Everyone wants to own some real estate as an investment, but it can be too expensive for most people to get started. So, the next question people ask – “Is a real estate ETF a good investment?”

Everyone’s financial situation, risk tolerance, life, and preferences are different. So, there is no one-size-fits-all answer. Even though we cannot say if a real estate etf is a good investment for you (and you should speak to a licensed investment advisor), we can compare how they stack up to other real estate investments that are available.

What is a Real Estate ETF?

A real estate exchange-traded fund generally holds a basket of securities in the real estate sector. This gives investors a less expensive way to invest in real estate than other methods.

These funds often hold numerous real estate investment trusts, which are simply securitized ownership in real estate. As with any other asset, some people think REITs are bad investments while others think REITs are good.

There are currently about 32 Real Estate ETFs in the United States excluding inverse or leveraged ETFs.

Why Real Estate ETFs Are Good

There are a number of reasons why a Real Estate ETF may be a good choice to add to your portfolio

Liquidity

Real Estate ETFs and REITs do offer income potential as well as the liquidity given to stocks. This is much different than a typical real estate investment which is illiquid.

Think about it another way – Imagine you need some money for something and you don’t have it in the bank. Where can you get some?

Liquid investments can be sold and are nearly as good as cash because of the speed at which you can get access to the capital.

Real estate, on the other hand, requires 30-45 days to sell in a hot market, and considerably more in an ordinary or slow market.

So, liquidity is a major factor when deciding how to invest.

Returns

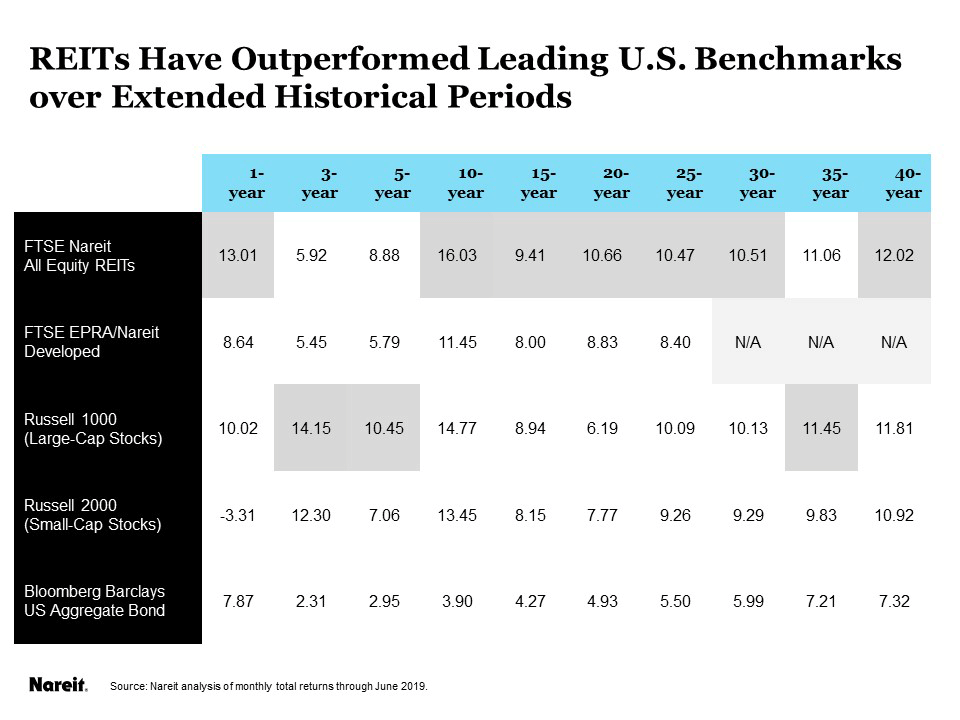

In general, a portfolio that has a portion of it allocated to real estate tends to outperform those that don’t have exposure to real estate.

There’s a variety of reasons for this, but a major factor is the lower volatility and higher dividends than other companies. Check out this long-term performance chart for real estate funds.

Why Real Estate ETFs May Be Bad Investments

REITs which comprise the ETFs, have a number of drawbacks you want to consider before investing in an ETF.

Fees

REITs are notorious for having extremely high fees when compared to other investments. While ETFs generally don’t have very high fees, if a real estate ETF is comprised mostly of REITs, then you are paying those fees by proxy.

REITs Correlation With Stocks

Because ETFs and REITs are traded on stock exchanges, then they are subject to the same whims and sudden changes in attitude as all other stocks are. Even though the asset should be valued based on the real estate it holds, this is often not the case.

There a variety of reasons for this, but a big part of this problem is because of one of the major benefits – liquidity.

Therefore, the Stock Market and REITs are correlated.

When people become fearful, they may pull investment capital out of the markets. This causes the value of a variety of stocks to rise and fall together, this includes REITs

Similarly, this lack of liquidity is what shields actual real estate values from sudden changes.

What Are Some Good Real Estate ETFs?

Here are a few good Real Estate ETFs based on historical performance. Note, as of the time of publication the author of this article has no financial stakes in any of these ETFs.

VanEck Vectors Mortgage REIT Income ETF (MORT)

- 1-Year Peformance: 100%

- Expense Ratio: 0.40%

- Annual Dividend : 6.90%

The index aims to track the overall performance of U.S. mortgage REITs by targeting the MVIS US Mortgage REITs Index.

Mortgage REITs are a little different than traditional REITs in that they don’t own real estate, but they generate profits by issuing mortgages or getting loans from mortgage-backed securities, or MBS.

iShares Mortgage Real Estate ETF (REM)

- Performance over 1-Year: 80.6%

- Expense Ratio: 0.48%

- Annual Dividend Yield: 6.12%

The index aims to track the performance of U.S. residential and commercial real estate mortgages by targeting the FTSE Nareit All Mortgage Capped Index. As such, REM does not focus exclusively on REITs. REM also includes other domestic real estate stocks and financial services names.

Rem also has an expense ratio that is a bit higher than many of its competition.

IQ U.S. Real Estate Small Cap ETF (ROOF)

- Performance over 1-Year: 60.8%

- Expense Ratio: 0.70%

- Annual Dividend Yield: 3.20%

The index is float-adjusted and market-cap-weighted and aims to track the performance of small-cap U.S. real estate companies via Real Estate Small Cap Index. ROOF maintains a portfolio of different categories of REITs, including specialized, retail, mortgage, hotel, diversified, office, and residential.

Is a Real Estate ETF a Good Investment?

There are a number of reasons why you might want to invest in a real estate ETF but there’s also a number of drawbacks. We believe that real estate is a solid investment overall and ETFs and REITs are a good way to start getting exposure to real estate if you aren’t able to acquire your own properties.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply