There are dozens of different ongoing operational costs to keep any rental property running smoothly. It’s really easy to miss some of these when you’re doing your analysis. That’s why many investors use the 50 percent rule as a reality check on their operating cost assumptions for their rentals.

I personally dislike this rule of thumb because not every owner operates the same. Some owners defer maintenance and don’t do basic repairs. Others over-improve a property and have really high expenses. The rule is overly simplified and is almost always far away from the real numbers.

To make it even more challenging, some properties require more maintenance than others. Things like age, property type, and location all play a major factor in determining the expense ratio.

Even the type of heating or cooling system in a multifamily building can dramatically change the ratios used for operating costs.

But, even with all its flaws, the 50% rule for rental property helps people stay on track because it really does give a solid middle range of proper operating costs.

So, in this article we will cover the 50% rule, how it works, and when to use it.

Then, we will dig through your actual operating costs and compare them to the 50% rule.

Then we’ll talk about how to play around with the rules of thumb to make them work better for you when you’re running your numbers.

The 50% Rule Defined

The 50% rule is just a simple assumption that 50% of your rental income will go toward operating expenses. Property taxes and insurance are part of operating costs, but principal and interest payments are excluded from operating expenses. Additionally, capital expenditures are also excluded but most other expenses you will incur are included in the 50% rule assumptions.

In order to analyze the property, you will need to make assumptions about your expenses. That’s where the 50% rule comes in: half of your income goes to operating expenses

50% may seem like a lot and it catches people by surprise. Imagine half of the $2,400 you charge for that house going toward maintenance and monthly expenses?

Then you still have to pay a mortgage on top of that? How does anyone make any money?

Well, it is a broad assumption so it may be accurate or not depending on your particular property. We’ll cover several situations where this rule is total garbage and other situations where it’s good to use.

What’s Included in the 50% Rule

The 50% rule includes all operating expenses which include (but are not limited to):

- Taxes

- Insurance

- Utilities

- Property management fees

- Maintenance expenses

- Marketing/rental fees

- Turnover costs

- General administration

- Payroll expenses

- Trash collection

- Pest control

- Fixing a toilet

What is Not Included in the 50 Percent Rule for Real Estate Expenses?

The #1 item that is not included is principal and interest payments. It’s important to note because many mortgages escrow taxes and insurance and many buyers don’t realize that part of the mortgage goes toward expenses and part does not.

Also, Capital expenditures are not included because these are not operating costs. Capex items are things that generally change the value of the asset by the amount of the upgrade. For example, a new kitchen will last decades and is a Capex item whereas replacing a leaky faucet is an ongoing maintenance item.

Breakdown of Expenses in the Real Estate 50% Rule

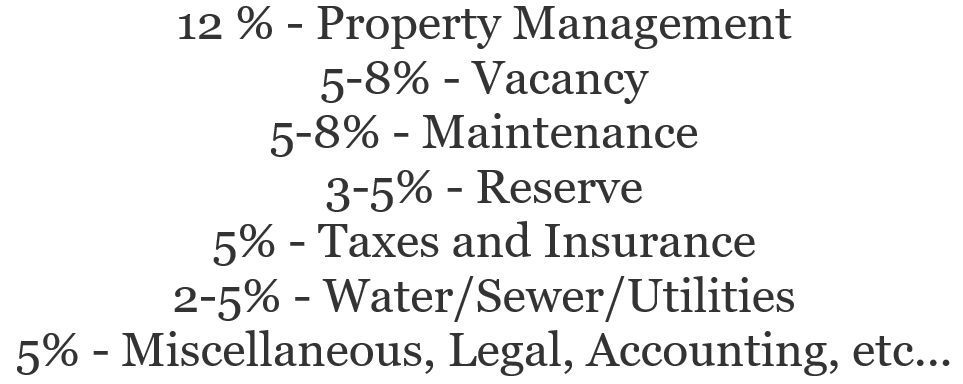

Here is a rough breakdown of expenses. You may have dozens of different expenses for your particular property, so there is no way we can capture every expense here. Your percentages may be different and every property is different, so use these only as a guide.

Total – Between 37 – 48% of rent will go toward operating expenses. To be conservative, it can be rounded up to 50%.

When Should You Use the 50% Rule in Real Estate?

Just like other ‘rules’, this one is just an assumption made to help analyze and screen properties. Your expenses are not actually related to the rent you charge. Fixing a toilet in a $1,000/month apartment costs the same as fixing a toilet in a $2,000/month apartment so it’s important to remember these are all approximations and assumptions.

So, when should we use this rule?

Use the 50% Rule For Quick Screening

In my experience, the 50% rule is best used for quick math.

There may be dozens or even hundreds of potential deals when you do a search. You need to be able to quickly sort these deals into good and bad ones or you’ll spend weeks doing spreadsheets.

In other words, the 50% rule is a good screening tool. While this article isn’t about doing deal analysis, you can see how you can rapidly get an idea if a deal will work or not but taking some quick assumptions and doing the math in your head or in a notebook.

***IMPORTANT NOTE***

Never use the 50% rule in place of actual historical expenses.

I used this a lot in the past when I’d do a search and come up with 200+ properties for sale. First, I would do a quick rent estimate, take 50% for costs, throw in a rough mortgage payment based on sales price, and sort the list. I could then focus on the best properties in the list and spend less time on the lower portion of the list.

Use in an Information Vacuum

Another situation you’ll run into is the owner has absolutely no information to share with you. This is common when the owner manages the property themselves. Often, they do a lot of work themselves and have no clue what it costs to actually manage the property.

So, if you have no expense history on the property, then use this rule as a starting place estimate.

You should still try to dig into every expense they have, and if you lack that information you should make an exhaustive list of potential expenses and estimate them.

Use as a Reality Check

One of my favorite uses of the 50% rule is to give myself a reality check to what I’m looking at. Also, it can highlight potential issues to exploit for my benefit.

Before I purchase a property, I make a list of all the expenses I expect to see on a property each year. I try to go through everything the seller gives me and then brainstorm any expenses beyond that.

Once I’m finished, I’ll see how these expenses compare to the rent. If the rent is $4,000 per month and my expenses are $1,000 per month for a 25% ratio, I have to think about what expenses I’m missing.

Also, if the seller documents very low expenses as a percent of their income, you can assume they have not been maintaining the property well. Or, perhaps they are understating the costs in order to look more profitable to sell it faster.

In this situation it could help me avoid making a major oversight!

Another potential use is to find potential benefits. Perhaps someone is selling a 4-family property with total rental income of $2,500 and monthly expenses of $1,750.

A 70% ratio is very high and I want to know why it’s so high. One possibility is the owner is paying way too much for expenses. I might be able to find a way to lower those monthly costs.

Another possibility I see often is the rents are far too low. The expenses will be accurate but the owner never raises rents because he wants to avoid tenant turnover.

In both situations this could provide a potentially good outcome. Regardless if you increase revenue or decrease costs, the end result is you will increase profit.

When to Avoid Using the 50% Rule

The 50% rule is a great approximation but it is not accurate 95% of the time (or more).

Imagine using the 50% rule to compare rental properties where one is built in 2005 and another is build in 1933. Even if they’re exactly the same size and dimensions, do you think the costs involved with maintaining these properties are remotely similar?

Obviously not.

So, here are several inconsistencies to think about when using the 50% rule.

Increasing the Rents But Keeping Fixed Costs the Same

Let’s say you have a 2 unit building and it costs you about $1,000/year to maintain the lawn and driveway, or about $500/unit per year.

Then one day you decide to add a 3rd unit to the attic or basement.

Once you add a 3rd unit, the yard maintenance still costs $1,000 per year but it’s spread out over 3 units instead of 2. That’s now $333 per unit per year for maintenance.

Certain fixed costs will not change as you stuff more units into the same building, thus reducing your expenses as a percent of the rent.

Building an Addition

You find a very small single-family residence that costs $75,000, is renting for $1,500 and it’s actual expenses are around $750 per month. Wow, what a perfect property to buy! So, you buy it.

You realize it is small and you decide to do some remodeling and add a bedroom. It costs you $25,000 and raises the rent to $2,000. You decide you like the returns on this and choose to pursue it.

Once the project is complete, your rents went up by $500.

So… does this mean your maintenance costs go up by $250 per month?

Some additional maintenance expenses will be incurred over time – floors wear out, walls need to be painted, etc. But, do you believe that costs $250 per month?

Of course not.

Upgrading Units

You purchase a 2 family property for $200,000 that is currently receiving $800 per side ($1,600 total). It’s performing well and the 50% rule applies and each month $800 is going toward expenses.

You decide to remodel the property by refinishing the floors, removing some old carpets, and throwing in some granite counter-tops, allowing you to now receive $1,000 per month.

Again, it’s very unlikely that these improvements will cause an increase in expenses by so much,

50% Rule and Operating Costs

While I am not a huge fan of the 50% rule, I do use it often.

It’s always best to estimate all of your operating costs using the actual costs provided by the current owner. But, I like to use it as a way to check if this is realistic or not.

Alternatively, I use it to screen large lists of potential deals.

Regardless of how you use the 50% rule, it’s important to know it inside and out as well as how to manipulate and adjust the information to tell a story to you.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply