Recessions are horrible economic events and I wish they were avoidable. The amount of human suffering can be extreme and I empathize for anyone suffering.

But, it’s also said that millionaires today were made during the last recession.

I know this is 100% true in my experience and I’d say that the upcoming recession will create a lot of opportunity for the right people. The question is – will you be one of those people?

This article aims to provide you with valuable insights and practical strategies for real estate investing during a recession. We will explore the actions you should take to capitalize on opportunities while avoiding common pitfalls.

- How to Take Make Money in Real Estate During a Recession

- Pitfalls to Avoid While Investing in a Recession

- Conclusion

How to Take Make Money in Real Estate During a Recession

In the world of real estate investing, economic downturns, such as recessions, can create both challenges and opportunities. Understanding how to navigate through these turbulent times is crucial for investors looking to make strategic decisions that will withstand market volatility.

Here’s a list of things to do while investing leading up to a recession.

Conduct Thorough Research and Analysis

It’s something I always harp on – To make informed investment decisions during a recession, conducting thorough research and analysis is paramount.

Evaluate Historical Market Data and Trends

When facing a recession, it is essential to review historical market data and trends. Look for patterns and cycles to gain insights into how the real estate market has performed during previous downturns. This analysis will help you identify potential risks and opportunities.

During recessions, real estate markets often experience declining prices and decreased demand. However, some property sectors may fare better than others. By examining historical data, you can identify areas that have shown resilience or even growth during previous downturns.

For example, affordable housing and rental properties tend to remain relatively stable, as people still need a place to live regardless of the economic climate.

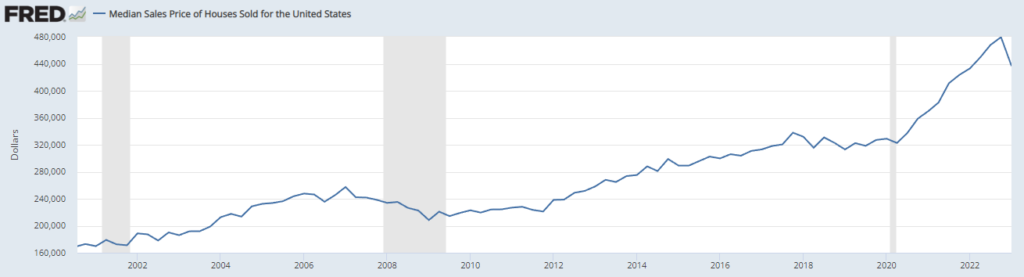

But this obviously was not the case during the Great Recession. Just look at this graph:

Also, you’ll see the speed at which prices are declining in the current market is shocking. But, it affects all areas and product types differently. Single family is doing much better than office space is currently.

Analyze Property Fundamentals and Financial Statements

Assess the financial health of the real estate you are considering investing in. Scrutinize the income statements, and cash flow statements. Look for areas with solid fundamentals, and maintain strong cash reserves and low debt levels, as this makes you more likely to weather the recession better.

If you’re going to passively invest, in times of economic uncertainty, it’s crucial to invest in financially stable real estate companies. Consider their leverage ratios, liquidity, and the diversity of their real estate portfolios. Companies with a history of strong financial performance and a conservative approach to debt are more likely to withstand the challenges posed by a recession.

Consider Industry-Specific Factors and Potential Growth Opportunities

While the overall economy may be experiencing a downturn, specific industries within real estate may still present growth opportunities. Evaluate market sectors like affordable housing, rental properties, or commercial spaces that cater to recession-resistant businesses. Such investments can provide stability and potentially generate long-term returns.

For example, healthcare real estate and industrial properties are often considered recession-resistant sectors. The demand for healthcare facilities and warehousing/storage space tends to persist even during economic downturns. Identifying industry-specific trends and opportunities can help you allocate your investment capital wisely.

Here’s a list of most of the different real estate niches to consider.

Diversify Your Portfolio

During a recession, diversifying your real estate investment portfolio becomes even more crucial to mitigate risks and seize opportunities.

Importance of Asset Allocation and Risk Management

By diversifying your portfolio, you spread your risk across different types of real estate assets. Consider allocating your investments across residential, commercial, and industrial properties, as well as other real estate investment vehicles. This diversification helps cushion the impact of a recession on your overall portfolio.

When diversifying your real estate portfolio, aim for a balance between income-generating properties and those with the potential for capital appreciation. Income-generating properties, such as rental units or commercial buildings with long-term leases, can provide a steady cash flow that helps offset market fluctuations. On the other hand, properties with growth potential, such as development projects or undervalued assets, can deliver substantial returns when the market recovers.

Explore Various Investment Options

Real estate investing offers a range of options beyond direct property ownership. Explore opportunities in real estate investment trusts (REITs), real estate crowdfunding platforms, or real estate exchange-traded funds (ETFs). These alternative investment avenues provide diversification, liquidity, and access to different segments of the real estate market.

REITs allow investors to own shares in a professionally managed portfolio of income-generating properties. Crowdfunding platforms such as Fundrise enable you to pool funds with other investors to participate in real estate projects that were traditionally accessible only to large investors. Real estate ETFs provide a convenient way to gain exposure to a diversified basket of real estate assets through stock exchanges. By exploring these options, you can diversify your real estate holdings and access markets that may otherwise be challenging to enter individually.

Balance Between Defensive and Growth-Oriented Assets

During a recession, it is wise to strike a balance between defensive assets and growth-oriented assets. Defensive assets, such as stable rental properties or income-generating assets, can provide steady cash flow even during an economic downturn. On the other hand, growth-oriented assets, like development projects or distressed properties, may present lucrative opportunities when the market begins to recover.

Defensive assets are typically less sensitive to economic cycles and can provide stability during recessionary periods. These assets, such as well-located residential properties in desirable neighborhoods, tend to maintain their value and rental demand even when the economy is struggling.

Even if the value declines, if the rent still performs well then you can easily survive until prices recover.

Growth-oriented assets, on the other hand, have the potential to deliver substantial returns as the market rebounds. Distressed properties or development projects purchased at discounted prices can turn into profitable investments when the economy recovers.

The problem is being able to cover the expenses when they are not producing income. This is especially risky during a recession when the back-end sales potential is uncertain.

Striking the right balance between defensive and growth-oriented assets is key to achieving a diversified and resilient portfolio.

Capitalize on Value Investing Opportunities

A recession often creates a fertile ground for value investing in real estate. By identifying undervalued assets, you can position yourself for potential long-term gains.

Identify Undervalued Properties and Distressed Sales

During a recession, some property owners may face financial difficulties and be motivated to sell their assets at discounted prices. Keep a close eye on distressed sales, foreclosures, or properties listed below market value. Thoroughly analyze the potential of these opportunities to identify those with the highest return on investment potential.

Distressed properties can be an excellent source of value investing opportunities during a recession. However, it’s essential to approach these deals with caution and conduct thorough due diligence. Assess the condition of the property, evaluate any legal or financial issues, and consider the costs of renovation or rehabilitation. By accurately assessing the true value of distressed properties, you can negotiate favorable purchase prices and potentially unlock significant profits.

Utilize Fundamental Analysis Techniques

Fundamental analysis helps assess the intrinsic value of a property. Consider factors such as location, property condition, rental demand, and future development plans. By conducting a comprehensive evaluation, you can identify properties with strong potential for appreciation and income generation once the market rebounds.

Location is a crucial factor in real estate investing, regardless of market conditions. Properties in desirable neighborhoods with access to amenities, transportation, and good schools tend to hold their value better during a recession and experience faster growth during the recovery phase.

Additionally, analyze the rental demand in the area to ensure a stable income stream from your investment property. By utilizing fundamental analysis techniques, you can identify properties that are well-positioned to weather a recession and offer significant long-term potential.

Here’s some information on performing a comparative market analysis in order to estimate the value of a single family home.

Be Patient and Focus on Long-Term Potential

Real estate investing during a recession requires a long-term perspective. Understand that the market will eventually recover, and well-chosen investments will appreciate over time. Avoid making hasty decisions driven by short-term market fluctuations. Instead, focus on properties that align with your investment strategy and have the potential for long-term growth.

During a recession, it’s natural to feel anxious about your investments. However, successful real estate investors maintain a patient and disciplined approach. By focusing on the long-term potential of your properties, you can weather the storm and capitalize on the eventual recovery. Resist the temptation to sell prematurely or chase short-term gains, as these actions may lead to missed opportunities and potential losses.

Pitfalls to Avoid While Investing in a Recession

While there are opportunities to be seized, it is equally important to steer clear of common pitfalls that can hinder your real estate investments during a recession.

Don’t Have Emotional Decision Making

I’m sure almost every regret in your life comes from being overly emotional while making big decisions. So, the number one thing to avoid is making emotional decisions.

Avoid Panic-Selling and Impulsive Investment Decisions

During periods of market volatility, emotions can run high. Avoid making impulsive decisions, such as panic-selling your properties or hastily investing in assets without proper due diligence. Stay disciplined and stick to your investment plan.

Control Fear and Greed

Fear and greed are common emotional drivers that can cloud your judgment. Fear may lead you to avoid opportunities due to uncertainty, while greed can push you to take excessive risks. Maintain a balanced approach, focusing on calculated risks and sound investment principles.

Maintain a Rational Mindset and Stick to Your Investment Plan

Develop a well-defined investment plan that aligns with your financial goals and risk tolerance. During a recession, it is vital to stay disciplined and follow your plan. Monitor your investments, make adjustments when necessary, but avoid making drastic changes based solely on short-term market fluctuations.

Don’t Ignore Risk Management

Understand the Importance of Risk Assessment

Even in a recession, risk assessment remains crucial. Evaluate the potential risks associated with each investment, such as vacancy rates, interest rate fluctuations, or changes in local regulations. Consider worst-case scenarios and implement risk mitigation strategies.

Implement Stop-Loss Orders and Risk Mitigation Strategies

If you are investing in exchange traded REITs, make sure you have stop-loss orders can protect you from significant losses by automatically selling an investment if it reaches a predetermined price. Additionally, diversify your investments across different geographic locations and property types to reduce risk concentration.

Avoid Excessive Leverage and Overexposure to High-Risk Assets

In a recession, access to credit may become more challenging. Avoid overleveraging your investments and be cautious of high-risk assets that may be more vulnerable to economic downturns.

During the GFC and Great Recession, many investors lines of credit were pulled which caused foreclosure of entire portfolios. Make sure that’s not you.

Strive for a balanced portfolio that can withstand market shocks.

Don’t Neglect Portfolio Monitoring and Adjustments

Regularly Review and Rebalance Your Portfolio

Monitoring your real estate investments is essential, regardless of market conditions. Regularly review the performance of your properties, analyze market trends, and rebalance your portfolio as needed. Stay informed about economic indicators that can impact the real estate market.

Stay Updated on Market and Economic Indicators

Stay abreast of relevant market and economic indicators, such as unemployment rates, GDP growth, and interest rate movements. These indicators can provide insights into the health of the real estate market and guide your investment decisions during a recession.

Be Flexible and Adapt to Changing Market Conditions

Real estate markets are dynamic, and conditions can change rapidly during a recession. Be flexible in your investment approach and adapt to the evolving market conditions. Stay open to alternative investment strategies and adjust your portfolio accordingly.

Conclusion

Real estate investing during a recession requires careful planning, thorough research, and a disciplined approach. By embracing strategies such as conducting research and analysis, diversifying your portfolio, and capitalizing on value investing opportunities, you can position yourself for success.

Simultaneously, avoiding emotional decision making, neglecting risk management, and neglecting portfolio monitoring will help safeguard your investments during challenging economic times.

Remember, strategic real estate investing in a recession can provide opportunities for long-term growth and resilience in the face of market volatility. Stay focused, informed, and proactive to navigate these conditions and emerge stronger as the economy recovers.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply