So you’ve come into some money and are trying to figure out how to invest a large lump sum of money.

Perhaps an investment has finally paid off, you’ve won the lottery, or received an inheritance. Regardless of how you came into your money, the hardest part is figuring out what to do with all that money.

There are two primary methods of investing large sums – Dollar Cost Averaging or Lump Sum Investing.

Unfortunately, these two basic theories don’t account for several variables that need to be considered. So, we’ll go over the two major investment strategies then we’ll also go over a hybrid approach that will help reduce the risks of each method.

Also, these strategies work in any sort of market including stocks, bonds, real estate, ETFs or REITs, and more.

Our Goals While Investing

It goes without saying that all investments seek to limit downside risk while maximizing upside potential. But, in order to figure out which method works best, we need to outline our major goals for this investment in more detail.

Capital Preservation

As an investor, your #1 goal should always be to preserve the capital you have. The reasoning is extremely simple – the gains required to offset a loss are multiplied.

Let’s say you invest $100,000 and found an investment that has the potential to double your capital in 5 years which comes out to approximately a 19% compound annual growth rate. It seems like a good investment, so you buy.

Unfortunately, it doesn’t work out and you lose half of your money. So, now you have $50,000.

In order to get back to even, you need to double your money. You lost 50% but need 100% gain to offset it.

If you found a similar investment as the one mentioned earlier, it would take you 5 years to recover from the loss and double back to your original balance.

If you take another 5 years and double again, you will be at $200,000 but it will have taken 10 years to achieve.

Meanwhile, if you had invested that initial balance more conservatively for 10 years at an 8% rate, you would have $200,000 and much less volatility and stress.

The point is – a conservative 8% growth rate may be much preferable to a 19% risky growth rate.

Capital Appreciation

The goal for all investments is to generate some kind of revenue. Regardless if you’re looking for regular cash payments or long-term capital growth, the general goal doesn’t change – to generate profits.

For this article, we will assume the goal is long-term capital appreciation, but you can very easily adjust the concept to fit a stable dividend investment strategy.

Lump-Sum Investing

Lump-Sum investing is exactly what the name suggests. You dump all of your money into the market as quickly as possible.

Biggest Benefit – Most Upside Potential

We never know what the market is going to do. Maybe stocks will go up 20% this year, or perhaps they’re going to drop 20%. If we knew the answer we could just wait to invest at the right time.

Unfortunately, that isn’t the case. But, we do know that the market tends to go up over time, not down. So, every day you don’t invest your money, that is a day of earnings you’ve missed. We call this your opportunity cost.

So, if you drop all the money in immediately, you maximize your upside potential.

Drawback – Maximum Short Term Downside

There is one major problem with the lump sum strategy – downside risk.

Since we don’t know if the market will go up or down, there is a real chance you are investing at the top of a bull market. If that’s the case, you most assuredly will lose a substantial sum as the market drops 10%, 20%, or even more.

The only way to offset this risk is to invest for a very long period of time. In fact, if you do not withdraw your money for a minimum of 20 years, then your risk of losing money is essentially zero.

While that’s great, a 20-year investment time frame for 0 returns would be disastrous.

When it’s Good or Bad to Use

Use the lump sum method when markets are functioning very normally and the economy is moving along normally.

Alternatively, use it when we are already down substantially from recent peaks.

Avoid this method if you sincerely believe an economic calamity is about to happen or we’re at or near the top of a market.

Dollar Cost Averaging

Dollar-cost averaging is a strategy to invest over a period of time in order to opportunistically buy as the markets fluctuate up or down.

Let’s say you wanted to buy $10,000 worth of Company X with a share price of $100. You could purchase 100 shares today.

Now, let’s say the market drops and those shares are only worth $80. You’ve lose 20% of your money or $2,000. The share price would have to increase 25% to get back to $100 for you to break even.

That is obviously a lot of risk to be taking, and you may not want to wait years to make it back. So, how do we avoid this in the first place? We use Dollar Cost Averaging.

Biggest Benefit – Reduces Downside Risk

Let’s say you used the dollar-cost averaging method and half of your money at $100 to acquire 50 shares but managed to invest the other half $80 which purchased 62.5 shares.

You spent the same $10,000 but have 112.5 shares which is an average cost of $88.88

You only need prices to increase roughly 10% to break even. If the price gets back to $100, you’ll have profited $11,250.

Not only have you protected the downside, but you’ve also profited from it. Good work!

Biggest Risk – Opportunity Cost

But, what if the market doesn’t go down? What if there’s a slow and steady climb for the next few years?

Perhaps you decide to DCA over a 12 month period to invest the one million dollars cash you have to invest.

If the market goes up by say 12% this year, you’re missing out on a lot of potential profits! Let’s go through this example and compare it.

If you invested all $1m on day one, you would have earned $120,000 in appreciation. Assuming stable and steady growth with no dips.

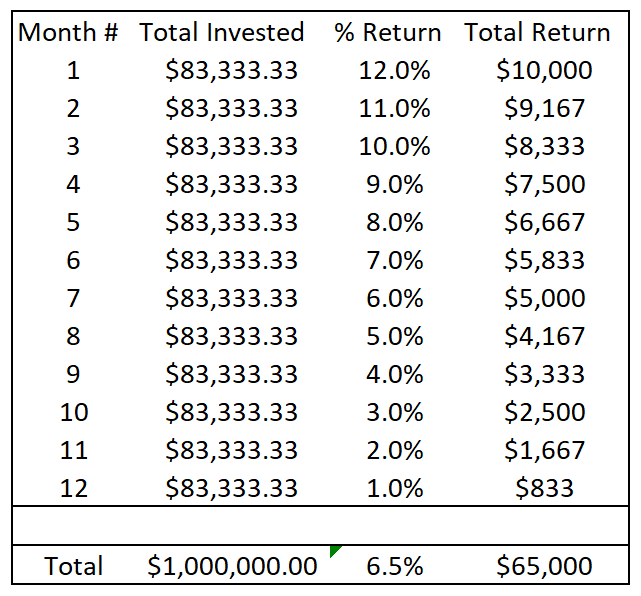

The other option was to invest 12 even investments of $83,333 each month for one year.

The first month’s investment would earn the full 12%. The second investment would earn 11%. The 3rd earns 10%, and so on.

As you can see, your total profits are $55,000 less than if you had used a lump-sum investing strategy.

When To Use

It’s best to use a dollar-cost averaging strategy when you’re trying to invest in a rapidly changing market, or one that is potentially poised for a drawdown.

Dollar-cost averaging really shines when there’s a lot of volatility or negative movement. It does not work well when prices are stable or increasing.

Hybrid – How to Invest a Large Sum of Money

It was at this point in my research that really left me wanting more answers. I had a large sum to invest but I didn’t trust the markets enough to dump it all in. Also, inflation has been so high that leaving it parked as cash is a terrible option.

So, it seemed neither option really worked.

Additionally, my large sum came from a cash-out refinance so I had to pay principal and interest on the sum starting day 1.

I needed to get the cash invested ASAP to limit the impact of inflation eating my savings and cover the cost of the debt. Unfortunately, the markets all seemed to be poised to turn around.

So, what I was looking for was Somewhere to park a lot of cash to cover inflation and debt service, then slowly reallocate into other investments.

So, let’s lay my requirements out.

- Needed to invest a large some of cash fast.

- It needed to be very stable and safe.

- Grows at a rate of 4-7% or more per year.

- Can reallocate the portfolio easily so I can DCA into new positions.

What Investment is Stable and Returns 4-7% or More?

It seems almost impossible – stable with solid returns?

Well, it turns out there are actually several ways to accomplish this. I’ll lay out two methods – Low Volatility and No Volatility Dollar-Cost Average hybrid method. But first, I’ll explain the general concept.

General Concept of Dollar-Cost Average Hybrid Method

Let’s say we have $1,000,000 cash to invest. We’ve decided the markets are riskier than usual and there is a high probability of a pullback. So, we’ve decided to use the dollar cost average method and slowly invest over the next year.

The only difference is we’ll invest the entire $1 million into the stable yielding investment we choose. Then, each week we’ll sell a portion of that investment (roughly $19,000) and purchase the stocks, bonds, or real estate that we wanted to.

So, to make this method work, we need to find low or no volatility investment vehicles to make the first step work. Then, you just follow the standard DCA process after that.

Low Volatility Method to Dollar Cost Average

Good options here are high dividend stocks such as AT&T or IBM which have dividends around the 4-8% zone. Let’s take a look at AT&T.

As you can see, AT&T is impacted by major events as evidenced by the dot com bubble and also the global financial crisis. In both situations, AT&T had major losses.

But, it’s losses were a fraction of what other companies experienced at the time. For example, the S&P 500 lost 50% of its value during the crash of 08-09 while AT&T lost around 30%.

Add to that their 7.6% dividend and you can see why a company like AT&T would be considered a low volatility play. Alternatively, Verizon is also very stable but with a lower yield. around 4.7%

No Volatility Method to Dollar Cost Average

Another interesting option combines new and old technologies. In this situation, you’ll want to utilize well-known companies in the Crypto space such as Blockfi or Voyager which allow you to lend your crypto assets for interest rates in the 5-12% range.

But wait, I thought crypto was volatile and risky?!

Well, it is, but you’d be utilizing a “stable coin” to do it. A stable coin is a real asset-backed crypto that doesn’t fluctuate in value against its peg.

A dollar-backed coin would maintain a 1 to 1 value against the dollar. For example, USDC stands for US Dollar Coin. It was created by Coinbase, a major public company. Read more about USDC here.

So, what you do is convert your US Dollars to USDC.

You can do this by setting up a totally free account with Coinbase (a major publicly-traded company.)

Next, you’ll want to head over to a company such as Blockfi or Voyager and open an account. Once you do, you can deposit the USDC and immediately start earning 5-9%.

Dollar-Cost Averaging vs Lump Sum Investing

In general, investing with a lump sum is better than dollar-cost averaging because of the opportunity cost. But, if a market correction is imminent (think dot com bubble or global financial crisis), then waiting and dollar-cost averaging is preferable.

Unfortunately, by definition of a bubble, you don’t know you’re in it. So, it’s pretty hard to know if or when a correction is coming.

So, if you cannot figure out how to invest a large lump sum of money, then a hybrid approach can help significantly if you are at or near the top of a market.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply