So you just sold one of your stock or bond investments and now you’re about to get crushed with capital gains taxes, right?

Not quite…

You see, you still have options to defer or even completely eliminate those taxes using a new loophole in the system.

Let me explain.

Opportunity Fund Investing is a newly-minted tax-advantaged method of investing in real estate that will accessible to individual investors, not just institutional capital.

What are opportunity funds?

Opportunity Funds are a new tax -advantaged investment vehicles created as part of the Tax Cuts & Jobs Act of 2017. The concept was introduced as part of the Investing in Opportunity Act – a bipartisan bill that was included alongside the broader tax bill -but has received far less attention until now.

The goal is to help spur greater private-sector investment in targeted communities across the country called Opportunity Zones.

What are opportunity zones?

Opportunity Zones are designated census tracts selected by the state and federal governments for economic devel

opment. Opportunity zones can be found in every state and in urban, suburban and rural areas. These are areas that have historically been passed over by investment capital, and meet certain qualifications with respect to poverty levels and/or sub-median income levels.

Qualifying census tracts must meet a minimum threshold of its population living below the poverty line, and/or a max average income of 80% area median income. This hardly means, however, that these areas should be unappealing to investors.

Many of the opportunity zones already established are centrally-located infill neighborhoods in thriving metros that, while less affluent than their cities overall, already exhibit signs of economic vibrance and should continue to develop alongside the broader metro.

Examples of such opportunity zones are The Pearl and waterfront Old Town in Portland, Oregon; Downtown Oakland, California; Koreatown in Los Angeles; sections of the Lower East Side in Manhattan, and various close-in neighborhoods in the Outer Boroughs of New York City, including Downtown Brooklyn.

Elsewhere, wide swaths of cities experiencing a renaissance have also been designated as opportunity zones, including much of central Houston, encompassing demand drivers like the Port of Houston and various large biomedical employers; and virtually all of Detroit, including the rapidly revitalizing area around Wayne State University.

Market fundamentals already support investments in many of these census tracts. This new system of tax incentives should make such investments all the more compelling.

Why Invest in Opportunity Funds?

Qualifying investments offer three unique and compelling tax advantages – investors can defer paying federal capital gains from recently sold investments until December 31, 2026, reduce that tax payment by up to 15%, and pay as little as zero taxes on their Opportunity Fund investment if held for 10+ years.

Opportunity Fund investing also offers the chance to have material impact on the well-being of under-resourced communities. This presents the opportunity for individual investors to include real estate in their portfolio of “triple-bottom-line” investments – those that not only yield compelling returns, but also yield positive social impact.

Even if you’re only concerned with net returns, however, the tax advantages alone should pique your interest (more on that in a moment)…

What kind of gains are eligible for tax deferral?

Investors may defer capital gains tax on any recently sold investment – including the sale of stocks, bonds or real estate – so long as those gains are rolled over into an Opportunity Fund investment within 180 days of sale.

Simply put, this new program for tax-advantaged investing is a sea-change in how investors are able to reduce capital gains tax, and carries the potential of funneling huge volumes of capital to communities across the country that need more affordable housing and more efficient access to equity for small business. If done well and with proper oversight and guidance from the Treasury Department, this may truly create win-win-win investments across the country.

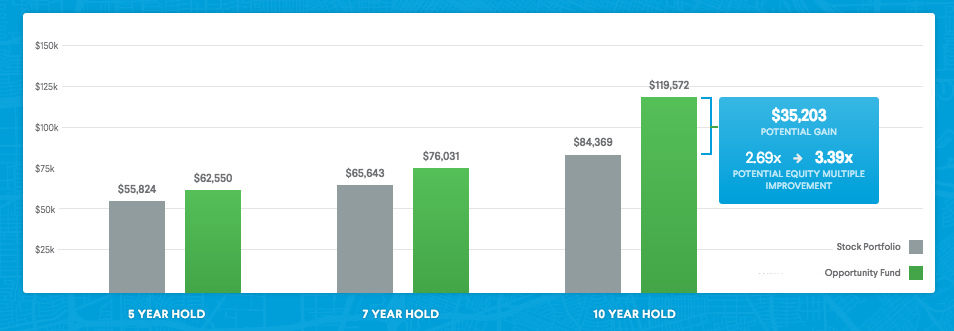

But focusing strictly on net returns for a moment, consider what would happen if a $50k stock portfolio with 10% expected annual pre-tax rate of return were instead rolled into a qualifying Opportunity Fund over 5, 7, and 10 year time horizons:

- 5 years: an additional $6,726 in net profits

- 7 years: an additional $10,388 in net profits

- 10 years: an additional $35,203 in net profits, or an equity multiple improvement from 2.69x to 3.39x over the lifetime of the investment.

Of course, the performance of Opportunity Funds will vary (just as other assets do).

Option #1 – Temporary Deferral Only (Less than 5 Years)

When rolling over your capital gain into a QOF, you will be deferring the taxes owed on those capital gains. If you sell the investment in the first five years, you will be subject to paying taxes on the capital gain earned from the sale. Only the taxes on the capital gains that were put into the QOF will be deferred.

Here’s an example:

John Q Taxpayer invests a $10,000 capital gain into a QOZ. (Based on current the IRS tax rate of 20%, John Q Taxpayer would have had to pay $2,000 in taxes if he had not have invested in a QOZ property. Therefore, he gets to keep his entire $10,000 capital gain because it is in a qualified opportunity fund that has invested in a qualified opportunity zone property.)

Less than five years later, John Q Taxpayer sells the property for $25,000. Because of this, both the original deferred capital gain invested, as well as any capital gain made from selling the property, is subject to taxation. This means that $25,000 is taxable capital gain.

In our example, the deferred capital gain investment was $10,000. Because John Q Taxpayer sold the investment for $25,000, the appreciated capital gain of $15,000 on this investment is taxable.

Using the current tax rate of 20%, we will calculate the total tax amount owed on these capital gains.

You can calculate this in one of two ways: total taxable capital gain or individual capital gain added together.

Total Taxable Capital Gain

$25,000 x 20% = $5,000

Individual Taxable Capital Gains Added Together

$10,000 x 20% = $2,000

$15,000 x 20% = $3,000

$5,000

This means the total taxes owed on the capital gain from this investment is $5,000 because the property was sold less than five years after the investment was made.

Option #2 – Step-Up Your Tax Basis at Years Five and Seven

Let’s say you invest in a QOZ property, and somewhere between five and nine years, you decide to sell the property. You will receive a tax break on the deferred capital gains of either 10% or 15%, depending on the length of the investment. Let’s look at five years first.

Five Years After Investing in a Qualified Opportunity Zone Fund

When your QOZ investment reaches five years, you will receive a tax break of 10% on the deferred capital gains. So, what does this savings look like?

We will use the same John Q Taxpayer example as above.

John Q Taxpayer invests his $10,000 deferred capital gain into a QOZ and holds the investment for five years.

When five years is reached, he will up his tax basis by 10%. This means his deferred $10,000 capital gain is now $11,000.

Because John Q Taxpayer sold this property in five years, he will be taxed on the appreciated capital gain received from selling the investment, as well as the original deferred capital gain (but with a 10% savings taken into consideration).

First, we will take the sale price of the investment, which is $25,000 and take away the new $11,000 deferred capital gain amount to determine the taxable gain amount.

$25,000 – $11,000 = $14,000 taxable capital gain on appreciation from selling the investment.

Next, we need to calculate the 10% savings to the deferred capital gain to determine the taxable capital gain amount.

As the deferred capital gain amount is $10,000, we need to deduct the 10% tax-free amount from this total. 10% of $10,000 is $1,000, therefore…

$10,000 – $1,000 = $9,000 taxable deferred gain from the investment.

Because John Q Taxpayer has sold the investment for $25,000, we have to determine the total taxable capital gain from this transaction. Therefore, we will add these two taxable capital gain amounts together.

$14,000 + $9,000 = $23,000 total taxable capital gain.

Just like the example above, you can calculate the total taxes owed one of two ways: individually or as a whole total. We will continue to use the current tax rate of 20% for this example.

Total Taxable Capital Gain

$23,000 x 20% = $4,600

Individual Taxable Capital Gain Added Together

$14,000 x 20% = $2,800

$9,000 x 20% = $1,800

$4,600

This means the total capital gain taxes owed on this investment is only $4,600 because you held the investment for 5 years, rather than the $5,000 amount for selling before reaching 5 years. This gives you a tax savings of $400.

So, what if you hold the investment even longer? What kind of tax savings does a 7-year investment look like? We’re glad you asked!

Seven Years After Investing

When your investment has reached a total of 7 years, you will receive an additional 5% on top of the 10%. This gives you a total tax savings of 15% on deferred capital gains.

Let’s put this into context by continuing with our example above.

John Q Taxpayer takes his $10,000 capital gain and defers the taxes by setting up a QOF and investing in a QOZ. (Remember: QOF = quality opportunity fund, QOZ = quality opportunity zone.)

At five years, he has stepped up his basis 10% from $10,000 to a new $11,000 deferred capital gain amount. Now, at year seven, he gets to step up another 5%, which is $500.

This makes his total deferred capital gain amount $11,500.

Because John Q Taxpayer sold this property in seven years, he will be taxed on the capital gain received from selling the investment, as well as the original deferred capital gain (but with a 15% savings taken into consideration).

First, we will take the sale price of the investment, which is $25,000, and take away the new $11,500 deferred capital gain amount to determine the taxable gain amount.

$25,000 – $11,500 = $13,500 taxable capital gain on appreciation from selling the investment.

Next, we need to calculate the 15% savings to the deferred capital gain to determine the taxable capital gain amount.

As the deferred capital gain amount is $10,000, we need to deduct the 15% tax-free amount from this total. 15% of $10,000 is $1,500, therefore…

$10,000 – $1,500 = $8,500 taxable deferred gain from the investment.

Because John Q Taxpayer has sold the investment for $25,000, we have to determine the total taxable capital gain from this transaction. Therefore, we will add these two taxable capital gain amounts together.

$13,500 + $8,500 = $22,000 total taxable capital gain.

Just like the example above, you can calculate the total taxes owed one of two ways: individually or as a whole total. We will continue to use the current tax rate of 20% for this example.

Total Taxable Capital Gain

$22,000 x 20% = $4,400

Individual Taxable Capital Gain Added Together

$13,500 x 20% = $2,700

$8,500 x 20% = $1,700

$4,400

This means the total capital gain taxes owed on this investment is only $4,400 because you held the investment for 7 years, as opposed to the $4,600 tax amount for 5 years and the $5,000 tax amount with no tax break.

By holding the investment for 7 years, you saved a total of $600 on capital gain taxes.

Option #3 – Ten Years After Investing in the Opportunity Zone

To avoid paying taxes on the appreciated capital gain from your QOZ investment, you must hold the investment for ten years. The Qualified Opportunity Zone program ends on December 31, 2026, so to maximize the tax savings on your deferred capital gain investment, you must invest in a QOZ by December 31, 2019. (Seven years is the magic number to receive the maximum 15% tax savings on deferred capital gains.)

Risk vs. Reward

As in any investment, there are always risks associated when investing. You may look at the above examples and think, “Why would I want to pay $5,000 in capital-gain taxes by investing in a QOZ, as opposed to paying $2,000 in capital-gain taxes outright when received?”

This is where the reward comes in.

When you received your $10,000 capital gain, you had to pay $2,000 in taxes; therefore, the total “bring home” amount was $8,000. That’s still a nice amount, right?

However, ten years later, you could have taken that $8,000 bring-home amount and turned it into $25,000, $50,000, or $100,000. Fair market value is determined by the price a willing seller and knowledgeable buyer can agree on when making a transaction.

Therefore, if you invested your capital gain of $10,000 in a QOZ by December 31, 2019, and the property appreciated after 10 years and sold for $1,000,000, you will have made an appreciated capital gain of $990,000, while paying capital-gain taxes on the deferred capital gain amount of $8,500 because you were able to take advantage of the 15% tax savings!

Sure, that may be a steep example, but it is possible.

So, while you may look at today’s $2,000 tax bill as being better than a $5,000 tax bill, you have to consider the future return of the investment.

At the same time, it is understandable if ten, seven, or even five years is too long to be wrapped up in an investment; especially if you feel you will have to dip into those funds relatively soon.

1031 Exchange vs Opportunity Zone Fund

Yes and no. Both programs allow real estate investors to roll over sale proceeds from an asset and thus defer paying capital gains tax, but they differ in some important ways.

1031 Exchanges allow for deferral of taxation, whereas Opportunity Fund Investing allows for not only deferral of taxes paid on a preexisting investment by rolling over proceeds into an Opportunity Fund, but also a) the opportunity to reduce the tax basis on that preexisting investment after 5 or 7 years and b) the opportunity to pay no capital gains tax on profits realized through the Opportunity Fund.

While 1031 Exchanges can be a valuable tool for more hands-on real estate investors, Opportunity Fund Real Estate Investing provides much more flexibility. Whereas 1031 Exchanges can only be used for ‘like-kind’ rollovers into a similar real estate asset, stocks or other assets can be rolled into Opportunity Funds. 1031 exchanges are designed for single-asset swaps; one property.

Multi-property funds may be eligible, but structuring the exchange typically carries additional fees and complexity. Conversely, Opportunity Funds can invest in a pool of real estate assets within qualifying opportunity zones, or gains from a preexisting investment could be rolled into fractional investment in various Opportunity Funds via platforms like EquityMultiple, allowing for diversification.

and New Market Tax Credits (NMTC’s) were designed for institutional investors, whereas Opportunity Zones allow individuals to more readily access tax-advantaged real estate investing. If you invest fractionally in an Opportunity Fund or an eligible Opportunity Zone real estate asset through a platform like EquityMultiple, you would see the same tax benefits as conferred upon the developer or sponsor.

Takeaways to Remember About QOZ’s

- The Qualified Opportunity Zone program will end on December 31, 2026, unless Congress extends the deadline. This means that you must realize and make your capital gain investment in a QOF during the 2019 year to receive the full seven-year 15% tax break on the deferred capital gain.

- There is always a risk associated with investing, so you should thoroughly consider your options when deciding how long to invest.

- There are approximately 8,700 Quality Opportunity Zones, and you do not have to live or work in a QOZ to invest. To find a map of the current quality opportunity zones, you can visit the IRS website here.

- You must create a Quality Opportunity Fund in order to invest in a Quality Opportunity Zone. You can self-certify (meaning, create your QOF) by filing a timely IRS Form 8996 along with an income tax return (this includes amended returns or returns with extensions granted, as well).

- Real estate investments in a QOZ will bring economic growth through expenditures and jobs within the impoverished community. The growth of the community will help bring spending, and the new residential or commercial investments will also bring jobs. These investments provide tax incentives to qualified investors. This is why the Qualified Opportunity Zone program is part of the Tax Cuts and Jobs Act.

- Ten years is the magic number for avoiding appreciated capital gain taxes on your QOZ real estate investment. If you sell prior to ten years, you can still receive a nice profit, so long as the property and investment has appreciated; but you will have to pay appropriate capital gain taxes associated with the transaction.

- You must invest the capital gain in a QOF within 180 days after realizing the capital gain.

- If you are considering making a capital gain investment within a community that will also help avoid paying capital-gain taxes, then the Qualified Opportunity Zone is worth discussing with a financial or real estate advisor.

Doing Well by Doing Good

This presents a true opportunity to “do well by doing good” – because the new tax regime requires that funds be held in a qualifying investment for 10 years to receive the lion’s share of the benefit, the program ensures that funds will remain allocated to under-resourced communities for long enough to make a true difference.

Many markets in the U.S. are suffering from an acute affordable housing shortage. This exciting new program affords individual investors the chance to invest in the revitalization of neighborhoods across the country, while potentially earning very compelling after-tax returns.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply