A REIT, or real estate investment trust, are companies specifically set up to purchase real estate and pass those profits on to their investors.

They have to meet a number of requirements for qualification and many REITs trade on the major stock exchanges and offer a range of benefits and drawbacks. In this article, we’re going to discuss what a REIT is, how to invest in them, and the benefits and pitfalls to avoid.

Types of REITs.

What are the different types of REITs?

There are a number of different types of Real Estate Investment Trusts and the benefits/pitfalls vary dramatically between the types.

Equity REITs

Overwhelmingly the majority of REITs are publicly traded and also equity REITs. an Equity REIT owns or operates any sort of real estate that is income-producing. Generally, an Equity REIT is simply referred to as a REIT as it’s the default and most common type.

When you invest in an equity REIT you are buying a part of a company that invests in any sort of real estate from multifamily to office space, mobile home parks to industrial parks.

Mortgage REITs

A Mortgage REIT (or mREIT for short) provides financing for investors who are purchasing income-producing real estate. The mREIT originates and services the mortgages or mortgage-backed securities. The income they earn is from interest paid on the debt.

Public Non-listed REITs

A Public, non-listed REIT (PNLR) is required to register with the SEC and meet a number of requirements that come with that registration, but they do not list on national stock exchanges.

Private REITs

A Private REIT is an offering that is exempt from SEC registration. This may be a 506(b) or 506(c) offering that draws investors from a limited pool of people, thus avoiding the requirement of registration. Additionally, these do not trade on any exchange.

Requirements to Be a REIT.

To qualify as a REIT a company must:

- Have invested at least 75% of its total assets in real estate

- It also must get at least 75% of its gross income from rent on income-producing real-property, interest on mortgage which finance real property, or from the sale of real property.

- A REIT must pay 90% or more of its taxable income as dividends each year to the shareholders.

- Be a taxable corporate entity.

- Be managed by a board of directors or trustees.

- Have a minimum of 100 shareholders.

- Have no more than 50% of its shares held by five or fewer individuals.

What Does a REIT Invest In?

REITs invest in just about everything related to real estate and their investments are categorized into 13 property sectors.

It’s also pretty amazing that REITs collectively own more than $4.5 trillion in assets across the US.

REITs invest in all kinds of real estate. Everything from offices, apartment buildings, warehouses, retail centers, medical facilities, data centers, cell towers, infrastructure, hotels, and more. Most REITs invest in only one type of real estate but some do hold properties of various types in their portfolio.

How do REITs Make Money?

REITs tend to have a very simple and understandable business model. They purchase property with the intent to lease it out. The property gets rented, maintained, and upgraded as needed. Then, 90% or more of taxable profits are passed on to the shareholders. The corporation avoids those taxes and instead shareholders pay tax on that income.

Mortgage REITs are slightly different as they finance real estate and earn income from interest on those investments. It’s fundamentally the same though.

Why Invest in REITs?

REITs have historically delivered very competitive total returns. Their returns are based mostly on dividends and also long-term capital appreciation. Compare this to most stocks which give returns mostly based on appreciation and only a small fraction for dividends.

Additionally, they have a lower correlation with other assets so which makes REITs great for diversifying a portfolio. REITs also play an important part in a well balanced portfolio because of their strong annual dividends along with long-term capital appreciation.

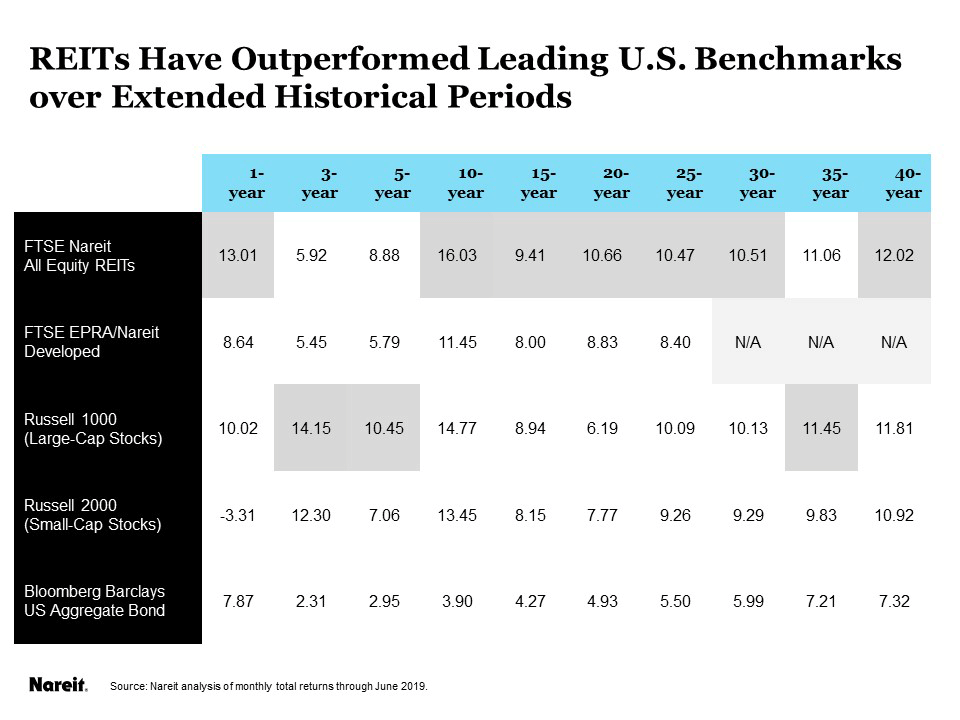

The REIT total return performance for the last 20 years has outperformed the S&P 500 Index, other indices, and the rate of inflation.

Another reason to invest in REITs over other assets is that they are easy to buy and sell, and many are traded on public exchanges. That reduces the liquidity risk associated with real estate. REITs offer attractive risk-adjusted returns and stable cash flow. Also, a real estate presence can be good for a portfolio because it provides diversification and dividend-based income and the dividends are often higher than you can achieve with other investments.

How Have REITs Performed Historically

REITs have actually outperformed the broader stock market during most periods of time. They provide reliable and increasing dividends over a long period of time which is combined with long-term capital appreciation through stock price increases.

How Can I Invest in REITs?

The easiest way is to purchase shares through your normal stock brokerage account or financial advisor. Non-traded REITs can be purchased through a broker or financial advisor who participates in REIT offerings.

Additionally, there are a growing number of defined-benefit or contribution investment plans. Roughly 87 million Americans own REITs through their retirement savings or investment accounts.

Why REITs May Be a Bad Investment

The biggest pitfall with REITs is they don’t offer much capital appreciation. That’s because REITs must pay 90% of their taxable income back to investors which significantly reduces their ability to invest back into properties to raise their value or to purchase new holdings.

Another drawback is because of their structure, REITs tend to have very high management and transaction fees.

Additionally, REITs have become more and more correlated with the broader stock market over time. So, one of the prior benefits has lost its appeal as your portfolio will become more subject to market swings.

What Are Some Alternatives I Can Invest in?

Alternatively, you can invest in an eREIT or real estate fund that many modern crowdfunding companies are offering.

Crowdfunding

Take Fundrise for example (you can check them out here). They offer a private REIT that invests in a variety of markets and real estate types. They have lower fees and more oversight than traditional REITs because they are offered under newer regulations that didn’t exist decades ago when REITs were created.

Investor Deal Room

Additionally, you can partner with an investor in a syndication or other partnered investment. You can apply to access our investor deal room where we offer various investment opportunities to those who are qualified.

Eric Bowlin has 15 years of experience in the real estate industry and is a real estate investor, author, speaker, real estate agent, and coach. He focuses on multifamily, house flipping. and wholesaling and has owned over 470 units of multifamily.

Eric spends his time with his family, growing his businesses, diversifying his income, and teaching others how to achieve financial independence through real estate.

You may have seen Eric on Forbes, Bigger Pockets, Trulia, WiseBread, TheStreet, Inc, The Texan, Dallas Morning News, dozens of podcasts, and many others.

Quick question, how does a company qualify as a REIT?