Are you storing your receipts in some random box somewhere? No organization no tracking at all?

Do you know what your cash on cash return was last quarter?

How about your overall return?

What about deciding if it’s the right time to sell or refinance?

It’s really hard to track any of these, let alone do your taxes, if you aren’t keeping a good rental income or rental expenses worksheet.

Track Rental Expenses and Income With This Super Easy Worksheet

You’re too busy right now to track every last penny, so you’ll get it done in April before your taxes are due.

Then April rolls around and you can’t remember what that $23 was for. What about this receipt for $125?…

…and you swear you have a receipt laying around somewhere for the $500 tool you bought.

Does this sound familiar?

You are leaving money on the table when you aren’t tracking your expenses properly. Stop overpaying the taxman!

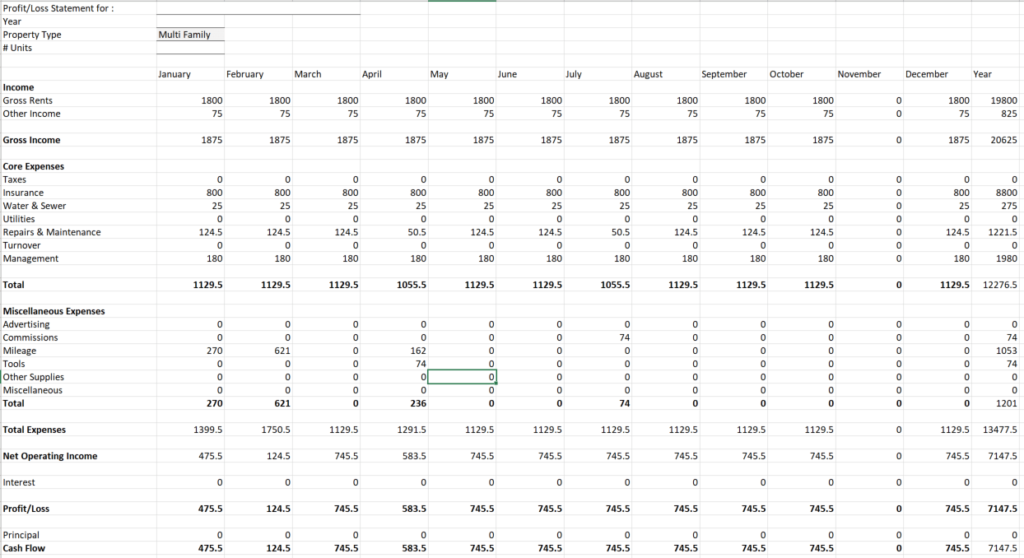

I’ve grown to the point where I use actual accounting software that syncs with my accounting software, which is pretty expensive. I know that not everyone is at that level, so in order to help you stay on top of your bookkeeping, I am releasing the actual excel spreadsheet I used to track my properties for the first 3-4 years of my business.

This Excel spreadsheet allows you to track all of your income and expenses. It is super easy to alter and make it your own.

It is essential that you track every single dollar that flows in or out of your business through your rental properties. Honestly, you have no idea if you are making or losing money until you start tracking it properly.

For the data to be calculated properly, you will need to use the tabs on the bottom of the sheet and fill out the monthly income and expense worksheets. There is also a tab for mileage.

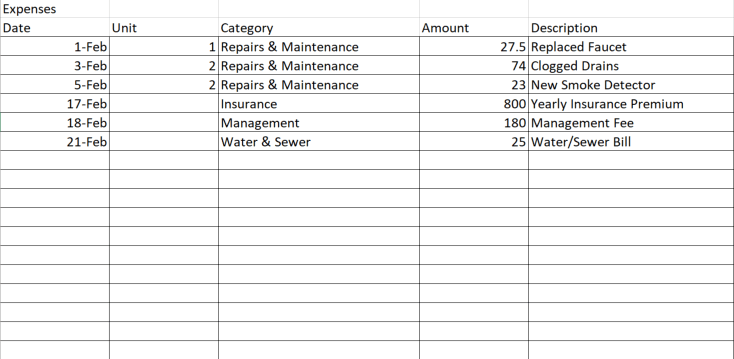

Rental Property Expenses Worksheet

Within the monthly sheets, you will find the rental expenses spreadsheet to help you track all your different sources of costs.

These can range from simple repairs or maintenance to major improvements. You also need to be tracking vacancy costs, all of your mileage, and even tools you purchase to do repairs.

All of these things may be deductions (consult with your CPA) and tracking your rental property expenses can save you money at tax time

It’s really essential that you track every dollar of expenses. Remember, every dollar you forget about is one more dollar that Uncle Sam gets to tax.

Don’t leave money on the table by not having a rental expense worksheet!

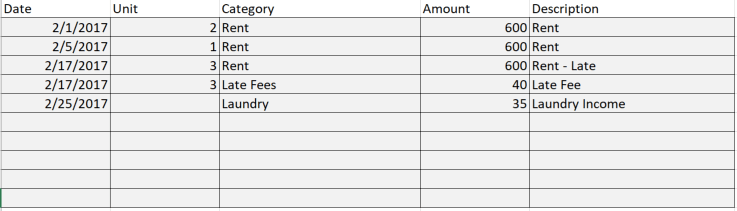

Rental Income Spreadsheet

Within the monthly sheets, there is an income worksheet to help you track all your different sources of income.

As you can see, you can choose from several options and record what the income is for.

By recording the dates and category of every income source, you will be able to identify areas where you can improve your business, determine who are good and bad tenants or help you think of creative ways to increase your income.

Just like you want to track every expense, you also don’t want to forget the record your income. Remember, if you forget to claim all of your income, the government could come knocking and they won’t be happy!

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply