Most investors grossly overestimate how much they’ll profit on a rental property.

This is just a simple truth; one that I fight with every day of my life with my students and clients.

Most people, courses, books, and gurus show you to overestimate the returns.

It’s important to earn a good profit and to earn as much as you possibly can. Remember, it’s ok to earn 4% if that’s what you’re looking for. Also, it’s ok to earn 10% if that was your goal.

It’s not ok to earn 4% when you expected to earn 10% (or more).

So, I’m here to set the record straight.

Understanding Real Estate Profits

Real estate is different than most other professions insomuch as it’s very difficult to calculate profits as compared to stocks.

At any moment in time you can look at your stock portfolio and know exactly how much you’ve earned or lost. With real estate, many of the benefits are hidden and property values can only be estimated.

Additionally, real estate investors have roughly 4 measures for profit including cash on cash return, return on investment (ROI), return on equity (ROE), and internal rate of return (IRR) whereas stock investors predominately use ROI. I did some excellent videos and writeups on those topics so check out those links if you’re interested in learning them in depth.

For some background though, there are 5 key areas that real estate creates profits for us as investors. They are:

- Income from rent

- Depreciation on our taxes

- Equity paydown on our mortgage from our tenants

- Appreciation either through improvements or from the market

- Leveraging the asset with debt to purchase more property.

Most other investments available to the average person only have income and appreciation. In some situations you can use leverage and depreciation but that is geared more toward industry than the average person.

Depreciation will help every person differently based on their tax situation so it’s hard for us to calculate. Additionally, leverage will help you grow but how you benefit depends entirely on how you use your leverage.

What Are the Average Real Estate Profits?

It’s not a ‘non-answer’ to say that it’s truly impossible to answer this question meaningfully, but I’ll try anyhow!

The reason it’s impossible to answer is that there are hundreds of real estate niches to work in. Also, some people are actively involved while others are not actively involved.

All these factors skew the results. But, fortunately I dug really deep into this question in this article on stocks vs real estate. But, I’ll take some of the conclusions here.

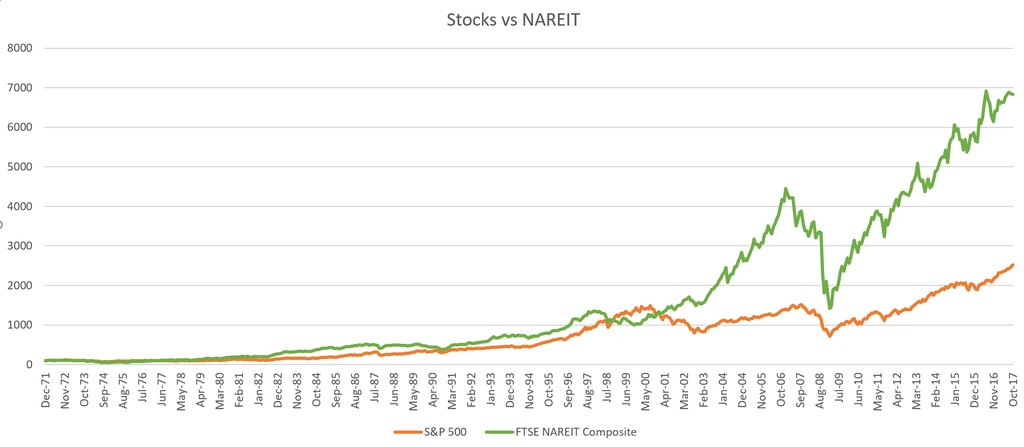

Real estate averages around 9.45% yearly return while the S&P 500 averaged 7.195% per year during the same period (since 1972). Here it is in a graph.

If you’d like the super detailed break down of every number behind this, check it out in the link I posted above.

But, a 9.45% average yearly return for real estate isn’t so simple to understand because there is one core difference between real estate and stocks. Real estate tends to have a lot of cash-flow and less appreciation while stocks tend to have very little cash-flow (dividends) but a lot of appreciation.

Also, we cannot forget about the other types of profit that real estate gets. But, since we can’t really calculate it, we’ll ignore it for this.

The point is, just because returns are expected to be around 9.5% doesn’t mean you’ll 9.5% more cash in your account every year. Let me explain.

Average Real Estate Returns by Market Type

The first thing we need to understand is the type of market we will be considering. There are 3 basic market types:

- Appreciation market

- Cash-flow market

- Hybrid market

Appreciation Markets

Appreciation markets tend to have extremely low (or negative) cashflow on property but they generally grow significantly in value. These markets are generally major cities along the coasts such as Boston, Seattle, etc.

Cash-Flow Markets

These markets earn a lot of cash flow but tend to have little appreciation over a long term. These are generally your secondary or tertiary cities, or most “middle America” type areas.

Hybrid Market

These markets have a mix of appreciation and cash flow. Often, these are suburbs near major cities or major cities in important states, but not so big as the primary appreciation markets.

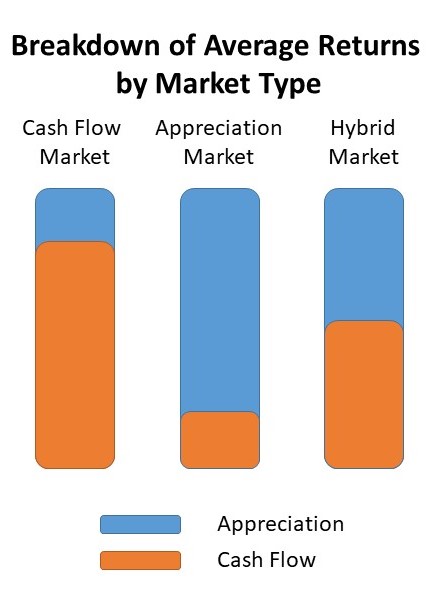

How Real Estate Returns Are Broken Down – Graphically

Lets just assume for a moment that all markets are going to give us that average 9.5%. Obviously this is an unrealistic expectation, but it highlights how we see the returns.

You can see that the proportion of returns that are due to cash flow or appreciation can vary dramatically and still lead to the same returns.

The reason I’m explaining this is because most investors only calculate the cashflow and forget entirely about appreciation when figuring out how much profit should you make on a rental property. By knowing your market, you’ll know if that 3% cashflow is good or not as compared to another markets 7% cashflow.

Understanding Real Estate Expenses

In order to figure out how much you should profit on a rental property, you need to understand operating costs. While most people can estimate the gross rental income on a property, very few people can accurately estimate the operating costs of that property.

Operating costs are the month to month costs you incur to simply own and operate the building. It includes, evictions, admin costs, advertising, repairs, etc.

The costs to operate a property vary by property type. For multifamily property the costs are around 45-55% of collected rents while a single family home will be slightly less around 40%.

This is a rule of thumb and all expenses should be verified and accurately calculated before purchasing.

Self storage, commercial, office, and all other types have different expense ratios.

How Much Profit Should You Make on a Rental Property?

The only correct answer is – how much do you want to earn? The reality is you can earn as much or as little as you want based on the amount of risk you’re willing to take.

The reality is you need to understand the concept of risk adjusted returns which i dig into in great detail this article on risk adjusted returns.

In a one sentence summary, as risks go up returns go up. So, high returns doesn’t always mean it’s a good deal if you can take a lot less risk but only a little less for returns.

So… How Much Should I Earn on a Rental Property?

Although there is no “right” answer, I’m not going to leave you hanging!

In general, it’s a bad idea to purchase property that doesn’t have a decently positive cash flow. That can vary a lot based on what kind of appreciation you expect, but I personally wouldn’t take less than 6-7% cash on cash return per year.

That means the last 3-4% should come from appreciation.

If you are a savvy investor that number can be a lot higher if you remodel, increase rents, or in other ways increase the rents, decrease expenses, or improve the value.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Any of these things happening should not cripple your investment but if your profit margin is low, it can.