They say that you make your money on the purchase.

But, what exactly does that mean?

It means that if you’ll ever make or lose money on a deal is based entirely on your analysis and plan which feeds into your and purchase price.

This article focuses on the deal analysis portion, which is by far the most important part. (You can read about business plan writing here)

Really, there are only 4 Fundamental steps to investment analysis:

- Determine Market Value

- Calculate Operating Costs

- Know Your Rents

- Estimate Rehab Costs

Pretty simple, right?

It’s simple but that doesn’t make it easy. So, let’s dive in!

- Step 1: Determine Market Value of the Rental Property

- Use a Comparative Market Analysis to Estimate the Value of Single Family Houses and 1-4 Unit Residential Property

- What is a Comparable Sale?

- CMAs Are Approximate and are NOT Appraisals

- Use a Comparative Market Analysis to Plan Rehab

- A CMA Cannot Estimate Price of Larger Multi-Family Rentals

- What is a “Cap Rate?”

- How to Calculate Cap Rates

- Market Cap Rates Can be Tough To Estimate

- Another Way to Look at Capitalization Rates

- When to Use Cap Rates

- When You Shouldn’t Use Capitalization Rates

- Rental and Commercial Property Valuation is Complicated

- Step 2. Calculating Operating Costs

- The 50% Rule – Making Assumptions About Rental Property Expenses

- When You Should Use the 50% Rule

- Break the Rule and Reduce Your Costs

- Save Money on Property Management

- The 2%/50% rule relationship

- Step 3. Knowing Market Rents

- Step 4. Estimating Rehab Costs

- Step 5. Calculate Returns On Your Investment Property

- Rental Property Analysis – What the Banks look at

- Debt Coverage Ratio (or Debt Service Coverage Ratio)

Step 1: Determine Market Value of the Rental Property

It can be very hard to calculate what a property should sell for; There are a lot of reasons why values can fluctuate significantly between two similar properties.

Market value, by definition, is the price at which a property can be sold. So, it may not be worth so much to you but if someone else will pay more, then that is the market value.

So, I’ll go over The primary two ways which we use to analyze rental properties.

Method 1 – Comparative Market Analysis

Your neighbor’s house just sold for $400k, so yours must be worth just as much, right?

Maybe, and maybe not.

Comps, or Comparable Properties, are what other properties in the area have sold for. They can give a hint to the value of another property, but can’t really predict it.

In some ways, who cares what it sold for? Your property is unique. This is why it’s called “real property” – It’s the only one on the planet and nothing is identical to it.

Though it is unique, people may be willing to buy another similar property for less (or more) than yours, which is why other property’s selling price is meaningful. The relationship ends there though because we can only care about what is similar, not was is identical.

Use a Comparative Market Analysis to Estimate the Value of Single Family Houses and 1-4 Unit Residential Property

“The CMA is used to help evaluate how your home will fare against the competition. It takes a look at both homes that are currently listed and those recently sold. The purpose is to find the highest price that will still make the home competitive on the open market.”

Realtor.com

Doing a Comparative Market Analysis (CMA), and finding comparable sales (comps) should be just one piece of your overall property analysis. You should also consider rent income and expenses (such as maintenance, taxes, and mortgages) to analyze your return.

It should also be noted that there are multiple ways to analyze the value of the property. Other methods include using the capitalization rate or gross rent multiplier. Check out each to learn more and see which method you should be using.

There are countless properties to waste your time analyzing. Honestly, finding great deals is the hardest part, so I strongly recommend you learn how to find investing deals without wasting all your time and money during the search. Don’t do a hundred comparable market analysis reports just to find they are all terrible deals.

What is a Comparable Sale?

A comp is a similar home that sold recently in your area. It should have similar features such as – the number of bedrooms and bathrooms, similar square footage, garage characteristics, lot size, etc. Fortunately, there are ways to adjust for differences, but you should find the most similar properties first, and only deviate if you absolutely must.

Finding recent sales is really easy because it’s all public record. If you have access to MLS then great, use that. If not, you can easily use a resource such as Zillow.com.

With services like Zillow, it’s easy enough to sort properties by what has recently sold, then write down the information about each property.

How to Use Comparable Sales to Determine Market Value

This is a little bit trickier because every market is different. If you can find nearly identical properties then you should have no problem simply comparing. For example:

Target property – 1500 sf, 3 bed 2 bathrooms, 5000 sf lot listed for $160,000

- First Comp – 1550 sf, 3/2, 4800 sf lot – sold for $152,000

- Second Comp – 1475 sf, 3/2, 5300 sf lot – sold for $150,000

- Third Comp – 1520 sf, 3/2, 5100 sf lot – sold for $155,000

In this example, (without getting extremely technical) the target property is probably worth somewhere around $152,000, and you should negotiate accordingly. There is some fluctuation in prices which we don’t have a reason for, but there is always some variance due to things such as condition, curb appeal, and location within the neighborhood.

Being able to estimate market value is also extremely important when determining if you should flip a property, or rent it out. If there is enough cash return, you may sell it for that quick cash instead of renting it for a small return.

How to Make Adjustments to a CMA

It get’s a little more difficult when there are no (or very few) similar properties in the area. Let’s take the same target property above, and find new comps.

Target property – 1500 sf, 3 bed 2 bathrooms, 5000 sf lot listed for $160,000

- First Comp – 2200 sf, 3/2, 7000 sf lot – sold for $200,000

- Second Comp – 2100 sf, 4/2, 7100 sf lot – sold for $220,000

- Third Comp – 1600 sf, 4/2, 5050 sf lot – sold for $175,000

Well now, isn’t this a tricky one?

Comp 1, the only 3/2 on the list, is WAY bigger and on a huge lot. There is no way this is comparable to our small house that we are looking at.

On the other hand, Comp 3 is similar sized but has an extra bedroom in it. Again, not great for comparison purposes.

The only way to try to get an estimate of the market value of our target property is to try to find the value of the differences. There are different techniques, and you will develop your own techniques as you gain experience, but I find the most similar property to my target, and just find the major difference.

Comp 1 is different in both building size and lot size; He second comp is different in building size, lot size, and bedrooms; comp 3 is different only with the number of bedrooms. I’ll pick comp 3 as my most similar.

Comp 3 has an extra bedroom compared to my target, so let’s find the value of 1 bedroom.

What is a Bedroom Worth?

Fortunately, Comp 1 and 2 are very similar to each other in size, but one has an extra bedroom. Since the number of bedrooms is their ONLY difference, we can assume that most of the price difference is due to that extra bedroom. Since Comp 2 sold for $220,000 and Comp 1 sold for $200,000, I will estimate that 1 bedroom is worth around $20,000 in a property that is identical in other ways.

Now, of course, you would need to do far more digging to find the average value of an extra bedroom… I’m only doing this to illustrate HOW.

Adjusting the Comp With the New Data

Back to comparable property # 3. It is very similar in size but has that pesky extra bedroom. Fortunately, we determined 1 bedroom adds $20,000 in value to a property. Comp 3 sold for $175k, so let’s take $20k off of it.

Using adjusted comps, we estimate the value to be $155,000 ($175-$20)

CMAs Are Approximate and are NOT Appraisals

You’ll notice that with each CMA we came up with a slightly different result. The fact is, a CMA is used to help estimate market value, but it does not determine market value – the market determines that. You should expect that you will find values that fluctuate depending on which properties you choose.

Also, the more variability you have in your comps, the less accurate your CMA will be. Essentially, the more things you need to estimate and adjust for, the more your results may vary from the true market value.

Additionally, a CMA does not replace the necessity of other due diligence. There are a thousand different unique characteristics of any property that can affect its market value. A comparative market analysis is a broad method to find price based on broad characteristics. Due diligence should find those unique characteristics that you may need to negotiate a lower price for.

Use a Comparative Market Analysis to Plan Rehab

I’m sure you’ve read all kinds of articles about what certain remodeling jobs add in value vs the cost of those projects. The reality is, all of those articles are just completely guessing and using averages across markets. There is really only one way to know if a project is worth the money…

Compare the cost of the project to the change in the value of your property!

It seems so intuitive once you read it, but, if it was so obvious then no one would ask the question.

So, using the example above, we know that the extra bedroom is worth around $20,000 extra on my property. If I can find a way to modify my floor plan, build an addition, or somehow add a bedroom for LESS than $20,000, then I have made money. If the project costs more than $20,000, then don’t do the project.

You can use this technique when considering if you should add a half bath or full bath, adding a garage, a deck, pool, remodeling a kitchen…you name it. The technique is exactly the same.

A CMA Cannot Estimate Price of Larger Multi-Family Rentals

As the first heading suggests, it is good only for 1-4 unit properties. This is not a hard rule; a 5 unit building doesn’t suddenly use a different method while a 4 unit building uses this.

The larger the building, the more it transitions to commercial valuation compared to a comparative analysis. Often, smaller multi-family buildings, such as a 3 or 4 unit building, will use a CMA primarily and then compare it to a value derived using a capitalization rate (read more about analyzing investment property). In theory, the valuations using two methods should be similar, but market forces can force them to diverge. Remember, a small multi-family property also has characteristics of a “Home” vs just a strict investment property.

A 5-8 unit building may use some comps as a comparison and focus mostly on cap rate, while larger buildings will be entirely evaluated on its return on investment (cap rate) and not at all on comps.

The capitalization rate, also called the cap rate, is a fundamental technique used for calculating the value in a commercial real estate property. This is generally defined as having 5 units or more.

Cap Rate Definition:

Capitalization rates, or just cap rate, is the ratio of Net Operating Income (NOI) to asset value. If a property sold for $100,000 and generates $8,000 of income after expenses (but before finance costs), then the cap rate would be $8,000 / $100,000 which is 8%.

Don’t forget to get the Free Deal Analyzer

What is a “Cap Rate?”

The capitalization rate is one method used to determine the value of income producing property. It is related to but fundamentally different than the gross rent multiplier.

The gross rent multiplier uses only the income to give a rough estimate of property and is generally used as a quick screening tool. The cap rate uses the entire picture – both income and expenses to determine property value.

It’s also important to note that the Gross Rent Multiplier and the Cap Rate are inversely related. The GRM is a price to earnings ratio while cap rate is the return on investment.

Though using cap rates to value property or your return on investment can be very accurate most of the time, it is still not applicable in some circumstances.

How to Calculate Cap Rates

Let’s take the most common application of cap rates. If you are considering purchasing an apartment building that is listed for $2,000,000 and has an NOI of $130,000, then it would be said to have a cap rate of 6.5% (or 6.5 cap).

Cap rate examples

Cap rates can also be used to back into an offer price. Let’s use the example above.

If your apartment building has an NOI of $130,000 but you know the market in your area has a 7% cap rate, you can calculate an offer price.

Here it would be $130,000 / .07 = $1,857,142.

So, you could say the market value of this property would be $1.86 million based on a 7% cap rate.

Alternately:

If cap rates are 6% in the market, you know the market value is closer to $2.17 million. You would have some room to bid up, or create excess equity.

You can use this cash on cash return calculator to back into your offer or estimate cap rates with this cap rate calculator.

Market Cap Rates Can be Tough To Estimate

One problem with cap rates is there are a lot of different rates in any one market.

Why?

Cap rates could alternatively be thought of as a risk premium. Certain buildings will be riskier than others, so they will demand a higher return to compensate the investors.

So you need a lot of data to try to break down the cap rate in each “class” of property. Once you have categorized all the other properties in the market, you can place this property into one of those classes.

You can’t expect a Class A property to have the same cap rate as a Class C property. The C property will clearly require a higher rate of return to compensate the investors for its perceived risk.

Another Way to Look at Capitalization Rates

Cap rate, along with any rate of return, can be looked at as the risk premium required to accept a given level of risk plus the risk-free rate of return.

So, if the current treasury yield is 1.6% and the cap rate for your potential property is 6%, then the risk premium is 4.4%.

Stated another way, you are being compensated an additional 4.4% to move your money from the safest investment (treasuries) and accept all the inherent risks of the investment property.

These risks could include:

- Age and condition of the property

- The type of tenants

- Market fundamentals (city/state is growing, gaining jobs, etc)

- Broader economic fundamentals (recession or growth)

When to Use Cap Rates

Cap rates are great for quickly comparing multiple properties in a given geographic area.

If one property is a 6% cap and the other is 8%, you know that one is riskier. Alternately, one may be overpriced or under-priced.

Cap rates are also good for determining market trends.

If cap rates are increasing or decreasing in a particular market, you may be able to understand the general trend. By looking at trends you may be able to decide if a certain market is over-valued or being sold at a discount relative to a long-run trend.

Cap rates can also determine when a property is being mismanaged.

If you find a property in a great location but has a high cap rate, it’s possible that the management has deferred maintenance or had low criteria for tenants. Ultimately these problems will decrease the quality and increase the risk.

It could create an opportunity for a “value add” by completing deferred maintenance and “stabilizing” the tenant base. Not only will profits increase, but you may be able to lower its risk premium and create value.

Cap Rate Risk Premium Example

Let’s say you identified a mismanaged C class property that would be a B- if it were managed well.

It has an NOI of $100,000 and is selling at a 7% cap rate for $1.43 million.

Now let’s say you put $100,000 of work into the property and raise the NOI to $110,000. At a 7% cap rate, the new value is $1.57 million. Not bad, you created about $40,000 in equity.

But, what if by doing the upgrades and making the tenant base higher quality, you have reduced the risk of the property from a C to a B-. In this imaginary market, let’s say a B- is going for a 6.7% cap rate.

You are now rewarded with a property that is worth $110,000 / .067 = $1.64 million.

You’ve created $40,000 in value through renovations then an additional $70,000 by reducing the risk for a grand total of $110,000 in equity.

When You Shouldn’t Use Capitalization Rates

If the property has a complex income stream that is irregular or will have large variations in cash flow it can be hard to estimate your rate of return. In these situations, it is better to use a discounted cash flow analysis.

For example, you may purchase a property and plan multiple phases of major renovations over a 3 year period. The renovations may cause high vacancy rates sporadically and create different rental rates at different points of time.

This sort of analysis is beyond the scope of cap rates and you would need something more advanced.

Cap rates also aren’t good at calculating the value of certain types of buildings with unique purposes. An example would be a large or historical structure such as a church or cathedral. These sorts of buildings would be valued using a cost approach.

Cap rates are also terrible at valuing properties that may be owner-occupied. These tend to be 1-4 unit residential properties but can include small mixed-use buildings.

4 units is not a strict cut-off, and buildings with slightly more may use a hybrid approach.

I general, a small residential property would be valued with the sales comparison approach, which can be estimated with a comparative market analysis.

Rental and Commercial Property Valuation is Complicated

There is no exact answer to evaluating the value of any property. Everyone has a different risk tolerance and ROI goals. What may be a good deal to one person may be a terrible deal to another person.

These methods should be used to help you analyze if the deal is good for you. It can’t be used to judge if the deal is good for someone else.

You need to be armed with knowledge about every aspect of property valuation and return calculations in order to get what you want out of your investments.

[/fusion_text][fusion_text]

Gross Rent Multiplier

This is by far the easiest way to get a rough idea of the investment property’s market value but also the least accurate. The Gross Rent Multiplier is a really rough measure of an investment property, using only the gross rents while ignoring any expenses.

How to Calculate the Gross Rent Multiplier?

Simply take the sale price (or asking price) and divide it by the gross rents (total rent before any expenses).

Asking Price / Gross Rents = GRM

If the asking price for a property is $250,000 and it has gross rents of $40,000 per year, the GRM is 6.25. Read all about the Gross Rent Multiplier.

How does the GRM fit into rental property analysis?

When you are searching for properties, you should research a number of recent sales in your market area. You can fairly easily calculate the GRM for these properties as the rent and sale price is generally available online. By making a spreadsheet you can calculate all the GRM’s and hopefully find a range or approximate average.

Once you do, you can reverse the calculation and use it to estimate the value. Let’s say you found that a GRM of 8 is average in your location. Use the new formula to calculate your potential investment

Reasons why you should use the GRM

- It’s super simple to calculate.

- Save a ton of time by filtering out low multiple properties

- Analyze price based on publicly available information

Basically, it’s easy and it can save you a lot of time.

If you are going to use the gross rent multiplier while searching for properties, I would use it as a filter, but not a deciding factor. By filtering out low GRM properties, you are probably saving yourself a lot of time and energy analyzing properties that would just be a waste of time anyhow.

Also, most properties don’t list detailed expenses when you are first looking at them. It is impossible to accurately evaluate a rental property without knowing the expenses (look at my 3 steps above). So GRM gives you a way to estimate price without having all the pieces you need.

Reasons You Should Not Use the Gross Rent Multiplier

It is a quick and dirty calculation to give you a rough starting point. It is not meant as an accurate measure of actual market value.

You may have noticed the GRM calculation doesn’t take into account any expenses at all. All of its downfalls are related to this. Because properties can fluctuate widely with their expenses, the GRM will also fluctuate like crazy. You may see one property with a GRM of 6 and another with a Rent Multiplier of 15.

It is unlikely that one property is a steal and the other one a bad buy, so the difference is most likely due to high expenses. Don’t forget, older properties tend to have higher expenses and sell for a lower price, so you may expect to see multiple changes based upon this as well.

Step 2. Calculating Operating Costs

The best thing you can do is get accurate expense information from the current owner BEFORE you make an offer.

You should compare the expenses they give you to your own proforma. Essentially, compare the accurate information they give you to your assumptions about income and expenses. You can do this by checking out a rental income worksheet.

Rental Income Worksheet

You can use the income and expense worksheet I have on the page linked, or you can create your own rental property analysis spreadsheet to carry around with you. Either way, you should have assumptions about expenses to compare to the current expenses on the property.

The 50% rule is a great place to start. Though any “rule of thumb” has its drawbacks, the 50% rule is actually a pretty safe number to run with.

The first problem is not every owner operates the same. Some defer maintenance and don’t do basic repairs. Others over-improve a property and have really high expenses.

To make it even more challenging, some properties require more maintenance than others. Things like age, property type, and location all play a major factor in determining the expense ratio.

So, to help analyze these differences and accurate predict your expenses, you need to download the deal analysis calculator.

The 50% Rule – Making Assumptions About Rental Property Expenses

In order to analyze the property, you will need to make assumptions about your expenses. That’s where the 50% rule comes in:

The 50% rule is just a simple assumption that 50% of your rental income will go toward operating expenses. Principal and interest payments are excluded from operating expenses as well as capital expenditures but includes most other expenses you will incur.

50% may seem like a lot, or it may not. It’s a broad assumption so it may be accurate or not depending on your particular property.

The best way to verify this rule is to own some property and keep track of your expenses. If you don’t own any, try to work with someone who does.

If you own 3 other rental properties that are all triplexes in one city and they all were built in the 1930’s, you can probably make accurate assumptions about a fourth triplex in the same city built that was in 1936.

On the other hand, it may not work on a townhouse built in 1989. That’s why we have the 50% rule as a starting point.

What’s Included in the 50% Rule

The 50% rule includes all operating expenses which include (but are not limited to):

The 2% rule and the 50% rule are closely related and often used together. (read more about the 2% rule.)

The 50% rule is used to estimate expenses as a percent of rent; The 2% rule is a screening tool suggesting that monthly rents should be around 2% of the sale price. (Also see how this all relates to the gross rent multiplier.)

Think about it – expenses are related to rents; rents are related to property values; so expenses have a relationship with property value as well.

- Taxes

- Insurance

- Utilities

- Property Management Fees

- Maintenance Expenses

- Marketing/Rental Fees

- Turnover Costs

- General Administration

- Payroll Expenses

- Capital Expenses (or savings for CapEx)

I have a simplified calculator you can use to estimate your expenses and potential cash flow. These are the same calculators that I use to analyze my deals, and I’ve bought over 200 units of rental property.

Breakdown of Expenses in the 50% Rule

Here is a rough breakdown of expenses. Your percentages may be different and every property is completely different, so use these only as a guide.

- 12 % – Property Management

- 5-8% – Vacancy

- 5% – Maintenance

- 5% – Capital Expenses

- 3% – Reserve

- 5% – Taxes and Insurance

- 2-5% – Water/Sewer/Utilities (Increase rent if this is higher)

- 5% – Miscellaneous, Legal, Accounting, etc…

Total – Between 42-48%. Operating expenses. To be conservative, it can be rounded up to 50%.

WHAT’s NOT INCLUDED

It’s important to know that principal and interest payments are not included.

When You Should Use the 50% Rule

Just like other ‘rules’, this one is just an assumption made to help analyze and screen properties.

There may be dozens or even hundreds of potential deals, and you need to be able to quickly sort these deals into good and bad ones.

You should never use this rule in place of actual historical expenses on any property.

Really, if you have no expense history or experience in rentals, then use this rule as a conservative estimate. Still, I would always get actual expenses from the property you are looking at.

If their expenses are higher than 50% of rent, you need to understand why. Perhaps rents are really low, or major repairs were recently made.

If the expenses are really low, you can assume there is deferred maintenance to be done or perhaps the seller is misstating their actual costs.

Break the Rule and Reduce Your Costs

Now that we know how the 50% rule works let’s figure out how to manipulate your costs to keep them low.

Increase Rents But Keep Fixed Costs the Same

Let’s say you have a 2 unit building. Your roof costs $6,000 to replace once every 20 years. That’s $300/year or $150 per unit per year. If each unit is generating $1,000 per month, you need to save 1.25% of rents each year toward this roof.

Let’s say you can add a 3rd unit to the attic or basement.

Once you add a 3rd unit, the roof still costs $6,000 to replace. That’s now $100 per unit per year or 0.83% of rent. Certain fixed costs will not change as you stuff more units into the same building, thus reducing your expenses as a percent of the rent.

Save Money on Property Management

You should include property management expenses into your calculations because of course someday you won’t want to manage all of your properties yourself.

Fortunately, you have some free time and are looking to maximize your income. Let’s look at 2 ways to leverage your free time to increase your income.

Property Management Play #1

Build the cost in but save the money by doing it yourself then use that savings to buy more property.

If you are able to find $100,000 properties that generate $2,000 in income, then doing your own property management will save you 200-240/month. Let’s just say $2,800 per year.

I’m also going to say that you are saving enough cash to buy 1 property per year with a $20,000 down payment.

So in year one you save $2,800 in fees on one property, in year two you save $5,600 on two properties, and so on. By the 5th year, you will have saved enough to buy one additional property.

So, you will have 6 properties instead of 5. By managing your own property, you have increased your assets by 20% in 5 years.

Basically, you are leveraging your time into more property.

Property Management Play #2

This one isn’t quite as cool as play #1, but it still works if you are planning to manage your own properties for a few years.

Nearly every year that you own a property, rents will tend to increase. If you find a good deal on a property now, even if it wouldn’t exactly meet the 50% rule (its expenses are too high just say), in 4 to 6 years of rent increases, rents may be high enough to justify a professional property manager.

It’s not the preferred method, but it’s important to remember that rents tend to increase as well as property value. If there is a solid deal that is borderline, you may still want to get it knowing the numbers will be solid in a couple years.

THE 50% RULE IS RIDICULOUS, BUT YOU SHOULD STILL USE IT

The 50% rule is ridiculous and really doesn’t work if you think about it logically for a second. I can easily think of a number of situations where this ‘rule’ completely fails. Let’s go over a few:

Fail #1

You find a very small single-family residence that meets the 50% rule and 2% rule criteria. It costs $75,000, is renting for $1,500 and its actual expenses are around $750 per month. Wow, what a perfect property to buy! So, you buy it.

You realize it is small and you decide to do some remodeling and add a bedroom. It costs you $25,000 and raises the rent to $2,000. Wow, this is really a property of our dreams!

But, what about the 50% rule? Since rents went up by $500, our costs should increase by at least $250/month (not counting principal and interest remember). Of course, some additional maintenance expenses will be incurred over time, but do you really believe a bedroom adds such a significant amount of monthly expenses? Of course not.

Fail #2

You purchase a 2 family property for $200,000 that is currently receiving $800 per side ($1,600 total). It’s performing well and the 50% rule applies and each month $800 is going toward expenses (or savings for capital improvements). You decide to remodel the property by refinishing the floors, removing some old carpets, and throwing in some granite counter-tops, allowing you to now receive $1,000 per month.

Again, it’s very unlikely that these improvements will cause an increase in expenses by $200.

Fail #3

You purchased a 2 unit building and are able to convert the attic or basement into a 3rd unit. The new unit will generate $1,000 per month in rent, so expenses should increase by $500, right?

In this scenario, you will incur increased expenses as a third kitchen, bathroom, floors etc will all require maintenance. But, there are some fixed costs that won’t change, such as roof, foundation, siding, and more that will actually cause your expense ratio to decrease.

As I mentioned above, by putting more units into a space, your fixed costs won’t change so your cost per unit decrease.

The 2%/50% rule relationship

The 2% rule and the 50% rule are closely related and often used together. (read more about the 2% rule.)

The 50% rule is used to estimate expenses as a percent of rent; The 2% rule is a screening tool suggesting that monthly rents should be around 2% of the sale price. (Also see how this all relates to the gross rent multiplier.)

Think about it – expenses are related to rents; rents are related to property values; so expenses have a relationship with property value as well.

Since these topics are so interrelated, it’s essential to read and learn about all of them.

Due Diligence

It is amazingly important to conduct your due diligence before purchase. It is quite likely that the current owner is hiding deferred maintenance, necessary repairs, or even bad tenants from you.

The biggest thing that can blow up your numbers is getting them wrong in the first place.

Check out this article on conducting due diligence to avoid these problems in the first place.

Step 3. Knowing Market Rents

It’s absolutely essential to know the rent you can receive for the unit.

Being off by just a few percent can totally kill the profits in a deal, so make sure you spend a lot of time on this.

Recently, I put together a video on this topic that will really help you out.

I hope that clears it up a bit for you.

Step 4. Estimating Rehab Costs

Before we even get started with this, I’ll just put a disclaimer saying that it is absolutely impossible to create an estimation rule of thumb that works in all markets at all times for all property types.

But, we need to do something to estimate rehab costs because we can’t take a contractor with us everywhere.

So, consider the concept behind it and make some adjustments so it fits your particular geographic area and niche.

We’ll briefly touch upon 2 primary ways to quickly estimate rehab costs

Interior Only Upgrades

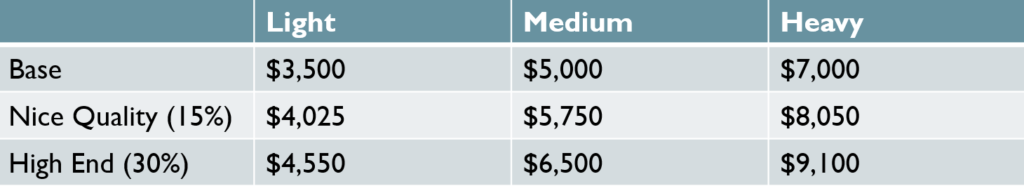

With this method you will use a chart to quickly estimate the rehab budget, then make adjustments from it. Here’s the chart:

Basically, you start with a single price and adjust it up for quality and up for scope of work. Pretty straightforward method.

You’d need to individually add in any big-ticket items that need replacement or repair.

Full Rehab Cost Per SF Method

If the property needs a large variety of work throughout, estimating a price per square foot may be useful and easier than trying to use the previous method then making adjustments off it.

Again, this will depend on the scope and location, but a full rehab is usually somewhere from $10 to $25 per square foot. Think about it this way, a 1200 sf single-family would range from about $12,000 to $30,000 under this method.

…and that does sound about right.

This method generally includes most big-ticket items (but excludes most major repairs such as foundation, major landscape, mold remediation, etc).

Step 5. Calculate Returns On Your Investment Property

This is the part we are all looking for, right? Knowing your return is the most important thing…but I’ll throw you a curveball – There are different types of return you can calculate. I’ll cover two major ways to calculate the return.

Cash on Cash Return

This is actually kind of interesting because it has different meanings in different fields. As it relates to rental property, Cash on Cash return is the Cash you get back each year compared to the cash you put down on the property.

Cash on Cash Return Formula

This is actually quite simple: (Net Operating Income – Debt Service)/Cash Invested.

How to Calculate Cash on Cash Return

Let’s say you put $50,000 down on a $200,000 house (assume that includes all closing costs) and it has a yearly Gross Rents of $20,000. Now let’s say the following are your expenses

- Principal & Interest – $12,000

- Insurance – $1,500

- Taxes – $2,500

- Maintenance, Repairs, Misc – $4,000

- Property Management – $4,200

- Total Expenses – $24,200

- Total return – $20,000 – $24,200 = -$4,200

So calculating your cash on cash return: $4,200/$50,000 = -.084= -8.4%

Your cash on cash return is negative 8.4%, not very good!

Return on Investment

ROI and Cash on Cash are very similar, except for one main difference. Cash on Cash is strictly cash in vs cash out. ROI includes only actual expenses, not principal payments. Remember, a principal payment is essentially putting cash from one pocket into another (your bank account into the equity of the property). Your new list of expenses looks like this:

- Interest – $6,000

- Insurance – $1,500

- Taxes – $2,500

- Maintenance, Repairs, Misc – $4,000

- Property Management – $4,200

- Total Expenses – $18,200

- Total return – $20,000 – $18,200 = $1,800

So calculating your cash on cash return: $1,800/$50,000 = .036 = 3.6% return on investment.

3.6% still isn’t very good in real estate, but when you sell the property, you should get that principal back, which is why it’s not counted as an expense for ROI.

Cash on Cash vs ROI

Though ROI is extremely important and a more accurate way to calculate your return, cash on cash return is the most prevalent way to calculate returns in real estate.

Why?

Well, it doesn’t matter if you are earning 20% per year ROI, if your Cash return is negative, you will eventually run out of money and you won’t have any money to pay the bills!

A high ROI but low CoC property definitely has a place in a portfolio, but will probably be a shorter term with the intent to sell, and you will need good cash-flowing properties in the portfolio to pick up the slack from the low cash generated from this investment.

Rental Property Analysis – What the Banks look at

Now let’s flip this whole thing around and look at what the banks want to see.

Who cares if you think you found a great deal, will the bank finance it?

Banks are pretty boring about how they lend. If you don’t meet their ratios they simply won’t lend. Learn a bit about the secret sauce and you’ll figure out how to get financing.

Debt Coverage Ratio (or Debt Service Coverage Ratio)

In layman’s terms, the debt coverage ratio is how much net rent you have each month above what the bank is going to charge for a mortgage.

Calculating Debt Coverage Ratio

DCR (or DSCR) = net rent/Debt Service

So if you have a net monthly rent of $1,200 and a monthly mortgage payment of $1,000, your debt coverage ratio is 1.2.

Why Banks Use Debt Coverage Ratio

Banks are very simple in the way they make investment decisions and this ratio is a simple number, so banks love it.

Essentially, if you have a good cushion of net rent each month above the mortgage amount, the bank feels comfortable you will pay them. Often, banks use a DCR or 1.2-1.3, though every bank has a different requirement.

Debt Coverage Ratios are a terrible way to analyze a deal, but it is essential to know it and calculate it. It doesn’t matter how much money you will earn, if you don’t have monthly rents at a certain threshold, they simply won’t lend.

How to Manipulate the DSCR

Everything that has numbers can be manipulated. It is important to know these numbers before you apply for financing because you can easily manipulate them.

If you find the debt coverage ratio on your deal is too low, but it’s a killer deal you don’t want to pass up, find ways to raise the ratio. You can do this by finding ways to increase rent or cut expenses. Electricity isn’t sub-metered? Done. Does the landlord pay for the water? Just fix the lease…

Now the debt ratios work and the bank will lend.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Absolutely! Before diving into real estate investing, make sure you understand how to compare markets and properties.