House flipping can be a lucrative field and you don’t need a degree to get involved. It’s not too hard to learn how to flip houses.

The unfortunate part of the house-flipping industry is how TV and gurus have made it sound like it’s the easiest thing to do. Add to that the incredible market we’ve had for 10 years and everyone thinks they’re a genius at it.

The basic concept of flipping a house is simple – find a good deal on a property and sell it for more. Unfortunately, there are about 382 ways you can make a mistake during that process causing you to lose money.

So, we built this guide to help you get started flipping houses the right way. We’ll walk you through the 4 core steps you need to take to start your real estate business.

- Prepare – Have all your ducks in a row so when you find a deal you can make a move on it fast.

- Procure – Finding the right deal and paying the right price for that deal

- Reposition – This could be anything from a touchup painting and carpets to a full rehab or even a tear-down rebuild. This is where you bring the property from the old value to the new value.

- Sell – Give your property an appearance that will make the buyer envision themselves owning it and living there then list and sell for the right price with the right terms.

1. Laying the Groundwork

There are a lot of moving parts with a house flip, and things can move very rapidly once you find the right property and get it under contract. That’s why it’s imperative to take care of as much preparation as possible before even making offers.

The core things you need to have before getting started are:

- Your plan/criteria – you should have your niche, process, and criteria established before starting.

- Access to Capital – you will need deposit money, equity, and access to lenders.

- Network of contractors – you need to be able to get quick and reliable quotes.

A. Plan and Criteria

This is definitely the most boring and tedious part of the process but you really can’t skip this step. Laying the groundwork is the most important thing you can do to improve your odds of success.

you should have your niche, process, and criteria established before starting. You’ll also want to take care of any obvious administrative tasks during this phase.

Create a Business Plan

Flipping houses is a business and with every business, you need a business plan before you do anything else.

Your business plan should give you an idea of your finances and what you want from flipping houses. It’s the framework that gets you from point A to point B.

There are a few important components that you should include:

- Budget and Funding: You need to know your budget. You need a budget for buying your first house and one for renovations. Let’s not forget that there might be costs to advertise or market the house once you’re done with repairs.

You also need to include loans and make sure your plan enables you to repay those loans. There are closing costs and other real estate fees, too. It’s expensive to start up a house flipping business. What’s your expected return on investment (ROI)? There needs to be a profit when you’re flipping a house.

- Your Goals: This is self-explanatory. Your plan has to have specific goals in this investment. How are you going to meet them?

- Project Timeline: You should have a set number for the number of projects you want to take on in a year or two years. You must have an estimate of how long your projects are going to take in your business plan.

These are only a few details you should have in your plan.

A business plan also helps you get a loan from a bank. If you have a detailed plan full of research on the market, it proves your commitment to reaching your goals and traditional lenders will be more willing to lend you money. When you reach your goals, you should be able to repay the loan.

Do Your Research on State Laws

Every state has different real estate laws and even every county can have a different way of doing things. familiarize yourself with the local rules through your state’s Department of Business and Professional Regulations.

It’s important to do your research. You want every detail and fee taken care of.

Get Your Real Estate License Before Flipping Houses

Now, a real estate license isn’t necessary for every state. But even if your state doesn’t require it, we recommend it for two big reasons.

First, hiring real estate agents to help you search for houses is pricey. What if you knew the real estate game yourself?

When you take the real estate license test, you learn everything you need to flip houses. You’ll have extensive knowledge that the average house-flipper doesn’t have.

Create a Legal Business Identity

There is another step that isn’t a necessity but we recommend it and that’s creating and registering a legal business identity.

This protects you if you’re sued. Your personal finances won’t take a hit. Instead, your business takes the hit. Your best bet is to register as either an LLC business or DBA business.

Once you’ve done that, it’s time to register for tax purposes, both state and federal. You have to apply for an Employer Identification Number or EIN.

Open a Business Bank Account

You need a business bank account. If you don’t, you’ll regret it. Keep your business (property flipping) expenses separate from your personal account.

It helps filing taxes so much easier at the end of the year, too.

Apply for a business credit card. When you’re running low on cash or funding, it’s your lifesaver. Always make payments towards your credit card though. This also helps build the credit of your business which opens up more avenues for your house flipping business in the future.

Additionally, you should also check out business insurance to protect you later down the road.

Determine Your Real Estate Niche

You can get rich in any real estate niche, but you can’t get rich if you go after all of them. The best thing to do is to figure out one, maybe two, niches and get really good at them.

Here are a few ideas of niches to focus on in your house flipping business:

- Foundation damage

- Mold

- Failed septic

- Additions

- Creating an open floorplan

Determine Your Geography

It’s hard to know the ins and outs of ten different cities or markets for flipping houses. instead, focus as much as possible while still maintaining a high enough lead flow. In some big cities, you may focus on just a couple of zip codes while in smaller areas you may focus on half a county.

B. Get Access to Capital

Almost every real estate deal has two types of capital involved – equity and debt. Equity is the portion you and your partners have to put into the deal while debt is everything you’ll finance with a lender. You’ll likely need to have access to both.

Some deals are bought with all cash, and some complex deals have unique structures for equity and debt that blur the lines, but we’re going to talk about the basics.

Finding Equity

The primary source of equity for a house flipper is your own savings. Alternatively, you can find someone who is willing to partner with you where they can put up some of the capital needed and you cut them in on the profits.

Another often used form of equity is by taking an unsecured loan and using that loan money as your equity. For example, you might have a friend or family member who is willing to let you borrow some cash which you can then use as the downpayment.

Using debt as your equity can be risky because you’ve essentially overleveraged the asset, but can juice up the potential returns since you’re putting little money down.

What Kind of Debt?

Most house flips don’t qualify for any sort of traditional finance – neither commercial nor standard residential mortgages are commonly used for flips.

Generally, traditional loans have long approval times, require properties that are habitable or need just a small amount of work, and bring little risk to the lender. A house flip is exactly the opposite. They are high risk, require extensive work, are usually in rough shape, and need the money quickly to close quickly.

House flippers will most often use a hard-money loan, a private loan, or leverage another asset they have with something like a HELOC.

A private loan is simply a loan from an individual or entity on the property. A hard money loan is just a private loan but with a mortgage broker in between to connect the borrower to the lender for a fee.

A HELOC is a good option because you can borrow against your other asset and use the cash for the purchase as if you aren’t getting a loan on the property (because you aren’t getting a loan on the new property). This makes your offers more competitive and you can get lower interest rates than a private loan.

C. Build a Network of Professionals

To be successful as a house flipper you need to grow a strong network around you. A network helps your business grow and makes flipping houses much easier in the future. You’ll need a large network of real estate agents, landlords, investors who want to buy, contractors, plumbers, etc. Not only will they give you invaluable advice when you’re getting started, but they actually help you get your deals done by being part of the process.

2. Procure the Right Deal

Now that you’ve laid the groundwork, you can focus on finding, offering, and buying the right deal.

We cover this in extreme detail in our Wholesaling Real Estate Guide in forensic detail. The guide covers the entire process to find and then wholesale a deal in 6 steps, but the first 4 steps are what you’ll need for house flipping, so check out that guide.

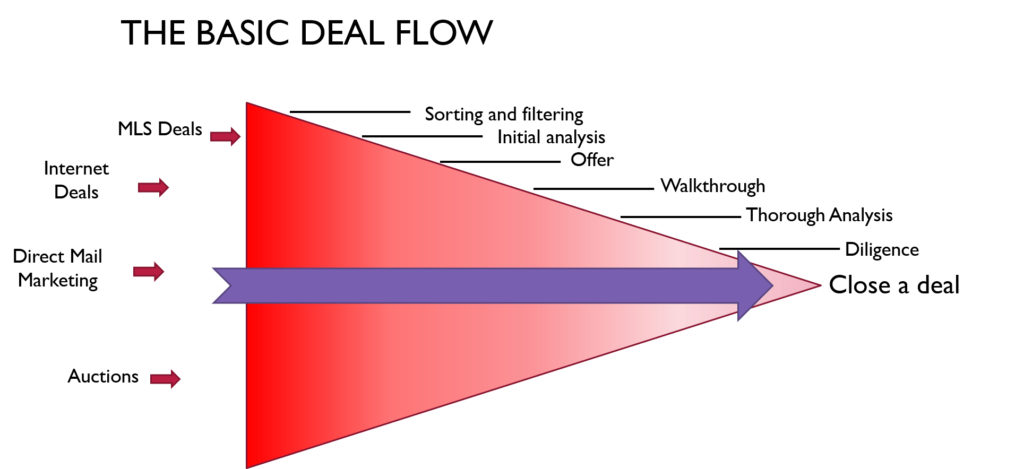

As you can see, procuring deals is a lot about lead generation, but also has multiple other important steps such as analysis and diligence.

We will cover the general 4 steps of deal acquisition here which are:

- Finding motivated sellers

- Do the Deal Analysis

- Put the deal under contract

- Due diligence

Finding Motivated Sellers

There are several ways to find great deals which include using internet marketing, direct mail marketing, and using wholesalers. Believe it or not, the MLS is often a great source for deals as well.

You’ll most likely want to combine them all by having a website, running some ads, doing direct mail campaigns, and checking with Wholesalers and the MLS daily.

Analyzing Your Potential House Flip

They say that you make your money on the purchase. What that means is if you bought a bad deal, there’s nothing you can do to make it profitable. But, if you bought a good deal, all you need to do is execute properly and your profit is guaranteed.

So, make sure you analyze it properly!

Doing analysis is pretty straightforward. First, you need to determine the After Repaired Value (ARV), then determine the rehab and carrying costs, subtract out your profit margin, and that’s your offer.

Doing a Comparative Market Analysis

The process of determining the ARV is called a comparative market analysis. What you’re doing is looking at recently sold houses nearby and trying to determine the future value of the property you’re looking at by comparing it to them.

Not every house will be the same, so during the process adjustments are made to estimate the difference in value based on each difference. For example, you can estimate the value of a garage by comparing the selling price of several houses with garages to other houses sold without garages. The difference is the estimated value of having a garage.

Learn how to do a comparative market analysis here.

Estimating the Rehab Costs

There are 4 major cost estimation techniques for real estate projects – stick method, labor hours, square foot estimate, and unit pricing.

Stick Method – Counting every board and nail and estimating the cost to install every time. Probably the most difficult method and there’s a lot of room for error if you miss some items.

Labor Hours – Estimating the estimated time and materials to do a project.

Square Foot – placing a flat cost per square foot of renovation. This works well for things such as decks, interiors, or even a roof. Doesn’t work well with big-ticket items.

Unit Pricing – Applying an estimated cost per item. Just to make a random example, you’d say A kitchen is $15k, a bathroom is $5k and floors are $2,500 per room. Then you add it up and get the total

Also Read: How to Estimate the Rehab Costs of a Property.

Putting a House Under Contract

The goal is to get a property under contract so you can close on it. There are two key things to remember for this step

- No real estate contract is binding without a deposit, also called “consideration.” You have to pay a deposit, even if it’s just $1. The higher your deposit the more compelling the offer is

- Make sure you get access to the property in some way to due diligence.

Diligence Clause

Access to the property is important, even if your contract doesn’t give you a diligence waiver. Think about it this way, if you put $5k down on a property and find tens of thousands of unexpected repairs that will ruin the deal, would you rather lose the tens of thousands of the $5k?

That’s why you always need access to do diligence, even if the contract doesn’t have a clause allowing you to get the deposit back from a failed inspection.

Mortgage Contingency

Depending on the deal, you may or may not have a mortgage contingency. This allows you to get your deposit back should you be rejected for a loan.

Most house flips are bought with cash or hard money loans, so this is a rare situation. Also, to get a seller to accept the low offer price, you’ll likely need to sweeten the pot by offering all cash, or at the minimum waive the mortgage contingency so the seller knows they can keep the deposit if you’re rejected.

How Much to Deposit on a House Flip?

This part of the offer can have a big impact on the seller’s decision. A substantial non-refundable deposit can encourage them to accept a lower offer. They know that if you back out, they can make a nice bonus.

Closing Deadline

The faster you can close a deal the more enticing the offer is. That’s why you want to take the time to line up your team before making offers. Some deals can close in under a week if a title search can be performed.

Due Diligence

Every deal is unique and may have a variety of diligence items unique to the niche you’re in. But, in general, there are 3 key areas to consider – Interior, Exterior, and MEPs.

Mechanical, Electrical, and Plumbing

A lot of people gloss over these which is what makes them the most important things to check. The electrical panel, heating/cooling, water heater, wiring, and type of plumbing are all extremely costly items to fix or replace.

Inspecting a House Flip Exterior

You’ll want to check the roof, siding, foundation, windows, and any MEP connections such as the electrical service. You may also need to check the driveway, sheds/garages, and other things.

For the roof, you’re looking for it to be nice and flat with no curling edges. you’ll want to get a pair of binoculars to inspect from a distance, or bring a ladder to get up close. Plenty of grit and no smooth shingles. See a more detailed Roof Inspection Checklist.

Siding you want to be free from cracks and damage. Windows you want them to be vinyl windows, not old wood single-pane windows.

In the foundation, you’re looking for big cracks or water penetration.

3. Reposition the House Flip for Maximum Profit

We like to use the phrase “reposition” rather than the commonly used term “rehab” and we have a good reason for it.

We don’t want people to get pigeonholed into the belief that they need to have a substantial rehab project with every house they flip. Some of the most profitable house flipping deals require little work.

Real estate investors, and more specifically house flippers, are often demonized by a lot of people and mainstream publications. That’s because they only see house flippers that take a good property and turn around and sell it for even more.

The reality is that house flipping plays an important role in the market by taking sub-optimal properties, transitioning them to their highest and best use, and selling them to someone who will pay for that use.

An old house on a busy street with business zoning may be best sold as an office instead of a single-family home. A small house with a large in-law apartment may be best transitioned to a multifamily rental. The reverse may also be true where a multifamily rental may be best used as a single family with an in-law apartment or rent-helper.

Also Read: How to Maximize Net Operating Income

A house with a giant piece of land may be best used if it’s sub-divided and developed with an additional house. Sometimes buying a small lot next door can make a house be able to be developed into something much larger and more desirable.

The list of opportunities to add value to a property is endless. It’s important to think outside the box and figure out the most valuable usage for the house.

Often, it is as simple as carpets and paint. Other times it’s an extensive rehab. But, your home runs will always be when you can get creative.

4. How to Sell Your House Flip For Maximum Profit.

Your goal with your house flip is to earn the maximum amount of profit. This means you’ll want the best price with the best terms when you sell. It’s important to remember that you need both good terms and a good price. The highest price with bad terms can lead to lower profits when flipping your house.

In general, the highest offer will come from the least qualified buyer. The buyer and their agent know they aren’t likely to get the deal, so they offer higher prices to compensate for their weak ability to close on the deal.

The most qualified buyer will almost always be the lowest offer.

Most of the offers will cluster in a range and will vary from qualified to unqualified and there may not always be a pattern to it.

Also Read: How to Stage a House For Sale

Taking the high offer from an unqualified buyer may work out, but there’s also a substantial risk the deal falls through and you’re back on the market a month later. You will rarely get the same price offers the second time around, leading you to get even lower offers than before.

Not only will you get lower offers, but you also incur additional interest, taxes, insurance, etc. So it’s a double whammy against your profit margins.

So it’s generally advisable to take the highest *qualified* offer while adjusting for cost differences based on the closing timeline.

The Bottom Line to House Flipping Profitably.

If you have the money and the credit, getting into house flipping is a fantastic idea. There’s money to be made in this area and a business to grow. So, how do you get started flipping houses? It’s not as hard or as easy as you would think. There’s a lot to think about but none of it is insurmountable. We hope these six steps to creating your house flipping business help you get your foot in the door. Learn and grow as you go.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply