Real Estate vs Stocks… The stock market beats real estate every time, right?

Wrong.

Unfortunately, there is a lot of misinformation out there on the web when comparing real estate vs stock market.

So who’s right?

There are a lot of respectable people on both sides of the argument, but we need to dig down a little deeper first and sort out the good from the bad information.

- What Are Average Stock Market Returns?

- What Are Average Real Estate Returns?

- Real Estate Returns

- Estimating Average Real Estate Returns Across the US

- Stock Market vs Real Estate – Which Is Better?

What Are Average Stock Market Returns?

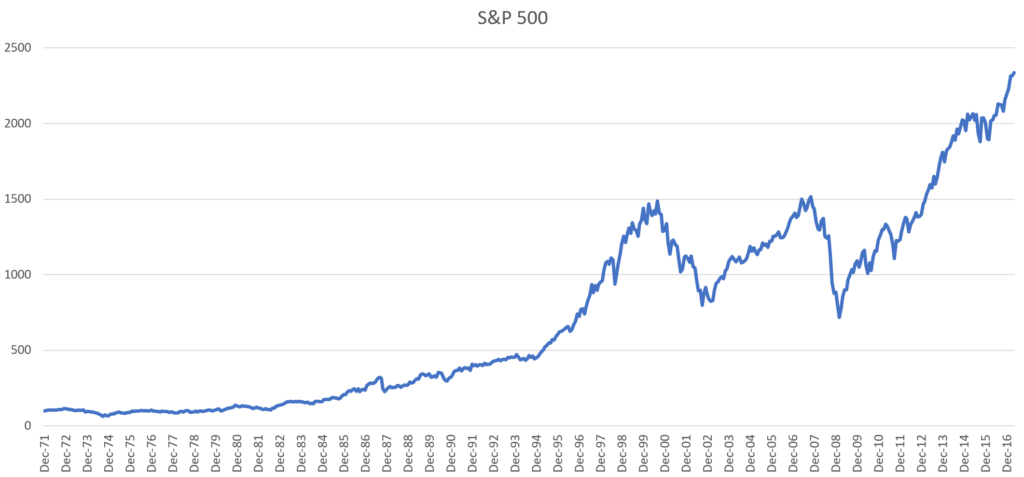

To answer the question “stock market vs real estate,” we must first determine what the returns are for both. The average returns of the s&p 500 are well studied – It is widely known that stock market returns are around 10% per year, or around 7% once adjusted for inflation. Look at the chart below:

An initial investment of $100 would have become $2,522.54 by October 2017. During this time you would more than 25x your money with an average yearly return of 7.195% which is in line with the information above (I used this calculator to determine the average return). That’s really not a bad return at all!

What Are Average Real Estate Returns?

This is very tricky but also very simple. The problem is that most people think of home values as “real estate” as a whole. While single-family residential homes are an important part of the real estate market, homes make terrible investments and shouldn’t be looked at when deciding what the real estate market is doing.

The key to real estate investment is its ability to produce cash flow (ie. dividend). Single-family homes do not create cash-flow for investors so they are not investments.

Instead, we should look at what actual investment property returns to its investors, and this is calculated using capitalization rates. The Capitalization Rates is the ratio of income from a property net all operating costs to the price.

Capitalization rates give us a very easy way to compare the stock market to real estate. If you want to beat the stock market, simply look for a property with a 7.2% cap rate or higher and you win. Also, you can have a lower cap rate if you use leverage to exceed that. (low-cost and long-term leverage is one of the advantages of real estate).

But this isn’t the whole story. Cap rates fluctuate over time so we really need to dig deeper. I just wanted to explain the difference between single-family and income-producing real estate.

Estimating Real Estate Returns

Unlike the stock market, which has been widely standardized and studied, real estate is extremely difficult to categorize and standardize because of the unique nature of every single property and the privacy surrounding most deals.

First, I’ll compare the stock market returns to a fairly average deal that can be attained in real estate.

Then, I’ll use a proxy to estimate returns across the real estate market as a whole. After a bit of research, I found a composite REIT index that has been tracking real estate in the US since 1972. Exchange-traded REITs make their information publicly available and also trade on the open market – allowing us to estimate returns and track them with accuracy.

REITs are a unique aspect of real estate and I wouldn’t say they are the best (or worst) investments. I’m simply suggesting that if REITs are doing well, real estate as a whole is doing well. If REITs are doing poorly, we can also believe that real estate as a whole is doing poorly. Proxies are not perfect, but they work well enough.

So, let’s dive into an example deal.

Real Estate Returns

The first thing we’ll have to discuss briefly is the meaning of Capitalization Rates.

In all of real estate, except residential (1-4 unit), Cap Rates are used to calculate overall returns of an asset. Basically, it is the total return of a deal if it was bought in all cash (no debt). Because mortgage payments can vary drastically depending on the individual borrower, this is a standardized way to compare properties.

So, if a property has a 7% capitalization rate, also called a “7 cap” property, it would have a total return of 7%. So, if you bought it for $100,000, you could expect a total return of $7,000 per year. This, of course, does not take into account any potential appreciation.

Here is a much more detailed article about cap rates, if you’d like to take a deep dive.

Example Real Estate Deal

Let’s take an example deal and say we are buying it at a 7% cap rate. You may not be totally familiar with cap rates and what is high or low, but I’ll just say that even in an amazingly hot market like it is in 2018, deals can be found at a 7% cap rate (just not in downtown big cities like NYC, Boston, etc).

They may be in the suburbs or cities surrounding these core markets, but these deals can definitely be found.

Let’s take a look at a quick rundown of some numbers in my quick and dirty analyzer

Based on the rents and expenses I put in there, at a 7% capitalization rate, this deal is worth around $353k. So I inputted that in as the purchase price and ran the numbers.

The overall cash flow is only $5,712 which is a cash n cash return of 6.47%. If you’re wondering what cash on cash return is, it’s just the cash received vs the cash invested. You can deep dive into cash on cash return here.

But, real estate is more complex than that. You have a mortgage and your tenants are paying that down every month. So, I added the approximate equity that is paid down. This is just a quick analysis calculator so it’s just the interest rate * the mortgage amount.

This bumps the return to over 12%.

Also, you can play around with the appreciation and see how just a 1% appreciation adds 4% to the total return due to the power of leverage.

Real Estate Has Higher Transaction Costs Than The Stock Market

You can click buy or sell and get all the shares you want for just a few bucks. But, real estate has a lot of transaction costs and inefficiencies that can cost anywhere from 5-8% of the total purchase/sale price.

You need to increase the value of your property by 8% just to cover the costs to sell it! That’s crazy to think about. Buy right in the first place because of the extremely high transaction costs.

Estimating Average Real Estate Returns Across the US

Having an example deal is great, but who knows if it’s normal or just a fluke. So, let’s compare it to a broader index.

Before diving into REITs, let’s get some base facts out of the way.

REITs will have much higher management and compliance costs than a deal bought and held by yourself. A massive portfolio will have a CEO, regional managers, asset managers, compliance officers, etc. All of this will reduce the returns.

So, if REITs can beat the stock market even a little bit or even just tie, then we know real estate wins.

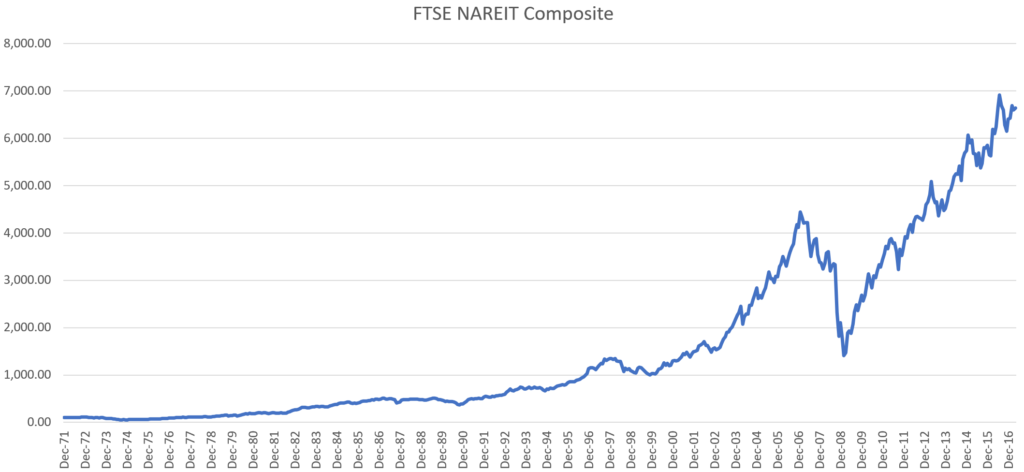

So, let’s look at the FTSE NAREIT Composite Index.

A $100 investment in 1972 would be worth about $6,839 today. This is a total of 68x your original investment and around a 9.425% return.

Stock Market vs Real Estate – Which Is Better?

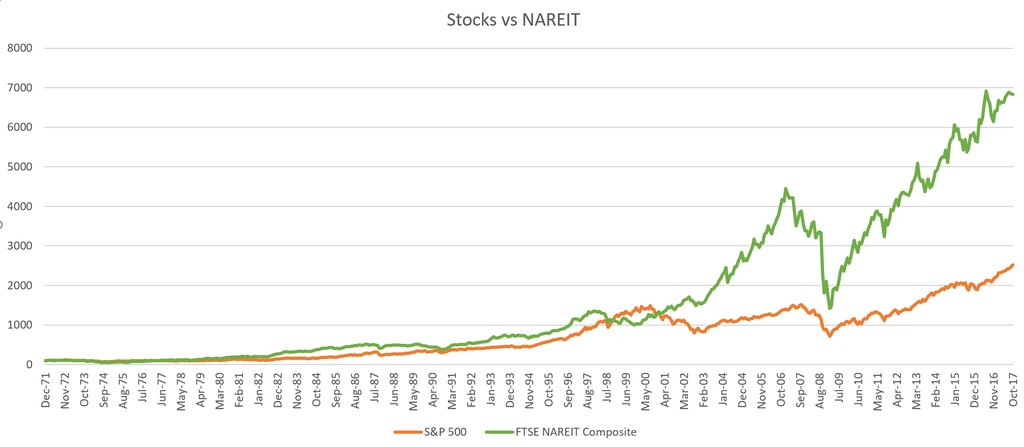

Yes, the returns are clearly higher in real estate than in the stock market but the answer isn’t so simple. First, let’s just combine the graphs for fun:

It’s interesting to show that for the first 20-25 years, both indexes closely track each other. They start to diverge around 1996 and they wildly diverge thereafter. Also, it’s interesting to point out the NAREIT index is generally correlated with the S&P 500 (correlation coefficient of .93). These aren’t reasons for or against, just interesting observations.

Pros and Cons of Investing in Real Estate Instead of Stocks

Real estate, as tracked by the FTSE NAREIT index, clearly outperforms the S&P 500. Buying a REIT fund is the best option, right? Well, most people don’t think of an index fund as “real estate investing” so to be completely fair, we should dive into actual real estate investing and compare it to the S&P 500.

There are literally dozens of ways to invest in real estate in some fashion. The vary from investing in liens to foreclosure, mortgages to equities. It’s impossible to compare everything, so we’ll just look at the top 3 ways people invest in real estate.

Exchange Traded Real Estate Funds And REITs

We’ve covered this a bit while looking at the NAREIT Composite. Real estate ETF’s and REITs have a low cost to get involved, and they are still priced mostly based on their underlying real estate holdings. There are a few pros and cons to these:

Pros:

- Compared to actually buying real estate, people can buy into an exchange-traded fund or REIT for as much or as little as they want.

- Very liquid – you can sell them very quickly.

Cons:

- REITs and ETFs correlate with the broader market.

- REITs incur significant regulations and overhead expenses to get listed on the stock exchange.

Since REITs and ETF’s are both still stocks and are tracked daily, they can be compared to the stock market quite easily. This is exactly what I’ve done by looking at the NAREIT Composite index.

I’m personally not a huge fan of REITs though I do have money invested in one REIT.

Home-Ownership

Most Americans look at their homes as an investment and I very quickly dismissed this idea at the top of this article. Here’s a deeper look at why.

The average home appreciation is 3.5% while the average US inflation rate has been just over 3%. So, in the best case scenario, your house is earning next to nothing. This is widely studied in economics and is published in what’s called the Case-Shiller Index which shows that over a long period of time (century +) real estate tends to go back toward its long-term average. So, over the very long term, homes don’t appreciate.

Also, you need to set aside 1 to 4 percent of the home value every year for maintenance. If your home appreciates at the same rate as inflation, you are really losing 1-4% per year because of maintenance.

I personally would consider a home like an expensive bank account (which is why I prefer a duplex or triplex instead). Unfortunately, most people will spend more money maintaining your home than it will ever return to you in appreciation which is why it’s not a good measure for real estate investments.

Direct Investment In Real Estate

Investing in real estate could mean buying a rental property and leasing it out yourself, investing passively through a syndication, buying tax liens, giving private mortgages, buying commercial, retail, or self-storage, or buying just about anything else that’s related to real estate.

All of these are very interesting ways to invest. It’s hard to break down every sub-niche of real estate and what the potential returns are. In general, the pros and cons are:

Real Estate is the Only thing that is “Real”

“Real property” is real estate and everything else is “personal property.”

It is tangible and cannot disappear suddenly, it never falls out of favor, and nobody can steal it (unless you don’t pay your taxes). You can also pass it down from generation to generation and it will never disappear or deplete (except in some extreme circumstances).

So, when considering the question “stock market vs real estate,” you need to think about how tangible the asset is. Businesses come and go but real estate is there forever. Though they can be difficult to quantify, these are real benefits that only real estate can provide.

Leverage Increases Real Estate Returns

This is the biggest advantage of real estate vs the stock market. Real estate can safely and cheaply, be leverage to really bump your returns.

Without diving into particulars, you can take a rent-producing property and leverage it. With the leverage, the return on investment goes up because the amount invested in the deal decreases.

One option is to leverage a stock portfolio as well. Unfortunately, it is generally at much higher interest rates, shorter terms can be subject to sudden calls, and adds a huge layer of risk.

Real estate has extremely mature lending markets where capital is plentiful and cheap and the terms are often 10-30 years.

Real Estate is Less Liquid Than Stocks

Joseph over at My Stock Market Basics makes a great point about liquidity. It goes without saying, but you can’t sell your house on a whim while you can cash out of the S&P 500 tomorrow. This is both a good and bad thing.

It’s good because people are emotional and tend to do the opposite of what’s smart. When the market crashes people want to sell what they have and hoard. Instead, they should buy more at a discount. Real estate is illiquid and doesn’t allow people to make extremely rash decisions.

On the other hand, it is very hard to rebalance a portfolio or cash out completely.

Real Estate Has Higher Transaction Costs Than The Stock Market

You can click buy or sell and get all the shares you want for just a few bucks. But, real estate has a lot of transaction costs and inefficiencies that can cost anywhere from 5-8% of the total purchase/sale price.

You need to increase the value of your property by 8% just to cover the costs to sell it! That’s crazy to think about. Buy right in the first place because of the extremely high transaction costs.

Stocks vs Real Estate -Which Is Better For Investing?

I can’t give you an exact answer because everyone has a different situation. I can simplify it a little for you:

- Invest in Real Estate – If you’re looking for higher returns but don’t need the money back immediately. Also, invest if you have time to learn about real estate and plan to hold long-term.

- Invest in the Stock Market – If you don’t have a lot of money to start investing with. Also, invest in it if you need your money to be more liquid.

Though real estate clearly earns more, it may not be the better investment for you, depending on your situation.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Leave a Reply