add another comparable sale that has the same number of bedrooms, square feet, and bathrooms as one of the other comps, but only had lot size as a difference.

The point is there will always be some fluctuation in the numbers and there is no way to make it perfect. If the adjusted price of one of your comps is dramatically different than the others, it means you didn’t do a good job isolating the value of the differences. So, if one of the comps was saying $180,000 while the other two said $145,000 or $146,000, then you might want to go find some more comps to add into the analysis and make it a bit more robust.

Now that we have 3 comps with adjusted prices that are relatively similar, we can simply average them which gives us a total of $143,000. So, we can estimate that the selling price of the target property should be somewhere around $143,000 based on the comps.

CMAs Are Approximate and are NOT Appraisals

Remember, a CMA is used to help estimate market value but it does not determine market value – only the market determines that. Your CMA may be wrong, it may be right, it might be close. Sometimes there aren’t enough comps to get a good feel for the value while in other circumstances you have a nearly identical property sell right next door just a few weeks prior.

The more variability you have in your comps, the less accurate your CMA will be. This is really common in older areas of the country where houses on the same street may have been built 80 years apart. Adjusting for all the differences can become amazingly complex and may not even be possible to do by hand. The best you can do is get a rough swag and hope for the best!

An appraisal is similar to a CMA but is done by someone who is licensed and has a lot more experience. Even with that, appraisals are not always accurate and often different appraisers will give different values for the same property. Remember, only the market determines price. All we are trying to do is estimate what that price may be.

Comparative Market Analysis FAQ

Yes. The best thing to do is to make a CMA for each major upgrade you plan to do then compare that to the cost of that work. For example, do a CMA if you renovate the kitchen, one if you do the bathroom, etc. Once you know how much each project adds in value, compare it to the cost of the work to see if it’s profitable.

As the first heading suggests, it is good only for 1-4 unit properties. This is not a hard rule; a 5 unit building doesn’t suddenly use a different method while a 4 unit building uses this.

The larger the building, the more it transitions to commercial valuation compared to a comparative analysis. Often, smaller multi-family buildings, such as a 3 or 4 unit building, will use a CMA primarily and then compare it to a value derived using a capitalization rate. In theory, the valuations using two methods should be similar, but market forces can force them to diverge.

A 5-8 unit building may use some comps as a comparison and focus mostly on cap rate, while larger buildings will be entirely evaluated on its return on investment (cap rate) and not at all on comps.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply