I’ve loved the idea of crowdfunding ever since it was introduced back in the 2012 JOBs act. In reality, though, it combines the internet with something that has already existed for a hundred years – real estate syndication.

There are a number of top players in the field, but EquityMultiple is definitely one of the best.

Review of EquityMultiple – Intro to the Company

What is EquityMultiple?

EquityMultiple is an investment service that allows you to invest directly into institutional quality real estate investments. In their marketplace, they offer both equity and debt investments.

They are focused almost entirely on very large projects, well above the $5 million mark, with many above $10 million and one that approached $200 million.

Their goal is to provide a transparent and high-quality marketplace where instution grade real estate from around the country can be offered.

Disclaimer: All of the crowdfunding reviews are based on an unbiased matrix of criteria, each weighted based on what we deem important for a crowdfunding platform. We generated the ratings and then sought out the top platforms to affiliate with. If you click on any links on this page or website and then sign up for their service, we may be compensated slightly at absolutely no expense to you.

How is EquityMultiple Different?

EquityMultiple is focused on institutional grade commercial real estate investments. They look for Commercial properties in thriving markets with current cash flow, Short-term senior loans with robust APR to investors and a promising exit strategy, and Value-add projects with construction components and more aggressive business plans.

For debt deals, we work with experienced lenders (rather than operating as a lender ourselves), giving investors an important extra layer of due diligence and servicing expertise. For equity deals, our primary compensation is a participation in investor profits (10%), which we only receive after your full initial investment has been returned. This helps incentivize us to find the best opportunities for EquityMultiple investors.

Most crowdfunding platforms are focused on just one type of real estate such as fix and flip residential, commercial debt, or others.

EquityMultiple is one of the few platforms that allows an investor to broadly diversify their portfolio using only one platform. On their platform, you can invest in both equity and debt, and diversify across property types such as commercial, retail, residential and others.

EquityMultiple Review Ranking

EquityMultiple is tied in 1st place which puts them in the top 5% of companies we review.

Pros of Investing with EquityMultiple

Accredited and Non-Accredited investors welcome

Investments as low as $5,000 though the average minimum investment requirement is $20,000

Very high-quality investments to choose from

Investment types include equity and debt

Factors critical to EquityMultiple high review rank

Overall, EquityMultiple touches upon almost every category that we believe is important. Specifically, though, their combination of low fees (which are aligned with investor interests), diverse investment options in debt and equity, and the extremely high-quality investment options are what gives them a high score.

Cons of Investing with EquityMultiple

Investments are not liquid (terms vary but can be up to 5 or 7 years)

Very high minimums (often $20,000 or more)

Areas of Improvement

The quickest way they could improve their score in our matrix would be to have lower investment minimums. The majority of platforms offer a $5,000 minimum while some are as low as $1,000. Though we understand why a company would have higher minimums, part of the spirit of crowdfunding is to have low investment minimums for a large number of investors. If they changed this one factor, they would rank rank higher than their competition.

How Does EquityMultiple Screen Investments?

One of the most important parts of a review of EquityMultiple is to go over their investment screening and due diligence process.

1. EquityMultiple only works with Sponsors and Lenders with Stellar Track Records

They work with a network of real estate companies across the United States. These companies are looking for good investments and bring an additional layer of diligence. They invest their own funds into the deal which aligns their interests with EquityMultiple.

They work with:

- National and regional lenders with significant experience & low default rates

- Real estate companies operating in thriving primary, secondary, and/or tertiary markets

- Sponsors with a proven record of meeting and exceeding return projections

2. They Focus on Opportunities Projected to Deliver Attractive Risk-Adjusted Returns

After vetting the sponsor, they evaluate the market and key metrics. They have a proprietary scoring matrix which every deal needs to pass through before moving to the next phse of diligence.

They look for:

- Commercial properties in thriving markets with current cash flow

- Short-term senior loans with robust APR to investors and a promising exit strategy

- Value-add projects with construction components and more aggressive business plans

3. EquityMuliple Does the Due Diligence for the Specific Project

For projects that survive the initial due diligence, they then go through stress test underwriting assumptions. Other key documents and third party reports are also reviewed. Only 5% of projects make it through the process and are presented on the EquityMultiple platform.

They strive to:

- Offer a highly curated set of deals, presented comprehensively and transparently

- Collaborate with the sponsor or lender to optimize risk-adjusted returns for the investors

- Ensure that all investor questions get answered by our dedicated team of investment specialists

Review of EquityMultiple – Fees

The fee structure of EquityMultiple is pretty straight forward compared to some other platforms.

EQUITYMULTIPLE charges investors a small annual fee — typically 0.5% of the aggregate amount invested — that is paid periodically to cover ongoing investor reporting, tax preparation and communications relating to the investment. EQUITYMULTIPLE also receives 10% of investor profits after investors have received all of their initial investment back.

For preferred equity and debt investments, EQUITYMULTIPLE typically takes a servicing fee in the form of a “spread” between the interest rate being paid by the sponsor or originating lender and that being paid to investors. EQUITYMULTIPLE also generally charges the lender an origination fee and other charges typically associated with initiating a real estate loan or preferred equity investment.

Their low fees are average to low for what other crowdfunding sites are charging.

Payment Distributions

Generally, payments from equity investments are paid quarterly while payments on loans are paid monthly.

How to open an account with EquityMultiple

Opening an account is very straight forward and takes about 2 minutes.

Once you sign up, you’ll be able to take a look at the investments they have done and what they have available.

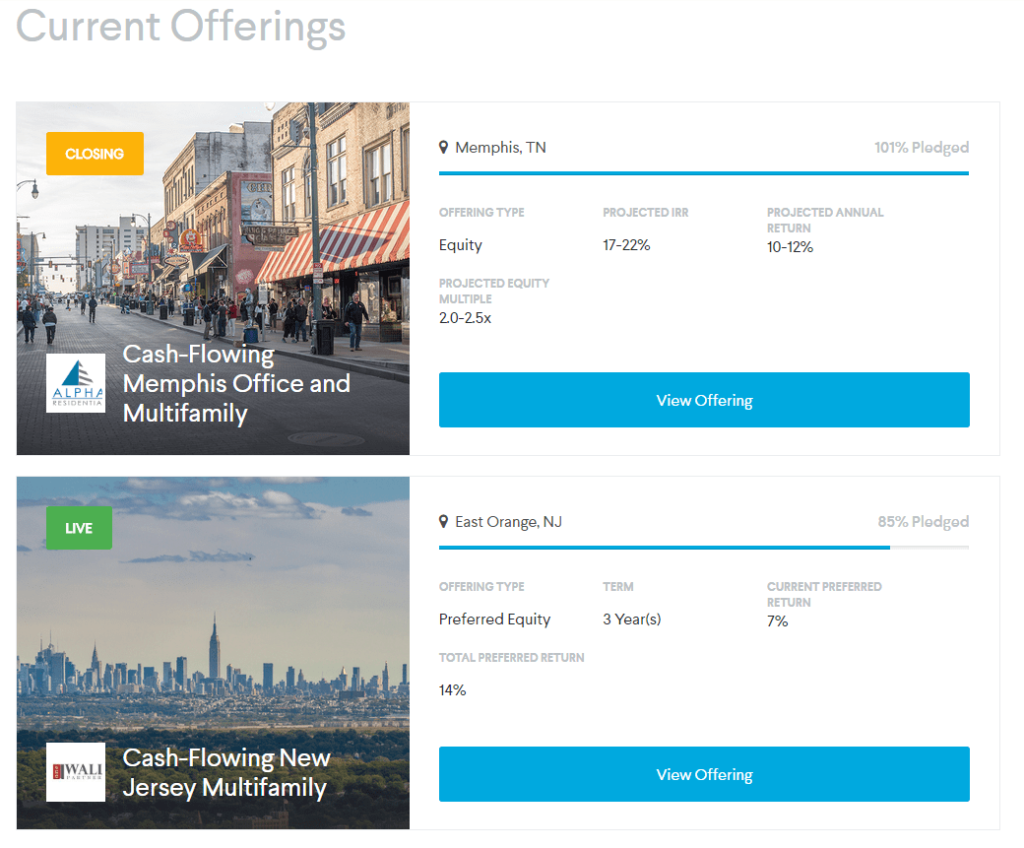

Looking through the past investments, you will see the majority of the projects are equity but there is a good mix of preferred equity and debt as well. There are only about 18 deals as of January 2017, but they didn’t start operations until September 2015. The deals they have done are all quite large and range from a few million up to almost $200 million. They said in the Q3 update that they are focused on high quality instead of a large quantity.

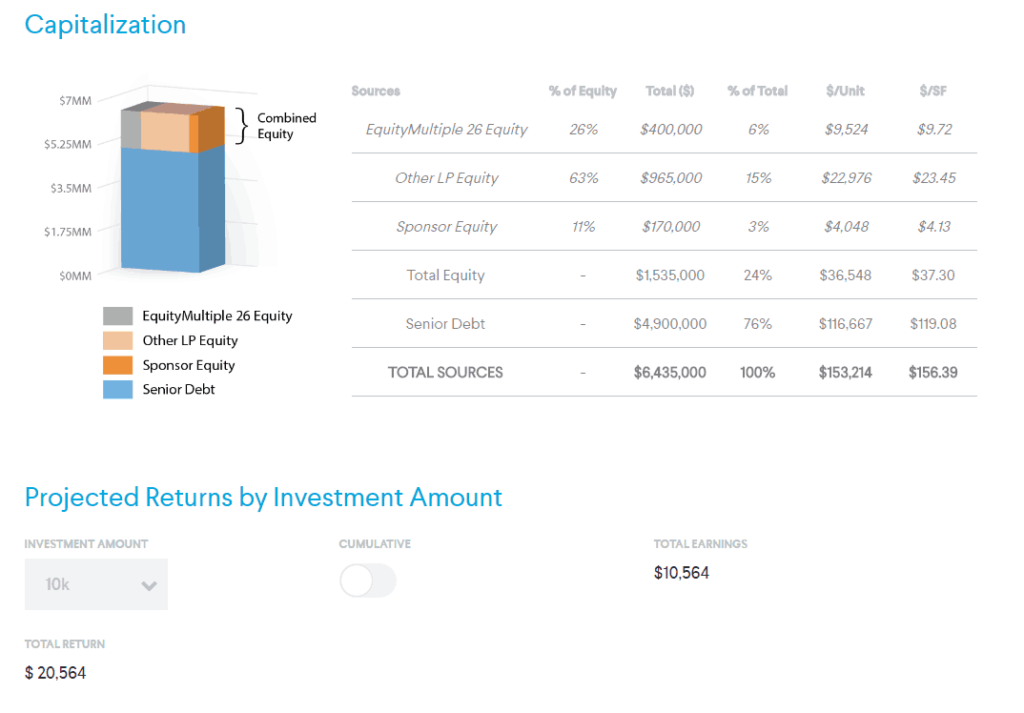

Here is a closer look at one of the offerings:

You’ll find the typical investment information – market, project, income/expenses projections, sponsor history and other info. They are all straight forward and easy to read. They do offer an interactive calculator that will estimate the returns based upon the projections.

We won’t go into more detail on any one individual deal. If you want to learn more, go sign up!

When you sign up through this link, you will get your management fee completely waived.

Summary of EquityMultiple Review

There are plenty of pros and cons to any crowdfunding platform, but EquityMultiple is among the best.

From equity to debt, residential to commercial, you can find just about anything you want on EquityMultiple. Though they lack a large number of deals to choose from, the ones they do offer are amazingly high quality and well-vetted.

The biggest negative to EquityMultiple is their high minimum investment. We believe that they will ultimately be able to lower their minimum requirements and offer more investment options as the company matures. Once they do that, they may be able to pull ahead of the pack. Until then, they are stuck tied for 1st.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply