Do you find yourself saying things like:

“I like working, why would I want to retire?”

“Financial Independence is a pipe-dream. You’ll never get there, so why try?”

“That’s only for the rich”

“If it was so easy, everyone would do it.”

If so, you’re not alone.

In fact, most people don’t actually believe that financial independence is possible.

But, as it turns out, it’s not impossible to become financially independent.

In this article, I will show you exactly what it means to be financially independent and how you can get there.

I’m going to show you how the old mindset of slaving away at a job is the wrong mindset, and how you need to adopt the mindset of the Financially Independent (or financially free) now, while you can. You need to start your journey…

…but first, I want you to watch this video. I randomly found it on the web, but it really gets the point across and capture the meaning behind financial independence.

I know at the end it says “contact the person to start building your pipeline.” Obviously this used to be some sort of sales pitch. I’m not selling you anything, I just like the video.

- Achieving Financial Independence

- How I Accidentally Discovered Financial Independence

- The 6 Steps To Financial Independence

- Step 1 to Being Financially Independent – Educate Yourself

- Step 2: Make a "Financial Independence" Plan

- Step 3: Before You Can Achieve Financial Independence You Need to GET YOUR FINANCES IN ORDER

- Step 4: Build Your First Passive Income Stream

- Step 5: Build Up That ONE Income Stream

- Step 6: Expand, Grow, and Diversify

- The Financial Independence Mindset

- Unlearning The Conventional Wisdom

- The Main Benefits of Being Financially Independent

- Why Aren't You Chasing F.I.?

Achieving Financial Independence

It all starts by having the right mindset. In this article, I’m going to show you:

- Exactly what you need to do in order to take the first step toward financial independence.

- The 6 steps you need to take in order to start creating those streams of passive income.

- How to start your journey to becoming completely financially free, regardless of your current salary or financial situation.

But first, I want to share with you a personal story…

How I Accidentally Discovered Financial Independence

I wanted to be a professor. Yes, a Professor… My goal was to have a good job with great benefits and be well off.

I was working toward that goal by attending a Ph.D. program at Clark University.

One of my other goals was to buy a home. Where I’m from, the cities are built out of a ton of small multifamily properties, so I ended up buying a triplex (known as a triple-decker up in Massachusetts).

I planned to live there for 3 or 4 years then sell it and buy a single family home like a “normal” person.

The Night That Changed My Life

Then, one evening I heard a knock at the door. It was kind of late at night and it was a rough neighborhood so people didn’t really go out at night. Turns out it was one of my tenants there to pay the rent.

There are very few singular events in any person’s life that can truly be called “life-altering.” You might call it an epiphany or a paradigm shift. Whatever you call it, an entire life can be broken down into “before” and “after.”

As I collected the rent and sat down on my couch, the wheels in my head began to grind. Though the rent was a measly $500 or so, I realized it was the easiest money I had ever earned in my entire life.

I don’t remember what was on TV that night, but I do remember that by the time I went to bed I realized that life is so much better when money comes knocking at my door rather than me having to go earn it.

I knew at that moment I would do real estate for the rest of my life.

It wasn’t long until I left the Ph.D. program and was in real estate full time.

Financial Independence is About Passive Income and Your Expenses

Financial independence is achieved once your passive income has exceeded your monthly expenses.

That day I discovered passive income, but it took me years to figure out the concept of financial freedom. Earning money in real estate came easily to me, but I also liked to spend money and have nice things.

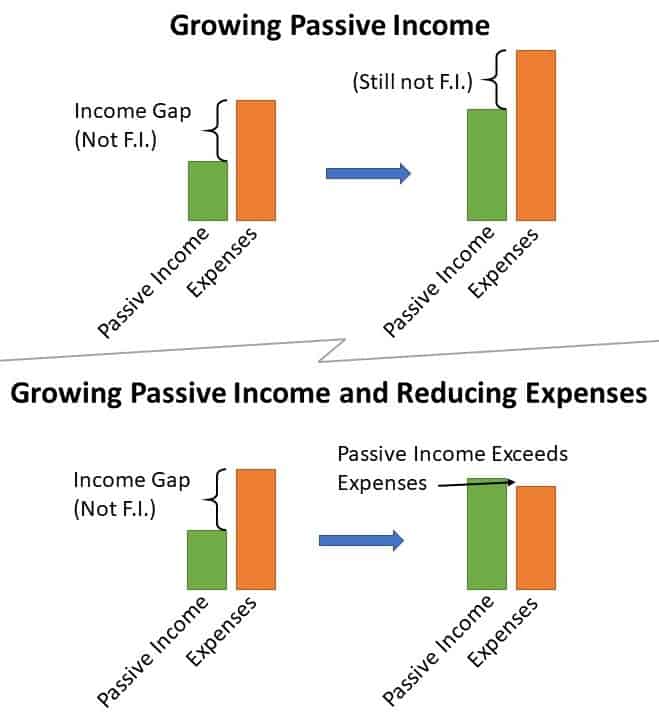

I was living my life like the first set of graphs here. Take a look:

I was the person on the top – I had discovered passive income, but as I grew my income my expenses also grew.

Honestly, I didn’t understand that financial freedom was only achieved when you control both sides of the equation.

What I needed to become was the person in option #2, where I grew my income, but also adjusted my lifestyle to achieve freedom.

I Was Able to Retire Financially Free After 4 Years

Eventually, the concept of financial independence grew on me – I made some major life changes to get my expenses in check and since then I have been completely free financially.

I accomplished it in January 2016.

So, since the end of 2015, I’ve been free from the need to work, free from stress, and free to do what I love. I was only 30 years old.

Just like Pablo in the video, I worked hard to create that passive income and to this day I have no regrets about leaving the Ph.D. program and the great salary and benefits that would go with it.

I took a lot of detours along the way and having a clear picture would have been helpful.

In hindsight, I’m able to see the path I took, how I got here, and what I could have done differently. Here is the path:

The 6 Steps To Financial Independence

Here are the basic steps you need to take to achieve financial independence.

- Educate yourself. Education is key. You need to relearn a lifetime of bad advice.

- Make a plan. You are exponentially more likely to succeed with a written plan.

- Get your finances in order. You need to get your ‘financial house’ in order before you can be successful at investing.

- Build your first passive income stream. You need to create your first stream of passive income to snowball into more passive income.

- Achieve a good income from ONE stream of income. Real estate is the most tried and true way to achieve financial independence. The hardest part is actually getting your first property.

- Diversify your investments. Grow thoughtfully in a planned and diversified fashion to get to FI the fastest.

You can click on any of the steps to be taken straight to that section.

Notice Investing Is Step 4, Not Step 1

I just want to point out real quick that “investing” is actually step 4.

That’s because the preparation is the most important step of your journey to financial independence.

You can’t build a house on a poor foundation and you probably won’t achieve financial independence without planning properly.

Step 1 to Being Financially Independent – Educate Yourself

It doesn’t take a graduate degree to achieve financial freedom. It doesn’t even take a bachelor’s degree.

Honestly, anybody can do it.

Don’t be confused though. A formal education isn’t a requirement but you absolutely need to have the right knowledge in order to becoming financially independent.

So, you must dedicate a huge amount of time to learning and growing.

Shortly after I discovered real estate as a vehicle to create passive income (and ultimately allowing me to become financially independent), I was deployed to Afghanistan.

I was completely removed from life and society here and dumped on a mountain for almost a year.

The reason I tell you that is because I’m not the kind of person to stop and study for 6 or 12 months. I like to dive right in and make my mistakes along the way.

My deployment forced me to study and learn. That year helped create the foundation I needed to come back and get right into investing.

Finding Time to Study

The problem with this is most people have “life” and don’t have time to study.

After work you might be too exhausted to study. Plus, you have kids and bills, and you just need a few hours to unwind before you try to sleep and do it all over again.

If that sounds like you’re life, let me just be blunt, find the time.

You need to have the intestinal fortitude to dig deep and find that motivation. Nobody can push you toward freedom except yourself.

If you aren’t motivated enough to find your own personal freedom, then I’m not sure what could motivate you.

But, if you are motivated, start by checking out our book reviews.

You should also bookmark this website. There are a TON of free resources, calculators, etc for you to learn with.

…and, don’t forget to check out my free PDF which outlines in more detail the strategy I used to achieve financial independence.

Step 2: Make a “Financial Independence” Plan

It’s pretty well established that those with a written plan are far more likely to succeed than those without one.

So, I’m not going to get into WHY you need a plan. Instead, I’ll just dive into how to make a plan.

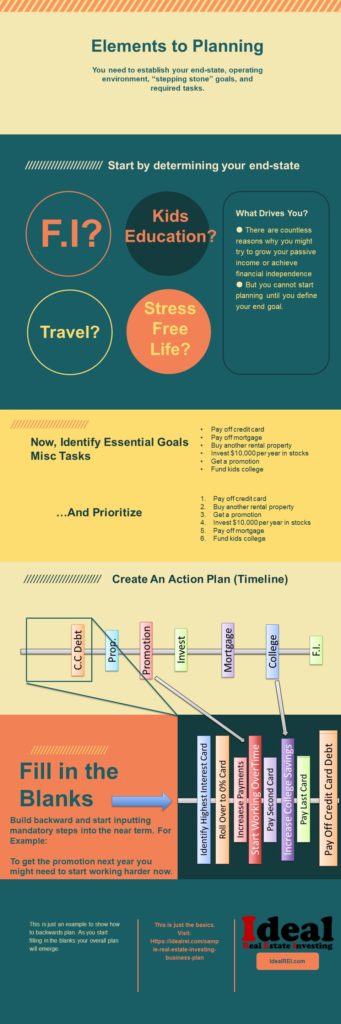

The key to any successful plan is to think backward. It seems counter-intuitive, but it’s a well-established planning technique.

Essentially, you need to list your goal, then define the mandatory items you need to accomplish to hit that goal, then start filling in the blanks. Take a look:

You can learn more about business plan writing in this article on how to write your first business plan,

Your plan will help you avoid some of the biggest pitfalls when getting started. In my experience, people will either be too narrowly focused or have no focus at all.

Having Too Little Focus and Doing Too Much

This is a pretty broad category and it can mean a lot of things. I like to say that you can be successful in any area of real estate, just not in every area of real estate. Meaning, you can be mediocre at a lot of things or be an expert at a few things.

Everything you do has a learning curve. If you do everything you’ll spend all your time learning and never reach an expert level.

You may be the worlds greatest house flipper, but if you try to develop your own land it’s like starting all over again. So, don’t try to do everything, just get good at one or two things.

You can do this by learning how to delegate tasks. This will help you focus on your one or two areas where you are an expert and allow someone else to help in other areas.

Look at this simple example:

Imagine you are the greatest typist in the world and also a highly paid lawyer. You may start your practice both in court and doing your own paperwork.

You figure nobody can do your paperwork better than you can – you are the greatest at it. After all, if you want something done right, you need to do it yourself, right?

You can be successful in any area of real estate, just not in every area of real estate. – Eric Bowlin

So every day you spend 4 hours doing paperwork and 4 hours in court.

You make a good salary as those 4 hours of consulting are worth perhaps $300/hour. So, every day you earn $1,200. Not bad!

But, you are spending 4 hours a day doing work that you could pay someone $15 per hour to do. In essence, you are sacrificing an additional $1,200 in income in order to save $60.

Don’t Settle for Less

A person who falls into the previous category can’t be faulted for being motivated. They are trying to save money, make more money, and get everything done.

This section is for someone in the exact opposite situation – someone who is satisfied too easily and settles for less.

In the video, Bruno was satisfied with his cattle, home, and lifestyle. He worked very hard for what he had and he was satisfied with it.

You may be satisfied with a few hundred dollars a month to substitute your income. Perhaps one or two properties is all you really aspire to.

But, I would challenge you to forget about that and focus on the goal of financial independence.

If your goal is to retire, then why are you settling for working? Why retire when you’re 65? Why not at 50, or 45, or at 40?

Pablo made a plan and stuck to that plan in order to achieve his dream of financial independence.

Like Pablo, you need a plan too.

Invest in Good Business Plan Writing Software

It’s true that anybody can write a plan in any word processor. But, if you haven’t written tons of business plans before then it can be overwhelming.

I’ve written many business plans and I still find it useful to use software that helps guide me.

I personally use LivePlan. It collects information from around the country and allows you to compare your plan to the performance of similar companies in your niche. Also, you can track your progress over time against your competition.

Find a software that you love and can work with, I just absolutely love how interactive it is.

Step 3: Before You Can Achieve Financial Independence You Need to GET YOUR FINANCES IN ORDER

I get a lot of emails from readers.

Most people have great dreams and love to tell me about how they want to quit their job, build those passive income streams, and achieve the financially independent lifestyle.

They always ask me how to get there.

It’s hard to help without knowing more, so I dig deeper and ask questions. Inevitably I find out they have massive car payments, credit card bills, student debt, etc…

Debt is not inherently bad… It just means that you need to earn more passive income before becoming free financially.

What is bad is when these debt payments override your ability to save and invest.

That’s why it’s so important to get your budget in check, get your debts paid off, and start saving/investing!

But, this requires a shift in mindset

The Investor Mindset

Who do you think can retire faster?

- The doctor with a million dollar house, 3 cars, and still paying off that 200k med-school bill.

- Laborer with no debt.

It’s hard to know without going into some serious detail, but look at it this way.

The laborer only needs a few thousand dollars in passive income while the doctor probably needs $10,000 – $15,000 in monthly passive income to pay all those bills.

While that doctor might be able to save more money per month, the laborer needs a lot less cash stashed away to achieve that passive income.

The point is, it’s not about your income, but it’s about your mindset.

If the high way doctor cut back his living expenses, got rid of one car, and downsized to a smaller house, he could achieve financial freedom very quickly.

So, if you change your mindset, you can change your finances immediately and permanently.

Step 4: Build Your First Passive Income Stream

I believe that investing is like building a house – you need a strong foundation first. The first 3 steps are that foundation.

That’s why investing comes so much later.

Most wealthy people have 5 or 6 different streams of passive income. On the other hand, most average people have 0.

So, the first goal is to create income stream #1.

Growing your first stream of passive income can be difficult, just like Pablo, you may have to wait to get the reward.

There are probably hundreds of ways to start building those streams of income. Here are a few ideas:

- Stocks

- Real estate rental income

- Crowdfunded real estate

- Limited partner in a business

- Royalties on book sales

- Advertising or affiliate sales on a website

- Creating an e-course

- Referral income

- …and so much more!

Most people don’t have a skill or set of knowledge that lends well to writing a book or getting affiliate sales. But, everyone can invest in stocks, real estate, or in a crowdfunded real estate deal.

Your First Passive Income Dollar

If you are like most people and have almost nothing saved outside of your 401k, then you need to start!

Start small. It could be as little as $1,000 or $5,000 invested with a crowdfunding platform such as RealtyShares or Fundrise. Another good option is EquityMultiple.

There are micro investment apps available now such as Acorns which lets you invest as little as $5 at a time. (I saved up a few thousand in a super short time simply by using the app).

You can also start with single-family flips or small multifamily (2-5 units), but often it’s overwhelming for new investors. Instead, just focus on doing ANY kind of investing to get your feet wet.

I often recommend starting more passively as a private lender, partner in a syndication, or even a small group partner on flips or rentals.

Those are just a few easy ways to start saving a few bucks.

The key is to take that passive income and reinvest it in even more investments to keep snowballing your passive income until you achieve the goal of financial independence.

Step 5: Build Up That ONE Income Stream

All the financial gurus always talk about diversification.

Don’t put too much money into any one thing… or so they say.

While this is true and makes sense, people really focus on it too much.

It’s really hard to find good deals and good investments. So, when you do find one, you probably want to put a good chunk of your money into it.

If you spend all your time spreading your money out, you won’t be focused on finding true bargains.

I believe you should get really good at one type of investing to start. Maybe that’s crowdfunding real estate deals, or just stashing away money somewhere like Acorns.

Whatever it is, FOCUS on building that up.

Don’t get me wrong though. You can use multiple platforms, apps, or whatever else to match your goals and lifestyle. But, if you are investing in real estate with Fundrise vs RealtyShares, or both, that isn’t the point.

The point is, you’re getting really good at real estate investing and building that up until it’s something worth talking about.

So, regardless if you pursue your own deals, invest passively, or partner with someone else, you should be building a portfolio of stable and reliable income producing properties.

Step 6: Expand, Grow, and Diversify

You’ve invested a ton into real estate, or stocks, or whatever. You’re generating a ton of income from it and that income exceeds your expenses.

So, you quit your job! You’re financially free now!

Then…the market crashes and you lose 40% of your value, and income.

Seems you’re not as safe as you thought you were.

I mentioned before that wealthy people tend to have 4 to 6 streams of passive income.

This isn’t to be confused with the common “you need to diversify” your investments type advice you get from your average money guru. It doesn’t matter if you’re invested in bank stocks or pharmaceuticals, when the next crash comes you’re going to lose a lot.

What you need is multiple sources of income. You can diversify within that stream of income, but the key is to have multiple sources.

Diversity of Income is Key

Real estate is one stream of income for me. I have small rentals, large rentals, student housing, mobile home parks. I’m invested in different regions as well. All of this helps diversify that stream of income.

But, if real estate crashes again, it will most likely affect all of my real estate. So, I invest in stocks as well.

Not much, but I’m building it up. I started with real estate and now I’m spreading out.

I also have this website which generates a little income (not much really) from ads and affiliate sales. Another thing I have is other web properties as well and I’m experimenting with different ways to monetize things on the internet.

I recently added e Courses to my offerings and sell a calculator and other knowledge based products. I’ve taken my success in real estate and I’m diversifying into other ways to make money.

That’s 4 sources of income I just listed.

Hopefully when the next crash comes, when real estate and the stock market are down, people will be more interested in buying knowledge or working with some of my affiliates.

The point is, as one source of revenue drops, others can stay steady or go up to offset the losses.

Don’t be a One Hit Wonder

The key to lasting financial independence is not to have a one-hit wonder.

There are a lot of examples of athletes or rock-stars that make millions upon millions but never invest and spend most of their money.

Don’t be like them. Grow your investments in a thoughtful and diversified fashion.

This will protect you from a changing economy, market fluctuations, and allow you to stay financially free, regardless of what’s going on.

The Financial Independence Mindset

I talked about it already, how I never planned to become financially independent until it came knocking at my door, literally.

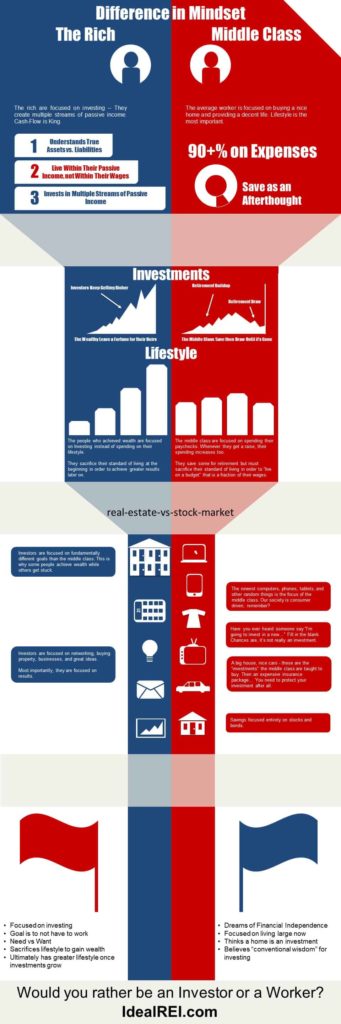

I realized that we all need money but investing is the only way to earn money without having to do any work. Finally, I realized that this is the fundamental difference between the financially independent and those who work.

While workers live off of their labor, the financially free live off of income generated passively.

The passive income frees up their time to allow them to pursue more financially rewarding endeavors or to spend that time with family or whatever they find fulfilling.

I realized that there is a fundamental difference in mindset between the financially independent and those who are not. I call it having a “rich mindset.”

1. The Financially Independent Understand Assets and Liabilities

I was lucky that I didn’t buy a home when I was young. The first big purchase people usually make is a car, after that it’s a house.

Fortunately, I bought an investment property instead.

I didn’t realize it at the time, but buying a home is a massive liability and not really an asset.

I was simply lucky that I missed this trap.

Just about everyone says that your home is your biggest asset.

Well, they are wrong.

Your Home is Not an Asset

Yes, I’m saying EVERY….SINGLE…PERSON who has ever given you this information is wrong. I don’t care who said it or what book they wrote. It’s wrong.Your home is your biggest liability. – Eric Bowlin

Most people buy things they think are investments, then get stuck paying for those “investments” for years.

Just read that sentence again. You will be stuck paying for those investments for years….

…But, I thought an investment should pay you?

See the trap?

Your home might have some appreciation over time, but generally, the costs far outweigh the increase in value.

Plus, to ever get that equity you will have to

- Sell your home

- Get further into debt with another mortgage.

Either option isn’t good.

An Investment is something that should pay you.

There may be some costs to own that investment, but if it pays you more than it costs to operate then it is an investment.

The financially independent people realize that your home is a very large liability!

2. The Financially Independent Live Within Their Means

So you have a good budget, you have no credit card debt, a nice savings account to cover 6 months of expenses, and your monthly expenses are less than your income.

You are eve saving a bit into that 401K provided by your job. You clearly live well within your means, right?…

…sort of.

It’s a good start but it isn’t enough.

The Financially Independent Have Expenses That are Less than Their PASSIVE Income

While you are living within your salary, the financially free live within their passive income.

Even if they choose to work and have an income, they don’t consider that income toward their budget. Instead, that income is used to invest more and boost their passive income.

As passive income increases, then and only then can their living standard increase.

The entire focus of earning money changes. Most people earn money to spend on housing, food, entertainment, etc. The rest gets saved.

The people with the financial independence mindset focus on saving and investing. They invest first and use that passive income to cover their costs.

The unfortunate reality is that achieving Financial Independence is not fun. It may require massive sacrifice in the short run.

It may be difficult at first when your friends are driving amazing cars and going on expensive vacations, but, over time your investments will grow and exceed your expenses.

Then, as your passive income grows, you’ll have more free time to invest in even better things.

Soon, you’ll have more money and time than any of your friends.

Being frugal at first and having the right mindset will lead to a Financially Independent Lifestyle.

My Friend Didn’t Want to Be a Miser

When I first got started down this path, I told my friends about it excitedly. I wanted people to come with me on my journey.

No one did.

One of my very good friends even told me…I’m not a miser, Eric. I can’t live like that.

Being frugal, saving, and spending way less than you earn is being miserly. To him at least.

It’s been years since he said that. He’s received promotions at work and earns more than he ever did before. He also spends way more than ever before.

I, on the other hand, spent the first few years spending a lot less, saving, and investing. Over time, my income grew faster than his and I earn far more.

Also, I don’t have to work 60 hours a week at a crappy job to achieve that income.

When we get older, my income will continue to grow while his will level off and eventually go down as he ages and reaches retirement.

The right mindset will allow you to achieve far more in life than you ever could have imagined.

3. The Financially Independent Don’t “Diversify”

A diversified portfolio of stocks and bonds outperforms…” – Everyone, everywhere

Throw that garbage out the window too.

I already covered this a bit, so I won’t beat a dead horse.

I’m not saying to spend all of your money in one investment, as that’s kind of stupid.

What I am saying is that the general wisdom of having a balanced portfolio consisting of tech stocks, healthcare stocks, manufacturing stocks, and some other stocks is pretty far from being diversified.

They are all stocks and they all tend to move together.

Stocks rise and fall together; dividends rise and fall based on stocks. Your entire investment portfolio is actually all in the same basket.

Financially Independent People Diversify Income Streams

Stocks provide income through dividends and then when they are sold you gain appreciation.

Dividends are just one stream of income and it’s a great way to start on the path toward becoming financially independent. But, focusing on just this is not good…

There are a number of income streams you should be focused on. We went over those already but, I want to dig deeper into diversification.

Each category of income can be further diversified.

Just like you can own different sectors of stocks, you can also own residential, commercial, or industrial real estate.

You can buy pert of multiple businesses.

You can own multiple web assets that generate revenue in different ways.

Now that you have the keys to start investing and understand the Investor mindset, are you ready to start down the path toward Financial Independence?

Unlearning The Conventional Wisdom

We are all taught to work and to save a little bit throughout life until retirement. So, we do that and spend the rest on nicer things, a bigger house, expensive vacations.

Just like Bruno and the villagers laughed at Pablo with his crazy ideas, I hear all the time that it’s “impossible” to create passive income and retire young.

Most people think that “some day” they will retire. Their focus is on earning and spending now and “some day” never really comes. Or it comes when they are incapable of working anymore.

I didn’t want to wait until I was in my 60’s; I wanted to have a free financial life now and I don’t care what other people think and I didn’t want to rely on a job, a boss, or some corporation.

Even recently people have told me that it’s impossible to do what I’ve done…

It’s funny to me because I started when I was barely earning more than minimum wage and now control millions worth of real estate.

I assure you, it is possible and achievable for just about anyone that is motivated.

Working is Not The Goal

Recently I was having a conversation with a group of people. One person was about to graduate college and others asked him what he wants to do.

He went into a long explanation of the job he wants to get, the direction of his career, and how he hopes to get promoted into higher positions.

He is a smart guy and driven, I believe 100% he will achieve any goal he has.

After his explanation, I looked at him and It suddenly came to me…

So your goal is to work?

…everyone was confused.

I continued,

You’ll accomplish anything goal you set. Why is your goal to have a certain job. Why isn’t the job just a way to achieve something beyond that?

My Goal is to Not Have to Work.

We had fundamentally different goals. It is really hard to achieve something when you’re not focused on it.

My goals are more like Pablo.

If I wanted to achieve my goals, I needed to find a new way to fund my lifestyle. I needed to take the focus away from working and put it toward not working.

We all need money to live, but there is no rule that says you have to trade your labor for money.

You can put in your time now, like planting a seed, and reap the rewards for years to come.

This is called investing.

Understanding this basic principle is the fundamental difference between the financially independent and those who work.

While one lives off their labor, the other lives off their investments.

The Main Benefits of Being Financially Independent

Being financially independent means different things to different people.

To some, it means retiring and traveling the world, relaxing at home, or doing whatever you love.

For others, it means having the financial stability to have at your back, while you continue your career or business.

In general, financial independence is defined as when your passive income is higher than your living expenses. Here’s the issue though…

It can be a moving target.

You need different levels of income at different points in your life. Let me explain

How Much Money Do I Need?

If you are 18 years old and have no debts, are healthy, and can get by with little, the amount of income you actually need to get by is very low.

Eventually, you might get married, have a family, a dog, etc. So, the income you need to sustain this is a lot higher.

Then, the kids move out and you downsize. You need a lot less again.

Then you start to get older and you find your health failing you. Your costs will go up once again.

So, at a minimum, I’ve already outlined 4 different points in your life where your “financial independence number” will go up or down.

Regardless of the difficulty in calculating exactly how much you’ll need, there still are a lot of benefits to strive for financial independence. Let’s take a look at those.

Freedom of Choice

I already alluded to it a bit, but the biggest benefit to financial independence is freedom.

As soon as your passive income is higher than your wages, you’ll find that you don’t need that job. You can continue to work, but you don’t have to. So, all the stress is gone.

Same goes if you’re a business owner. You can continue to grow your business if you want, but you don’t need to.

You could opt to walk away from it and do something else entirely. It allows you could leave the high paying job and find a job that is more rewarding.

Whatever you choose to do, it’s because you’ve achieved Financial Independence.

You’ll Be Able to Make More Money

You can never unlock your true potential as long as you are a slave to your job or business. It’s hard to pursue other opportunities when you can’t afford to leave your job.

As an employee, you can earn money by working more, getting a raise, or getting better positions. But, you are actually very limited because most of your time is dedicated to the job.

And that brings us to the heart of financial independence – time. The most valuable commodity is time, and if your time is spent working for someone else, it isn’t spent finding new opportunities for growth.

By growing your passive income to the point where you don’t have to work anymore, you can unlock that time and harness all of your intelligence and creative power to pursue more valuable endeavors.

You’ll Actually Get to Retire

If you haven’t realized it yet, Social Security is going to go broke, pensions can disappear overnight, and even state or municipal government benefits can be slashed to pennies on the dollar.

While some people will be able to retire with these, we should not depend on them entirely. Doing so will make it far less likely that you’ll have the security you need or want in retirement.

But, retirement isn’t something many of us worry about until it’s far too late. We don’t save or prepare, then find ourselves unable to retire.

So many people work until they are no longer able to work and they are forced to retire. By then, they have no way to actually enjoy any of their ‘retirement.’

If you are financially independent at a young age, you are kind of already retired. Additionally, you can continue to work and just save everything to get to a point where you are truly prepared for retirement.

You might even be able to afford to retire early and enjoy your later years to their full potential.

Passive Income is Like Unemployment Insurance

Unemployment insurance covers only a portion of your lost wages. But, if your passive income is already at or above your wages, then it’s like a really good insurance policy.

The fact is that many industries are changing and advancing, which is leaving its older workers behind. Having financial independence means that you’ve got something to fall back on and can take your time to find new work without worrying.

You Can Plan

A lot of people never plan ahead. While they might plan their next vacation, wedding, or Black Friday shopping spree, most people aren’t planning for their finances next month let alone 20 years from now.

A lot of that comes from the belief that it’s impossible to get ahead, be successful, wealthy, and secure. Planning ahead would just be depressing.

But, if you work to attain financial independence, planning for the future becomes fun. Who doesn’t want to think about the future when the world is your oyster?

You’ll Be Less Stressed

Money is one of the leading causes of worry and stress in our society and in most households.

Having more passive income can help with your finances, allowing you to enjoy the company of your spouse and children. It can allow your family to actually enjoy each other rather than always being stressed over paying bills.

Why Aren’t You Chasing F.I.?

What is holding you back from pursuing financial independence? Comment below.

What are you doing to achieve financial independence?

Comment Below

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply