I set up my account and invested an initial $1,000 into Fundrise back in 2016. I did it just to try it out and invest a few bucks, but I loved it so much I decided to make a Fundrise Review.

There are 80+ crowdfunding websites, and the majority of them aren’t really that good. But, most review sites simply pick the ones with the highest affiliate payout and rank them.

Because of my experience with Fundrise and others, we’ve created one of the most stringent sets of grading criteria on the web for crowdfunding platforms and we review as many crowdfunding sites as we can.

This strict and well-documented methodology helps us avoid any potential conflicts of interest, and you can see the methodology with the link above. We have 11 overall categories and rank every company based on the information we have and weight the responses based on what we believe is most important.

So, check out the criteria and read the review below about the company and how it stacks up against its competition. You can click on any link below to be taken to that part of the review.

- Fundrise Review – Intro to the Company

- Why Try Crowdfunding?

- What is Fundrise and How Does it Work?

- Accreditation Requirements – Fundrise Review

- How Does Fundrise Find and Screen Investments?

- Choosing How to Invest With Fundrise

- Breakdown of the eREIT Fees

- Redemption of Fundrise eREIT Shares

- What is the Fundrise Scandal I've About?

- Fundrise vs The Competition

- Frequently Asked Questions About Fundrise

- What Others Are Saying

Fundrise Review – Intro to the Company

Fundrise is one of the early successes in real estate crowdfunding. Originally, it was for accredited investors only, but a few years ago they began to allow unaccredited investors the opportunity to invest in commercial real estate. That’s when their growth absolutely exploded!

The minimum investment amount is $500 and they make it very similar to investing in a mutual fund.

Investors can expect a quarterly dividend payment from the Fundrise eREITs and whatever appreciation has accrued when the assets investment term has expired.

There are currently 9 different eREITs that they have, some of which are stabilized and no longer accepting new investors. When you invest, you can choose an investment strategy and Fundrise will distribute your investment across the eREITs to diversify the money. We’ll get more into that in a moment.

Disclaimer: When I first wrote this article it was because I invested in Fundrise and enjoyed my experience with it. After some time I came to love it so much that I am now an affiliate. If you click on one of the links and sign-up for Fundrise, I may be compensated a small referral fee at absolutely no cost to you.

Why Try Crowdfunding?

I’ve been enamored by the idea of crowdfunding since before 2012. Not only have I thought about ways to crowdfund my own investments (though I haven’t got to that level yet), but I’ve also thought about investing in other’s real estate deals as well.

I have noticed that real estate is so far behind other areas when it comes to crowdfunding. Real estate investing is still amazingly arcane with how developers find investors, syndicate deals, and then move forward on projects.

Why can tech startups find hundreds of millions of dollars in funding practically overnight, even for terrible ideas, but real estate is reserved for a very small and elite group, even when the potential projects are amazing?

So, if you are an experienced investor currently and want to diversify or simplify your portfolio, online investing is a great place and that’s why I made this Fundrise Review. On the other hand, new investors might find online investing a great place to start!

How Does Crowdfunding Work?

Real Estate Crowdfunding is simply a way to take the investment capital of a lot of different investors, pool the funds, and buy a real estate asset with those funds.

The investors then receive a distribution of the earnings throughout the holding period of the investment. They also receive their portion of the appreciation upon sale.

In real estate this is generally called syndication, but with the JOBs act and new crowdfunding rules, money can be solicited online and openly. In the past, it had to be done privately and without any open advertising.

Since these offerings are technically securities, not much different than a stock, they are regulated by the SEC. In order to be compliant with the SEC regulations, companies such as Fundrise can use one of two primary ways to raise money.

Crowdfunding With 506(c) For Accredited Only

The only way to really explain in this Fundrise Review how they do it is to explain Reg D. The SEC put out regulation D and it has several exclusions to allow capital raisers to get the capital without filing the paperwork to go public. The traditional way is with 506(b) which allows them to raise capital from an unlimited number of accredited investors and up to 35 non-accredited investors.

The catch? You need to have a personal and substantive relationship with the deal sponsor. That’s why you’ve probably never been asked to invest in one of these.

506(c) allows capital to be raised openly and publicly online, on billboards, or anywhere else. The caveat is that all of the investors need to be accredited.

The majority of online platforms use the 506(c) exclusion to raise capital including almost all of the competition of Fundrise.

What is an Accredited Investor?

Real quick, just to define an accredited investor. It means you earned $200,000 ($300k if married filing jointly) in each of the last 2 years and reasonably expect to earn the same moving forward. The other way to be considered an accredited investor is to have over $1,000,000 in net worth, excluding your primary residence.

Regulation A+ For Non-Accredited Investors

Regulation A+ allows the company to raise up to $50m to invest. Due to the size of these offerings, there is a high cost to set these up. Because the costs are high, all of the offerings are structured in a REIT style.

But, both accredited and non-accredited investors can participate. The only caveat is that a non-accredited investor is generally capped at investing up to 10% of their net-worth or their income, whichever is greater.

Now that we understand what crowdfunding is and how it works, let’s dive into Fundrise a bit more and see how it fits in the crowded crowdfunding space.

What is Fundrise and How Does it Work?

Fundrise an investment service that allows you to invest directly in commercial real estate.

Fundrise created a marketplace that is fairly transparent and their goal is to “make the process of investing in the highest quality commercial real estate from around the country simple, efficient, and transparent.” Essentially, they bridge the gap between the investor and the developer.

As I complained about above, real estate is traditionally very exclusive, and the only investors were those with direct access to the institutions that fund the deals. Fundrise (along with many others) is cutting out the middle-man and allowing us to directly invest. Also, by cutting out the institutions, it should hopefully reduce the overhead expenses and keep our fees low.

Fundrise currently has hundreds of thousands of members and they have invested in billions worth of real estate. They let you invest as little as $500 at a time into commercial real estate and you get to pick the allocation of the funds into different REITs.

Are you ready to see how they do it? Continue reading this Fundrise review to find out. But first.

What is Commercial Real Estate?

There are 4 primary types of real estate – land, industrial, residential, and commercial. Commercial real estate is the broadest type of real estate and there are a dozen or so sub-categories within the CRE category.

The most common types of real estate are multifamily apartment complexes, office buildings, and retail.

While multifamily is used for residential purposes, it is classified as commercial real estate because it’s primary purpose is to provide income for the owners. Residential real estate is 1-4 unit properties and the primary purpose is for the owner to live there.

Review of Fundrise – Why Invest in Commercial Real Estate?

One of the big things we need to cover in this Fundrise Review is why commercial real estate is a great place to invest your money and a great long term investment.

The biggest reason is income. Commercial real estate is bought for the primary purpose of providing income, and that’s what it does best. In CRE, even the price of the building is determined entirely on the income it provides, not on what other properties are selling for.

The second biggest reason to have commercial real estate as an investment is because of appreciation. Since price is determined by the income, anything that increases income will increase its value. In real estate, we call this ‘forced appreciation’ and it’s a great way to increase the value of your investment.

Accreditation Requirements – Fundrise Review

A few years ago Fundrise was for accredited investors only. The SEC released Regulation A which made things available to unaccredited investors, but it was too complicated so most sites used Regulation D instead, which excludes unaccredited investors.

The SEC surprised everyone in March 2016 and released Regulation A+ which further simplifies the process for the unaccredited investors to invest.

Fundrise really has been the pioneer in this area and being one of the first (if not the actual first ones) to use Regulation A+ to bring online offerings to the masses….again.

I was browsing around their site and found they are actually available to unaccredited investors as well (us unsophisticated masses that can’t make good investment decisions). It was a welcome surprise to see the potential for normal people to get their hands on passive real estate investments.

How Does Fundrise Find and Screen Investments?

Fundrise claims to receive over 250 submissions per week with less than 1 percent being approved. According to the Fundrise website, they have a very strict underwriting process that includes the following steps:

1) Sponsor Screening

The first thing they look at is the company and the sponsors. They look only for companies that are well capitalized and have a history of success in top US markets. They claim that only 25% of sponsors move beyond this step.

2) Initial Project Due Diligence

Fundrise is focused on short-term projects that last 1-3 years. Their preferred structure is Senior Secured Debt, Mezzanine Debt, or Preferred Equity. Fundrise investors are senior to the sponsor and “Fundrise investors must get paid back their principal and any owed returns before the company is able to realize any profits.”

3) Detailed Underwriting

If the sponsor and project meet the Fundrise requirements, it moves on to the detailed underwriting. The Fundrise underwriting team completes an extensive analysis and review of all these points. The total underwriting checklist contains more than 350 different data points.

I was originally going to include a list of some of the underwriting criteria, but instead I found a cool video and linked it above. Check it out!

4) Purchase by Fundrise

So Fundrise actually funds the deal before putting it on the platform. By pre-funding the deal, they take on a large amount of risk that this project will be good and investors will want it.

Choosing How to Invest With Fundrise

One thing to remember about Fundrise – you are actually investing in a bundle of real estate deals. They’ve created a revolutionary real estate platform that most of you will be comfortable with.

Simply put, you pick you broad investing objectives, and Fundrise helps choose how to allocate your money.

As you can see, it’s generally broken down into high income, balanced, and growth.

Choosing an Investment to Crowdfund with Fundrise

Continuing on with the Fundrise Review… As you can see, there aren’t many choices. So how do you get diversification? Simply, they have several eREITs that have invested throughout the country.

By choosing one of their options, Fundrise will suggest an allocation. You can choose if you’re focused on current income, future potential, or a balance of the two.

A Real Estate Investment Trust (REIT) is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, ranging from office and apartment buildings to warehouses, hospitals, shopping centers, hotels and even timberlands. – Wikipedia

a REIT has a lot of requirements in order to qualify and it needs to distribute 95% of its taxable income to the shareholders. There are also different types of REITs, such as a publicly listed REIT, non-listed REITs. These eREITs offered by fundrise are non-traded REITs as they are not listed or traded on the stock exchange.

According to FINRA, there are a number of risks associated with non-traded REITs, the biggest of which is that it can be very difficult to get your principal back. Other issues are potentially high fees, especially on the front-end and a limited secondary market to sell your shares. In fact, you can read a very scathing review of non-traded REITs if you’d like.

So I decided to do a bit of digging on this eREIT. I was able to pull up the offering circular on the SEC website. Wow, what a hard document to read!

The first thing I wanted to investigate was the fees. Here is a quick breakdown of the fees I was able to find:

Breakdown of the eREIT Fees

- Manager – Offering costs of $1,000,000 or roughly 2% f money raised

- Acquisition/Origination Fee – Manager – 3% of the amount funded. Paid by borrowers and not by the Fundrise investors

- Reimbursement of Acquisition – Manager – Only if not reimbursed by the Borrower – Amount Unknown

- Asset Management Fee – 1%

- Servicing Fee – 0-0.5% * This is the fee that may be waived if underperforming

- Special Servicing Fee – 1% of non-performing assets

- Other Fees – Unknown

- Commissions – There appears to be no commissions

Redemption of Fundrise eREIT Shares

Here is another complicated one because there are a few variables at play here.

First, Fundrise will only redeem a certain amount of shares per quarter. Once they have redeemed those shares, you will get in line for the following quarter, and so on. Additionally, when you redeem the shares, you will incur a penalty of between 3 and 5% of the share price. Thirdly, Fundrise gets to calculate the value of the shares and it’s essentially impossible for us to determine that value on our own.

- Less than 6 months – No Redemption Allowed

- 6 Months to 2 Years – 95%

- 2 to 3 Years – 96%

- 3+ Years – 97%

The biggest unknown appears to be the unknown value that Fundrise will place on each share. Upon purchase, each share is worth $10, but that can easily go up or down based upon their valuation. On top of that, you can only get a portion of your money back when you redeem.

Checking the Fundrise Offerings

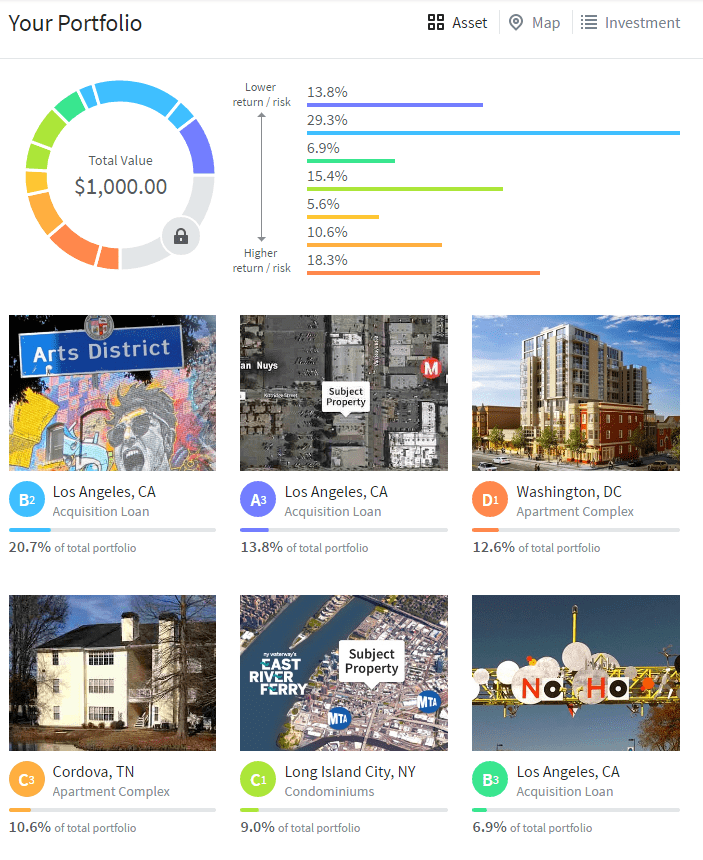

Fundrise is unique with the fact that you don’t actually choose specific projects to invest in. Instead, you choose an investment style and Fundrise helps choose a portfolio allocation across their investments. Below is the actual allocation of my investment money.

What is the Fundrise Scandal I’ve About?

Unfortunately, it only took three months after the creation of the first Fundrise Fund for things to take a bad turn. On February 9th, 2016, Fundrise filed a complaint with the SEC and addressed its shareholders in the following manner:

“Strategic Investors & Advisors —

I am saddened to have to inform you that an employee of our company has engaged in what we believe to be an attempt to extort over $1M from the company. As part of this, he claims the company acted inappropriately concerning two real estate deals. Though we believe there is no merit to his claims, we take any allegation with the utmost seriousness.

As a result, we have engaged a third-party financial audit firm to conduct a thorough investigation concerning his allegations. We are pursuing all appropriate and precautionary steps to protect our investors and our organization.

Furthermore, we are contacting the appropriate law enforcement agency to report what we believe to be his criminal behavior.”

They were refering to the chief financial officer and treasurer Michael McCord, who joined Fundrise in 2014 after spending the previous few years at auditing firm KPMG.

Fundrise founder Ben Miller temporarily assumed McCord’s position until the matter was sorted out. Unfortunately for Fundrise, McCord went on the offense to win in the court of public opinion.

A few weeks later the Washington Post published an interview with McCord where he said:

“The extortion allegations are baseless, and nothing more than a pathetic deflection attempt from the real story. On February 8, 2016 at 10:00 a.m., I repeated my concerns about what I believed constituted serious fraudulent behavior at the company to Benjamin Miller, CEO, and told him that I would not participate in it. We exchanged severance proposals without agreement.

By 11:00 a.m. and without any further communication from anyone, the company constructively terminated my employment by removing me from their website, discontinuing access to essential information systems, removing access to critical company files, and terminating email access.

I have been and will remain willing to fully participate in any legitimate investigation by the SEC or other authorities. The outpouring of support I’ve received from people both inside and outside of the company has been incredible, and I’d like to thank everyone who has reached out.”

Fundrise swiftly responded and issued the following statement to the Post:

“Over a month ago, we terminated McCord after what we believe to be a criminal extortion attempt, where McCord threatened to hurt the company by making wild accusations unless we agreed within two hours to pay him nearly $1 million and give him more stock in the company. We took immediate steps to protect our investors by reporting the matter to the Securities and Exchange Commission and the police department, as well as by opening our books to a top-10 independent accounting firm.”

McCord even showed up with two other unnamed individuals at Fundrise’s Washington offices, which Ben Miller wasn’t aware of. During this visit McCord made his alleged extortion attempt.

The allegations were somewhat amplified by the fact that Dan Miller, Ben’s brother and Fundrise’s other co-founder, departed from the firm without any reasoning just months prior.

Interestingly, despite expectations of the contrary, this was the last we heard of the dispute between McCord and his former employer. But what exactly happened after?

The Aftermath of The Fundrise Scandal

It seems that the dispute has been resolved though it is unknown if they settled out of court or not as this hasn’t been disclosed.

However, if that settlement was material or at least acknowledged that Fundrise was without fault, then the company likely would have disclosed its outcome. In all likeliness, both parties did have some dirt on them, which they were happy to move past.

Even under those circumstances, Fundrise went on to become one of the leading real estate crowdfunding platforms of its kind. All of its public REITs have achieved cumulative annual returns of more than 4 percent according to its website. I’ve Personally received approximately 8% on average.

Today, close to 400,000 people have put their money with Fundrise, which has facilitated transactions totaling $7 billion.

My Thoughts on the Fundrise Scandal

I’ve had my money in Fundrise for 7 years as of writing this and have seen no problems or issues and the returns on the portfolio have been in line with expectations.

So, I’m personally glad I didn’t allow this scandal to stop me from investing with them.

Fundrise vs The Competition

Fundrise vs other crowdfunding platforms is really what it comes down to. How does Fundrise compare in this review against others.

Well, at the time of writing there are 11 categories we rank them by. Here they are:

- Is Fundrise Available in all 50 states? – Yes

- Do they prefund deals? – Yes

- Fees? – Approximately 3%

- Minimum Investment? – $500

- Co-Investing? – Unknown, but most likely not

- Bankruptcy Protection? – Yes

- VC Funding? – Yes

- Non-Accredited Investors Allowed? – Yes

- Diverse Property Types? – Yes

- Equity Investments? – Yes

- Debt Investments? – Yes

A few months ago, Fundrise was tied in first place with 3 other platforms, but now that they have dropped their minimum investment to $500 from $1,000, now they will take first place with an overall score of 5.5 points out of 6.5 points.

Our rule is the top 5% of sites will get a 5-star ranking, so it’s still an overall tie which Fundrise shares with EquityMultiple and RealtyMogul.

Realty Mogul

This platform was founded in 2013 and is for both accredited and unaccredited investors.

Realty Mogul tends to invest in apartment buildings, retail centers and class A office buildings. The minimum investment amount is $1,000. They offer both debt and equity investments and have what is called “private REITs”. These are similar to REITs sold on the stock exchange.

To date, they have over 130,000 investors, borrowers and sponsors. Realty Mogul has provided financing to over 135 properties and loans amounting to $280 million.

You can learn more about Realty Mogul here.

Equity Multiple

Equity Multiple is focused in bringing institutional grade investments to average investors. So, very large apartment complexes, retail centers, office buildings, etc.

The minimum investment is between $1,000 and $5,000 generally, but it varies by deal. Compare that to the Fundrise Review here.

Learn more about Equity Multiple here.

What I Like About Fundrise

Here is a summary of this Review and what I like about Fundrise.

Seemingly lower fees than traditional real estate investing

I am impressed by the website, layout, and utter simplicity.

I love how you can reinvest dividends

It’s great that you can pick a strategy based on your risk tolerance and investing goals, then Fundrise does the rest.

The Bad Side of Fundrise

It’s actually hard to find negatives about Fundrise. But here are the worst parts.

I wish there were more offerings to choose from, or that they came along more often. You’re limited to the funds they have available.

It would be great if they brought back individual deal crowdfunding.

Frequently Asked Questions About Fundrise

I get emails and comments all the time about Fundrise, here is a compilation of the most common ones.

What Others Are Saying

FinancialSamurai – 5 Star

ListenMoneyMatters – 4.5 stars

InvestorJunkie – 4.5 stars

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Hi Eric. I ended up investing too just to see what happens. I like that it’s super-passive but the returns aren’t that great.

I’m curious. Did you invest in their stock offering?

I haven in it for 18 months and my return has been around 4.3%…not great.

Most real estate funds and investments (including the ones I operate) paused or reduced distributions due to covid. This is not unexpected at all.

I’ve actually been using the platform for a year now and I invest $5,000 and have received $756.75 in under 1 year.

Hi thank you for sharing I was trying to consider and what amount I should invest $1000 or $5000 and you just made my decision a lot easier for me I want to invest at the level where I will get the best dividends so thank you.

So do you get the Dividend each month sent to your Bank Account or Mailed a Check to you or reivested into more shares? I

You can get dividends distributed to you or reinvested. I choose to reinvest into my Fundrise account.

Hi Eric, so can I use Fundrise as a way to fund your retirement?

I think Fundrise has a retirement account option. Other than that, remember that Fundrise is illiquid. If you need to withdraw the money early there is a penalty.

I invest in single family homes using leverage. It seems like something like Fundrise wouldn’t be able to touch the returns on a leveraged deal, correct?

Actively buying property and passively investing are never comparable investments. Fundrise is entirely passive, along with any other crowdfunding site. Finding, buying, renovating, and renting property is mostly an active business.

Am I crazy or did this not tell us what happened with his $1000 after 3 years. That would have been nice.

I think the video posted at the top shows you where it was at the time it was taken.

If your objective is long term growth you’re not going to see any gains until they sell. These types of programs take time so you can’t expect a sizeable return in the 1st 3 years

Agreed. Fundrise, along with all real estate investing, is not a short term play.

What is considered early when withdrawing ? Is it based on your whole amount or based on your latest investment ?

That’s a legal question about Fundrise I really can’t answer since I can’t give legal advice. But, I will say that’s all detailed in the docs you have to sign. Make sure you read and understand all investment documents before investing in anything at all.