If you’ve been scouring the web trying to find a sample business plan so you can get your real estate investing business off the ground, look no further.

On this page, I will provide you a real, sample real estate investing business plan.

I will also give you step-by-step instructions to help you create your own business plan so you can stop sitting around and start investing in real estate.

How to Write a Real Estate Investing Business Plan.

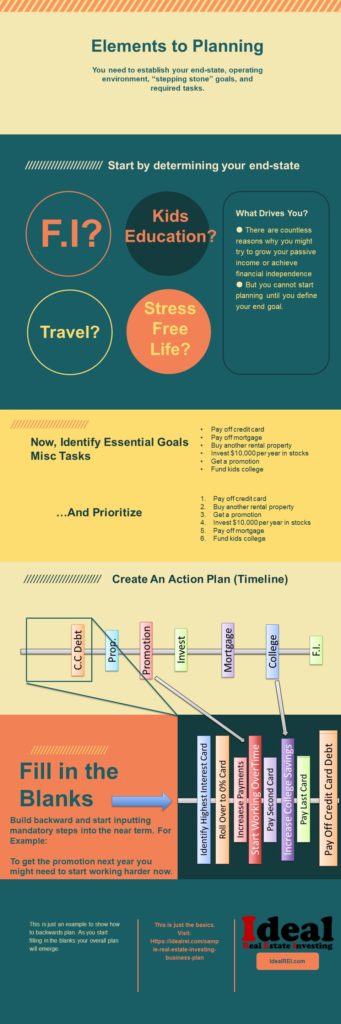

I put together this infographic which will help break down the elements of planning (and backward planning), then we’ll pick it up on the other side with more information about crafting your sample business plan.

Writing Your Business Plan

Before you even start typing, you need to know your goals and write them down. The infographic above has an example of how to backward plan and fill in the blanks.

Alright, now that you have a general idea of where you are going and how you will get there, you are ready to start writing your business plan.

What You Need Before Starting Your Investing Business Plan

Before you get started writing your business plan, you need to put together a few pieces of information:

- Business plan writing software (I use LivePlan)

- Your target market

- Your analysis criteria

- How you will find real estate deals

- How you plan to finance your properties

- How you plan to rent/sell your properties (exit strategy).

1) Start Writing the Pitch

The first thing I like to do is write the pitch. Imagine yourself on a 30-second elevator ride to the 10th floor of some building, and you happen to be riding along with the CEO, or finance manager of some investing firm. What could you say to that person in 30 seconds to make them want to sit down and hear more?

That’s your pitch.

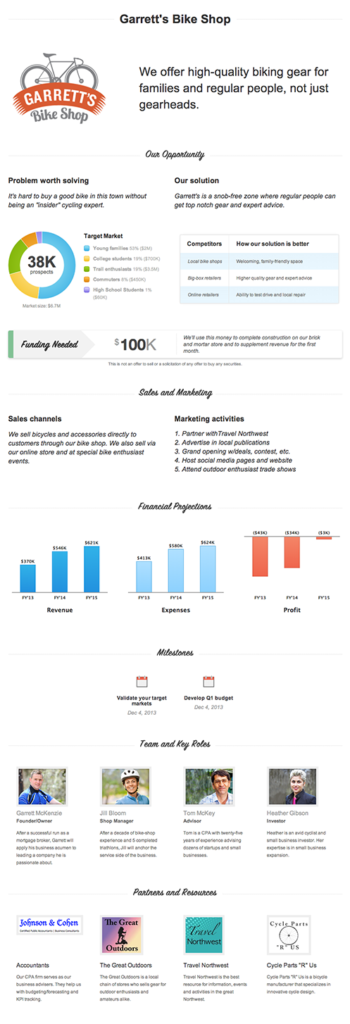

Click on the image to see an example of a “pitch” (it’s just a fictitious company I made up for this example).

The business plan writing software that I use puts this all together for me and even hosts it on a unique webpage so I can email the pitch if I want. Obviously, you don’t have to get that fancy – you could even put something together in PowerPoint if you want.

Writing this pitch is going to help you start working on a few important details:

The Real Estate Problem You are Solving (and Your Solution)

This is how you will position yourself and be better than everybody else…and fully expect it to change over time.

- When we first started investing, we focused on student rentals. More specifically, we realized that foreign students had a hard time finding good apartments and trusting their rent and security deposit wouldn’t be stolen before they arrived in the United States.

- Though that was our focus, we also bought other buildings if the numbers made sense…and our mission changed to acquiring under-valued properties and using my expertise to renovate them cheaply.

- Finally, as we grew, we have incorporated those other things into our target investments but now we are focused on building systems that other smaller landlords couldn’t have in place.

Real Estate Financial Projections

The great thing about real estate, when compared to other startup businesses, is the financials are already out there for you. You can easily look at any property and get the current owner’s proforma rent (rent and expenses on paper under ideal circumstances).

In other industries, you may be stuck guessing what your retail demand will be, what your advertising, marketing, and other overhead might be.

In real estate, it’s easy to find and easy to estimate in the absence of actual numbers. My point is, there is no reason why your financials section shouldn’t be amazing. It should be spot on so you can impress whoever your lender will be.

Since the financial section should be easy to figure out, it’s what I like to work on second.

2) Create an Amazing Financial Forecast

The financial forecast should be pretty boring and not hard for you to determine.

There is nothing terribly exciting about the financial section of a business plan. There is even less excitement with real estate financials. If you aren’t actively buying more property, then your revenue and expenses should literally never change.

And in this example, you can see how I plan for absolutely no change throughout most of 2016 for this made-up company.

But then something happens – I plan to buy more property!

But then it flatlines again.

Real Estate is predictable, and your numbers should be too

Your banker, financier, or private lender will know real estate inside and out. They will know how much people spend on maintenance, collections, etc.

So, if the numbers in your plan are out of line, they will see it.

If you’re lucky, they will assume it’s a simple mistake, let you amend the numbers and move on… or they may think you’re a novice and it could jeopardize your financing. So spend more time on this section than any other

Honestly, I probably spend 3 or 4 hours just making up numbers for this example. It would take me a few days to get everything perfect if I were using this for funding.

3) The Rest of the Business Plan

Maybe it seems weird that I just throw it all together at the end, but in real estate, it’s pretty true. If you’ve created a solid plan utilizing the backward planning method, then created a pitch and did a solid job on your financials, the rest of the plan will fill itself in.

Sure, there may be a few areas that you haven’t put thought into yet, but that’s the purpose of the business plan.

The great thing is, the pitch uses these categories as well, so it gives you a great starting place.

Here is a quick breakdown of the real estate business plan categories

Executive Summary

The Executive Summary is a brief outline of the company’s purpose and goals and should include:

- A brief description of products and services. For real estate, this could mean single family vs multi-family, self-storage, commercial, etc.

- A summary of objectives.

- A solid description of the market. How is your niche growing and what does the future look like in your particular market?

- Financial justification. What your profit margins look like and how you plan to make money. Include growth potential

- An overview of funding requirements.

Find your Business Opportunity

Every business finds an Opportunity to exploit. Essentially, opportunities are created by problems which you will solve. There may be a lack of low-income housing, or on the opposite side, a lack of luxury apartments. Other problems may be poor management, high eviction rates, or a lack/excess of a particular type of real estate.

It may be helpful to answer these four questions to help you define your opportunity:

- Where do you make your money? – What niche of the market will you operate in?

- How do you spend your time? – Will you focus on management, maintenance, finding investments, etc.

- Who do you sell? – Are your target tenants businesses, low-income, high-income, students, or something else.

- What do you sell them? – Are you selling tiny (green) homes to high-income individuals or large homes to middle-income people with families?

Execution of your Business Plan

Writing the execution part of your business plan isn’t always easy because it includes some big sections. In the execution section, you will have Operations, Marketing & Sales, Milestones, Metrics, and anything else that will affect your investments on a day-to-day basis.

Operations – This includes technology you may use (property management software), locations, management plan, and anything else that affects the day-to-day operations of your business and investments.

Marketing & Sales – This may include how you plan to stage and rent properties or to sell your real estate. From online listings all the way down to your concept for showings.

Milestones – How fast do you want to grow, when will you raise rents, when do you want to hire your first employee… anything can be a milestone and it’s unique to your particular investing strategy.

Metrics – It’s important to determine how you measure success. There are many ways to measure this, but in real estate, it could be the number of units, yearly income, or net worth among other things.

Company Profile

The company profile section is where you “sell” the management team and history of the company. If you have a lot of experience in real estate, then really highlight it in this section.

If you don’t have a strong real estate background (a lot of new investors have very little experience) then focus on talking about your “team” such as your real estate agent, accountant, attorney, contractors, and other professionals

Business Financial Plan

Remember all the numbers you worked on before? Well, this is the where they go.

Try not to create pages and pages of useless graphs, charts, or spreadsheets. Try to put the important information up front, and tuck supporting spreadsheets in the back as a reference.

Another note – profit is really important in business, but cash-flow is more important. In real estate, it’s quite possible that a company can be profitable but cash-flow negative. It’s also possible to exhaust cash reserves and fail to meet debt obligations, even if you planned on earning a fortune in just a few months.

Your financial section should show your solid cash-flow management plan.

Don’t forget to download your free sample real estate investing business plan

Wrapping up Your Real Estate Investment Business Plan

The design is an important last step. People are more likely to read through your business plan and judge it’s content if it has a beautiful and easy to read design. Spend plenty of time making it colorful, make the headings pop, and work hard to draw attention to the areas you want to highlight.

With that last piece of advice, I hope I’ve been able to give you some specific advice about real estate investing and your business plan.

Check out LivePlan and give it a shot. It’s an amazing product!

And if you haven’t already yet, get a copy of the free business plan for real estate investors

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

This is a great blog post! I’m a recent college graduate and I’m looking to get into real estate investing. This post has given me a lot of great information to work with.